DON'T MISS OUT! Try Our FREE Calculator Now

- Home reversion allows retirees to sell part or all of their property while retaining the right to live there rent-free for life. The provider pays a lump sum or regular payments, typically below market value.

- Unlike equity release loans, home reversion plans don’t require monthly repayments. Instead, the provider recoups its share when the property is sold, usually after the homeowner passes away or moves into long-term care.

- Since ownership is partially or fully transferred, it reduces the inheritance left to heirs. It may also affect eligibility for means-tested benefits, so financial advice is crucial.

- Home reversion schemes work best for older homeowners (usually 65+) who want to unlock home equity without debt. However, they should compare with other options like lifetime mortgages to ensure the best fit for their needs.

As homeowners approach retirement, many consider strategies to enhance their financial situation.

Home reversion plans have become a popular type of equity release, providing a means to access cash while retaining the right to live in one’s home.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This guide explores the fundamentals of home reversion schemes and how they can benefit homeowners in 2025.

What is a Home Reversion Plan?

A home reversion plan is a type of equity release scheme designed for homeowners, typically aged 60 and older.

In this arrangement, homeowners sell a portion or all of their property to a plan provider in exchange for a cash lump sum or regular payments.

This allows them to release equity from the value of their home while continuing to live in it rent-free for the rest of their lives.

Homeowners effectively become tenants in their own homes, and the provider takes ownership of the sold share, usually at a price below the market value.

This arrangement is particularly appealing for individuals seeking to improve their financial stability without incurring monthly mortgage repayments.

How Home Reversion Schemes Work

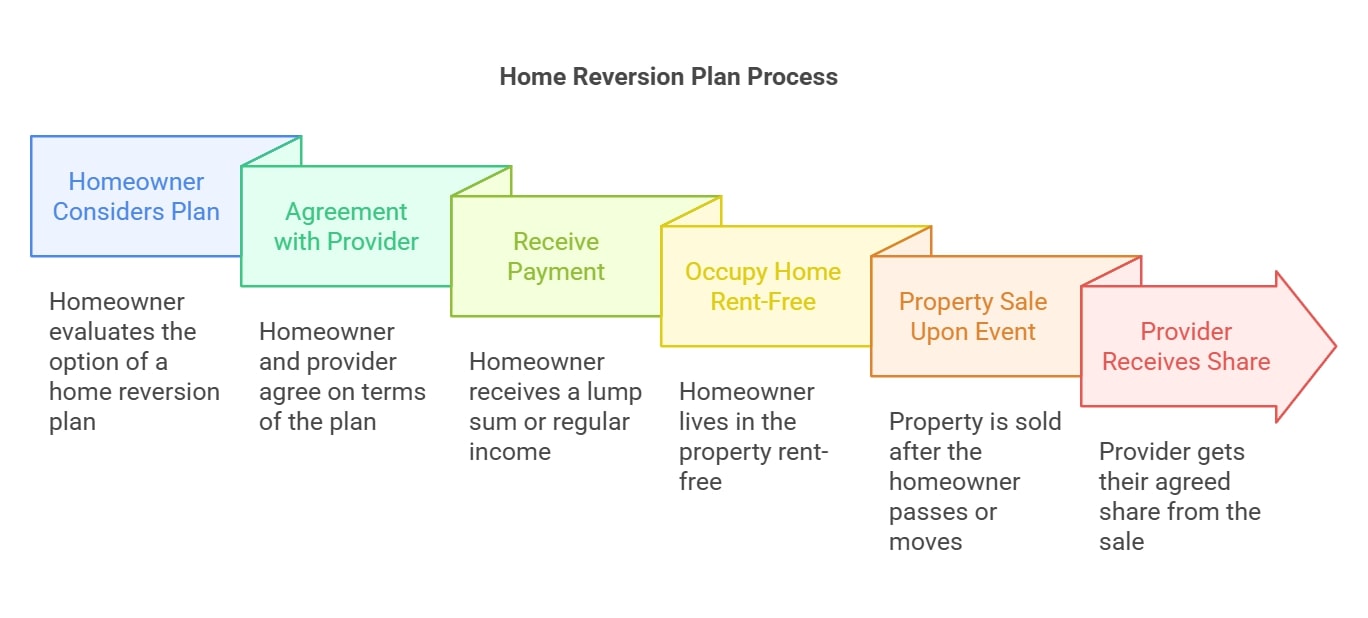

When entering a home reversion scheme, a homeowner agrees to sell a percentage of their property to the provider, who then pays them a lump sum or regular income.

