DON'T MISS OUT! Try Our FREE Calculator Now

Can You Get Equity Release With Your Existing Mortgage?

Quick Summary

- Older homeowners can access the value in their property through equity release, but any existing mortgage must be repaid as part of the process.

- To qualify for equity release, you must be at least 55 years old, own a UK property that meets lender requirements, and have sufficient equity after clearing your mortgage.

- Equity release funds are used to repay the outstanding mortgage, after which the provider secures a charge on your property. The remaining funds can be used as needed.

- If equity release does not fully cover your mortgage, you may need to use savings, remortgage, or seek financial support from family.

- Consulting a qualified equity release adviser ensures you explore suitable products, understand the financial implications, and secure the best available deal.

Older homeowners weighing up their retirement finance options may be wondering if they can get equity release with a mortgage.

Equity release has become an increasingly popular financial solution for homeowners aged 55 and over.1

According to the 2025 Market Outlook summary put together by provider LV=, the continuing popularity of equity release products can be put down to increased longevity, pension shortfalls, and rising house prices.2

But what if you're still paying off a mortgage?

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

In this article, we'll take a look at your options.

What Is Equity Release?

Equity release is a financial solution that enables homeowners, usually those aged 55 and older, to access some of the value of their property without selling it.

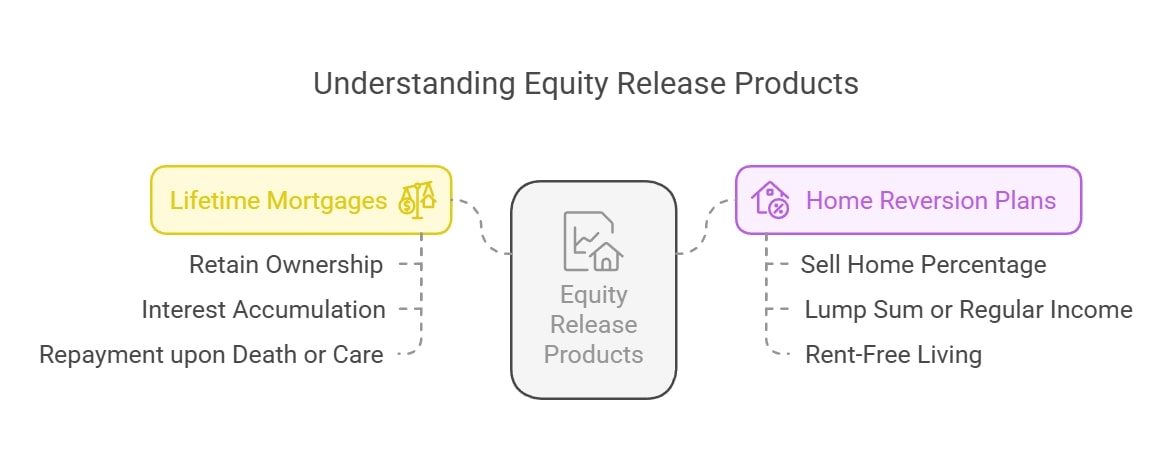

The two main types of equity release products available in the UK are lifetime mortgages and home reversion plans, both of which allow homeowners to retain the right to live in their homes for life.

What Are the Types of Equity Release?

There are primarily two types of equity release products: lifetime mortgages and home reversion plans.

With lifetime mortgages, you take out a loan secured against your property, while home reversion plans involve selling a portion of your home to a provider in exchange for a lump sum or regular payments.

How Does It Work?

A lifetime mortgage lets you borrow against your home without the obligation to make monthly repayments.

The interest on this loan accumulates over time, with repayment typically required only when the homeowner passes away or enters long-term care.

Conversely, home reversion plans require homeowners to sell a percentage of their home to a provider in exchange for a cash sum while living in the property for life.

Are You Eligible for Equity Release?

You are eligible for equity release if you meet certain requirements.

These usually include:

- Age: You must be at least 55 years old. Some providers may have higher minimum age requirements, depending on the specific product.

- Property Ownership: You must own a property in the UK, which serves as security for the equity release plan. The property should be your main residence and meet the lender's criteria regarding condition and value.

