DON'T MISS OUT! Try Our FREE Calculator Now

- When borrowers fail to repay an interest-only loan, the outstanding principal remains untouched, leading to a significant financial strain when the full repayment becomes due.

- Lenders may take legal action, including repossession of assets, if the borrower cannot repay the loan at the end of the term, particularly for mortgages.

- Borrowers struggling with repayment may face challenges securing refinancing, especially if property values have dropped or their financial situation has worsened.

- Missed payments and defaulting on an interest-only loan can severely damage a borrower's credit score, making it harder to access future credit or loans.

Interest-only mortgages can be a viable option for many borrowers looking to manage their monthly payments effectively.

However, as the mortgage term ends, understanding the implications of this type of loan is crucial.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This article will guide you through the essential steps to take as you navigate the end of your interest-only mortgage, ensuring you are well-prepared to handle repayment and avoid potential pitfalls.

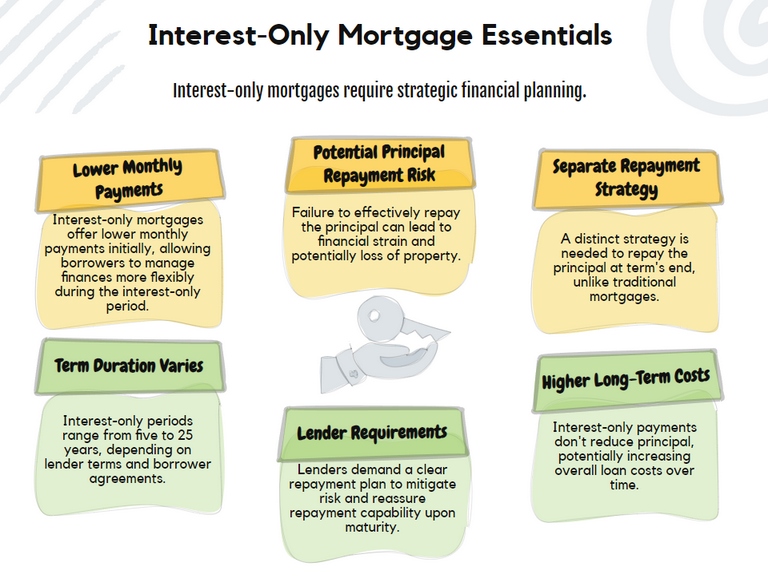

Understanding Your Interest-Only Mortgage

An interest-only mortgage is a type of loan where the borrower pays only the interest for a specified term, typically ranging from five to 25 years.

Unlike a repayment mortgage, where monthly payments contribute to both the interest and the principal, an interest-only mortgage requires a separate repayment strategy to address the full capital amount at the end of the term.

This unique structure allows for lower monthly payments, which can be appealing for many borrowers.

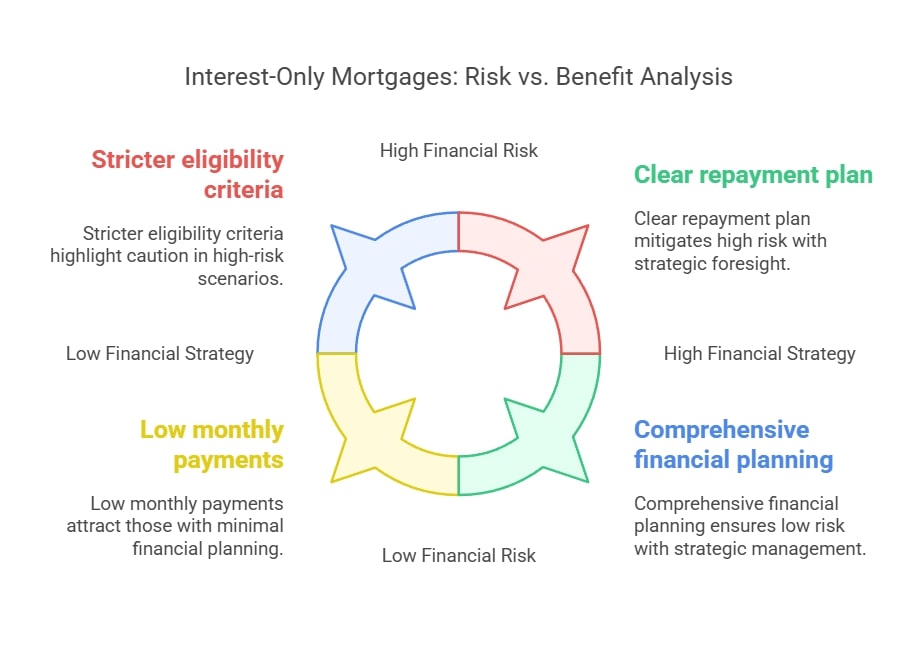

However, it also carries the inherent risk of not being able to repay the principal upon maturity.

