DON'T MISS OUT! Try Our FREE Calculator Now

- Warning signs of companies offering this financial service include lack of transparency in fees, aggressive sales tactics, unclear terms, and no membership in recognized industry bodies like the Equity Release Council.

- To conduct due diligence on these companies, verify their accreditation with the Equity Release Council, check customer reviews, and consult financial ratings from independent agencies. Ensure they offer clear information and a no negative equity guarantee.

- Common complaints against substandard providers often focus on high fees, misleading terms, inadequate communication, and difficulties faced when trying to repay or modify the plan.

- To check for regulatory actions against these companies, visit the Financial Conduct Authority (FCA) website, where warnings, penalties, or regulatory actions are listed against financial institutions.

- Resources to identify providers to avoid include the websites of the Financial Conduct Authority and the Equity Release Council, along with consumer finance websites and forums that provide user feedback and professional reviews.

When thinking about unlocking the value of your home, it's crucial to know which equity release companies to avoid.

Did you know that over 40% of equity release customers end up dissatisfied with their providers?

Unfortunately, some of these companies come with hidden fees, subpar customer service, or inferior products that could disadvantage you over time.

That's precisely why we've crafted this guide: to steer you away from the least desirable equity release firms and towards the ones that best suit your needs.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Our team, seasoned in the equity release sector, has conducted thorough research to bring you impartial and trustworthy insights.

Continue reading to learn which equity release companies to avoid and which ones come highly recommended.

Why Should You Avoid Certain Equity Release Companies in 2026?

Avoiding some equity release companies ensures you protect your finances and are treated fairly and transparently.

It's all about making sure you partner with a provider that genuinely looks out for you, offering clear terms and the support you need to navigate this big financial decision.

Criteria for Choosing Your Equity Release Provider in 2026

Picking the right equity release company takes a bit of thought and research to make sure your finances are in good hands and you end up with a deal you're happy with.

Here’s what to look for to avoid unsuitable companies:

- Adherence to Equity Release Council Guidelines:1 Essential for financial safety, firms following these guidelines offer crucial features like the no negative equity guarantee, protecting you from owing more than your home's worth.

- Full Fee Disclosure: Opt for companies that are transparent about all fees, including those for arrangement, advice, and potential early repayment charges. Hidden costs can significantly impact the financial viability of your plan.

- Commitment to Quality Service: Given the complexity of equity release, select a provider known for excellent customer support to guide you through decision-making processes.

- Independent Advice: Choose firms that support consultations with FCA-regulated advisers, ensuring recommendations are tailored to your unique financial situation.

- Diverse Product Range: A broad selection of products means a higher chance of finding a plan that fits your specific needs, enhancing your financial strategy's effectiveness.

- Regulatory Compliance: Firms regulated by the Financial Conduct Authority (FCA)2 are held to high standards, offering an extra layer of protection to consumers.

What Are the Top Equity Release Companies to Avoid?

When exploring equity release, identifying which companies to avoid is as important as finding the right provider.

Watch out for these signs that a company might not be the right fit:

- Regulatory Issues: Be cautious of companies recently penalised by the FCA, as this could signal significant concerns regarding their operations and ethics.

- Customer Feedback: Lack of positive reviews or an abundance of negative testimonials can indicate problems with service quality or product offerings.

- Sales Pressure: Steer clear of providers that push you into decisions or products that don't seem tailored to your needs. A trustworthy company will ensure you have all the information and time you need.

- Ethical Concerns: Companies that fall short in demonstrating ethical practices, transparency, and a commitment to customer satisfaction may not align with your best interests.

When it comes to providers, making the right impacts your financial security and peace of mind.

Keeping an eye on these pointers will help you find a company that really gets what you need and looks after your financial well-being.

How Can You Spot Red Flags in Equity Release Providers?

Equity release can be a powerful tool, but navigating the market requires a keen eye for potential pitfalls.

Just like any financial decision, it's crucial to identify red flags early on to avoid getting caught in a financial nightmare.

What Are Key Indicators to Avoid Certain Equity Release Providers?

Be wary of providers that do not offer clear, upfront information about their equity release plans, including the fees involved and the conditions for early repayment.

A lack of personalised advice tailored to your financial situation is another red flag, as equity release should be considered with your specific needs in mind.

How Can You Identify High-Pressure Sales Tactics in Equity Release Companies?

High-pressure sales tactics can lead to rushed decisions and unsatisfactory outcomes.

Here's how to spot them:

- Urgency to Sign: If a company is pushing you to make a quick decision without giving you time to consider your options or seek advice, it's a red flag.