- Property Value: Most providers require the property to have a minimum value, often £70,000.

These requirements may differ between providers, and some lenders may impose additional criteria.

Can You Take Out Equity Release If You Already Have a Mortgage?

Yes, you can take out equity release if you already have a mortgage on your property.

However, any outstanding mortgage balance must be repaid as part of the equity release process.

Why is that?

Equity release providers require the first legal charge on the property, ensuring their loan is secured.

How Does It Work If You Have an Existing Mortgage?

If you have an existing mortgage, the funds from the equity release can be used to clear the mortgage, effectively replacing it with the equity release plan.

The process generally involves the following steps:

- Assessment: A financial adviser assesses your eligibility and determines how much equity you can release based on your age, property value, and outstanding mortgage balance.

- Calculation: The amount you can release depends on factors such as your age, the value of your property, and the amount of equity available after repaying the existing mortgage.

- Repayment of Existing Mortgage: The funds released are first used to repay your existing mortgage. Any remaining amount can be used at your discretion.

- Establishing the Equity Release Plan: Once the existing mortgage is cleared, the equity release plan is established, with the provider holding the primary charge on your property.

Before Deciding on Equity Release

Before deciding on equity release, there are some things you need to consider.

Understanding how your existing mortgage impacts the equity release process will empower you to make informed decisions, ensuring you avoid unexpected financial burdens during this transition.

Assessing Your Existing Mortgage Situation

Before deciding on equity release, you'll need to assess your current mortgage situation.

This will involve determining how much you owe on your existing mortgage, as this amount will need to be cleared before any cash can be released through an equity release plan.

Read the small print

You will also have to review the terms of your current mortgage, including any early repayment charges that may apply if you choose to pay off your mortgage early.

How Much Equity Can You Release?

Understanding how much equity you can release from your home is fundamental to the equity release process.

This will depend on several factors, including your property's market value, your age, and your existing mortgage balance.

Using an equity release calculator can provide a clearer picture of the equity available to you, allowing you to gauge how much money you could release.

Remember

The amount you can release will be significantly influenced by the outstanding mortgage that will have to be repaid.

