DON'T MISS OUT! Try Our FREE Calculator Now

- To obtain a free equity release quote online, visit a reputable provider's website and use their equity release calculator, entering details such as your age, the value of your property, any existing mortgages, and your contact information.

- Online equity release quotes are relatively accurate when provided with detailed and precise information; however, these quotes are preliminary estimates that may change following a formal valuation.

- The variability in quotes across different providers can be attributed to differences in interest rates, loan-to-value ratios, and specific terms and conditions.

Equity Release Quotes are a hot topic since over £6 Billion have been unlocked in the UK over the course of 2022.1

As a financial tool that has grown exponentially in popularity, it offers you a unique opportunity to tap into the value of your property.

But with so many variables at play, understanding your quote is essential.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

How do factors such as age, health, property value, location, outstanding mortgages, and interest rates influence your quote and why is it crucial to compare different providers?

Compiled by our expert team of expert researchers, this article gives you the facts you need.

What Is Property Equity Release?

Property equity release involves unlocking the wealth stored in your property, offering a flexible way to supplement your retirement income.

Are You Seeking an Equity Release Quote in 2026?

If you are looking for a quote, our detailed guide will help to answer some questions you may have in order to make informed decisions.

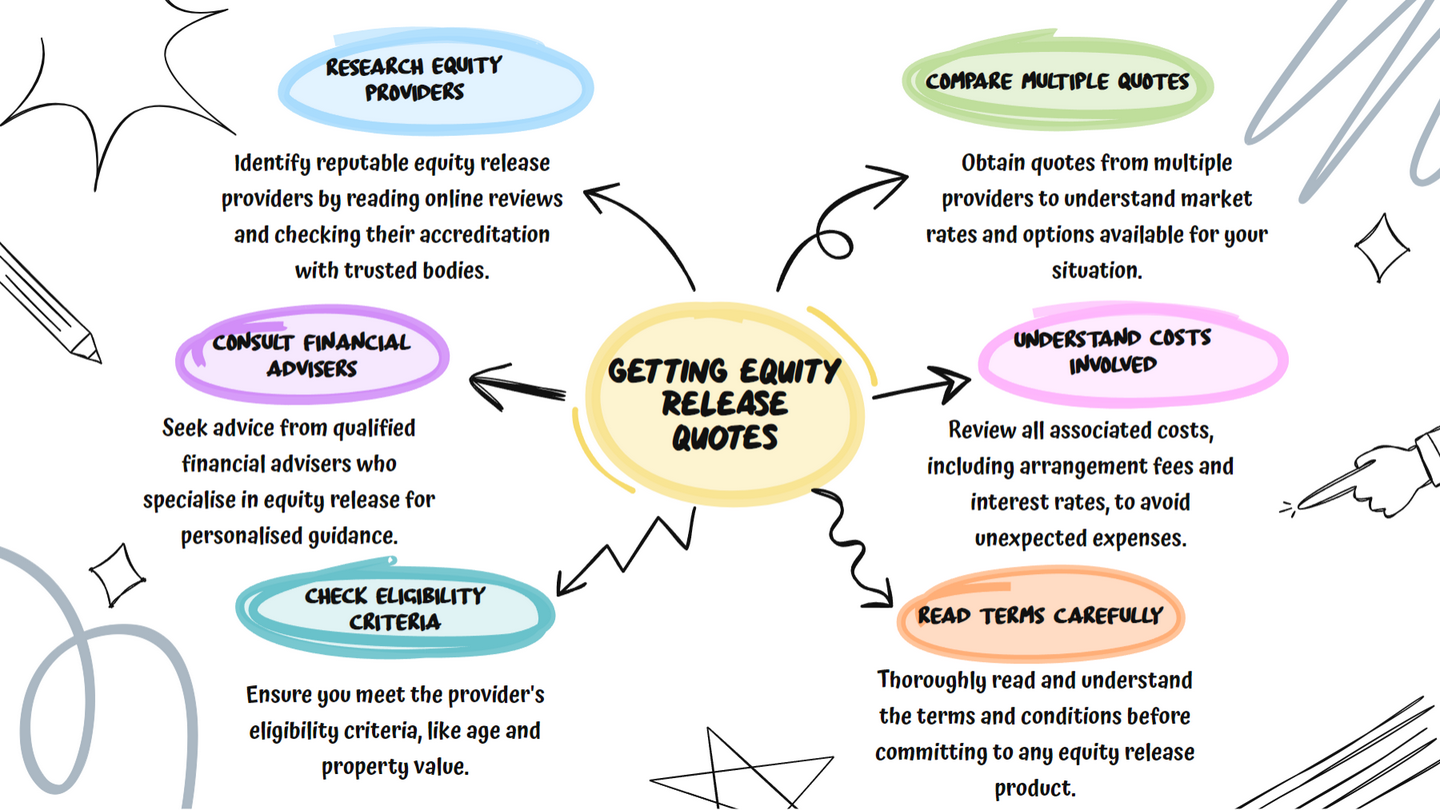

What Is the Best Way to Get an Equity Release Quote in the UK?

