DON'T MISS OUT! Try Our FREE Calculator Now

Equity Release in Northern Ireland | Expert Guidance & Best Rates 2025

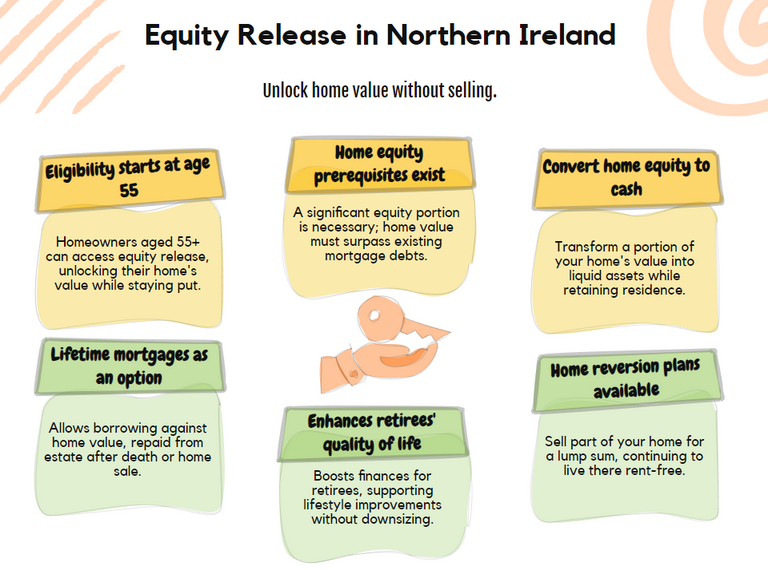

- Equity release allows homeowners aged 55+ in Northern Ireland to unlock tax-free cash from their property's value while continuing to live in it.

- Homeowners can choose a Lifetime Mortgage (a loan secured against the home with interest rolled up) or a Home Reversion Plan (selling a portion of the home while retaining the right to live there).

- With most plans, repayment happens when the homeowner passes away or moves into long-term care, typically through the sale of the property.

- Releasing equity reduces the value of your estate and could affect means-tested benefits, so financial advice is essential.

- The Equity Release Council (ERC) sets standards to protect consumers, ensuring features like the "no negative equity guarantee", meaning you’ll never owe more than your home's value.

As homeowners in Northern Ireland consider their financial options for retirement, equity release emerges as a vital solution.

This article provides a comprehensive guide to understanding equity release, including its workings, benefits, and the various schemes available, ensuring you navigate this financial landscape with confidence and expertise.

In This Article, You Will Discover:

NB: Fundweb is an unrelated and independent 3rd-party provider, and the information provided in this article are the opinions of Fundweb only and may not reflect the views of Northern Ireland. This article is not to be construed as advice, nor is it a solicitation to enter any financial product provided by Northern Ireland.

Understanding Equity Release in Northern Ireland

Equity release in Northern Ireland is a financial product tailored for homeowners aged 55 and over, enabling them to unlock the value of their home.

By converting home equity into cash, retirees can enhance their quality of life without the need to sell their property or relocate.

Homeowners must typically possess substantial equity, meaning their property’s value exceeds any existing mortgage.

The predominant types of equity release include lifetime mortgages and home reversion plans, both designed to provide homeowners with financial flexibility while allowing them to continue living in their homes.

What is Equity Release?

Equity release is a financial solution that empowers homeowners to access cash by releasing equity tied up in their property.

Specifically, this product caters to individuals aged 55 and older, allowing them to tap into the value of their home without the necessity to move out.

Homeowners must have significant equity, ensuring that their property is worth more than any outstanding mortgage.

The two main forms of equity release are lifetime mortgages, which provide a lump sum, and home reversion plans, where homeowners sell part of their home to access funds while retaining the right to live there rent-free.

How Equity Release Works

Equity release operates by permitting homeowners to borrow against the value of their home.

In the case of a lifetime mortgage, homeowners receive a lump sum, with the repayment of the loan and accrued interest occurring upon their death or transition into long-term care.

Alternatively, home reversion plans involve selling a portion of the home to a provider in exchange for cash while allowing homeowners to continue living in the property rent-free until they pass away.

Depending on age and health, homeowners may access up to 80% of their home’s value, making it a viable financial option for many.

