DON'T MISS OUT! Try Our FREE Calculator Now

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Understanding Reverse Mortgages: Insights from the Consumer Financial Protection Bureau

As the population ages, the need for financial solutions that cater to retirees becomes increasingly significant. One such solution is the reverse mortgage, a complex financial product that allows homeowners, particularly seniors, to leverage their home equity without having to sell their property.

Understanding reverse mortgages is essential for those looking to enhance their retirement income or cover unexpected expenses. This article explores the details, benefits, and considerations associated with reverse mortgages, informed by insights from the Consumer Financial Protection Bureau.

What is a Reverse Mortgage?

Definition and Overview of Reverse Mortgages

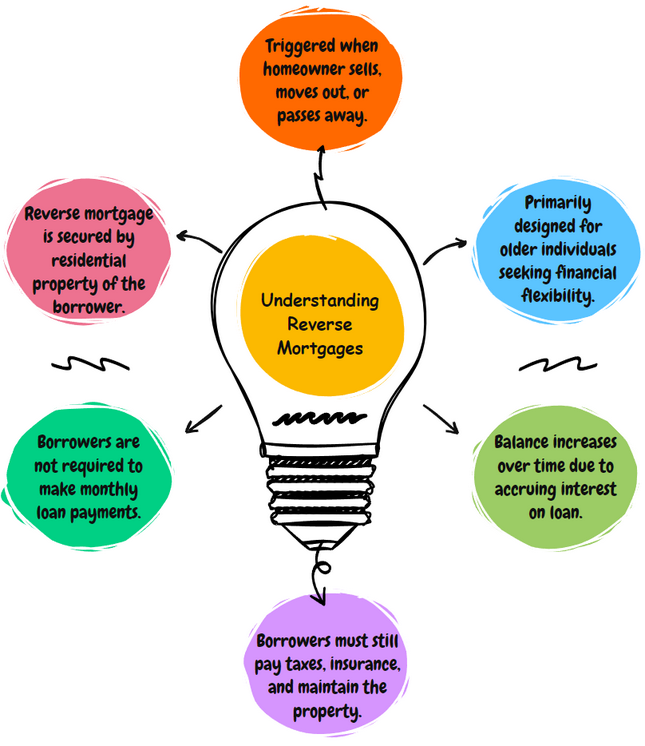

A reverse mortgage is a loan secured by a residential property, enabling homeowners—mostly older individuals—to access the unencumbered value of their home.

Unlike traditional mortgages, where borrowers make monthly payments, a reverse mortgage does not require these payments; instead, the loan balance increases over time as interest accrues.

The reverse mortgage loan is typically repaid when the homeowner either sells the property, moves out, or passes away. It is crucial to note that borrowers are still responsible for property taxes, homeowner's insurance, and maintenance.

This financial product is specifically designed to help retirees use a reverse mortgage to tap into their home equity while retaining ownership of their residence.

How Reverse Mortgages Work

Reverse mortgages work by converting a portion of a homeowner's equity into cash, which can be disbursed in several ways, including a lump sum, monthly payments, or a line of credit.

The borrower retains the right to live in the home as long as they meet the obligations of the loan, such as maintaining the property and paying property taxes and insurance. Importantly, the reverse mortgage may not need to be repaid until the homeowner no longer occupies the property.

Over time, the interest on the loan compounds, significantly increasing the total amount owed and potentially impacting the equity left for heirs. Understanding how reverse mortgages work is vital for anyone considering this financial option.

Key Features of a Reverse Mortgage Loan

The key features of reverse mortgage loans include the absence of monthly mortgage payments, the ability to access home equity, and the responsibility to maintain property taxes and insurance. Additionally, reverse mortgages often come with a "no negative equity" guarantee, ensuring that borrowers will never owe more than the home's value upon sale.

Among the different types of reverse mortgages, the Home Equity Conversion Mortgage (HECM) is the most common type of reverse mortgage. These loans can be structured in various ways, including fixed-rate and adjustable-rate options, providing flexibility in how funds are accessed and utilised.

