DON'T MISS OUT! Try Our FREE Calculator Now

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Using Equity Release to Pay Off a Mortgage: What You Need to Know

As homeowners approach retirement, many seek ways to manage their finances effectively, particularly regarding their existing mortgage. One increasingly popular solution is equity release, which allows individuals to access the equity built up in their homes.

This article explores how equity release can help homeowners aged 55 and older pay off their mortgages, providing an overview of the types available, their benefits, and essential considerations.

Understanding Equity Release

What is Equity Release?

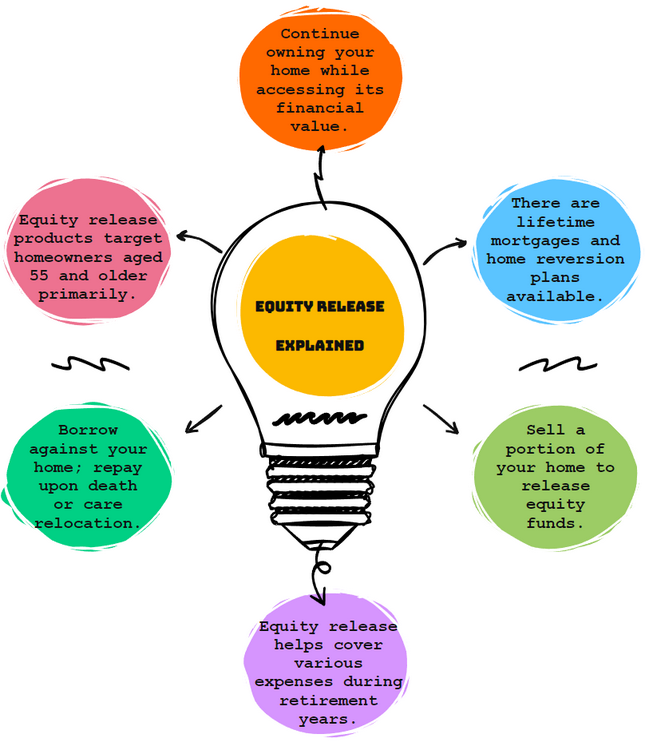

Equity release is a financial product designed primarily for homeowners aged 55 and older, allowing them to access the value tied up in their home without needing to sell it.

This financial approach can be particularly beneficial for those looking to pay off an existing mortgage or cover retirement expenses.

The two main types of equity release are lifetime mortgages and home reversion plans.

A lifetime mortgage allows homeowners to borrow against their home, with repayment occurring upon death or when moving into care.

In contrast, home reversion plans involve selling a portion of the property to release equity. With equity release, homeowners can maintain ownership while accessing cash to meet their financial needs.

How Equity Release Can Help

Using equity release can significantly assist homeowners in paying off their mortgages by converting part of their home’s value into cash.

This strategy eliminates monthly mortgage payments, providing financial relief, especially during retirement when income may be reduced.

To effectively navigate this process, homeowners should assess the property's value and consult with an equity release adviser to determine the best equity release plan for their circumstances.

Once approved, the funds can be directly used to pay off the mortgage, simplifying finances and potentially freeing up cash flow for other essential expenses.

Types of Equity Release

The primary types of equity release include lifetime mortgages and home reversion schemes.

Lifetime mortgages allow homeowners to borrow against their home, with the loan and accrued interest repaid when the homeowner dies or moves into care.

On the other hand, home reversion schemes involve selling a portion of the home to a provider in exchange for a lump sum or regular payments, allowing the homeowner to retain the right to live in the property until death.

Each type of equity release product has its benefits and considerations, making it essential for homeowners to understand their options before proceeding to ensure equity release is right for them.

Using Equity Release to Pay Off Your Existing Mortgage

How to Use Equity Release to Pay Off Your Mortgage

To effectively use equity release to pay off your existing mortgage, homeowners must first assess whether they can release enough equity from their property to cover the outstanding mortgage balance.

This evaluation typically starts with consulting an equity release adviser who can guide homeowners through the process. Utilising an equity release calculator can provide an estimate of the amount of tax-free cash available.

Once it is confirmed that the released equity is sufficient, the next steps involve applying for an equity release product.

Following a property valuation conducted by the lender, the approved funds are then transferred directly to the mortgage lender, thus clearing the existing debt and simplifying financial commitments for the homeowner.

