DON'T MISS OUT! Try Our FREE Calculator Now

- If a person is unable to make decisions due to health issues or incapacity, a Power of Attorney is crucial for managing their equity release process. It allows a designated individual to make financial decisions on their behalf.

- There are two main types of Power of Attorney that can be used in equity release—Lasting Power of Attorney (LPA) and Enduring Power of Attorney (EPA). LPA gives the attorney authority in case of mental incapacity, while EPA is typically used for financial decisions.

- Having a PoA in place ensures that the attorney can manage the property and any associated loans, making the process smoother and avoiding delays in releasing funds when needed.

- Before a PoA can act on behalf of someone in an equity release transaction, it must be legally registered and verified. Financial providers will require proof that the PoA is valid and has been granted with the proper authority to make decisions.

In today's financial landscape, understanding equity release and the role of an attorney in managing your financial affairs is crucial, especially as we age.

With options like lifetime mortgages and home reversion plans available, homeowners aged 55 and over can benefit significantly from these financial products.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This article explores the intricacies of equity release, the importance of a power of attorney, and how legal support can guide you through the process.

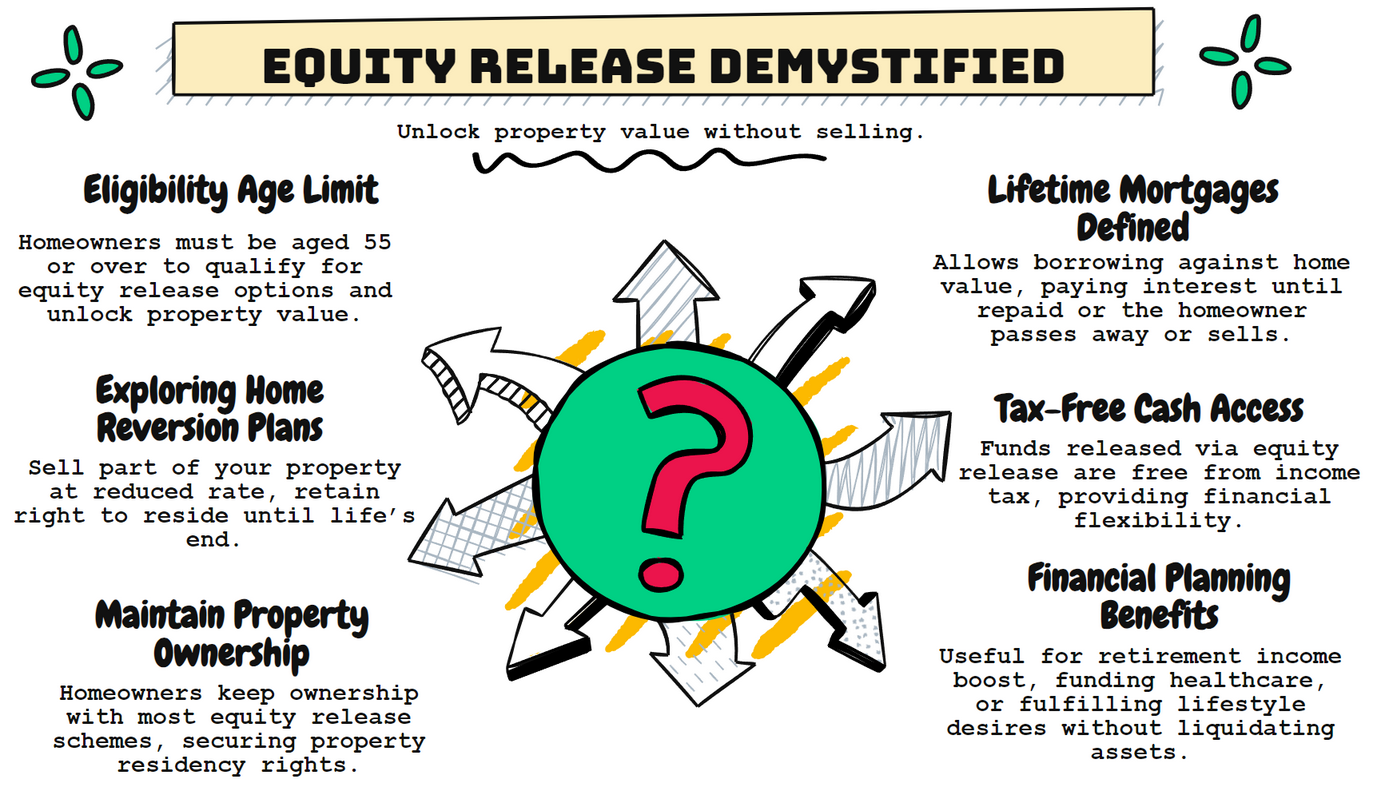

Understanding Equity Release

Equity release is a financial strategy tailored for homeowners aged 55 and over, enabling them to access the equity tied up in their property without needing to sell it.

