DON'T MISS OUT! Try Our FREE Calculator Now

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Retirement Interest Only Mortgage Calculator: Understanding RIO Mortgages in the UK

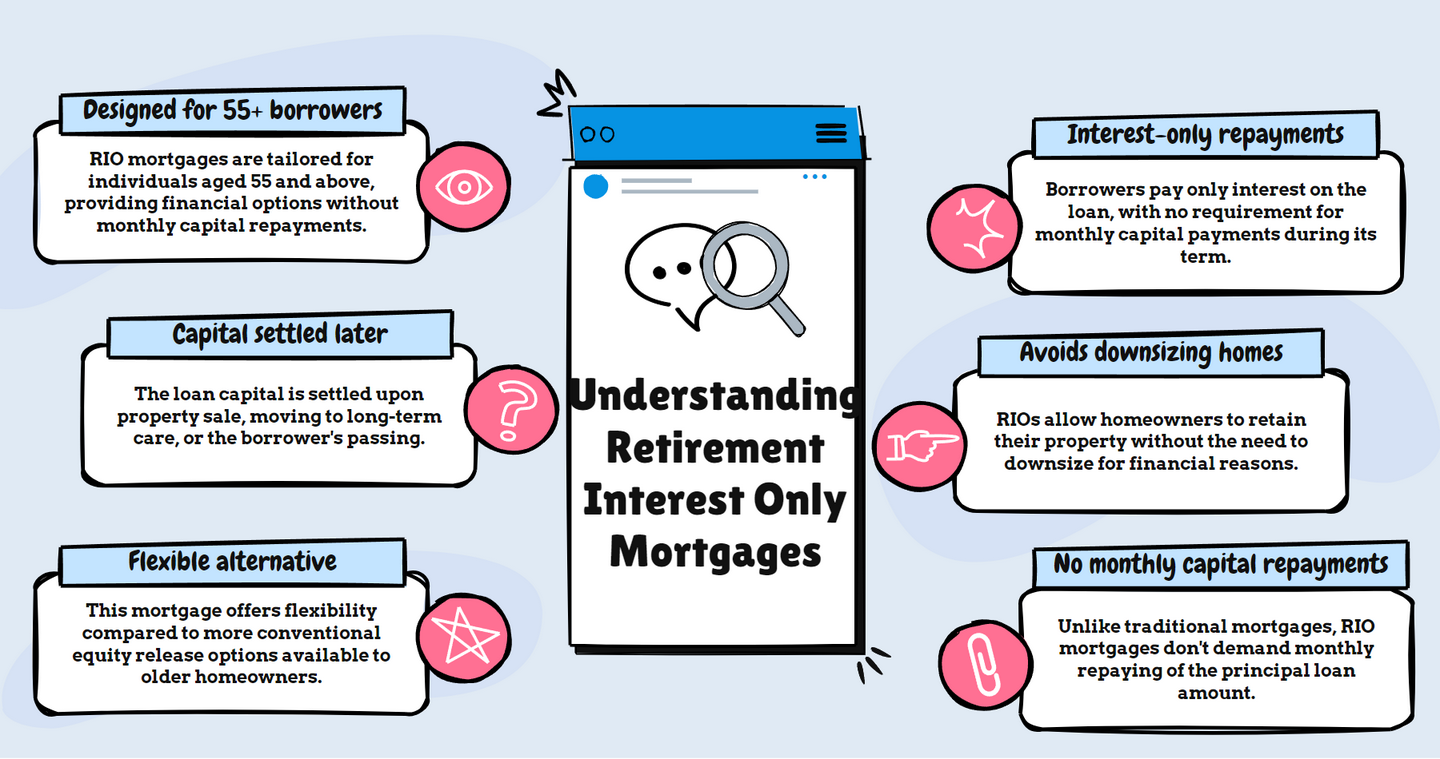

As the population ages, financial products like Retirement Interest Only (RIO) mortgages have gained prominence in the UK. These mortgages are designed specifically for older borrowers, providing them with flexible options to manage their finances during retirement. Understanding RIO mortgages is crucial for homeowners considering their long-term financial strategies.

What is a Retirement Interest Only Mortgage?

Definition and Key Features

A Retirement Interest Only (RIO) mortgage is a unique type of mortgage aimed at borrowers aged 55 and above. It allows individuals to borrow against their property without the necessity of making monthly capital repayments. Instead, borrowers are required to pay only the interest on the loan amount. The capital is then settled when the property is sold, the borrower moves into long-term care, or passes away. This structure provides remarkable flexibility, making RIO mortgages an attractive alternative to traditional equity release options, thus enabling homeowners to remain in their homes and avoid downsizing during later life.

How RIO Mortgages Differ from Traditional Mortgages

Unlike traditional interest-only mortgages, RIO mortgages do not demand capital repayments throughout the loan term. In standard mortgages, the capital is typically repaid at the end of the mortgage term. However, RIO mortgages have no fixed term and allow the capital balance to be repaid upon specific life events. This distinction offers a unique solution for those looking to secure their housing situation without the stress of monthly capital repayments. Furthermore, RIO mortgages undergo income and affordability assessments similar to traditional mortgage evaluations, ensuring borrowers can manage their interest payments effectively.