Calculating the Equity Needed to Pay Off My Mortgage

Calculating the equity needed to pay off a mortgage requires a comparison between the current mortgage balance and the estimated value of the home.

Homeowners can leverage various equity release calculators provided by lenders to gain insights into the potential tax-free cash they could release.

If the estimated equity falls short of the mortgage balance, it may prompt homeowners to explore alternative methods to cover the gap, such as utilising savings or considering other financing options.

Additionally, understanding the total costs involved, including any early repayment charges associated with the existing mortgage, is crucial for making informed decisions about paying off a mortgage with equity release.

Benefits of Paying Off a Mortgage with Equity Release

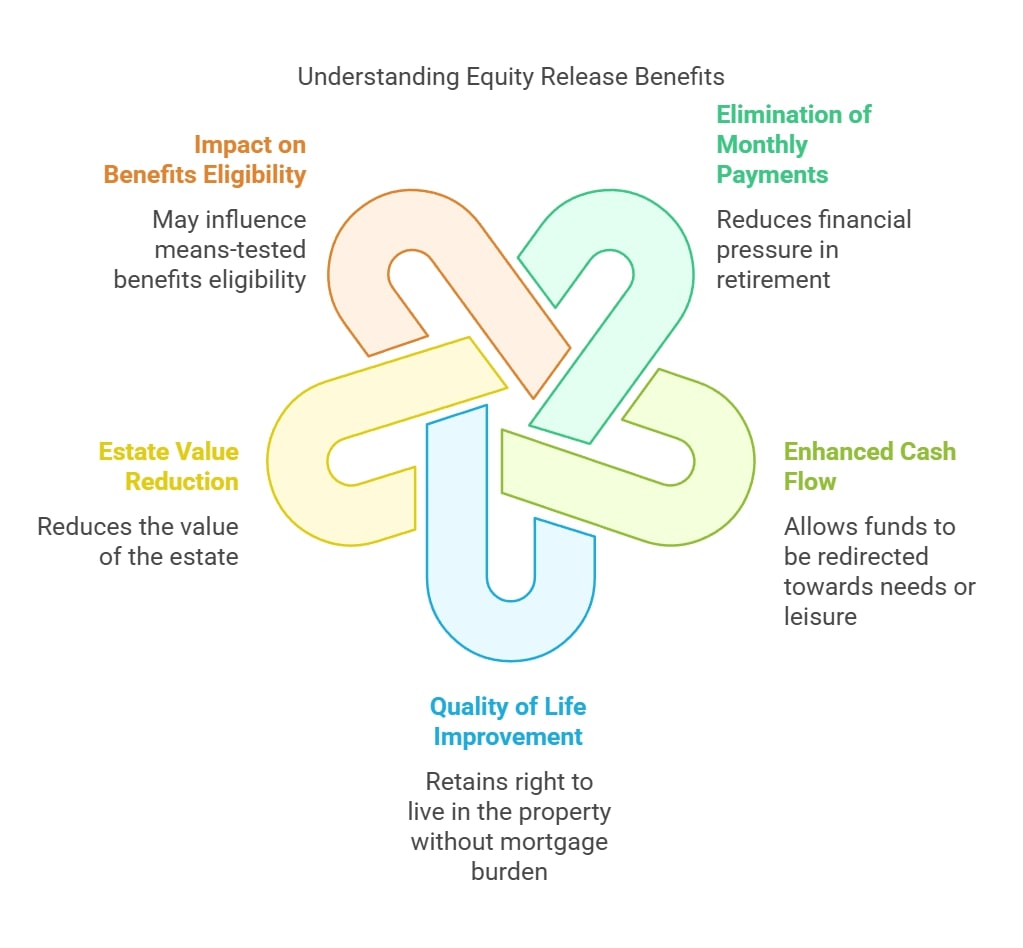

Choosing to pay off a mortgage using equity release presents a range of benefits that can greatly improve financial wellbeing, particularly for retirees.

One of the most significant advantages is the elimination of monthly mortgage payments, which can alleviate financial pressure during retirement years when income might be limited.

This can enhance cash flow, allowing homeowners to redirect funds towards essential needs or leisure activities. Moreover, retaining the right to live in their property without the burden of traditional mortgage payments can significantly enhance the overall quality of life.

However, it is essential to consider that while equity release can provide financial relief, it does reduce the value of the estate and may influence eligibility for means-tested benefits, making it vital to weigh all factors before proceeding.