This approach is advantageous for individuals seeking additional funds for unexpected expenses or wishing to maintain a comfortable lifestyle in retirement.

The primary forms of equity release in the UK include lifetime mortgages and home reversion plans.

By understanding these options, homeowners can effectively navigate their financial landscape.

What is Equity Release?

Equity release refers to financial products that allow homeowners to release equity from their properties, particularly those aged 55 and older.

This financial mechanism is essential for those who may face unexpected expenses or wish to enhance their retirement lifestyle.

The two main types include lifetime mortgages, where homeowners borrow against their property, and home reversion plans, which involve selling a portion of the home for immediate cash while retaining the right to live there rent-free.

Types of Equity Release

The two primary types of equity release available in the UK are lifetime mortgages and home reversion plans.

A lifetime mortgage allows homeowners to borrow against the value of their property, with the total amount, including interest, payable upon sale or the homeowner's death.

Conversely, home reversion plans enable individuals to sell a percentage of their home in return for cash, maintaining the right to live in the property rent-free.

Both options provide financial flexibility, but they entail different implications for inheritance and estate value.

How to Take Out Equity Release

To initiate the equity release process, homeowners must first evaluate their financial needs and understand the implications of releasing equity.

Consulting with a qualified financial adviser specialising in equity release is crucial to explore suitable products.

The process typically involves an initial consultation, followed by a property valuation and a comprehensive assessment of the homeowner's financial situation.

Once a suitable equity release plan is identified, legal advice is strongly recommended to ensure compliance with regulations and thorough understanding.

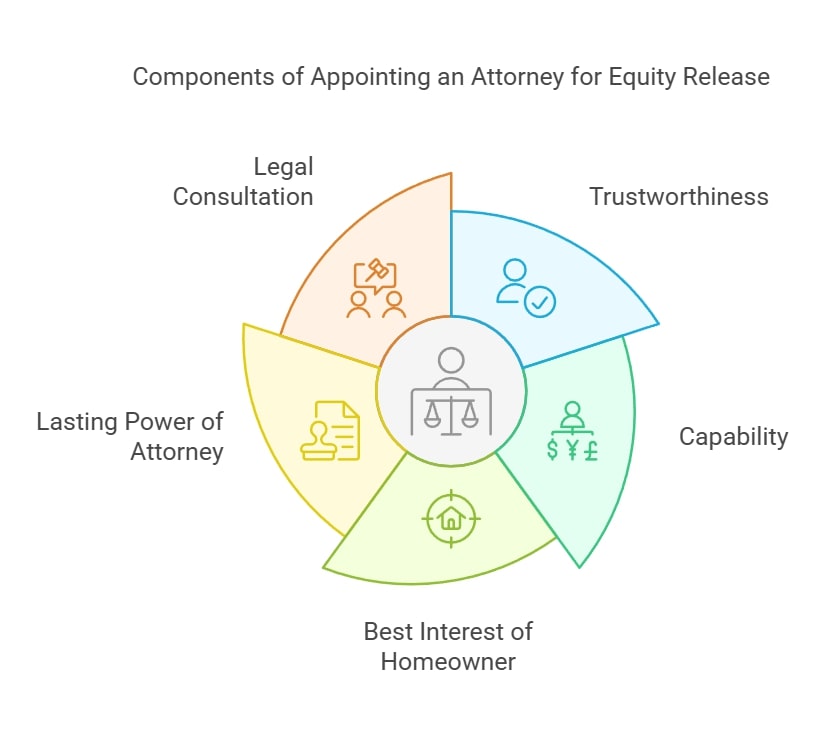

The Role of an Attorney in Equity Release

An attorney can play a crucial role in assisting clients with equity release by providing legal guidance and ensuring that the process adheres to all regulatory requirements.

They can help homeowners understand their options, navigate the complexities of equity release agreements, and ensure that the decisions made align with the homeowner's best interests.

Attorneys can also facilitate communication between the homeowner and the lender, ensuring that all necessary documentation is completed accurately and submitted on time.

Legal Advice for Equity Release Clients

Legal advice is essential for equity release clients to understand the implications of their decisions fully.

An attorney can explain the terms of the equity release product, including any potential impact on inheritance and eligibility for means-tested benefits.

They can also assist in drafting and registering a Lasting Power of Attorney (LPA) if needed, ensuring that the homeowner's financial affairs can be managed by a trusted individual in case of incapacity.

This legal support helps protect the homeowner's interests and provides peace of mind throughout the equity release process.

Appointing an Attorney for Equity Release

When appointing an attorney for equity release, it is crucial to choose someone trustworthy and capable of managing financial matters.

The attorney must be prepared to act in the best interest of the homeowner, making informed decisions regarding the equity release process.

This appointment can be formalised through a Lasting Power of Attorney, which grants the attorney the authority to manage the homeowner's financial affairs if they become incapacitated.

It is advisable to consult with a legal professional to ensure the LPA is properly drafted and registered with the Office of the Public Guardian.