However, potential borrowers should also consider the pros and cons of reverse mortgages, as they may involve upfront costs, interest rates that can be higher than traditional mortgages, and increasing debt over time.

Types of Reverse Mortgages

Different Types of Reverse Mortgages

There are several types of reverse mortgages available to homeowners, each designed to meet different financial needs. The most common type of reverse mortgage in the U.S. is the Home Equity Conversion Mortgage (HECM), which is federally insured and regulated by the Department of Housing and Urban Development.

HECMs provide significant flexibility in accessing home equity and can be a valuable tool for retirees looking to enhance their financial security. In addition to HECMs, proprietary reverse mortgages are offered by private lenders and may allow for larger loan amounts, though they lack federal insurance.

Another option is the single-purpose reverse mortgage, typically provided by state or local governments, which can be less expensive but is limited to specific uses, such as home repairs or paying property taxes. Understanding these different types of reverse mortgages can help potential borrowers choose the right option for their circumstances.

Pros and Cons of Reverse Mortgages

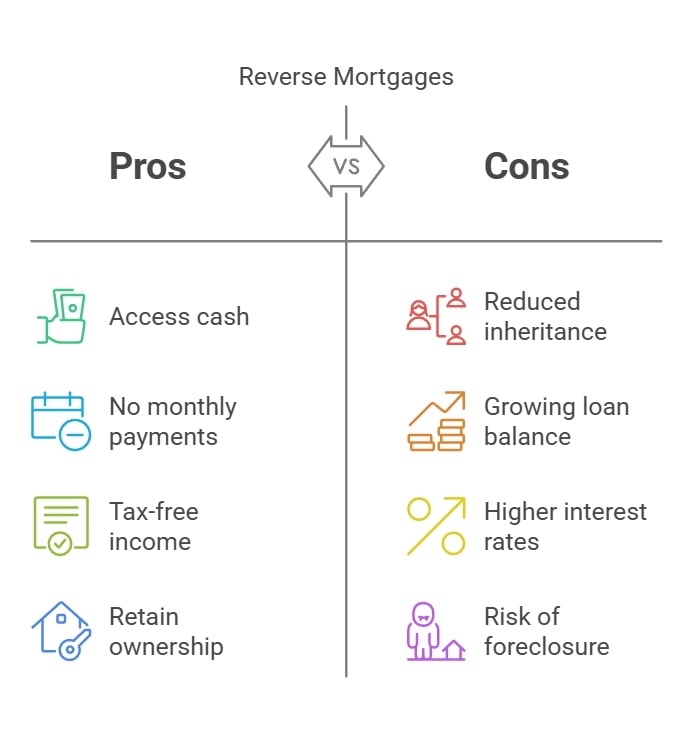

Reverse mortgages come with a range of pros and cons that potential borrowers should carefully consider. On the positive side, a reverse mortgage allows homeowners to access cash without the burden of monthly payments, which can be a lifeline for retirees in need of additional income.

Moreover, the income received from a reverse mortgage may be tax-free, providing a financial advantage. Homeowners can also retain ownership of their property while using a reverse mortgage to tap into their home equity.

However, there are notable drawbacks, including the potential reduction of inheritance for heirs, as the loan balance may grow significantly over time due to compounding interest.

Additionally, reverse mortgage interest rates can be higher compared to traditional mortgages, and failing to meet loan obligations may lead to foreclosure. Evaluating the pros and cons of reverse mortgages is crucial for anyone considering this financial option.

Specifics of Reverse Mortgages in the UK

In the UK, reverse mortgages are commonly referred to as lifetime mortgages, designed for homeowners aged 55 and over who wish to borrow against their home equity without making monthly repayments. The loan is typically repaid when the homeowner dies, sells the property, or moves into long-term care.

