DON'T MISS OUT! Try Our FREE Calculator Now

Quick Summary

- If you have an existing loan on your property, you can still access funds through equity release, but the initial amount must be used to fully repay the existing loan and any remaining funds available for your use.

- Eligibility for accessing additional funds depends on having sufficient home equity to cover the repayment of your current loan and meeting the lender’s minimum criteria.

- The proportion of loan debt relative to your home’s value significantly influences your eligibility to qualify for additional funds.

Equity release with a mortgage can offer a lifeline for many homeowners seeking additional financial freedom.

Surprisingly, more than 10% of UK homeowners aged 55 and above are juggling mortgages, unaware that they could tap into their property's value by releasing equity, despite having an existing mortgage.1

Welcome to our in-depth exploration of 'equity release with a mortgage'.

This subject, often under-represented or misunderstood, can be a powerful financial strategy for those who understand its complexities.

As a trusted source of financial information, we aim to demystify these complex concepts and give you the tools to make an informed decision.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

We are going to break down how these plans interact with existing mortgages, assess eligibility criteria, and illustrate how to calculate potential equity.

Our team is committed to delivering accurate, current, and straightforward financial advice, supporting you in navigating your financial journey.

So, if you are a homeowner grappling with a mortgage and intrigued by the benefits of equity release lending, this guide will shed light on your options.

What Is Equity Release Lending?

Equity release lending is a financial arrangement that facilitates older homeowners in unlocking the dormant value within their property, turning it into a valuable resource.

Read On: Releasing Equity from Home

Can I Get Equity Release If I Still Have a Mortgage?

It is possible to get equity release even if you still have an outstanding mortgage.

Equity release schemes essentially allow homeowners aged 55 and over to unlock the value tied up in their property, which can be used to pay off the remaining mortgage balance.

Lenders will typically require any outstanding mortgage to be cleared at the outset of an equity release plan.

However, it's important to remember that the amount you can release may be reduced, as you'll first have to pay off the existing mortgage.

The remaining equity can then be released as a lump sum or in smaller amounts.

Just keep in mind that releasing equity from your home reduces its overall value, and the interest can quickly accumulate.

What Is A Mortgage?

A mortgage is a loan obtained to purchase real estate, secured by the property itself. Borrowers make regular payments over an agreed-upon period, covering both the principal and interest, with the property serving as collateral.