What is Power of Attorney?

Power of Attorney (POA) is a legal document that allows an individual to appoint someone else, known as an attorney, to make decisions on their behalf if they become unable to do so.

There are different types of POA, including Lasting Power of Attorney (LPA), which is specifically designed to remain in effect even if the individual loses mental capacity.

The two main categories of LPA are Property and Financial Affairs LPA, which covers financial decisions, and Health and Welfare LPA, which pertains to personal welfare and medical decisions.

Lasting Power of Attorney (LPA) and Its Importance

A Lasting Power of Attorney (LPA) is essential for individuals who want to ensure their financial and healthcare decisions are made by someone they trust in case they become incapacitated.

An LPA must be registered with the Office of the Public Guardian before it can be used.

It is crucial to set up an LPA while the individual is still mentally capable, as once capacity is lost, it becomes impossible to create one.

Having an LPA in place provides peace of mind and ensures that the appointed attorney can manage the individual's affairs according to their wishes.

How Power of Attorney Can Work in Equity Release

Power of Attorney can significantly streamline the equity release process, especially for individuals who may lose mental capacity.

If a homeowner has an LPA in place, their attorney can act on their behalf, making decisions related to equity release and managing the application process with lenders.

This ensures that the homeowner's interests are protected, and that financial decisions align with their wishes.

However, it is essential that the LPA explicitly grants authority over equity release matters to avoid any complications during the process.

Steps to Obtain Equity Release Advice

The process of obtaining equity release advice typically begins with an initial consultation with a qualified adviser specializing in equity release products.

During this meeting, the adviser will assess the homeowner's financial situation, needs, and goals.

They will provide information on various equity release options, including the advantages and disadvantages of each.

Once the homeowner decides on a suitable equity release plan, the adviser will guide them through the application process, including obtaining necessary valuations and legal documentation.

Choosing a Solicitor for Equity Release

Choosing a solicitor for equity release is crucial in ensuring that the process is handled correctly and efficiently.

It is advisable to select a solicitor who specializes in equity release and possesses a thorough understanding of the legal implications involved.

The solicitor will assist in drafting necessary documents, such as the Lasting Power of Attorney, and ensure that all legal requirements are met.

Additionally, they can provide guidance on the potential impact of equity release on the homeowner's estate and inheritance.

Case Study: Power of Attorney in Action

A practical case study can illustrate the importance of having a Power of Attorney in place when engaging in equity release.

For example, a homeowner suffering from Alzheimer's was unable to make financial decisions regarding her property.

With an Enduring Power of Attorney appointed, her solicitor was able to facilitate the equity release process, allowing her to access funds to cover long-term care costs.

This case highlights how having a trusted attorney can ensure that financial matters are managed effectively, even when the homeowner is unable to participate in the process.

Mental Capacity and Equity Release

Mental capacity is a critical factor in the equity release process.

Homeowners must have the mental capacity to understand the implications of releasing equity from their property.

If a homeowner loses mental capacity, their Power of Attorney can step in to manage their financial affairs, including equity release.

It is essential for individuals to plan ahead and establish an LPA while they still have capacity, as this ensures that their wishes are respected and that their financial matters can be managed by a trusted individual.

Drawdown Lifetime Mortgages Explained

Drawdown lifetime mortgages allow homeowners to release equity in smaller amounts over time, rather than taking a lump sum upfront.

This type of equity release product is particularly beneficial for those who want to manage their finances carefully and only access funds as needed.

Homeowners retain the flexibility to draw down additional funds in the future, providing a safety net for unexpected expenses.

However, it is crucial to understand the terms and conditions associated with drawdown mortgages, including any fees or interest implications.

Releasing Equity Responsibly

Releasing equity should be approached with caution and responsibility.

Homeowners must consider the long-term implications of accessing their property’s value, including the potential impact on inheritance and eligibility for means-tested benefits.

Seeking independent financial advice is crucial to ensure that equity release aligns with the homeowner's overall financial strategy and personal goals.

Additionally, it is important to understand the specific terms of any equity release product and how it may affect the homeowner's financial situation in the future.

Common Questions

What is the role of a Power of Attorney in equity release?

Can I release equity if I have a Power of Attorney?

What types of Power of Attorney are needed for equity release?

How do I ensure my Power of Attorney is recognised by equity release providers?

Can a Power of Attorney access the full value of my property through equity release?

Conclusion

Having a Power of Attorney in place is vital for managing equity release, particularly when the individual is unable to make decisions themselves.

Whether through a Lasting or Enduring Power of Attorney, this legal document ensures that a trusted representative can act on behalf of the person in question, ensuring a smooth process for accessing the equity tied to their property.

It is essential that the PoA is properly registered and legally recognised to avoid any complications during the equity release process.

By taking these precautions, individuals can secure their financial interests while ensuring their wishes are respected, even in the event of incapacity.

WAIT! Before You Go...