- Too Good to Be True Offers: Promotions that seem overly advantageous may come with hidden terms that are not in your best interest.

- Disparaging Other Products: A provider that spends more time criticising competitors' products than explaining the benefits of their own may be more interested in making a sale than helping you find the best solution.

Recognising these warning signs can guide you towards making a more informed and confident decision regarding your equity release provider.

What Makes a Reputable Equity Release Company?

Choosing a reputable equity release company is paramount to ensuring a safe, secure, and ultimately beneficial experience.

It's not just about accessing your home's value; it's about trusting your financial future to a company that prioritises your needs.

The standing and regulatory compliance of a provider are essential markers of their dependability and dedication.

Why Are Reputation and Track Record Vital in Choosing the Best Equity Release Companies?

Reputation and track record emerge as vital factors, guiding you towards a safe and informed decision.

Firstly, consider the weight of trust in such a sensitive transaction. Equity release isn't simply about accessing funds; it's about entrusting someone with the keys to your future financial stability.

Companies with a solid reputation built on positive client feedback and ethical practices earn this trust through transparency, clear communication, and a commitment to responsible lending.

Choosing such a partner instills confidence, knowing you're in capable hands.

Beyond trust

Consider the expertise needed to navigate the intricacies of equity release. This field involves complex details, varying product options, and potential pitfalls.

Opting for a company with a demonstrated history of success suggests they possess the experience and expertise to confidently manage these complexities.

This translates into tailored solutions that cater to your unique needs and objectives, ensuring you don't get lost in a maze of generic products.

Finally

Prioritising customer satisfaction speaks volumes about a company's quality. When a company focuses on exceeding client expectations, it's more likely to deliver high-quality advice, clear terms, and ongoing support throughout the process.

This commitment translates into a positive reputation, as satisfied clients become vocal advocates, sharing their positive experiences with others.

Remember

The value of your home is more than just a number. It represents aspirations, security, and peace of mind for the future.

By choosing an equity release partner with a reputation and track record that inspire confidence, you invest in more than just financial gain; you invest in a secure and empowered future..

How Important Is Regulatory Compliance for Equity Release Companies in UK?

Regulatory compliance is not just important; it's essential.

Here are the reasons why:

- Consumer Protection: Firms regulated by the Financial Conduct Authority (FCA) and members of the Equity Release Council adhere to strict guidelines designed to protect consumers, such as the no negative equity guarantee.

- Professional Standards: Compliance ensures that companies maintain high professional standards, including transparent fee structures and fair advice.

- Security and Peace of Mind: Knowing your provider meets rigorous regulatory requirements gives you confidence in the safety and suitability of your equity release plan.

Finding the best equity release partner goes beyond reputation.

Prioritise companies with a proven track record, ethical practices, and a commitment to responsible lending that caters specifically to your unique financial needs.

How Do Equity Release Schemes' Features Impact Your Choice?

When it comes to choosing an equity release scheme, the features on offer are key. They can make a real difference in how well it fits your financial plan.

From protecting your future finances to providing options that adjust as your needs change, these features directly influence your decision.