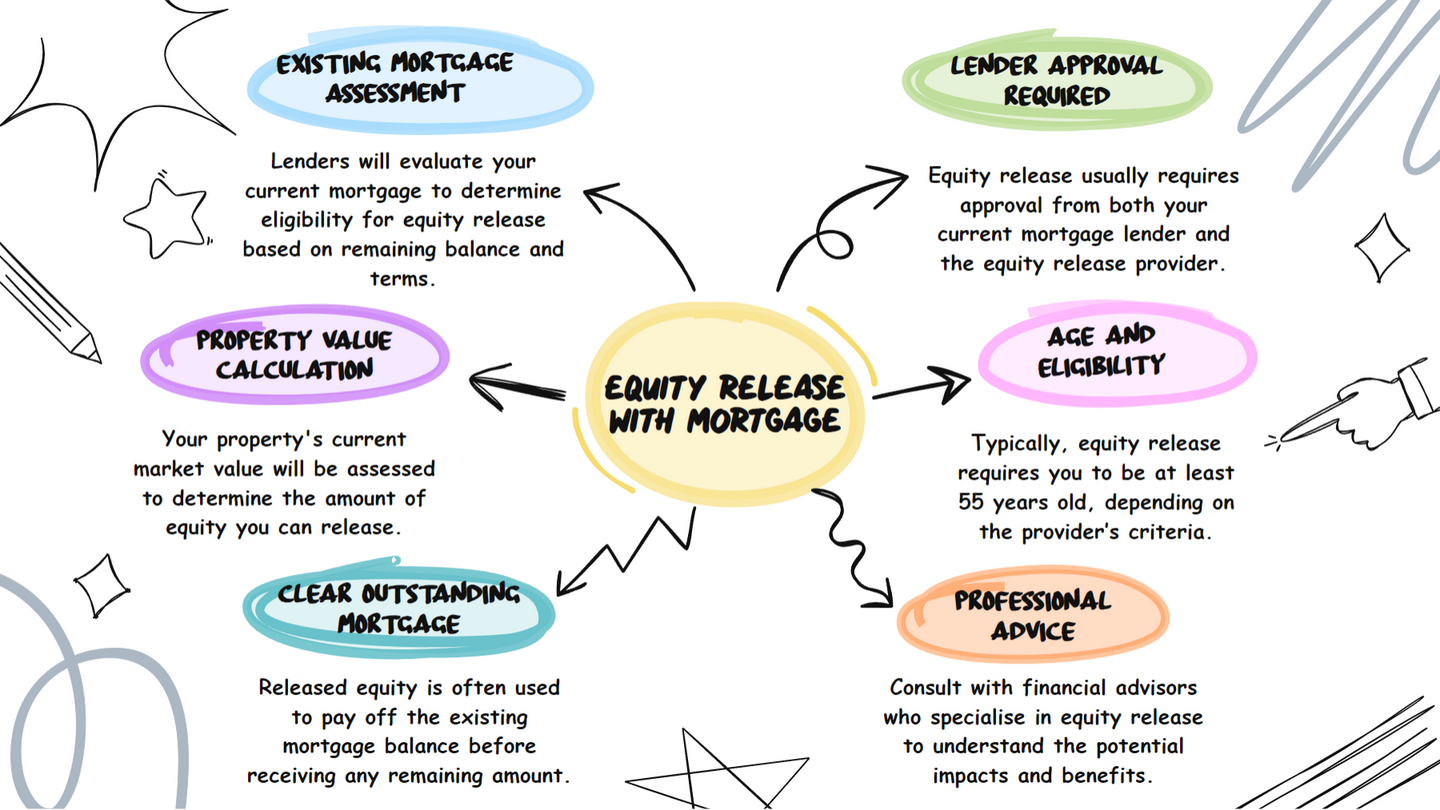

How Can Equity Release and Existing Mortgages Interact?

Equity release refers to a range of products that allow you to access the equity (cash) tied up in your home.

This is often considered by individuals aged 55 and over who own a property in the UK.

Importantly

Having an existing mortgage does not exclude you from taking advantage of these plans.

In fact, the process often involves using part of the funds you receive to pay off the remaining balance on your mortgage.

The remainder can then be used as you see fit, offering a potential boost in your retirement finances.

Read More: Top Uses for Equity Release

Are You Eligible for Equity Release as a Mortgage Payer?

Releasing equity in the UK typically requires a minimum age of 55, although some plans may set this at 60 or even 65.

Some plans also have an age cap of 85 or 90 at the time of application.

As a mortgage payer, you are absolutely eligible to apply for these plans if you meet all other qualifying criteria.

Apart from age, the main prerequisites include owning your home, using it as your primary residence, and meeting the specifications set by equity release providers.

Read On: Best Equity Release Schemes Providers

These specifications may encompass:

- The property's type

- Location

- Condition

It is important to note that your existing mortgage must be at a level that can be completely settled by the loan.

Providers typically offer a percentage of your property's value based on your age, with older individuals often being eligible for a higher percentage.

Moreover, your overall health condition may also influence the percentage you can access.

Keep in mind that each provider may have its specific eligibility criteria, which can impact the amount you can release.

Therefore, it is highly advisable to seek independent advice from a financial advisor specialising in equity release before proceeding.

How Can You Calculate Potential Equity Release With an Ongoing Mortgage?

The extent of equity you can unlock hinges on a multitude of interrelated factors that collectively determine the final amount available for release.

Considerations include:

- Your age

- The value of your property

- The size of your existing mortgage

Many lenders provide an online equity release calculator, allowing you to input your details and receive an estimate.

It is recommended to speak with an independent financial advisor for a more accurate calculation.

What Does Applying for Equity Release With an Ongoing Mortgage Entail?

Applying for these loans with an ongoing mortgage typically kicks off with an initial consultation with an independent financial advisor, experienced in this sector.

In this consultation, you lay out the full scope of your financial situation, your future financial objectives, and any specific concerns you may have.

Your advisor will then evaluate your circumstances against the backdrop of current financial trends and regulations.

Once this assessment is complete, your advisor will recommend a suitable plan.

What happens next?

The application process, which follows the initial consultation, involves a thorough valuation of your property by a professional surveyor to determine its market value and any potential hindrances to the loan.

Simultaneously, legal checks are conducted to verify your ownership of the property and any outstanding mortgage details.

Upon approval of your application, the first priority is to pay off your existing mortgage using the released equity.

Finally

Any remaining funds are then disbursed to you, either as a lump sum or in smaller, regular amounts, depending on your chosen plan.

What Happens if Equity Release Does Not Cover Your Current Mortgage?

If your property's equity is insufficient to cover your existing mortgage, this type of loan may not be a viable option.

In such cases, you many need to need to explore other financial strategies to address your mortgage debt.

These may include:

- Downsizing

- Remortgaging

- Loaning money from family

- Speaking to your lender about repayment options

What Are the Pros and Cons of Combining Equity Release With a Mortgage?