Lifetime Mortgages and Interest-Only Mortgages

Understanding Lifetime Mortgages

Lifetime mortgages represent a significant category of equity release products, specifically tailored for homeowners aged 55 and over.

This type of equity release allows individuals to borrow against the equity from their home without the burden of monthly repayments.

The loan, including any accrued interest, is typically repaid when the homeowner passes away or transitions into long-term care.

One of the most appealing aspects of a lifetime mortgage is the no-negative-equity guarantee, ensuring that homeowners will never owe more than the property's value at the time of sale.

This feature not only provides peace of mind but also makes lifetime mortgages a compelling option for those looking to access cash while maintaining ownership of their homes.

How Interest-Only Mortgages Work

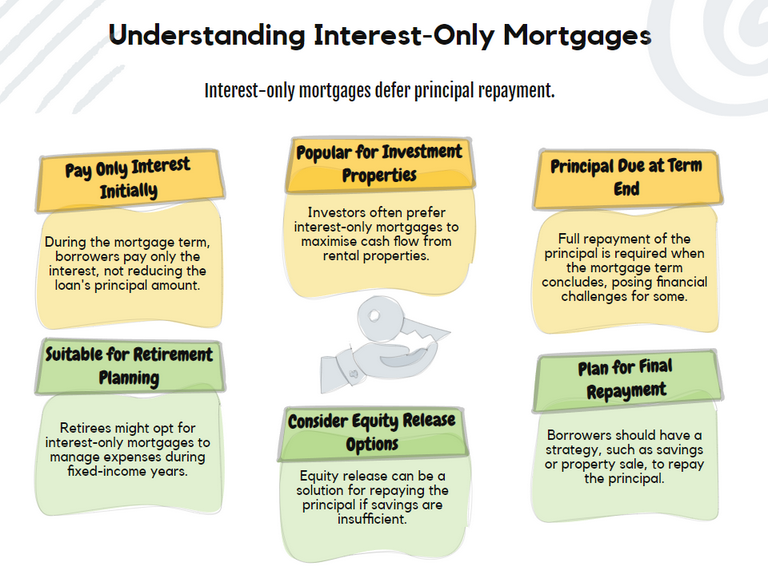

Interest-only mortgages operate distinctly from traditional mortgage structures, as borrowers are only required to pay the interest accumulated on the loan throughout the mortgage term.

This means that the principal amount remains intact and must be repaid in full once the term ends.

For many homeowners, especially those nearing retirement, this can pose a challenge if adequate savings have not been set aside to meet this repayment obligation.

Interest-only mortgages are often favoured for investment properties or by individuals who expect to settle the principal through alternative means, such as selling the property or utilising savings.

As homeowners approach the end of their interest-only mortgage term, they may find that using equity release could provide a viable solution to meet their repayment requirements.

Using Equity Release on an Interest-Only Mortgage

For homeowners grappling with an interest-only mortgage, equity release can serve as an effective tool to manage the repayment of the principal amount due at the end of the term.

By opting for a lifetime mortgage, individuals can access the necessary funds to clear their interest-only mortgage, thus alleviating the stress associated with repayment.

This financial manoeuvre is particularly advantageous for those who may not have sufficient savings or who are hesitant to sell their property. However, it is crucial to consult with an experienced equity release adviser before proceeding.

This consultation ensures a comprehensive understanding of the implications of such a decision, including potential impacts on inheritance and long-term financial planning, ensuring that equity release is right for their situation.

Equity Release Advice and Considerations

Seeking Specialist Equity Release Advice

Before proceeding with equity release, it is crucial to seek specialist advice from a qualified financial adviser.

They can help assess individual circumstances, explain the various options available, and guide homeowners through the application process.

This professional support is vital in understanding the potential risks and benefits associated with equity release, ensuring that homeowners make informed decisions that align with their financial goals.

Additionally, advisers can help navigate any implications for inheritance and means-tested benefits, ensuring that homeowners are aware of how equity release could impact their overall financial future.

Potential Risks of Equity Release

While equity release can provide financial relief, it also carries potential risks that homeowners must carefully consider.

One significant concern is the impact on inheritance, as releasing equity reduces the value of the estate passed on to beneficiaries.

Furthermore, the accumulation of interest on the loan can lead to a substantial debt over time, especially if no repayments are made during the homeowner's lifetime.

Additionally, accessing equity may affect eligibility for means-tested benefits, which could have long-term financial implications.