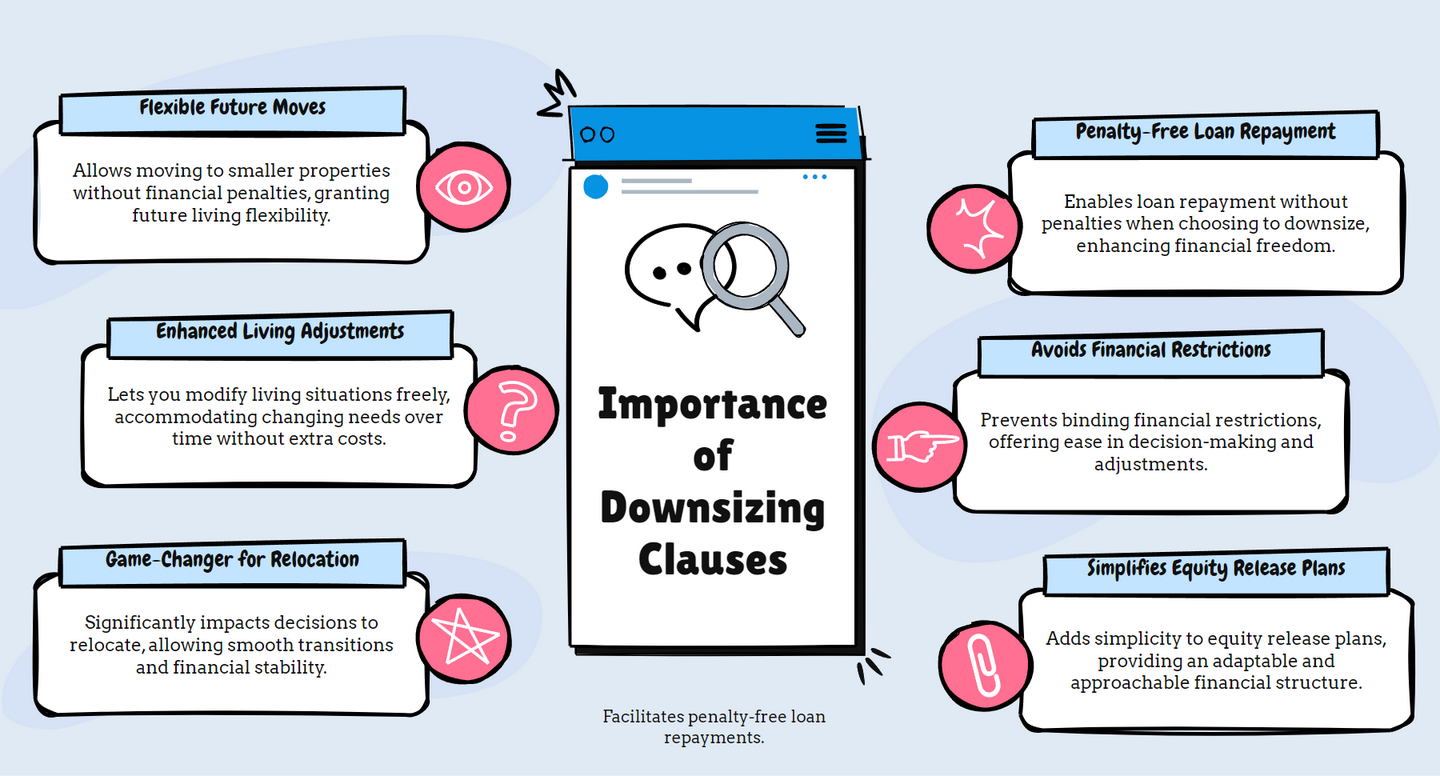

Why Is a Downsizing Clause Significant in Equity Release Plans?

A downsizing clause offers you the flexibility to repay your loan without penalties if you decide to move to a smaller property.

If you're thinking about moving in the future, whether downsizing or relocating, this feature is a game-changer.

It means equity release won't tie you down and lets you adjust your living situation without any additional fees.

Why Consider Voluntary Interest Payments in Equity Release?

Voluntary interest payments offer the flexibility to reduce some or all of the accrued interest on your loan, leading to a significant decrease in the total amount owed over time.

This option empowers you to manage the remaining equity in your home, making it particularly attractive for individuals seeking to preserve the value of their estate for future beneficiaries.

How Does a No Negative Equity Guarantee Work in Equity Release?

A ‘no negative equity guarantee’ ensures that you or your estate will never owe more than the value of your home, regardless of how property prices fluctuate.

This guarantee protects both you and your estate from unexpected debt, offering peace of mind that your equity release plan will not result in financial burdens beyond the worth of your property.

What Are the Financial Considerations When Choosing Equity Release?

When contemplating equity release, several financial factors come into play that could significantly impact your financial health and the legacy you wish to leave behind.

Understanding these aspects ensures you make a well-informed decision that aligns with your long-term financial goals.

Why Is Transparency in Fees Crucial When Choosing Equity Release Companies?

Transparency in fees is essential in the equity release process because it allows you to fully understand the financial commitment you are making.

Clear information on arrangement fees, advice fees, and any potential charges for early repayment helps you assess the cost-effectiveness of the plan.

This transparency ensures there are no surprises down the line, allowing for accurate financial planning and peace of mind.

Should High Early Repayment Charges in Equity Release Concern You?

High early repayment charges should definitely be a concern when considering equity release.

These charges can make it costly to repay your loan early, whether due to a change in financial circumstances or a decision to downsize.

Being aware of these charges and how they apply to your plan is crucial for maintaining financial flexibility and minimising potential penalties.

Is Choosing Variable Interest Rates in Equity Release Risky?

Opting for variable interest rates in an equity release scheme carries a degree of risk due to the potential fluctuation in interest rates over time.

While there might be the opportunity to benefit from lower rates, there's also the risk that rates could increase, raising the amount of debt accrued against your home.

This uncertainty can affect your ability to plan financially for the future, making it a significant consideration for those prioritising stability in their retirement finances.

How to Safely Navigate Equity Release Advisors and Solicitors?