Benefits of Choosing a Retirement Interest Only Mortgage

Opting for a RIO mortgage comes with several notable benefits. It enables retirees to access equity in their homes while avoiding monthly capital repayments, which can significantly enhance cash flow during retirement. This mortgage type permits older homeowners to stay in their properties while generating funds for living expenses or home improvements. Additionally, RIO mortgages can be an appealing alternative to the complexities of equity release schemes. By only paying the interest, borrowers can retain more disposable income for personal enjoyment throughout their retirement years. However, it's vital for individuals to consider the implications on inheritance and their overall financial planning when choosing this route.

Using the Retirement Interest Only Mortgage Calculator

How to Calculate Your Potential Borrowing Amount

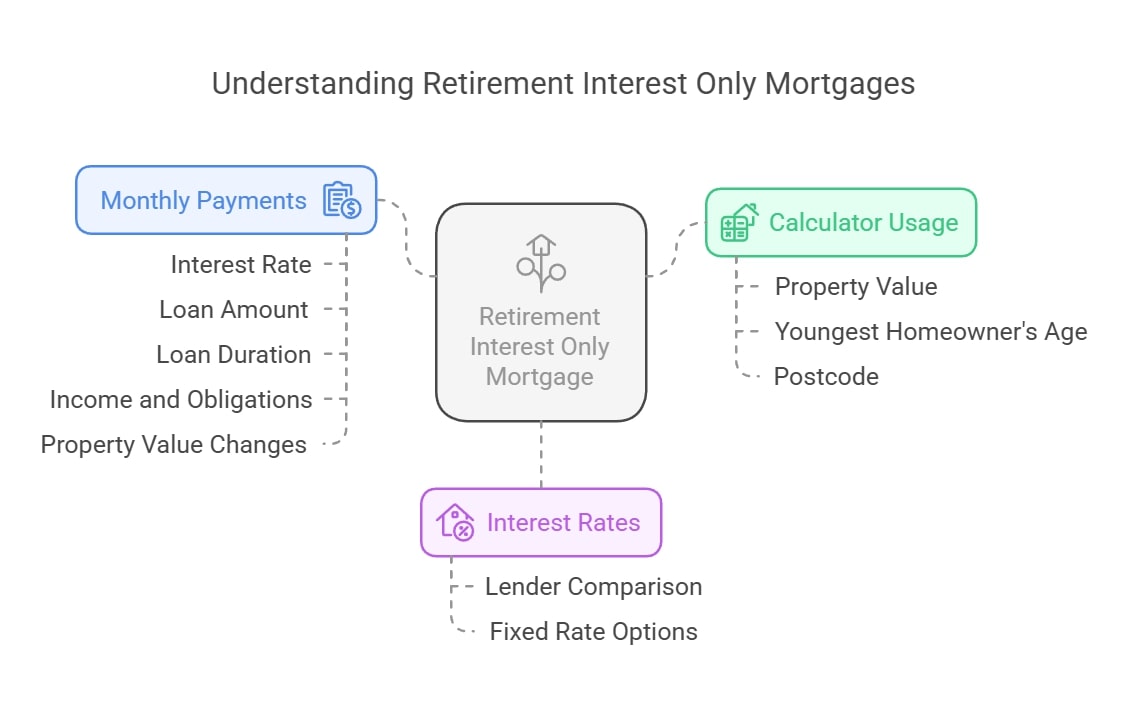

To effectively determine how much you could borrow with a Retirement Interest Only (RIO) mortgage, utilising an online retirement interest only mortgage calculator is essential. Typically, this calculator requires the input of significant details, such as the property's value, the age of the youngest homeowner—who must be at least 55—and your postcode. The calculator will give you an instant estimate of the maximum loan amount available based on these variables. However, this figure is merely a preliminary estimate. A thorough assessment by a professional mortgage advisor is necessary to evaluate your exact borrowing capacity, considering your overall financial situation and individual circumstances.

Understanding Interest Rates and Fixed Rate Options

Interest rates on RIO mortgages play a crucial role and can vary significantly from one lender to another. These rates are often influenced by broader market conditions and the financial profile of the borrower. Many lenders provide fixed-rate options, which can offer the stability of consistent monthly payments throughout the mortgage term. By locking in the interest rate at the time of borrowing, homeowners can safeguard themselves from potential future increases. Therefore, it is critical for borrowers to compare different lenders and their offerings to find a suitable interest rate that aligns with their financial objectives and personal circumstances.

Factors Influencing Your Monthly Payments

Several key factors influence the monthly payments associated with a RIO mortgage. The most significant factors include the interest rate, the amount borrowed, and the duration of the loan. Borrowers must also assess their income and other financial obligations, as these will impact their ability to manage monthly interest payments effectively. Furthermore, the property's value and its potential for appreciation or depreciation can affect the overall financial landscape of the RIO mortgage. Understanding these factors is essential for effective financial planning, ensuring that repayments remain manageable throughout retirement while safeguarding against the risk of future financial strain.