UK regulations mandate that borrowers obtain independent legal advice before taking out a reverse mortgage, ensuring they fully understand the implications. Many lifetime mortgage products offer a "no negative equity" guarantee, protecting homeowners from owing more than the value of their property when the loan is settled.

The market for reverse mortgages in the UK is growing, driven by retirees seeking to unlock home equity to enhance their financial security in retirement. Understanding the specifics of reverse mortgages in the UK can provide valuable insights for those considering this financial option abroad.

Getting a Reverse Mortgage

Steps to Obtain a Reverse Mortgage

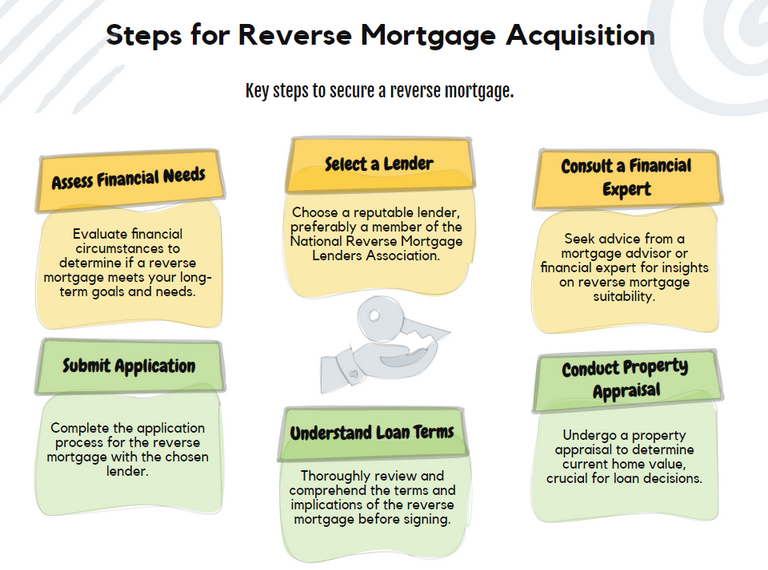

Obtaining a reverse mortgage involves several critical steps that homeowners must navigate to ensure a successful application.

The first step is to assess the need for a reverse mortgage, considering personal financial circumstances and goals. Consulting with a mortgage advisor or financial expert can provide valuable insights into whether a reverse mortgage is the right choice.

After determining the need, the next step is to choose a lender, ideally one that is a member of the National Reverse Mortgage Lenders Association. Once a lender is selected, borrowers must apply for the reverse mortgage and undergo a property appraisal to evaluate the home's value.

It's essential to understand the terms and implications of the reverse mortgage loan before signing any agreements.

Additionally, completing a counselling session with an approved HUD counsellor is a requirement; this ensures that borrowers have a comprehensive understanding of the product and its potential impacts on their financial situation.

Finding the Right Lender

Finding the right lender for a reverse mortgage is pivotal to the borrowing experience. Homeowners should begin by researching various lenders and comparing interest rates, terms, and fees associated with different types of reverse mortgages.

Selecting lenders who are members of organizations like the National Reverse Mortgage Lenders Association is advisable, as these lenders adhere to higher ethical standards. Prospective borrowers should also pay attention to the lender's reputation, customer service quality, and the specific features of their reverse mortgage products.

By thoroughly evaluating these factors, borrowers can choose a lender that aligns with their financial needs and preferences. Additionally, understanding the lender's approach to mortgage insurance and any potential costs involved can help borrowers make informed decisions throughout the reverse mortgage process.

Understanding Interest Rates and Fees

Interest rates on reverse mortgages can vary significantly depending on the lender and the type of reverse mortgage being considered. Typically, reverse mortgages have higher interest rates compared to traditional mortgages, which can affect the overall cost of the loan.

Borrowers should be aware of the various fees associated with obtaining a reverse mortgage, including origination fees, closing costs, and servicing fees. These fees can often be rolled into the loan, contributing to an increasing loan balance over time.

