DON'T MISS OUT! Try Our FREE Calculator Now

- To qualify for equity release on a leasehold property in 2025, lenders typically require a minimum remaining lease term, often at least 75 years. If your lease is shorter, you may need to extend it before applying.

- Homeowners can access equity release through lifetime mortgages or home reversion plans. Lifetime mortgages are the most common, allowing you to borrow against your property while retaining ownership.

- Leasehold properties may come with additional complexities, such as ground rent, service charges, and freeholder permissions. Some lenders may have restrictions on certain types of leasehold agreements.

- Before applying, consult a specialist equity release adviser, check lender requirements, and consider legal implications. Ensure your lease terms meet lender criteria and explore all available options to maximise your financial benefits.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

As homeowners seek financial solutions in the evolving market of 2025, understanding how to get equity release on a leasehold property becomes essential.

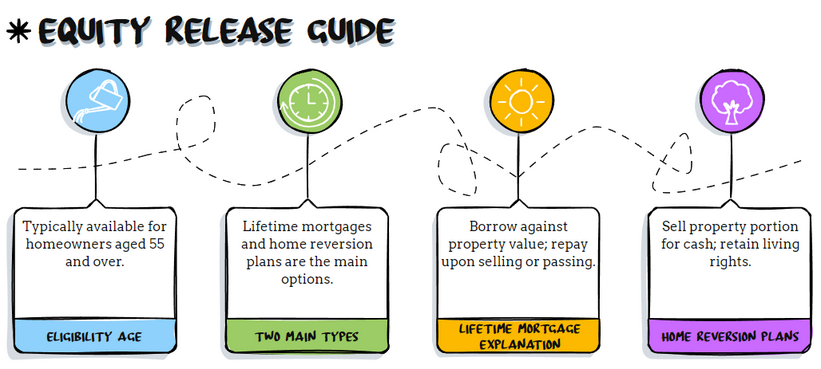

Equity release offers a way for individuals, particularly those aged 55 or older, to access the cash tied up in their property.

This article will explore the intricacies of equity release on leasehold properties, the types of properties that qualify, and the necessary conditions for homeowners to consider.

Understanding Equity Release on Leasehold Properties

Equity release is a financial product designed for homeowners, typically aged 55 and above, allowing them to release equity from their property without the need to sell it.

This can be achieved through two main types of equity release products: lifetime mortgages and home reversion plans.

In a lifetime mortgage, homeowners borrow against the property value, which is repaid upon selling the property, often triggered by the owner's death or transition to long-term care.

Conversely, home reversion plans involve selling a portion of the property to an equity release provider in return for a lump sum or regular income, while the homeowner retains the right to live in the property until they pass away.

It is crucial for homeowners to consider whether equity release is the right choice for them, especially when contemplating leasehold properties.

How Equity Release Works for Leasehold Flats

When looking to obtain equity release on leasehold flats, homeowners must be aware of specific conditions set by lenders.

Generally, a leasehold flat must have at least 75 to 90 years left on the lease to qualify for equity release.

Additionally, the property must be the homeowner's primary residence.

If the lease duration is insufficient, homeowners may need to use equity release to extend their lease before applying for release on a leasehold property.

This can be a complex process involving negotiations with the freeholder and may incur service charges and other costs.

Lenders will also evaluate the property’s condition, location, and the homeowner's financial situation when considering eligibility for equity release on leasehold properties.

Types of Leasehold Properties That Qualify for Equity Release

Not every type of leasehold property qualifies for equity release, making it important for homeowners to understand their options.

Typically, lenders are more willing to approve equity release on standard flats and houses.

Properties should ideally have a minimum of 75 years remaining on the lease, although some lenders may prefer even longer terms.

Ex-council flats and retirement flats might also be eligible for equity release, but these properties often have additional restrictions that can complicate the process.

For instance, retirement flats may include lease conditions that affect eligibility for equity release on leasehold flats.