Equity Release Options for Later Life Mortgages

What is Equity Release?

Equity release encompasses various financial products designed to enable homeowners, typically aged 55 and over, to access the equity tied up in their homes without needing to sell the property. This can be accomplished through a range of schemes, including lifetime mortgages and home reversion plans. Equity release provides homeowners with funds that can be utilized for multiple purposes, such as financing home improvements, settling debts, or supplementing retirement income. It is essential for individuals to comprehend the implications of equity release, particularly concerning how it may affect inheritance and their overall financial health.

Types of Equity Release Products

There are primarily two categories of equity release products: lifetime mortgages and home reversion plans. Lifetime mortgages permit homeowners to borrow against the home’s value while retaining ownership, with the loan being repaid upon the death of the homeowner or when they transition into long-term care. Conversely, home reversion plans involve selling a portion of the home to a provider in exchange for a lump sum, allowing the homeowner to continue living in the property rent-free until they die or move into care. Each type of equity release product has distinct advantages and considerations, making it essential for individuals to evaluate which option aligns best with their personal needs and financial circumstances.

How to Choose the Right Equity Release Option

Selecting the appropriate equity release option requires a careful assessment of personal financial circumstances, objectives, and the implications of each product type. Homeowners should consider factors such as the amount of equity they wish to release, their future plans, and how the selected option will impact their estate. Consulting with a qualified financial adviser can provide valuable insights and assist in navigating the complexities of the equity release landscape. Additionally, it is crucial to review each product's terms and conditions, including fees and potential early repayment penalties, to ensure informed and confident decision-making regarding this significant financial choice.

Working with a Mortgage Advisor

Choosing the Right Mortgage Advisor for RIO Mortgages

Selecting a knowledgeable and experienced mortgage advisor is crucial when considering a Retirement Interest Only (RIO) mortgage. Advisors should be familiar with the specific requirements and features of RIO products, as well as the broader landscape of retirement finance. Look for advisors who are regulated and have a strong track record in helping clients navigate later-life mortgage options. Personal recommendations and online reviews can also be useful in identifying qualified professionals who can provide tailored advice based on individual circumstances, ensuring you receive the best possible guidance for your mortgage needs.

Questions to Ask Your Mortgage Advisor

When consulting with a mortgage advisor, it is important to ask specific questions to ensure you receive comprehensive guidance. Inquire about the different types of RIO mortgages available, their features, and how they compare to other equity release products. Ask about the eligibility criteria, the application process, and any associated fees or costs. Additionally, understanding the advisor's experience and approach to client service can help establish a productive working relationship. Don't hesitate to request examples of how they have assisted other clients in similar situations, as this can provide insight into their ability to manage your mortgage effectively.

Understanding the Role of the Lender

The lender plays a critical role in the RIO mortgage process, as they assess the borrower's application, conduct affordability checks, and ultimately decide whether to approve the loan. Lenders will evaluate factors such as the value of the property, the borrower's financial situation, and their ability to meet interest repayments. It is essential for borrowers to understand the lender's criteria and processes, as this can impact their chances of securing a mortgage. Building a good relationship with the lender can also facilitate smoother communication and support throughout the application process, enhancing the overall experience of obtaining a RIO mortgage.

Common Questions About Retirement Mortgages

How Much Could You Borrow with a RIO Mortgage?

The amount you can borrow with a RIO mortgage typically depends on several factors, including the value of your property, your age, and the lender's criteria. Generally, borrowers can access up to 65% of the property’s value. It’s essential to use a mortgage calculator to get an initial estimate, but a full assessment by a financial advisor is necessary to determine the exact borrowing capacity based on individual circumstances and financial health. Understanding these limits is vital for effective financial planning, ensuring you make informed decisions regarding your retirement mortgage options.

What are the Repayment Options Available?

Repayment options for RIO mortgages primarily involve paying the interest monthly while the capital is settled upon specific life events. Borrowers do not have to repay the capital until they sell the property, move into long-term care, or pass away. This structure allows for flexibility in managing finances during retirement. However, it is essential to maintain regular interest payments to avoid defaulting on the mortgage, which could lead to repossession of the home. Being clear on these options can help ensure that you are prepared for the responsibilities that come with a RIO mortgage.

Can You Pay Off a Retirement Interest Only Mortgage Early?

Yes, borrowers can typically pay off a RIO mortgage early, though there may be penalties or fees associated with early repayment. It is important to review the terms of the mortgage agreement to understand any potential costs involved. Early repayment can be beneficial for those who wish to settle their mortgage and free up equity in their home, but it is advisable to consult with a mortgage advisor to assess the financial implications and ensure that it aligns with overall financial goals. Understanding your options for early repayment can significantly impact your long-term financial strategy.

WAIT! Before You Go...