The Process

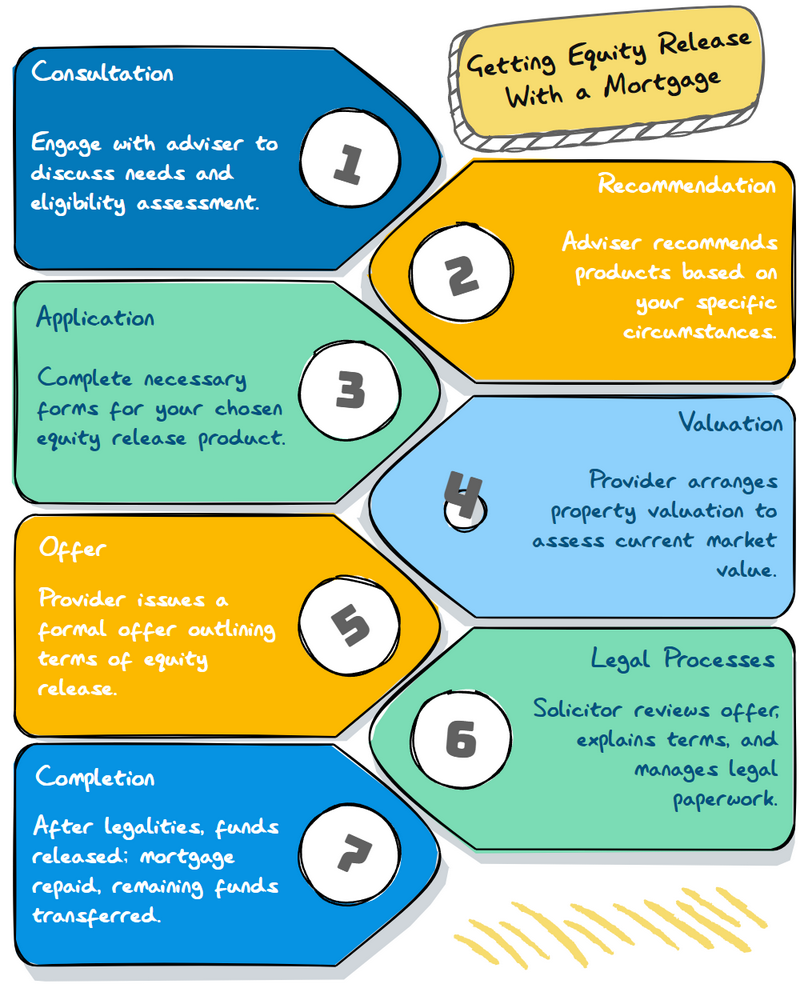

The process of obtaining equity release with an existing mortgage typically involves a standard set of steps.

These include:

- Consultation: Engage with a qualified equity release adviser to discuss your needs and assess your eligibility.

- Recommendation: The adviser recommends suitable equity release products based on your circumstances.

- Application: Complete the application forms for the chosen equity release product.

- Valuation: The provider arranges for a valuation of your property to determine its current market value.

- Offer: Based on the valuation and application, the provider issues a formal offer outlining the terms of the equity release plan.

- Legal Processes: A solicitor, acting on your behalf, reviews the offer, explains the terms, and manages the legal paperwork, including the repayment of the existing mortgage.

- Completion: Once all legalities are completed, the funds are released. The existing mortgage is repaid, and any remaining funds are transferred to you.

What Happens to Your Mortgage When Taking Out Equity Release?

When you take out an equity release plan, your existing mortgage must be repaid.

This is typically done using the funds from the equity release.

Once the mortgage is cleared, the equity release provider places a charge on your property, securing their loan.

What If Your Equity Release Funds Won't Cover Your Mortgage?

If the amount you can release through equity release is insufficient to repay your existing mortgage, you will need to cover the shortfall through other means.

This could mean turning to sources such as savings or investments.

Remember

Equity release providers require the existing mortgage to be cleared to grant the new loan.

If you cannot cover the shortfall, equity release may not be a viable option.

Which Lenders Allow Equity Release With a Mortgage?

Most equity release providers allow applications from homeowners with existing mortgages, provided the mortgage is repaid during the equity release process.

Providers tend to be specialist companies, though some traditional banks and building societies will assist their clients by referring them to equity release providers they have agreements with.

Providers include SunLife, Aviva, Just, and Legal & General, but a significant number of other providers are available.

Speak to a qualified equity release adviser to identify suitable lenders based on your circumstances.

What's the Difference Between a Standard Mortgage and a Lifetime Mortgage?

A standard mortgage is a loan secured against your property, typically requiring regular monthly repayments of both capital and interest over a fixed term (e.g., 25 years).

In contrast, a lifetime mortgage is a type of equity release designed for older homeowners.

It allows you to access a lump sum or drawdown facility by borrowing against your property's value without requiring monthly repayments.

The loan, plus any accrued interest, is repaid when you die or move into long-term care.

Are There Alternative Ways to Repay a Mortgage?

Yes, there are alternative ways to repay a mortgage.

Options include:

- Savings and Investments: Using personal savings, investments, or pension lump sums to pay off the mortgage.

- Family Assistance: Receiving financial help from family members to clear the mortgage balance.

- Remortgaging: Switching to a different mortgage product with better terms or extending the mortgage term to reduce monthly payments.

Common Questions

How much equity can you release?

Can you borrow more if you already have equity release?

Can I release equity if I still have an outstanding mortgage?

Can I use equity release to repay my mortgage?

Are there alternatives to equity release?

Conclusion

Equity release can be a viable option for homeowners looking to unlock the value of their property while managing an existing mortgage.

However, it is essential to understand the eligibility criteria, the repayment requirements, and the impact on your long-term financial plans.

Seeking professional advice is crucial to ensure you choose the right solution for your circumstances.

Whether you opt for a lifetime mortgage or explore alternative ways to clear your mortgage, careful consideration is key.

With the right approach, you can make informed decisions about equity release with an existing mortgage.

WAIT! Before You Go...