Searching for an equity release quote in the UK is most effective when done online.

Many equity release providers offer instant online quotations, where you can input your age, property value, and amount of Equity to get an immediate estimate.

Websites such as Equity Release Supermarket, Age Partnership Equity Release, and more offer these services, making it easy to compare from a variety of providers.

To get an even more accurate quote, consider speaking directly with an advisor from a reputable equity release provider.

These professionals can offer a personalized quote based on an in-depth understanding of your situation.

Be sure to check the provider's credentials on the Equity Release Council’s member directory, for a trustworthy and reliable service.

Remember, a good quote isn't just about the lowest interest rate, but also the terms and conditions, and potential impact on your future financial planning.

What Factors Determine What Quote You Will Receive?

There are a number of factors that could impact your quote, including:

- Your age and health.

- Property’s value and location.

- Outstanding mortgage, if applicable.

- Current interest rates.

How Do Age and Health Influence Your Quote?

Age and health are crucial when calculating an equity release quote.

This is because usually the older you are, the more equity you are able to release.

Some plans even consider your health and lifestyle conditions, potentially offering more favourable terms if you have certain medical conditions or lifestyle habits that lower your life expectancy.

You may wonder if there is a property equity release age limit. The youngest applicants cannot be under the age of 55, and some providers have a cap on the maximum age of applicants.

What Role Does Property Value and Location Play?

The value and location of your property significantly influence your quote since a higher property value means more equity can be released.

Additionally, properties in sought-after locations may secure better terms.

Are Outstanding Mortgages or Debts a Concern?

Yes, an existing mortgage must first be paid off when you take out an equity release plan, which will then be deducted from the released funds before paying anything left over to you.

This may be a concern when your outstanding mortgage is higher than the amount you are able to release, which could disqualify you.

There are still options to consider

However, you could still qualify even with an existing mortgage.

Outstanding debts do not necessarily affect your quote, as many homeowners use the funds received to settle other types of debt in their retirement.

Learn More: Equity Release With an Existing Mortgage

How Do Interest Rates Affect Equity Release?

Interest rates play a crucial role because higher rates increase your overall debt and may reduce the amount of inheritance you leave behind.

Yet lower rates (compared to traditional mortgages and other financial types of borrowing) may make the offer more attractive than regular loans in the long run.

How Can You Obtain an Equity Release Quote?

You can obtain a quote from financial advisors, online platforms, and directly from a provider.

You will be required to provide some information, and it is recommended to obtain a few quotes and ensure you only approach advisors or providers registered with the Equity Release Council (ERC).

What Personal Information is Required

You many need to need to provide the following personal information:

- Your age or the age of the youngest applicant

- Your health and lifestyle conditions

- Your marital status, if applicable

These factors all impact the terms and conditions of your plan.

What Property Specifics Do You Need?

Property-specific details you need to provide to release equity include:

- Your property's current market value

- The property type (such as detached, semi-detached, or terraced)

- The property’s location (regional location and whether it is near council buildings, shopping centres, etc.)

These elements play a significant role, as certain areas or property types do not qualify.

What Details Do You Need About Existing Financial Commitments?

Details on existing mortgages or secured loans must be provided, as these will be deducted from the total equity that can be released.

Why Is It Essential to Compare Different Equity Release Providers?

Comparing different providers is essential to secure the most advantageous terms, as providers differ in their interest rates, product features, and drawbacks.

By weighing up various quotes, you can pinpoint the right option tailored to your financial situation, potentially leading to significant savings throughout the loan's duration.

Engaging with a knowledgeable advisor or broker is advisable to ensure you select the most appropriate deal for your needs.

