DON'T MISS OUT! Try Our FREE Calculator Now

- Equity release funds are not taxed as income in the UK, but accessing your home's value could affect eligibility for means-tested benefits and may influence taxation if the funds are invested with taxable returns.

- Large withdrawals from equity release might shift your taxation bracket if those funds are then invested to generate taxable income, with no direct fiscal benefits but the potential for indirect financial stability by using funds to clear debts.

- Using equity release can reduce your estate's value, potentially lowering inheritance tax liabilities depending on how the funds are used and the total worth of your estate.

Navigating the complex terrain of equity release tax is critical for property owners in the UK, particularly those looking to unlock the value tied up in their homes.

With the latest data showing a staggering £8.68 trillion of property wealth in 2022, the implications of tax laws on this sector have never been more pertinent.1

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This comprehensive guide delves into how these products interact with different types of taxation, whether it is income tax, capital gains tax, or the potential implications for inheritance tax.

Drawing from our depth of experience and up-to-date information in the financial sector, we aim to offer you an insightful, reliable, and easy-to-understand guide on equity release tax, reinforcing our commitment to empowering you in making informed financial decisions.

What Are Equity Release Loans In The UK?

In essence, equity release loans allow homeowners to turn the wealth stored in their property into a usable and accessible form of cash.

Is Equity Release Taxable in the United Kingdom?