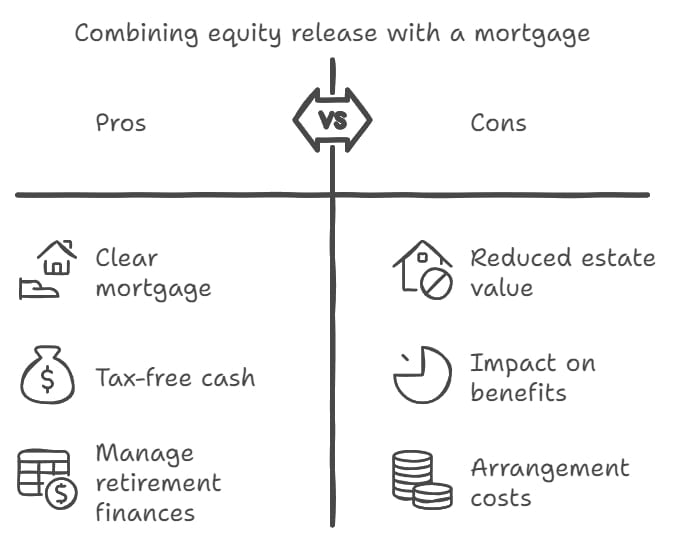

Releasing equity offers several advantages that make it an appealing financial strategy for many.

Firstly

It can enable you to clear your mortgage without making regular monthly payments, freeing up your budget considerably.

Additionally

Many schemes offer a tax-free cash lump sum, which you can spend as you wish, making it a useful tool for managing retirement finances.

Nevertheless, this choice comes with its share of potential challenges.

One significant disadvantage is the potential reduction in your estate's value, which means there could be less to leave as an inheritance for your loved ones.

Also, the funds received may impact your entitlement to means-tested benefits, such as Pension Credit2 or Housing Benefit3, potentially disrupting your overall financial stability.

Furthermore

There can be costs involved in arranging equity release, including setup fees, valuation fees, solicitor fees, and potential early repayment charges.

It is essential to consider these factors and seek professional advice before proceeding with a plan.

Read More: Local Equity Release Solicitors

Is Equity Release With Your Current Mortgage the Right Financial Strategy for You?

While these plans can be a beneficial financial strategy for some, they are not suitable for everyone.

It is important to consider your current financial situation, future plans, and potential alternatives.

What Are the Alternatives to Equity Release With a Mortgage?

Alternatives come in various forms, each with its unique benefits and drawbacks.

They include:

- Downsizing, where you sell your current property and move into a less expensive one, freeing up funds tied in your home's value.

- Selling and renting is another avenue, where you sell your home outright and then rent a property, allowing you to access all of your home's value immediately.

- Taking in a lodger may provide you with a regular source of income and reduce your living costs. It is a suitable choice if you have spare rooms and are comfortable sharing your space.

- Government schemes can offer viable alternatives. The Pension Loans Scheme, for instance, allows individuals of qualifying age to obtain a voluntary non-taxable loan, which can help provide an additional income stream in retirement.

Your personal circumstances, financial situation, and future plans will play a crucial role in determining the most appropriate solution for you.

Professional financial advice is invaluable in this process, as advisors can help you understand the long-term implications of each option.

Common Questions

Can I Use Equity Release With an Existing Mortgage

How Does Equity Release Work If I Still Have a Mortgage

Is It Possible to Get an Equity Release If I Haven't Paid Off My Mortgage

What Happens to My Mortgage If I Decide to Release Equity

Are There Any Implications of Using Equity Release to Pay Off My Mortgage

What Types of Equity Release Plans Are Available to Homeowners With a Mortgage

Can I Move to a Different Property After Taking Out Equity Release

How Does Equity Release With a Mortgage Impact My Eligibility for State Benefits

How Does a Change in Property Value Affect an Equity Release Plan With a Mortgage

Can I Take Out Equity Release if I Have a Joint Mortgage With a Partner Who Is Below the Eligible Age

Conclusion

Navigating the financial landscape of equity release with a mortgage can be a complex journey, but armed with the right knowledge and advice, it becomes a far less daunting task.

Understanding how these plans interact with existing mortgages, the potential implications, and available alternatives are all vital aspects of making an informed decision that can potentially change your financial outlook.

Whether you are considering this option to bolster your retirement finances, settle outstanding debts, or provide support to your loved ones, always keep in mind that seeking professional advice is paramount.

To delve deeper into the potential of equity release with a mortgage, we strongly recommend scheduling a consultation with a financial advisor who can tailor their guidance to your specific circumstances and needs.

WAIT! Before You Go...