Lenders often require borrowers to outline their repayment strategy when applying for this type of mortgage, emphasising the need for a solid plan to repay the loan and avoid potential repossession.

How Does an Interest-Only Mortgage Work?

With an interest-only mortgage, the borrower pays solely the interest during the mortgage term, resulting in significantly lower monthly payments compared to a repayment mortgage.

However, since the principal remains unpaid throughout this period, borrowers are responsible for repaying the entire loan amount at the end of the term.

This repayment can be accomplished through various means, such as selling the property, utilising savings or investments, or accessing pension funds.

Lenders typically remind borrowers of the repayment due date at least a year in advance and provide a redemption statement detailing the total amount owed.

It is essential for borrowers to have a well-structured repayment plan in place to navigate the end of an interest-only mortgage successfully and avoid falling into mortgage arrears.

Key Features of Interest-Only Mortgages

Interest-only mortgages are characterised by their lower monthly payments, as borrowers only pay interest during the term.

Additionally, lenders require a detailed repayment strategy, which must be disclosed upon application.

These mortgages can be particularly appealing to those wishing to keep their monthly costs down or those who have a clear plan to pay off the principal through investments or savings.

However, the major drawback is the risk of being unable to repay the principal at the end of the term, which could lead to repossession.

Furthermore, lenders may impose stricter eligibility criteria, particularly for borrowers nearing retirement age or those with unstable incomes.

Understanding these features is critical for managing your mortgage effectively and ensuring you are not left in a precarious financial situation when your mortgage ends.

The End of the Mortgage Term

When the end of an interest-only mortgage term approaches, it is crucial for borrowers to understand what this entails.

As the term concludes, the borrower is obligated to repay the total amount borrowed, which can be daunting without proper planning.

Various methods can facilitate this repayment, such as selling the property, utilising savings or investments, or even accessing pension funds.

If a borrower finds themselves in a position where they cannot pay back the loan, they may consider extending the mortgage term or remortgaging with a different lender.

Communicating with the mortgage lender is vital, as they typically reach out at least a year before the term ends to discuss repayment options and avoid any financial distress.

Consequences of Not Preparing for Term End

Failing to prepare for the end of an interest-only mortgage can lead to dire consequences, including mortgage arrears and potential repossession of the property.

If a borrower cannot pay their mortgage when the term ends, the lender may initiate legal actions, which could result in losing their home.

Additionally, not having a solid repayment plan can severely impact the borrower's credit score, making it more difficult to secure future loans.

Therefore, it is essential for borrowers to proactively address their repayment strategies and maintain open communication with their lender to avoid these potential pitfalls.

Understanding Mortgage Arrears

Mortgage arrears occur when a borrower fails to make timely mortgage payments, putting them at risk of severe financial consequences, including repossession.

If a borrower finds themselves in arrears, it is crucial to contact their lender immediately to explore possible solutions, such as restructuring the loan or establishing a manageable payment plan.

Lenders may also offer temporary relief options to assist borrowers in managing their payments.

To mitigate long-term damage to their credit rating and overall financial stability, borrowers must be proactive in addressing any arrears that arise.