Homeowners maintain the right to reside in the property for life, with the provider receiving their share upon the home’s sale, typically after the homeowner's death or if they move into long-term care.

Many plans offer portability options, allowing homeowners to transition to another property under specific conditions.

However, it’s crucial to recognize that selling a share of the home at less than market value may limit potential future gains and affect inheritance for beneficiaries.

Benefits of Choosing a Home Reversion Plan

One of the primary benefits of a home reversion plan is that it allows homeowners to access cash without incurring monthly repayments, making it an ideal choice for retirees seeking financial flexibility.

Homeowners can receive either a lump sum or regular payments, which can be utilised for various purposes such as home improvements, debt repayment, or supplementing retirement income.

Furthermore, these plans offer a sense of security, as homeowners can live in their properties for life.

Home reversion plans also protect against negative equity, ensuring that homeowners will never owe more than the value of their home.

Additionally, certain plans may include inheritance guarantees, safeguarding a portion of the property value for heirs.

Types of Equity Release Options

Home Reversion vs Lifetime Mortgages

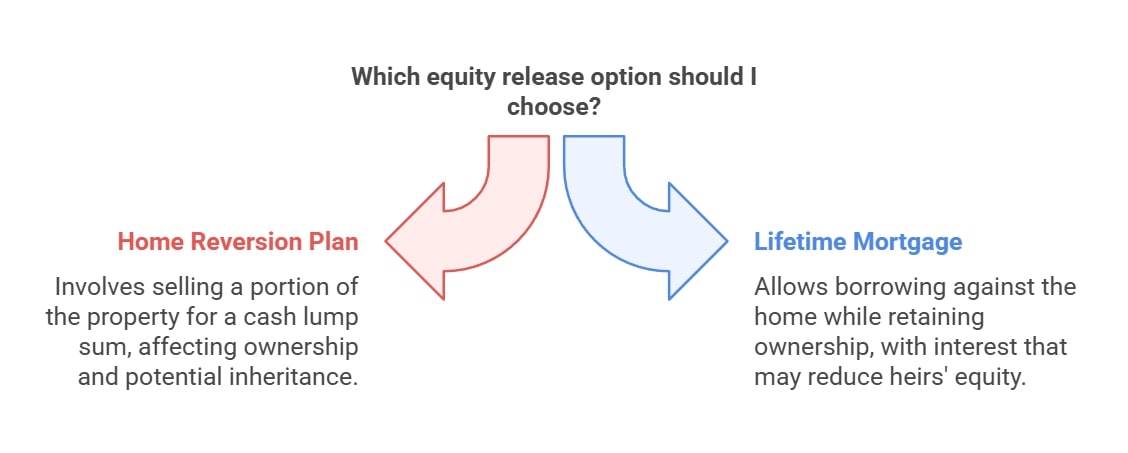

Home reversion plans and lifetime mortgages represent two popular equity release options, each functioning distinctly.

In a home reversion plan, homeowners sell part or all of their property in exchange for cash, while a lifetime mortgage involves borrowing against the value of the home while retaining ownership.

Lifetime mortgages typically require interest payments that accrue over time, leading to potential negative equity, whereas home reversion plans do not accumulate interest.

Home reversion schemes may be particularly suitable for older homeowners or those in poor health, as they may receive more favourable terms due to a shorter expected property tenure.

Both options can impact inheritance and eligibility for means-tested benefits, underscoring the importance of consulting with a financial adviser.

Exploring Different Types of Equity Release

Equity release options primarily encompass home reversion plans and lifetime mortgages, with the latter being the most widely adopted due to their inherent flexibility.