Homeowners should carefully review their lease terms and consult with equity release lenders to determine if their property qualifies for equity release.

Steps to Get Equity Release on a Leasehold Flat

Assessing Your Eligibility to Qualify for Equity Release

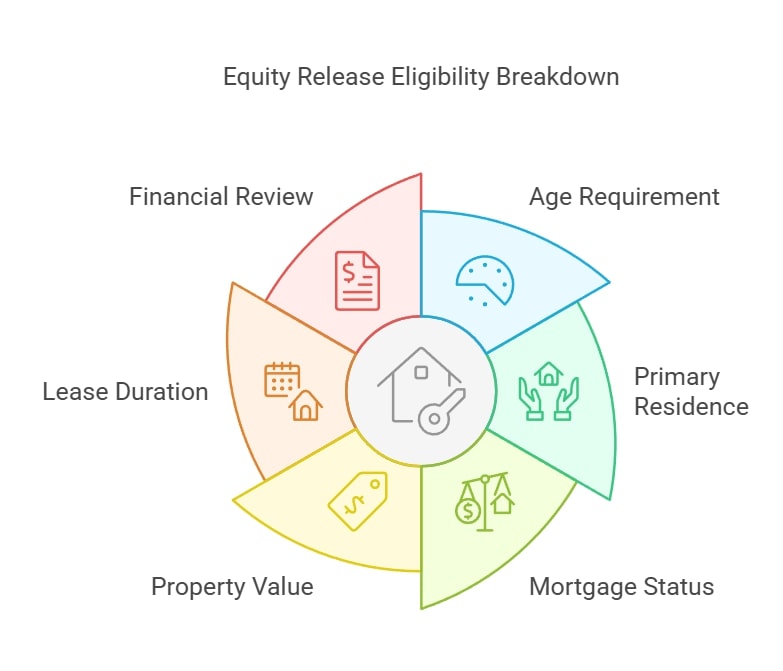

To get equity release on a leasehold flat, homeowners must first assess their eligibility based on specific criteria set by lenders.

Typically, individuals should be at least 55 years old, as this age threshold is standard for many equity release products.

Additionally, the leasehold property must serve as the homeowner's primary residence and should ideally be free from significant mortgage debt.

The property must also possess a minimum value, generally around £70,000, ensuring that enough equity can be released.

Furthermore, having at least 75 years left on your lease is crucial, as this duration helps maintain the property's value over time.

Lenders will conduct a comprehensive review of the homeowner's financial situation, including income sources and credit history, to determine whether they qualify for equity release.

Finding an Equity Release Provider

Finding a suitable equity release provider is a pivotal step for homeowners looking to release equity on a leasehold property.

It is important to conduct thorough research into various equity release lenders and their unique criteria, especially those who specialize in leasehold properties.

Homeowners should compare interest rates, fees, and the types of equity release products available, as different providers may offer different terms.

Consulting with an independent financial adviser who specializes in equity release can also be beneficial, as they can provide insights into the best options for your situation. They can help assess whether equity release is right for you, ensuring that you make an informed decision that aligns with your financial goals.

Understanding the Application Process

The application process for obtaining equity release on leasehold flats typically involves several detailed steps.

Homeowners will need to gather comprehensive information about their property, including the lease terms, service charges, and any ground rent obligations.

An independent valuation of the property may be necessary to establish its current market value, which plays a significant role in how much equity can be released.

Lenders will perform a thorough assessment of the homeowner's financial circumstances, reviewing income, expenses, and existing debts.

Once the application is submitted, it may take several weeks to receive a decision.

If approved, the funds can be released from the equity, which homeowners can then use for various purposes, such as home improvements, paying off debts, or enhancing their quality of life in retirement.

Using Equity Release to Extend Your Lease

Benefits of Extending Your Lease with Equity Release

Using equity release to extend a lease can provide significant benefits for homeowners.

A longer lease can increase the property’s value and make it more attractive to potential buyers in the future.