Options Available at Term End

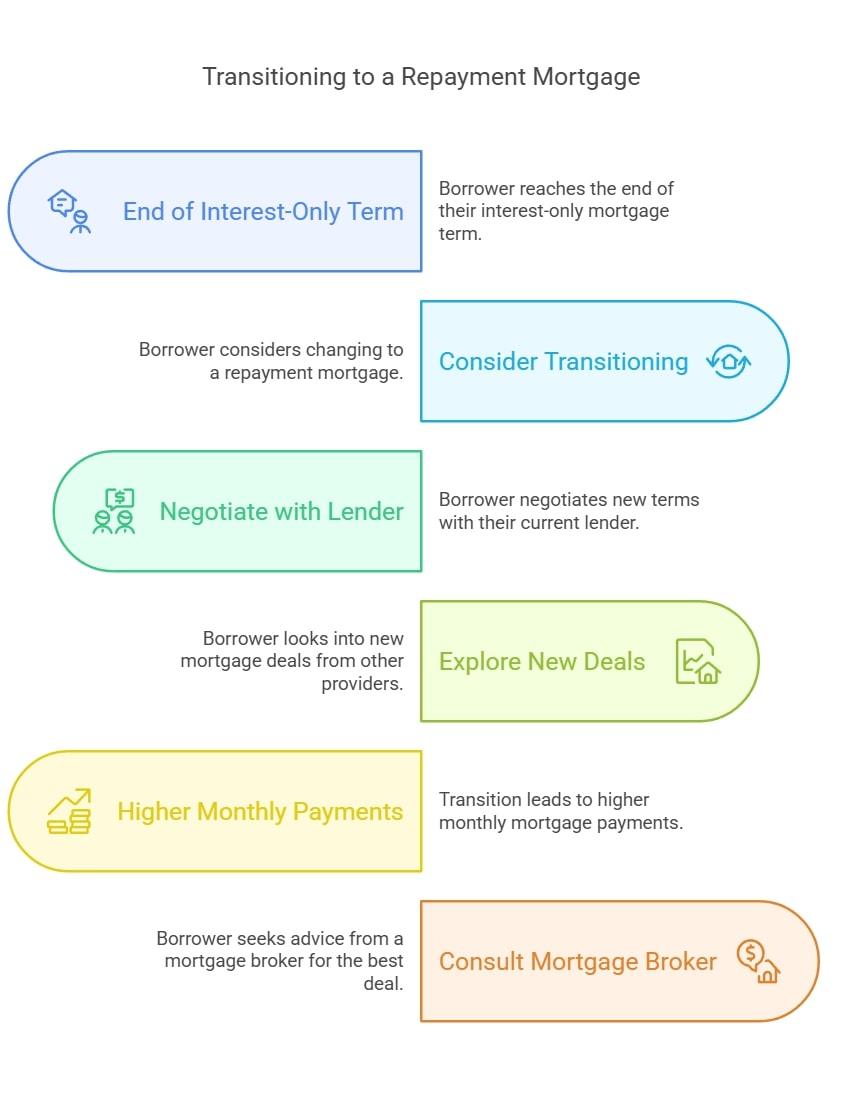

Transitioning to a Repayment Mortgage

Transitioning to a repayment mortgage is a viable option for borrowers at the end of their interest-only mortgage term.

This process involves changing the mortgage terms so that the borrower begins to pay both the interest and a portion of the principal, significantly reducing the lump sum owed at the end of the term.

Borrowers can negotiate this transition with their existing lender or explore new mortgage deals with other providers.

However, this option often leads to higher monthly payments, so it is crucial for borrowers to ensure they can afford this increased financial commitment.

Consulting with a mortgage broker can also provide insights into the best available deals and terms that suit their financial situation.

Paying Off Your Mortgage

At the end of an interest-only mortgage term, borrowers have several options for settling their outstanding loan.

These options include selling the property, utilising personal savings or investments, or even cashing in on a pension.

If the property can be sold for a price that covers the mortgage balance, the proceeds can effectively pay off the mortgage.

Additionally, borrowers may consider selling other properties or liquidating assets to meet their obligations.

In situations where these options are not feasible, negotiating with the lender for an extension or considering a remortgage may be necessary to avoid defaulting on their loan.

Possible Outcomes: Repossession and Selling Your Home

If a borrower cannot repay their interest-only mortgage, repossession may be the lender's last resort.

This process involves the lender reclaiming the property to recover the outstanding debt.

Before reaching this point, borrowers should diligently explore all available options, such as remortgaging or negotiating a payment plan with their lender.

Selling the home can also be a practical solution if the sale price can cover the mortgage balance.

It is imperative for borrowers to maintain communication with their lender to seek solutions that can help them avoid repossession and maintain their financial stability.

Working with Lenders and Brokers

How to Talk to Your Lender

Effective communication with your lender is crucial, especially as the end of your interest-only mortgage term approaches.

Borrowers should initiate discussions well in advance to explore their options and understand any potential consequences of failing to repay the loan.

When speaking with the lender, it is essential to be transparent about your financial situation and repayment plans.

Lenders are often willing to work with borrowers to find a suitable solution, such as extending the mortgage term or remortgaging.

Keeping a record of all communications can also help facilitate the process.