Lifetime mortgages enable homeowners to borrow a percentage of their home's value while retaining ownership, allowing repayment when the home is sold.

Other alternatives include Retirement Interest-Only (RIO) mortgages, which permit older homeowners to borrow on an interest-only basis without a defined end date.

Each equity release option carries its own set of advantages and risks, and the best choice will vary based on individual circumstances such as age, health, and financial requirements.

Comparison of Home Reversion Plans and Lifetime Mortgages

When comparing home reversion plans to lifetime mortgages, several critical differences become apparent.

Home reversion plans involve selling a portion of the home, while lifetime mortgages are loans secured against the property.

Home reversion schemes typically do not charge interest, contrasting with lifetime mortgages, which do and often lead to higher overall costs.

Moreover, home reversion plans may provide better terms for older homeowners or those facing health challenges, as their life expectancy may be shorter.

Both options can provide tax-free cash; however, they can also influence inheritance and eligibility for means-tested benefits, highlighting the necessity for thorough research and professional guidance.

Top Home Reversion Plan Providers for 2025

Leading Home Reversion Plan Providers in the UK

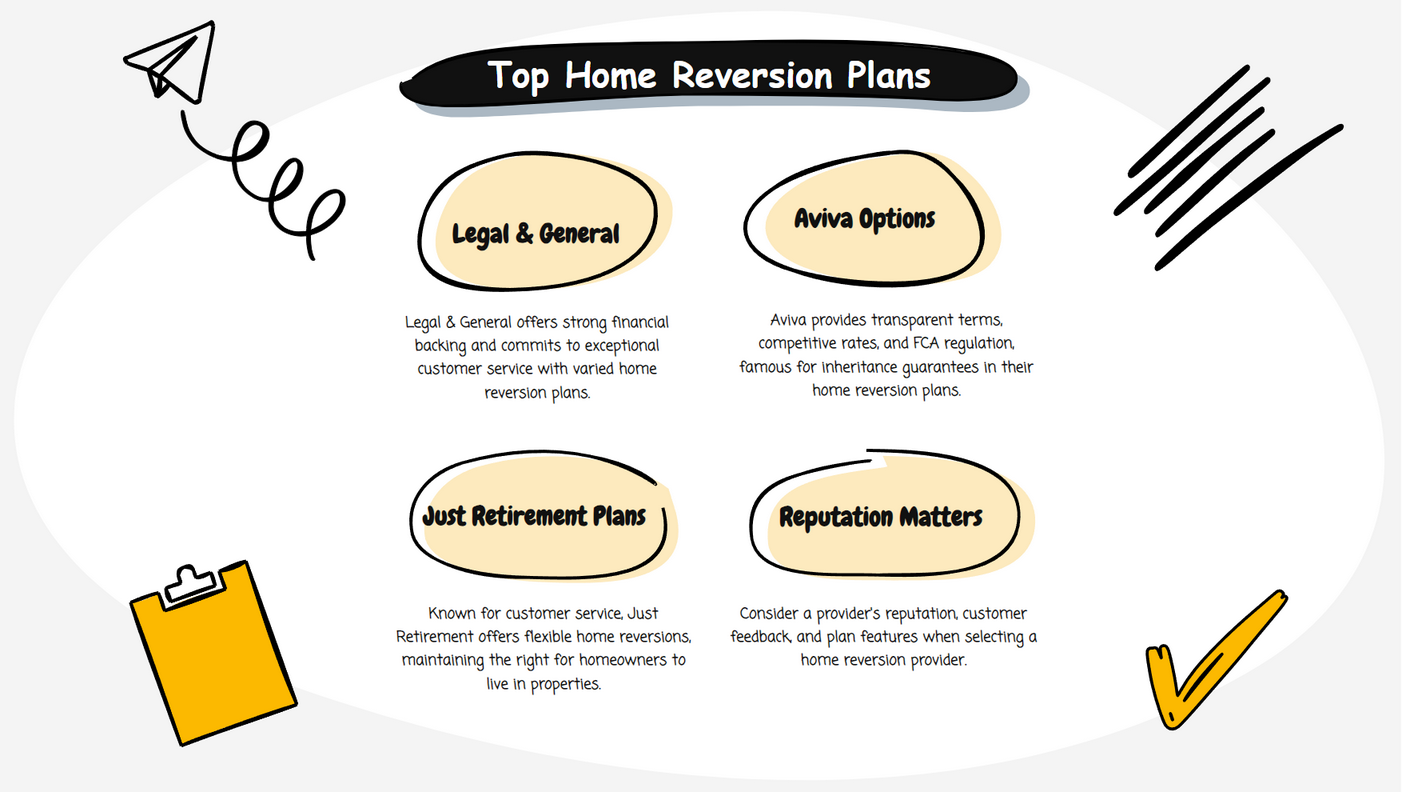

As of 2025, the leading home reversion providers in the UK include Legal & General, Aviva, and Just Retirement.

These companies are recognised for their strong financial standing and commitment to customer service.

They offer a range of flexible agreements that cater to various homeowner needs, allowing individuals to unlock the value of their property while maintaining the right to live in their homes.

When choosing a provider, it's crucial to consider their reputation, customer service, and the specific features of their home reversion plans.

Overview of Aviva's Home Reversion Plans

Aviva offers a comprehensive range of home reversion plans designed to meet the needs of older homeowners.

Their plans allow individuals to sell up to 100% of their property value in exchange for a cash lump sum or regular payments.

Aviva is known for its transparent terms and competitive rates, making it a popular choice among retirees.

The company provides options that include inheritance guarantees, ensuring that a portion of the property value is preserved for beneficiaries.

Additionally, Aviva's plans are regulated by the Financial Conduct Authority (FCA), providing added security for customers.

Pure Retirement and Their Offerings

Pure Retirement is another key player in the home reversion market, offering tailored plans that cater to individual financial needs.

Their home reversion products allow homeowners to sell a percentage of their property while retaining the right to live in it for life.

Pure Retirement is known for its flexible terms and competitive rates, making it an attractive option for those looking to release equity.