Homeowners should carefully weigh these risks against the benefits before making a decision, ensuring that they fully understand the consequences of taking out equity release.

How Equity Release Affects Your Inheritance

Using equity release to access funds can significantly affect the inheritance left to beneficiaries. Since equity release reduces the value of the estate, heirs may receive less than expected when the homeowner passes away.

This reduction in inheritance can lead to family conflicts or dissatisfaction, particularly if beneficiaries were counting on a certain amount.

It is essential for homeowners to discuss their plans with family members and consider the long-term effects of equity release on their estate and the financial well-being of their heirs, ensuring that everyone is aware of the implications of utilising this financial strategy.

Paying Off Your Mortgage Early with Equity Release

Strategies to Pay Off Your Mortgage Early

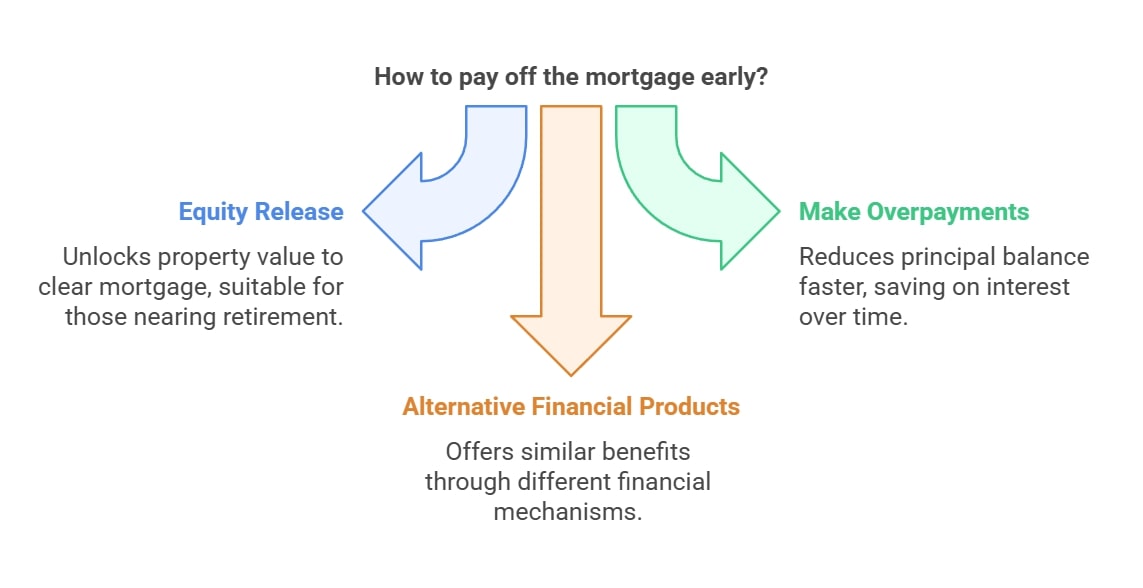

To pay off a mortgage early using equity release, homeowners can unlock the value of their property and use the released funds to clear their existing mortgage.

This strategy can be particularly advantageous for those approaching retirement who wish to eliminate monthly payments.

Homeowners should first assess their eligibility and the amount of equity they can release from their home, then consult with a financial adviser to explore the best options.

Additional strategies may include making overpayments on the mortgage or considering alternative financial products that could provide similar benefits, ensuring a comprehensive approach to managing their financial obligations.

Can You Release Enough Equity to Clear Your Mortgage?

Determining whether enough equity can be released to clear a mortgage involves evaluating the current market value of the home and the outstanding mortgage balance.

Homeowners can use equity release calculators to estimate the amount of tax-free cash available. If the estimated equity is insufficient to cover the mortgage, they may need to consider other financing options or adjust their plans.

It is crucial to understand that equity release must fully pay off any existing mortgage, so careful planning and assessment are necessary to ensure that the chosen equity release product aligns with their financial needs.

Tax Implications of Using Equity Release

Generally, the funds released through equity release are tax-free, meaning homeowners do not need to pay income tax or capital gains tax on the amount received.

However, it is essential to consider the potential impact on means-tested benefits, as the released equity may be classified as capital or income when assessing eligibility for these benefits.

Homeowners should consult with a tax professional or financial adviser to fully understand the tax implications of equity release and how it may affect their overall financial situation, particularly in relation to their retirement planning and long-term wealth management strategies.

WAIT! Before You Go...