By extending your lease, you not only enhance the marketability of your leasehold flat, but you also protect your investment against depreciation that often accompanies shorter lease terms.

This action alleviates concerns about lease expiration, which could impact your ability to secure equity release or sell the property later on.

Moreover, by using funds from equity release to cover the costs of extending the lease, homeowners can ensure they meet lender requirements, thereby maintaining the property’s desirability and potential for future equity release.

Potential Costs Involved in Lease Extension

Extending a lease can incur various costs that homeowners should be aware of when considering equity release on leasehold properties.

These costs may include legal fees for solicitors, which can range from £500 to £1,500, and surveyor fees for property valuations, typically costing between £300 and £800.

Additionally, a premium payment to the freeholder for the lease extension can vary significantly based on the property value and remaining lease term.

This premium payment could range from a few thousand pounds to much higher amounts for more valuable properties.

Understanding these potential costs is crucial for homeowners planning to use equity release to extend their lease, ensuring they budget appropriately and avoid financial strain.

How to Release Equity for Lease Extension

Homeowners can apply for equity release and a lease extension simultaneously if they do not have the funds to cover the extension costs upfront.

The equity release provider may allow the use of released funds to pay for the lease extension, which can streamline the process significantly.

It is essential to engage in negotiations with the freeholder, obtain a valuation of the property, and finalize all necessary legal documentation.

Homeowners should work with experienced solicitors to navigate this process effectively, ensuring compliance with all legal requirements and protecting their interests.

This collaborative approach can help facilitate a smoother transaction, ultimately enhancing the success of their equity release plan.

Pros and Cons of Equity Release on Leasehold Flats

Advantages of Equity Release

Equity release on leasehold flats offers several compelling advantages for homeowners.

One of the primary benefits is the ability to access tax-free cash without the need to sell the property.

This financial flexibility allows homeowners to use equity release for a multitude of purposes, such as making home improvements, paying off debts, or enhancing their retirement income.

Additionally, equity release plans typically do not require monthly repayments, as the loan is repaid only upon the homeowner's death or transition into long-term care.

This structure enables individuals to maintain their lifestyle while effectively utilizing the value of their property, making equity release an attractive option for many.

Cons of Equity Release

Despite its numerous benefits, equity release on leasehold properties has potential drawbacks that homeowners must carefully consider.

A significant concern is the impact on inheritance, as the amount owed can accumulate over time, which may substantially reduce the value of the estate left for heirs.

Furthermore, interest rates associated with equity release plans are often higher than those of traditional mortgages, potentially leading to a larger debt burden over time.

Additionally, homeowners should be aware that releasing equity could affect their eligibility for means-tested benefits, making it essential to weigh these factors before proceeding with an equity release plan.

Alternatives to Equity Release

For homeowners looking for financial relief, exploring alternatives to equity release is a prudent approach.

One viable option is downsizing to a smaller or more affordable property, which can help free up capital without the complexities associated with equity release.

Additionally, securing loans or grants for specific purposes, such as home improvements or healthcare needs, may provide financial assistance without the need to borrow against the home.

Consulting with a financial adviser can also be beneficial, as they can help identify the most suitable options based on individual circumstances, ensuring homeowners make informed decisions that best suit their financial needs.

Common Questions

Can I get equity release if my lease has less than 75 years remaining?

Will ground rent and service charges affect my eligibility?

Do I need the freeholder’s permission for equity release?

Are leasehold retirement properties eligible for equity release?

Can I sell my leasehold property after taking equity release?

Conclusion

Before deciding on equity release, homeowners should thoroughly evaluate their financial needs and long-term goals.

This involves careful consideration of current debts, future expenses, and the potential impact on inheritance.

Homeowners may find it beneficial to assess how equity release aligns with their retirement plans and whether it provides the necessary financial flexibility they seek.

Taking the time to understand personal financial situations can lead to more informed decisions regarding equity release, helping to ensure that homeowners choose a path that aligns with their unique circumstances and goals.

WAIT! Before You Go...