The company emphasizes customer service and transparency, ensuring that clients fully understand their options before committing to a plan.

Additionally, Pure Retirement is a member of the Equity Release Council, adhering to industry standards and best practices.

Hodge Lifetime's Home Reversion Options

Hodge Lifetime, established in 1965, has a long history in the equity release market and offers a variety of home reversion options.

Their plans are designed to provide flexibility, allowing homeowners to choose how much of their property they wish to sell.

Hodge Lifetime is known for its customer-centric approach, offering personalized advice to help clients find the best solutions for their financial needs.

The company also provides inheritance guarantees, ensuring that a portion of the property value is preserved for heirs.

As a regulated provider, Hodge Lifetime adheres to strict industry standards, offering peace of mind to customers.

Equity Release Process

Steps to Applying for a Home Reversion Plan

The process of applying for a home reversion plan typically involves several key steps.

First, homeowners should assess their financial needs and determine if a home reversion plan is suitable for them.

Consulting a qualified financial adviser is crucial, as they can provide guidance on the various options available and help evaluate the potential impact on inheritance and benefits.

Once a decision is made, the homeowner will need to choose a provider and complete an application form, which may include a property valuation.

After the application is submitted, the provider will conduct assessments and provide a formal offer.

Upon acceptance, legal documents will be prepared, and the homeowner can receive their funds.

Understanding the Role of Mortgage Brokers

Mortgage brokers play a vital role in the equity release process, acting as intermediaries between homeowners and lenders.

They provide expert advice on the various options available, helping clients understand the differences between home reversion plans and other equity release products.

Brokers can assist in comparing providers, ensuring that clients find the best terms and rates that suit their needs.

Additionally, they can facilitate the application process, guiding homeowners through the necessary paperwork and legal requirements.

Utilizing a mortgage broker can save time and ensure that clients make informed decisions regarding their equity release options.

Important Considerations Before Signing Up

Before committing to a home reversion plan, homeowners should carefully consider several important factors.

These include the potential impact on inheritance, as selling part of the property will reduce the value passed on to beneficiaries.

Additionally, homeowners should assess how the plan may affect their eligibility for means-tested benefits, as receiving cash from a home reversion plan can influence financial assessments.