Try Go Compare to compare different equity release providers

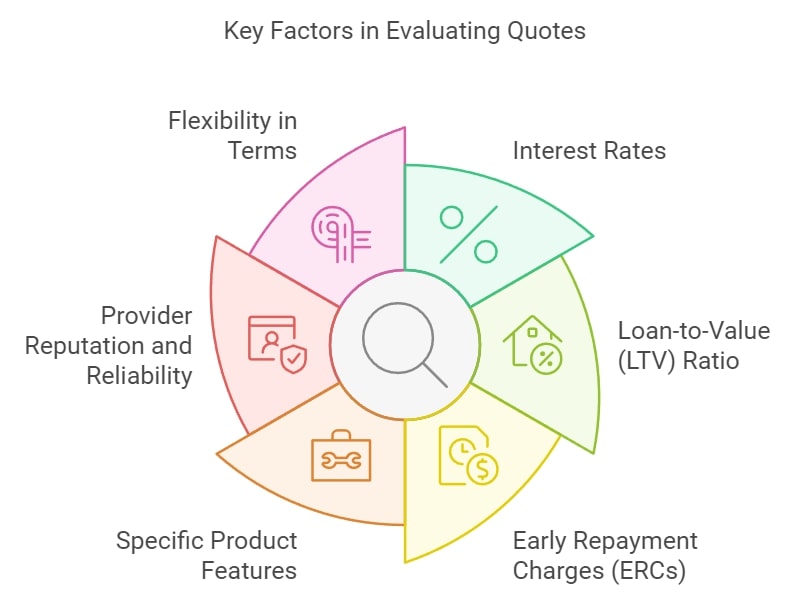

What Should You Consider When Evaluating Quotes?

When evaluating these quotes, consider the interest rates, loan-to-value ratio, product features, and more.

Interest Rates

Interest rates play a vital role in the overall cost, influencing both the amount you can borrow now and the total amount you will owe at the end.

By comparing the rates various providers offer, you can identify the most suitable option that aligns with your financial goals.

This not only helps you secure a favourable deal but also ensures that your plan is sustainable over time.

Loan-to-Value (LTV) Ratio

The Loan-to-Value (LTV) Ratio is a critical factor in determining your equity release quote, as it indicates how much of your property's value you can access, expressed as a percentage.

Understanding this ratio can help you gauge your borrowing power, making it essential to know which provider is giving you the best deal.

Early Repayment Charges (ERCs)

Early repayment charges can be quite costly and are often not something that is considered at the onset.

If you repay the loan earlier than expected, your provider may charge you for doing so.

Understanding how these charges work and when they apply is vital to avoid unexpected costs.

Specific Product Features

Look for product features that suit your needs, such as drawdown facilities, which allow you to access funds as and when required.

Other features can include inheritance protections, cash-back benefits, and no early repayment charges, to name a few.

Understanding these features can provide flexibility and control over your finances now and in the long run.

Provider Reputation and Reliability

The providers’ reputation and reliability are among the most important aspects of obtaining a quote.

You do not want to deal with an unreliable provider that is not a member of the Equity Release Council (ERC).2

Things to look for include:

- The provider's track record.

- Customer satisfaction rates and reviews.

- Member of the ERC and regulated by the Financial Conduct Authority (FCA).3

By ensuring you vet the provider, you can avoid unnecessary issues and expect a commitment to quality service and ethical practice.

Flexibility in Terms

Flexibility in terms means more adaptable options, accommodating for future changes in your financial or personal circumstances.

This can include voluntary repayments towards the interest or capital, the ability to access more funds in the future, or the option to change your plan from a lump sum to a drawdown facility.

This adaptability can provide peace of mind, ensuring the plan remains suitable for your needs even as your situation evolves.

Common Questions

What is the Average Equity Release Quote in the UK

How to Get an Equity Release Quote Online

What Factors Influence My Equity Release Quote

Can I Trust an Instant Equity Release Quote

How Does an Equity Release Quote Compare to Traditional Mortgages

What Happens if My Circumstances Change After I Get an Equity Release Quote

Does Having a Partner or Spouse Affect My Equity Release Quote

Can I Get an Equity Release Quote if I Have a Leasehold Property

How Can I Ensure That My Equity Release Quote Is Competitive

Does an Equity Release Quote Affect My Credit Score

Conclusion

The journey towards an equity release quote is dependent on various factors such as age, health, property type, market conditions, and individual financial situations.

Each decision in this process carries unique implications, underscoring the necessity of expert guidance.

If you are considering obtaining an equity release quote, it is essential to first contact a trusted financial adviser to explain how it works.

WAIT! Before You Go...