DON'T MISS OUT! Try Our FREE Calculator Now

- Equity release is considered safe for homeowners over 55, particularly with schemes approved and monitored by the Equity Release Council, ensuring you never owe more than your home's worth and can remain in your home until moving into long-term care.

- Key risks of equity release include the potential to diminish your estate's value, affect eligibility for means-tested benefits, and the accumulation of interest, which can significantly increase over time.

- For reliable and safe equity release, opt for plans sanctioned by the Equity Release Council and provided by the Financial Conduct Authority (FCA) to ensure product transparency and fairness.

Is equity release safe? In recent times, many UK homeowners have sought answers to this very question seeing as over £6.2 billion have been unlocked from homes in 2022 alone.1

Are there risks you must consider?

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

As expert researchers, we have combed through various reputable sources to look into the safety of releasing property equity, saving you the trouble.

Read here about the roles of industry and regulatory bodies such as the Equity Release Council (ERC) and the Financial Conduct Authority (FCA), and how these bodies address potential concerns around how does equity release work in the UK when it comes to mis-selling and financial safety.

Is Equity Release Safe and Secure for Retirees?

Equity release can be a safe and secure option for retirees. It allows individuals to access the value tied up in their homes without having to sell or move out.

While there are risks involved, such as potential negative equity and impact on inheritance, with proper guidance and advice, retirees can mitigate these risks and ensure a secure financial future.

It is important for retirees to seek advice from qualified professionals and choose reputable Equity release providers to ensure the safety of their investment.

By conducting thorough research and understanding the terms and conditions of the Equity release agreement, retirees can make informed decisions and enjoy the benefits of unlocking their home's value while maintaining a secure financial position.

What Is Releasing Property Equity?

Releasing property equity is a financial arrangement that grants homeowners the ability to access cash tied up in their property without the need to sell or downsize.

What Is the Equity Release Council (ERC)?

The Equity Release Council (ERC) is the industry's self-regulating body, setting high standards for its members to ensure consumers are treated fairly.

Originally established in 1991, the ERC is committed to protecting and educating consumers about available products.

Introduction to the Financial Conduct Authority (FCA)

The Financial Conduct Authority (FCA) is the main financial regulatory entity in the UK, tasked with overseeing the financial markets and ensuring their integrity.

It sets criteria for financial products, ensuring products are sold ethically and that consumers are treated fair.

Roles and Responsibilities in the Equity Release Sector

The ERC2 sets guidelines and standards for companies offering equity release services, aiming to ensure fairness and clarity for people using these services.

At the same time, the FCA3 acts as a regulator to ensure that all companies follow the rules and treat customers properly.

Together, the ERC and the FCA work to make sure equity release is secure and fair for everyone involved.

How Does the ERC Contribute to Client Safety?

The Council is crucial for keeping clients safe when using UK equity release.

It sets strict rules for its members, making sure they treat clients fairly, share clear details about their products and avoid hidden fees or conditions.

What Standards and Guidelines Are Upheld by the ERC?

Certain crucial standards and guidelines are maintained, including the No Negative Equity Guarantee.

This rule ensures that homeowners who opt for one of these products will never be required to repay more than the value of their home, even if the property's worth decreases.

Additionally

Clients enjoy the assurance of residing in their property for their entire life or until they move into a care home, providing a sense of security and control.

Also, as of 28 March 2022, the ERC has made it a requirement that their members do not penalise customers who make voluntary repayments of up to 10% of the total amount per annum for lifetime mortgages taken out after the date of the announcement.4

What Is the Regulatory Role of the FCA in Equity Release?

Its role revolves around ensuring that providers maintain credibility, operate transparently, and adhere to regulations.

The FCA's central objective is to assess whether equity release products are suitable for consumers and to facilitate the transparent communication of associated risks.

FCA-Established Criteria for Equity Release Providers

The FCA's regulatory criteria seeks to create a secure and transparent environment for individuals engaging in these and other financial transactions.

These standards include:

- Robust operational processes

- Financial stability

- Adherence to FCA guidelines

One crucial requirement is that lenders must provide consumers with clear, detailed pre-contractual information to ensure transparency of all product terms and condition.

The reason for this to help you, as an consumer, to make well-informed decisions when you are considering releasing home equity.

Verification of Regulatory Compliance

To ensure that providers adhere to regulatory standards, consistent audits and assessments are carried out.

The Financial Conduct Authority (FCA) and the Equity Release Council (ERC) play pivotal roles in overseeing the industry, actively investigating and addressing any instances of non-compliance to maintain the well-being of consumers and uphold the integrity of the equity release market.

Understanding Mis-Sold Equity Release

Mis-sold products occur when a financial advisor or institution provides inadequate or misleading information regarding the products they are offering.

This can involve recommending an inappropriate plan for the customer's needs or failing to explain the associated risks and implications of the agreement, such as long-term financial consequences or the potential impact on inheritance.

What Are Common Methods of Equity Release Mis-Selling?

Mis-selling often arises when advisors fail to present all suitable options or neglect the long-term consequences for homeowners.

These instances include:

- Overlooking more cost-effective alternative

- Not discussing how the scheme may affect your entitlement to state benefits.

- Failing to emphasise the fees associated with early repayment.

It is essential for consumers to be fully informed, ensuring they make decisions that are in their best financial interests.