It's also essential to understand the terms of the plan, including any fees, charges, and the implications of moving or selling the property in the future.

Consulting with a financial adviser can help clarify these considerations and ensure that homeowners make the best choice for their circumstances.

Building Society and Mortgage Provider Insights

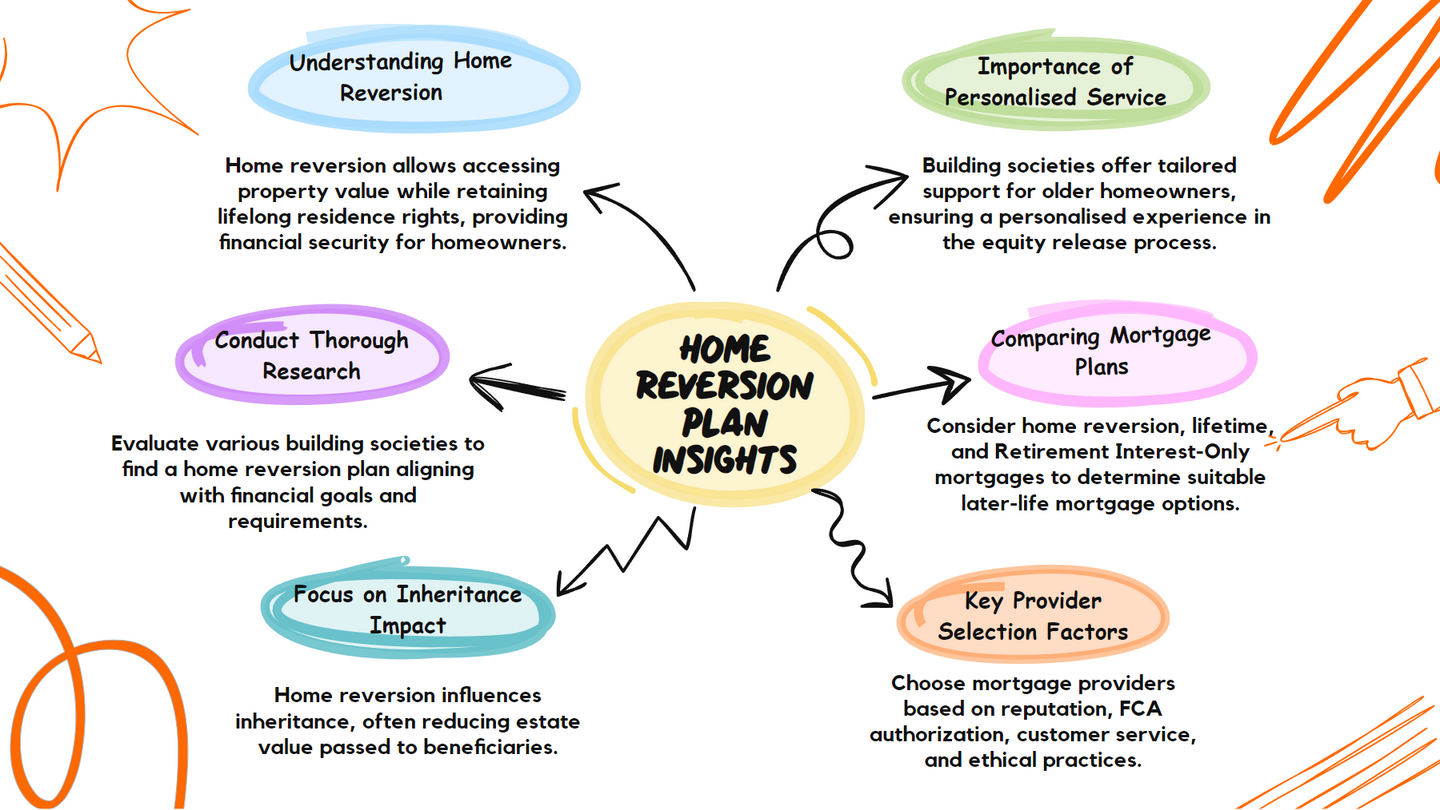

How Building Societies Offer Home Reversion Plans

Building societies are increasingly offering home reversion plans as part of their later-life lending options.