The Role of a Mortgage Advisor

A mortgage advisor plays a vital role in helping borrowers navigate their options at the end of an interest-only mortgage term.

They can provide expert advice tailored to the borrower's financial situation and help identify the best repayment strategies.

Advisors can assist in negotiating with lenders, exploring remortgaging options, and finding suitable products that align with the borrower's needs.

Additionally, they can offer ongoing support and guidance throughout the process, ensuring that borrowers make informed decisions about their mortgage.

How a Broker Can Help You Navigate Your Options

Mortgage brokers can be invaluable resources for borrowers nearing the end of an interest-only mortgage.

They have access to a wide range of lenders and mortgage products, allowing them to find the best deals available in the market.

Brokers can help borrowers understand their options, whether it involves transitioning to a repayment mortgage, remortgaging, or exploring equity release.

They also assist with the paperwork and negotiations, ensuring a smoother process for the borrower. Engaging a broker can save time and reduce the stress associated with managing mortgage options.

Managing Bad Credit and Mortgage Arrears

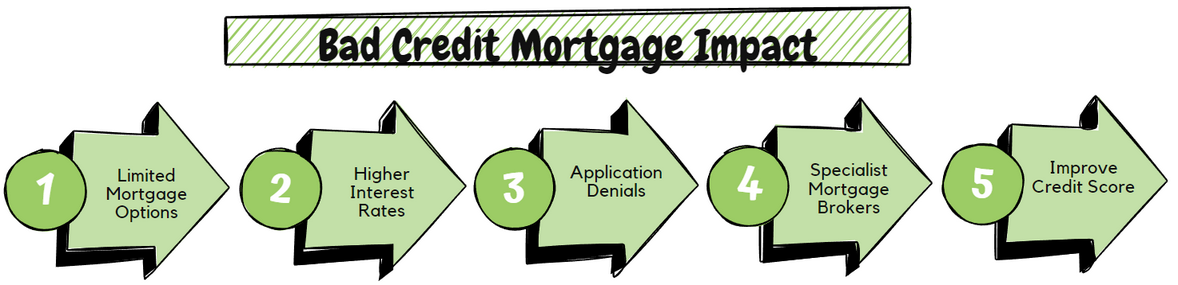

Impact of Bad Credit on Your Mortgage Options

Bad credit can significantly limit a borrower's mortgage options, particularly when seeking to remortgage or extend an interest-only mortgage.

Lenders may view borrowers with poor credit histories as high-risk, leading to higher interest rates or outright denial of applications.

Borrowers with bad credit should consider working with a mortgage broker who specialises in bad credit mortgages, as they can help identify lenders willing to work with them.

It is also essential for borrowers to take steps to improve their credit score before applying for new mortgage products.

Strategies to Manage Mortgage Arrears

Managing mortgage arrears requires prompt action and effective communication with the lender.

Borrowers should contact their lender as soon as they realise they are falling behind on payments to discuss possible solutions, such as payment plans or temporary forbearance.

Seeking advice from a financial advisor or mortgage broker can also provide valuable insights into managing arrears and exploring refinancing options.

Additionally, borrowers should review their budget and cut unnecessary expenses to redirect funds toward their mortgage payments, aiming to catch up as quickly as possible.

Seeking Help When Facing Financial Difficulties

When facing financial difficulties, borrowers should not hesitate to seek help from professionals.

Consulting with a mortgage advisor or financial counsellor can provide guidance on managing debt and exploring repayment options.

Many organizations offer free or low-cost financial advice services that can assist borrowers in creating a budget, negotiating with creditors, and understanding their rights regarding mortgage arrears.

Early intervention is key to preventing more severe consequences, such as repossession, and finding a sustainable path forward.

Common Questions

1. What happens if I can’t repay my interest-only loan?

2. Can I switch my interest-only loan to a repayment loan?

3. Will failing to repay an interest-only loan affect my credit score?

4. What should I do if I’m struggling to repay my interest-only loan?

5. Are there any alternatives if I can’t repay my loan?

Conclusion

Failing to repay an interest-only loan can lead to serious financial consequences, including increased debt, risk of asset repossession, and long-term credit damage.

Borrowers should plan ahead by exploring refinancing options, overpaying when possible, or seeking financial advice to avoid default.

If repayment difficulties arise, early communication with lenders can help find alternative solutions and minimise financial hardship.

Being proactive is key to managing the risks associated with interest-only loans.

WAIT! Before You Go...