Benefits of Equity Release

The benefits of equity release are manifold, providing an additional income stream during retirement, funding home improvements, and assisting family members financially.

Homeowners can use equity release to access cash without the burden of selling their homes, which preserves their living situation.

Furthermore, reputable equity release providers often offer a "no negative equity" guarantee, ensuring that homeowners will never owe more than the value of their home, thereby providing peace of mind for them and their heirs.

Main Types of Equity Release

Understanding the main types of equity release is crucial for homeowners considering this financial option.

The most prevalent form is the lifetime mortgage, which allows homeowners to borrow money secured against their property while maintaining full ownership.

The loan and interest are repaid upon the sale of the property, usually after the homeowner’s death.

This type of equity release is particularly appealing for those seeking to supplement their retirement income without the obligation of monthly repayments.

Lifetime Mortgages

Lifetime mortgages represent the most common type of equity release scheme available.

They enable homeowners to borrow funds against their property while retaining complete ownership.

The repayment of the loan and any accrued interest typically occurs upon the sale of the property, often after the homeowner passes away.

Homeowners can opt for a lump sum, smaller amounts, or a combination of both, making this option ideal for those wishing to enhance their retirement income without the stress of regular repayments.

Home Reversion Plans

A home reversion plan allows homeowners to sell a portion or their entire property to a reversion provider in exchange for a lump sum or regular payments.

Homeowners benefit from the right to live in their home rent-free until they pass away.

Upon the homeowner’s death, the provider sells the property and shares the proceeds based on the agreement.

This type of equity release is particularly attractive for individuals looking to access cash while still enjoying the comforts of their home.

Comparison of Equity Release Schemes

When comparing equity release schemes, it is essential to evaluate various factors, including interest rates, repayment conditions, and the potential equity that can be released.

Lifetime mortgages usually feature fixed or capped interest rates, while home reversion plans do not accrue interest.

Additionally, eligibility criteria may differ, with lifetime mortgages often available to a broader audience compared to home reversion plans.

Understanding these distinctions enables homeowners to make informed decisions that align with their financial needs and long-term objectives.

Equity Release Providers in Northern Ireland

Popular Equity Release Providers

In Northern Ireland, several trusted equity release providers stand out, including Aviva, Canada Life, Lloyds Bank, and Nationwide.

These lenders offer a range of equity release products, such as lifetime mortgages and home reversion plans, designed to meet the diverse needs of older homeowners.

Furthermore, 1st UK Money connects homeowners with preferred lenders that deliver competitive rates specifically tailored to the Northern Irish market.

To secure the best financial outcomes, it is imperative for homeowners to compare different providers and their offerings, ensuring they select an equity release plan that aligns with their financial goals.

Choosing an Equity Release Specialist

When homeowners consider equity release in Northern Ireland, selecting a qualified equity release specialist is critical.

It is advisable to choose firms that are members of the Equity Release Council, which guarantees adherence to high standards and customer protection.

Additionally, finding a specialist based in Northern Ireland with extensive market experience can provide invaluable insights into the unique challenges and opportunities available.

Personalized advice is essential for homeowners, allowing them to make informed decisions regarding their equity release options and ensuring that they are well-informed throughout the process.

Criteria for Selecting Providers

Choosing the right equity release provider requires careful consideration of several important criteria.

Homeowners should prioritize lenders that offer "no negative equity" guarantees, ensuring they will never owe more than the value of their home.

Transparency regarding fees and costs is also crucial; homeowners should thoroughly review testimonials to gauge the quality of customer service provided.

An evaluation of the range of equity release products offered by potential providers is essential, as well as whether these align with the homeowner’s financial aspirations.

A provider that offers personalized consultations can guide clients through their options effectively, aligning their choices with their long-term financial objectives.

Calculating Your Equity Release Options

Using an Equity Release Calculator

An equity release calculator serves as a beneficial tool for homeowners looking to estimate how much equity they can release from their property.

By inputting essential information such as age, health, and the current value of the home, homeowners can quickly gauge potential loan amounts and understand monthly repayment obligations, if applicable.

While these calculators provide a useful starting point for initial planning, it is crucial for homeowners to seek professional financial advice for a comprehensive assessment of their equity release options and to ensure they are making informed decisions that suit their needs.

How Much Equity Can You Release?