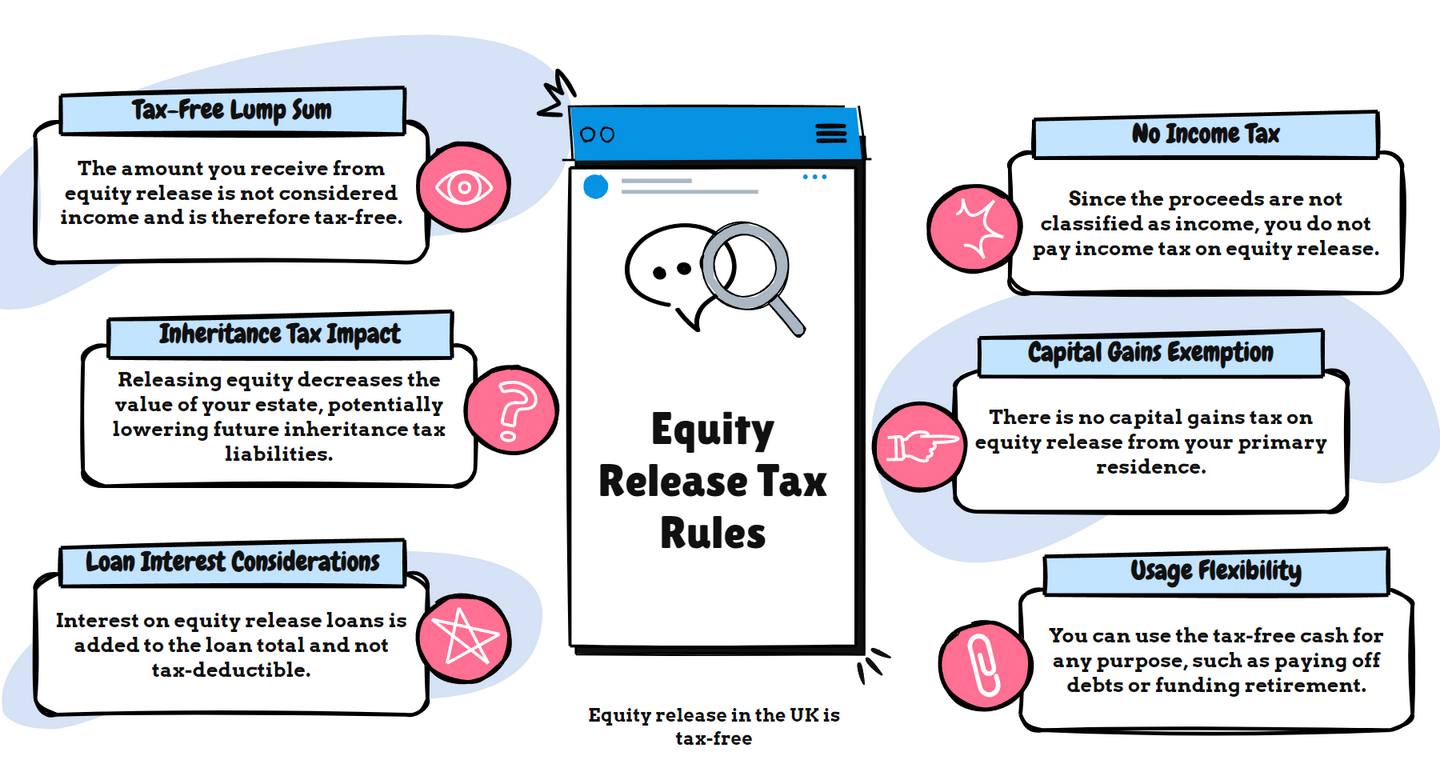

Equity release in the United Kingdom is not typically subject to taxation.

As homeowners, we can unlock the value tied up in our property without incurring income tax or capital gains tax liabilities.

This is primarily because the money received is considered a return of capital, rather than a conventional income source.

However, the money received from equity release can potentially affect eligibility for means-tested benefits.

Additionally, if the money released is invested and generates an income, the income may be subject to tax.

It's crucial to understand the ramifications on various financial aspects to make well-informed decisions.

What Do You Need to Know About Taxes and Equity Release?

Equity release allows homeowners aged 55 and above to unlock the value tied up in their property without needing to sell.

It can provide a lifeline for those looking for additional income in retirement.

But what about the tax implications of such an arrangement?

In the UK, equity release is typically not subject to income tax or capital gains tax, but it can have implications for inheritance tax (IHT).

Why Does Equity Release Remain Unaffected by Taxation?

It is a common misconception that the funds received from equity release will be taxed.

However, as per HMRC's current rules, these funds are classified as a loan rather than income or capital gain.

This means they are exempt from both income and capital gains tax.2

This tax-free status often makes releasing equity an attractive option for retirees looking to supplement their pension.

Read More: Equity Release Rules and Guidance

How Do Income Tax and Capital Gains Tax Relate to Equity Release?

Understanding the nuances of how unlocking property equity interacts with these 2 primary forms of taxation is essential in making informed financial decisions.

Is Income Tax Applicable on Equity Release?

Income tax, in its simplest form, is a tax on the money you earn.

In the context of equity release, it is important to understand that the funds you receive from such a scheme are not classed as earned income.

They are, instead, a form of borrowing against the value of your property.

How does that affect the tax?

Because of this distinction, income received from an equity release scheme is not subject to income tax.

This is a key advantage for homeowners, as it enables them to access a significant sum of money without increasing their tax liabilities for that tax year.

What Are the Capital Gains Tax Implications for Equity Release?

Capital gains tax, often shortened to CGT, is a tax levied on the profit you make when you sell or 'dispose of' an asset that has increased in value.

In terms of equity release, your property is certainly an asset; however, capital gains tax is generally not applicable.

The reason for this is two-fold.

Firstly

Capital gains tax is only due when you sell or 'dispose of' an asset. In an equity release scheme, you are not selling your property - you are borrowing against it.

Secondly

Your main home (or 'primary residence', as it is often referred to) is usually exempt from CGT, under what is known as Private Residence Relief.3

Can Equity Release Serve as a Tool to Lessen Inheritance Tax (IHT)?

While equity release loans in the UK are not subject to income or capital gains tax, it can have an impact on the inheritance tax.

By releasing equity from your home, you may reduce the value of your estate, and hence the potential inheritance tax bill.

This can serve as an efficient estate planning tool, but it is always recommended to take professional advice as this is a complex area.

Will Beneficiaries Be Required to Pay Inheritance Tax on Proceeds Received?

When it comes to inheritance tax, UK law mandates that any estate worth more than £325,000 is subject to a 40% tax on the amount exceeding the threshold. 4

This tax is payable by the estate, but ultimately, it often reduces the inheritance passed onto beneficiaries.

Herein lies the key: equity release reduces the value of your estate, which can potentially lower the inheritance tax due.

By releasing equity and spending, gifting, or investing these funds, homeowners can effectively diminish the size of their taxable estate.

But it is important to tread cautiously. Any gifts made from the equity release are potentially liable for inheritance tax if you pass away within 7 years of making the gift – this is known as a 'potentially exempt transfer'.5

Also, remember that releasing property equity will reduce the amount of inheritance you can leave to your loved ones, and it may also affect your tax situation and eligibility for means-tested benefits.