These institutions typically provide competitive rates and flexible terms, catering to the specific needs of older homeowners.

With a strong community focus, building societies deliver personalised service and support throughout the equity release process.

By facilitating home reversion plans, they enable homeowners to access their property's value while maintaining the right to live in their homes for life.

It’s essential for homeowners to conduct thorough research on various building societies to identify one that aligns with their financial goals and needs.

Comparing Mortgage Options for Later Life

When exploring mortgage options for later life, it is vital for homeowners to compare products such as home reversion plans, lifetime mortgages, and Retirement Interest-Only (RIO) mortgages.

Each option presents unique advantages and disadvantages, and the best choice will depend on personal circumstances, including age, health, and financial needs.

Comparing interest rates, fees, and terms is crucial to finding the most suitable product.

Additionally, homeowners should factor in the potential impact on inheritance and means-tested benefits, as these elements can significantly influence the overall financial outcome.

Seeking guidance from a financial adviser can provide valuable insights during this comparison process, ensuring informed decision-making.

Factors to Consider When Choosing a Mortgage Provider

When selecting a mortgage provider for a home reversion plan, several key factors should be considered.

These include the provider's reputation, market experience, and customer service track record.

Homeowners must choose a provider authorized and regulated by the Financial Conduct Authority (FCA) and a member of the Equity Release Council.

Reviewing the specific terms and conditions of the plans offered, such as interest rates, fees, and flexibility, is essential.

Transparency in communication and a commitment to ethical practices are also critical qualities to seek in a mortgage provider, as these can significantly affect the overall experience and outcomes associated with equity release.

Impact of Home Reversion on Inheritance

Home reversion plans can significantly influence inheritance, as they involve selling a portion or all of the homeowner's property.

Consequently, the value available to pass on to beneficiaries may be diminished based on how much of the property has been sold.

Additionally, since home reversion plans often sell shares of the property at below-market value, future price increases may not benefit the homeowner or their heirs.

Homeowners should carefully contemplate these implications and consult with financial advisers to ensure that their estate planning goals are met while considering the drawbacks of home reversion schemes.

Planning for Inheritance with Equity Release

When planning for inheritance alongside equity release, homeowners should take proactive measures to ensure that their wishes are realized.

This may involve discussing their plans with family members and beneficiaries to set realistic expectations regarding the potential impact of a home reversion plan on the inheritance.

Homeowners can also explore options that include inheritance guarantees, which can help protect a portion of the property value for heirs.

By engaging with a financial adviser, homeowners can navigate the complexities of equity release and inheritance planning, ensuring that they make informed decisions that align with their long-term financial goals.

Future Considerations for Heirs

Heirs must understand the implications of a home reversion plan on their inheritance, particularly concerning the reduced value of the estate.

It is crucial for heirs to grasp the terms of the plan and how it may affect their rights to the property after the homeowner's passing.

Furthermore, heirs should consider the potential for negative equity issues with lifetime mortgages, which could further diminish the estate's value.

Open communication with the homeowner about their plans and intentions can help ensure that heirs are prepared for any changes in the inheritance landscape.

Consulting a financial adviser can also provide heirs with valuable insights into their options and rights concerning the inherited property.

Common Questions

1. How does a home reversion plan work?

2. How much money can I get from a home reversion plan?

3. Can I sell more of my home later if needed?

4. What happens if I want to move home?

5. Is a home reversion plan better than a lifetime mortgage?

Conclusion

Home reversion plans can be a suitable option for retirees looking to unlock equity from their property without the burden of monthly repayments.

However, the trade-off of receiving significantly less than the market value and the permanent nature of the agreement make it essential to consider long-term financial goals.

Before committing, seeking independent financial advice and ensuring the provider is regulated by the Financial Conduct Authority (FCA) and follows Equity Release Council (ERC) standards can offer peace of mind.

For those who prioritise financial security over leaving a property inheritance, home reversion could provide a practical solution for retirement funding.

WAIT! Before You Go...