The amount of equity that homeowners can release varies based on multiple factors, including their age, health status, and the overall value of the property.

Generally, homeowners may access around 60% or more of their home’s value through equity release schemes.

In specific instances, particularly with lifetime mortgages, this figure may reach as high as 80%.

Lenders will carefully assess these factors to determine the maximum amount available for borrowing, allowing homeowners to make effective financial plans based on their unique circumstances and needs.

Factors Affecting Your Equity Release Amount

Several key factors influence the amount of equity that homeowners can release from their properties.

Primarily, a homeowner's age plays a significant role; older homeowners typically qualify for higher amounts because lenders perceive them as lower risk.

Additionally, the health status and the condition of the property also affect the equity available for release.

Any existing mortgage on the property must be considered, as it impacts the net equity that can be accessed.

By understanding these factors, homeowners can better navigate their financial needs and make informed decisions regarding equity release options that align with their long-term plans.

Disadvantages of Equity Release

Potential Risks and Considerations

While equity release can provide financial flexibility, it is essential for homeowners in Northern Ireland to be aware of various potential risks and considerations.

A primary concern is the accumulation of debt, as interest on the loan can compound over time, significantly reducing the value of your home left to heirs.

Moreover, equity release may impact eligibility for means-tested benefits, creating long-term financial implications that require careful evaluation.

Homeowners must understand the full scope of their decisions and how they align with their overall financial plan, particularly as they age and approach long-term care needs.

Impact on Inheritance

Equity release can significantly affect inheritance, as the amount borrowed and accrued interest will need to be repaid upon the homeowner's death.

This repayment process typically involves selling the property, which may reduce the amount left to beneficiaries.

Homeowners should carefully consider how equity release will impact their estate planning.

Engaging in open discussions with family members about these intentions is crucial, ensuring that everyone is informed and understands the potential outcomes of such financial decisions.

This proactive approach can help mitigate misunderstandings and foster family support regarding financial strategies.

Long-Term Financial Implications

The long-term financial implications of equity release can be substantial and warrant thorough consideration.

As homeowners age, the debt from equity release can grow significantly, potentially surpassing the value of the property.

This scenario could limit options available to heirs and may lead to financial strain, particularly if the homeowner needs to transition into long-term care.

Therefore, it is vital to weigh the benefits of equity release against these potential long-term costs.

Homeowners should engage with a qualified equity release adviser to navigate these complexities and develop a strategy that aligns with their financial goals.

Best Practices for Equity Release in Belfast

Finding the Best Rates in Northern Ireland

To find the best equity release rates in Northern Ireland, homeowners should proactively compare offers from multiple equity release providers.

Utilizing an independent equity release specialist can also help uncover competitive interest rates, which can vary significantly between lenders.

Homeowners must inquire about any associated fees with the equity release products.

These fees can impact the overall cost of borrowing, making it essential to understand the fine print before committing to an equity release plan.

A thorough comparison ensures that homeowners select a product that aligns well with their financial needs.

Steps to Take Before Committing

Before committing to an equity release plan, homeowners in Northern Ireland should undertake several essential steps to make informed decisions.

Seeking independent financial advice is crucial, as it helps to clarify the terms and conditions of the chosen equity release product.

Additionally, considering alternative options like downsizing or retirement interest-only mortgages can provide a broader perspective on financial strategies.

Engaging family members in discussions about these plans ensures that everyone is on board, fostering transparency and understanding regarding the homeowner's financial decisions and future intentions.

Common Questions

Who is eligible for equity release in Northern Ireland?

Will I still own my home if I take out equity release?

How much tax do I have to pay on the money I release?

Can I move house after taking out equity release?

What happens when I pass away or move into long-term care?

Conclusion

Equity release in Northern Ireland can be a valuable financial solution for homeowners looking to access the wealth tied up in their property.

Whether through a Lifetime Mortgage or Home Reversion Plan, it offers a way to supplement retirement income, fund home improvements, or assist family members.

However, it’s crucial to consider the long-term implications, including its impact on inheritance and benefits.

Seeking advice from a qualified financial adviser and choosing a plan regulated by the Equity Release Council ensures protection and peace of mind.

With careful planning, equity release can provide financial freedom while allowing you to stay in the home you love.

WAIT! Before You Go...