Understanding these costs upfront is crucial, as they can impact the amount of home equity accessed and the total amount owed when it comes time to repay the reverse mortgage. Being informed about interest rates and fees ensures that borrowers can make sound financial decisions and prepare adequately for their future financial obligations associated with the reverse mortgage loan.

Using a Reverse Mortgage

How to Use Reverse Mortgage Proceeds

Proceeds from a reverse mortgage can be incredibly versatile, allowing borrowers to address various financial needs. Many retirees choose to cover living expenses, ensuring they can maintain their quality of life without the stress of monthly payments.

Additionally, these funds can be pivotal in managing healthcare costs, which can be significant in retirement. Home renovations are another common use, enabling homeowners to update their residences for safety or comfort.

Furthermore, some individuals utilise reverse mortgage proceeds to consolidate debt, reducing financial burdens and simplifying their financial landscape. This flexibility is one of the standout advantages of a reverse mortgage, as it allows homeowners to tailor the use of funds to their unique financial situations.

Borrowing with a Reverse Mortgage

When borrowing against home equity through a reverse mortgage, homeowners can access cash while sidestepping the obligation of monthly repayments. The amount available to borrow is determined by several factors, including the homeowner's age, the home's value, and current interest rates.

Typically, as the homeowner ages, they can qualify for a reverse mortgage that provides a larger loan advance, enhancing their financial flexibility in retirement.

This dynamic makes reverse mortgages an appealing option for seniors looking to tap into their home equity without the immediate burden of repayment. Understanding how to navigate the borrowing process is essential for those considering a reverse mortgage as a viable financial tool.

Paying Back a Reverse Mortgage

Repayment of a reverse mortgage usually occurs under specific circumstances: when the homeowner sells the property, moves out, or passes away.

At this juncture, the loan balance, which includes accrued interest and any associated fees, must be paid in full. Heirs have the option to sell the home to pay back the reverse mortgage or refinance it to retain ownership.

One significant feature of reverse mortgages is the "no negative equity" guarantee, which protects borrowers by ensuring they will not owe more than the home's value at the time of sale. This guarantee provides peace of mind, allowing homeowners to enjoy their retirement without the fear of depleting their estates.

Considerations and Risks

Common Scams Related to Reverse Mortgages

As the popularity of reverse mortgages grows, so does the risk of scams targeting vulnerable homeowners, especially the elderly. Common scams include misleading advertisements and high-pressure sales tactics that promise unrealistic benefits.

It is crucial for homeowners to remain vigilant, particularly in the face of unsolicited offers that may appear too good to be true. Verifying the credentials of potential lenders and advisors is essential to avoid falling victim to fraudulent schemes.

Additionally, reporting suspicious activities to the appropriate authorities can help protect oneself and others from potential fraud in the reverse mortgage market.

Understanding Your Reverse Mortgage Rights

Borrowers need to be aware of their rights regarding reverse mortgages to safeguard their interests. Among these rights is the entitlement to receive clear and accurate information about the loan terms before proceeding.

Homeowners also have the right to change lenders if they find better options and are required to undergo counselling prior to taking out a loan. Understanding these rights empowers borrowers to make informed decisions, ensuring they are not taken advantage of during the borrowing process.

Being knowledgeable about reverse mortgage rights is essential for protecting one's financial future and ensuring a positive borrowing experience.

Consulting a Mortgage Advisor

For those considering a reverse mortgage, consulting a qualified mortgage advisor is highly advisable. These professionals can provide personalised guidance tailored to individual financial situations and help navigate the complexities of different types of reverse mortgages.

A mortgage advisor can elucidate the details of a Home Equity Conversion Mortgage (HECM) and identify alternatives that may better suit the homeowner's needs.

By leveraging their expertise, borrowers can make informed decisions about whether to take out a reverse mortgage and how to best utilise the proceeds. This step is crucial for ensuring that retirees maximise their financial security and make the most of their home equity.

WAIT! Before You Go...