It is essential to take independent financial and legal advice before proceeding with equity release.

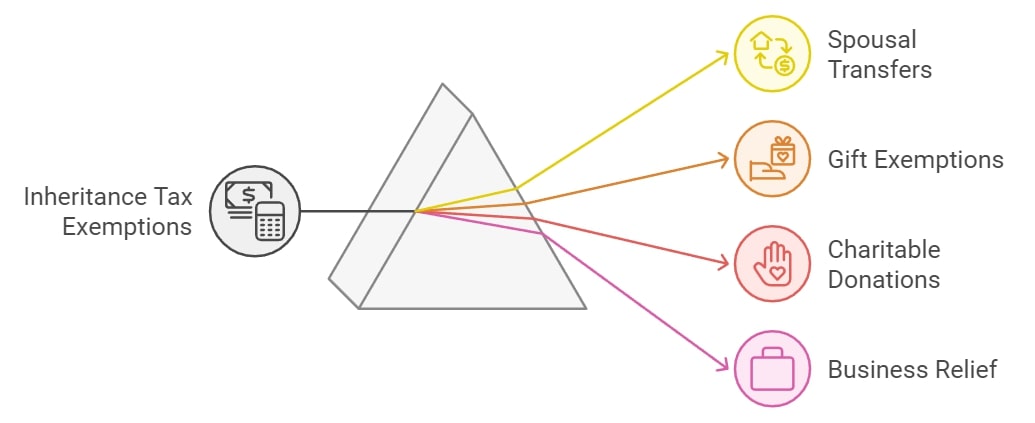

What Other Circumstances Could Lead To Inheritance Tax Exemptions?

Circumstances that could lead to exceptions include:

- Spousal Transfers: The estate left to a spouse or civil partner who lives permanently in the UK is usually exempt from IHT.

- Gift Exemptions: The 'seven-year rule' allows you to make gifts during your lifetime, which will be exempt from IHT if you live for seven years after making the gift.

- Main Residence Nil Rate Band: This is an additional IHT threshold applied when your main home is passed on death to your children or grandchildren. This can potentially increase the IHT threshold to £500,000. 6

- Charitable Donations: If you leave at least 10% of your net estate to a charity, you can reduce the rate of Inheritance Tax on some assets from 40% to 36%.

- Business, Woodland, Heritage, and Agricultural Relief: Certain assets are wholly or partly exempt from IHT, such as farmland, woodland, or some business assets.

How Would Inheritance Tax Apply in Different Scenarios?

There is typically no inheritance tax to pay if either the value of your estate is below the £325,000 threshold or you leave everything above this threshold to your spouse, civil partner, a charity, or a community amateur sports club.

What Would Inheritance Tax Look Like Without Equity Release?

If your estate is worth £500,000, without equity release, your estate would be liable for inheritance tax on the amount over the £325,000 threshold.

In this case, the taxable portion of your estate is £175,000 (£500,000 - £325,000). Therefore, your estate would have to pay 40% of £175,000, which is £70,000, in inheritance tax.

What Would Inheritance Tax Look Like With Equity Release?

On the other hand, suppose you decide to release £200,000 in equity from your home.

The total value of your estate now drops to £300,000.

Since this value falls below the inheritance tax threshold, your estate would not be liable to pay any inheritance tax.

Common Questions

What Are the Tax Implications of Equity Release in the UK

Do You Pay Tax on Equity Release in the UK

How Does Equity Release Affect My Tax Status

Is Equity Release Tax-Free in the UK

Can Equity Release Impact My Inheritance Tax

What Could Be the Tax Implications of Selling Your Home After Releasing Property Value

Can I Offset Interest Charges From Equity Release Against My Tax Bill

How Does Equity Release Affect My Tax Code

Can Equity Release Change My Tax Bracket

What Is the Impact of Equity Release on My Estate’s Value for Tax Purposes

Conclusion

Understanding the intricacies of taxation in relation to equity release is crucial for anyone considering this financial step.

Although the funds received are typically tax-free, there can be complex implications for your estate, potential inheritance tax, means-tested benefits, and overall financial situation.

Hence, it is essential to fully understand the wider impact on your finances and not just the immediate benefits.

Reach out to a qualified finance expert or tax advisor today, and make sure your decisions about equity release tax are well-informed, and offer you the financial peace of mind you deserve.

WAIT! Before You Go...