Navigating the complex landscape of equity release requires careful consideration, especially when it comes to seeking advice and choosing solicitors.

Ensuring you engage with reputable professionals can protect you from misguided decisions and potential financial pitfalls.

Read More: Is Equity Release a Safe Option?

How to Identify Equity Release Advisors to Avoid?

To ensure you're receiving reliable and trustworthy advice on equity release, look out for several red flags in advisors.

Be wary of advisors who:

- Are not regulated by the Financial Conduct Authority (FCA), as this may indicate a lack of proper accreditation or oversight.

- Push specific equity release products without considering your full financial situation, suggesting a possible conflict of interest or commission-based motivation.

- Lack specialisation in equity release, as this can lead to advice that is not tailored to the unique complexities of these products.

How Can You Identify Equity Release Solicitors to Avoid?

Choosing the right equity release solicitor is equally important.

To avoid unsuitable solicitors, look out for those who:

- Do not have specific experience or accreditation in dealing with equity release transactions, which is essential for navigating the legal intricacies of these agreements.

- Fail to communicate clearly or promptly, as effective and transparent communication is key to understanding the legal aspects of your equity release plan.

- Seem overly aggressive in their solicitation or are recommended by an advisor under questionable circumstances, which could indicate a lack of independence or ethical concerns.

By exercising diligence in selecting advisors and solicitors, you can ensure that your equity release journey is guided by professionals who prioritise your best interests and financial security.

What Future Trends and Innovations Should You Be Aware Of in Equity Release?

As the equity release market continues to grow and evolve, staying informed about future trends and innovations is essential for anyone considering this financial option.

Developments in the industry are shaping how equity release products are structured, marketed, and chosen by consumers.

What Are the Future Trends in UK Equity Release Schemes?

The UK equity release market is a dynamic environment constantly adapting to consumer demands and evolving market conditions.

Looking ahead, several key trends are likely to shape the future of these schemes:

- Increased Flexibility: Expect to see more products offering flexible repayment options, allowing borrowers to make voluntary payments without incurring penalties.

- Product Diversification: The market is likely to introduce more varied products tailored to specific customer needs, such as plans with features beneficial for early inheritance gifting or for funding long-term care.

- Greener Options: In response to growing environmental awareness, some companies are beginning to offer incentives for borrowers making eco-friendly home improvements.

What Innovations Are Top Equity Release Companies Implementing?

Top equity release companies are embracing innovation to enhance your experience and empower your financial choices.

Here's a glimpse into the cutting-edge solutions transforming the market:

- Digital Platforms: Enhanced online services for application processing, account management, and customer support are becoming more prevalent, improving accessibility and convenience.

- Bespoke Solutions: Personalised equity release plans based on sophisticated algorithms that consider individual financial situations and future projections.

- Enhanced Advising Tools: Using advanced technology to provide more accurate, personalised advice, helping consumers make better-informed decisions.

How Do Consumer Preferences Influence Equity Release Company Selection?

Consumer preferences are increasingly leaning towards companies that offer clear communication, personalised advice, and flexible terms.

The demand for transparency and ethical practices is shaping how companies approach equity release, with a focus on customer satisfaction and security.

How Have Top Equity Release Companies UK Evolved Recently?

Top equity release companies in the UK are adapting by prioritising customer feedback, enhancing product transparency, and offering competitive rates.

Their evolution reflects a commitment to meeting the changing needs of retirees, ensuring that equity release remains a viable and safe option for financial planning in retirement.

Common Questions

How Does Equity Release Work?

Which Equity Release Schemes Should Be Avoided?

How Does Equity Release Stand Against Other Retirement Financial Solutions?

How Can You Determine Which Equity Release Companies to Avoid?

Which Are the Worst Equity Release Companies in the UK?

What Are the Known Equity Release Scams to Watch Out For?

What Are the Red Flags to Look For in Equity Release Companies?

Which Regulatory Bodies Monitor Equity Release Providers in the UK?

What Are Common Pitfalls When Choosing the Wrong Equity Release Company?

Should You Rely Solely on Online Reviews When Evaluating Equity Release Companies?

In Conclusion

Choosing the right equity release company is key to unlocking your home's value while ensuring your financial security.

Don't settle for the first company you find. Instead, prioritize providers who prioritize your needs, follow ethical practices, and adhere to strict regulations like those set by the Equity Release Council and FCA.

Independent financial advice and thorough research are your allies in this process. Take control, do your research, and choose wisely – your financial well-being depends on it.

When talking about equity release companies to avoid, keep in mind that it's not just about avoiding pitfalls; it's about finding a partner who empowers you in the future

WAIT! Before You Go...