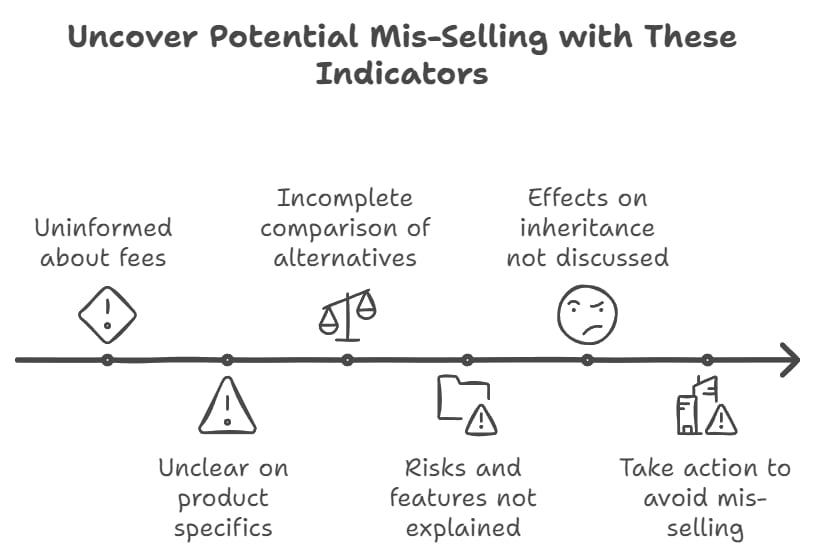

What Are the Indicators and Signs of Potential Mis-Selling?

Indicators of potential mis-selling include:

- Not being fully informed about associated fees.

- The effects on your potential inheritance.

- Lacking clarity on vital product specifics.

- You were not provided with a thorough comparison of alternative financial solutions.

- The risks and features of the plan were not clearly explained.

Make sure you always seek professional financial advise before finalising any transaction.

Steps to Consider if You Believe You Have Been Mis-Sold Equity Release

If you suspect you have been mis-sold a product, there is a process to follow.

Steps in this process include:

- Initially discuss your concerns with a qualified financial advisor to assess the situation.

- If not resolved, lodge a formal complaint with provider detailing your grievances.

- Should the provider's response be unsatisfactory, escalate your complaint to the Financial Ombudsman Service5 for an impartial review.

The Importance of Seeking Professional Financial Advice in Retirement

Given the complexities, professional financial guidance, especially in retirement, is crucial.

Why Is Professional Financial Guidance Important?

Professional financial guidance is crucial for equity release because it helps consumers navigate a complex landscape.

Qualified advisors can provide valuable guidance around:

- Particular financial products.

- Interest rates.

- Long-term implications of your financial decisions.

Experienced advisors will guide you towards:

- Tailored recommendations

- Based on your financial goals

- Consider your circumstances

A financial advisor should also provide you with alternatives to make sure that you have considered all your options.

Furthermore

By taking all of this into account, you will then be empowered to make a well-informed decision that is best for you.

Read On: A Guide to Equity Release in 2026

Services Provided by Age UK in Retirement Planning

Age UK,6 a leading charity for older individuals, provides comprehensive retirement planning guidance, focusing on topics like equity release to enable seniors to unlock the value of their homes.

Its tailored advice covers the pros and cons of different schemes, ensuring that retirees fully understand their choices and potential implications.

Additionally, through a network of trained advisors, Age UK offers face-to-face consultations, online resources, and helpline support, all geared towards facilitating informed financial decision-making in later life.

Overview of the Money and Pensions Service (MaPS)

The Money and Pensions Service (MaPS)7 is a UK government-backed organisation dedicated to offering independent guidance on financial matters.

It specialises in providing unbiased advice on pensions, including equity release options, assisting people in making informed decisions about their retirement finances.

Leveraging its resources can help ensure you are well-equipped to manage your financial future in retirement.

The Role of Citizens Advice

Citizens Advice8 plays a crucial role in providing free, impartial advice on financial topics, including equity release schemes in the UK.

With trained advisors, it helps individuals navigate complex financial decisions, ensuring transparency and understanding.

While it offers essential guidance, it is always recommended to consult with a specialist before making any significant financial commitment.

How to Identify and Select Reputable Financial Advisors

When seeking a reputable financial advice provider for equity release in the UK, first make sure they are registered with the Financial Conduct Authority (FCA).

Additionally, it is wise to peruse independent reviews online and gauge the experiences of other clients.

Lastly, personal referrals from friends, family, or professionals in related fields can also offer valuable insights into the credibility and reliability of potential advisers.

You can also find an advisor that is an Equity Release Council member.

Common Questions

What Are the Risks Involved in Equity Release

Is Equity Release Safe for My Retirement

What Safety Measures Protect Me in Equity Release

How Safe is Equity Release Against Market Volatility

Does Equity Release Affect the Safety of My Home Ownership

How Can Consumers Ensure That Their Equity Release Plan Complies With ERC and FCA Regulations

Are There Any International Standards or Regulations That Apply to Equity Release

How Do FCA-Established Criteria Impact the Safety of Equity Release

What Measures Are Taken by ERC and FCA to Enforce Compliance With Equity Release Rules and Regulations

What Legal Recourses Are Available if a Person Is a Victim of Equity Release Mis-Selling

Conclusion

So, is equity release safe?

Releasing property value can offer a valuable financial solution for many homeowners in the UK.

However, its safety largely depends on the due diligence of the consumer, the reputation of the provider, and strict adherence to FCA and ERC guidelines.

It is crucial to fully understand the terms and potential long-term implications of any agreement.

For anyone considering this option, always seek professional advice and ensure you are well-informed to answer the question of: 'is equity release safe?’

WAIT! Before You Go...