DON'T MISS OUT! Try Our FREE Calculator Now

- Equity release allows homeowners to unlock the value tied up in their property without having to sell it, offering a flexible way to access cash while continuing to live in the home. This option is especially helpful for those looking to fund retirement, home improvements, or other expenses.

- If you choose to sell your home as part of an equity release plan, the sale proceeds will be used to pay off the loan amount plus interest. This can be a beneficial way to clear debt, but it requires careful planning and understanding of potential tax implications.

- The value of the home may increase over time, but the debt accumulated through equity release (including interest) could reduce the inheritance left to heirs. Homeowners should carefully assess the long-term financial impact and involve their family in discussions about this decision.

- Before proceeding with equity release or selling your property, it's essential to seek advice from financial experts, such as mortgage advisors and legal professionals, to ensure you understand all terms, fees, and implications of the process.

Deciding to sell your house can be a complex process, especially if you have an equity release plan in place.

Understanding how equity release works and the implications for selling your home is crucial.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This article provides key insights and tips for homeowners considering selling a house with equity release, ensuring that you make informed decisions while navigating this financial landscape.

Understanding Equity Release

Equity release is a financial product designed for homeowners aged 55 and above, allowing them to access the value tied up in their property.

It enables individuals to receive funds either as a lump sum or in smaller, regular payments.

The loan, along with accrued interest, is typically repaid from the estate upon the homeowner's death or if they move into long-term care.

This mechanism allows seniors to utilise their home equity without needing to sell their property immediately, providing financial flexibility during retirement.

What is Equity Release?

Equity release is essentially a way for homeowners to unlock the equity from their home without having to sell it.

This financial strategy is particularly beneficial for seniors looking to enhance their retirement lifestyle.

Homeowners can access funds through various means, allowing them to maintain ownership of their property while also benefiting from the equity they have built over the years.

However, it is essential to understand the implications, including how the equity release loan will affect the estate and future financial planning.

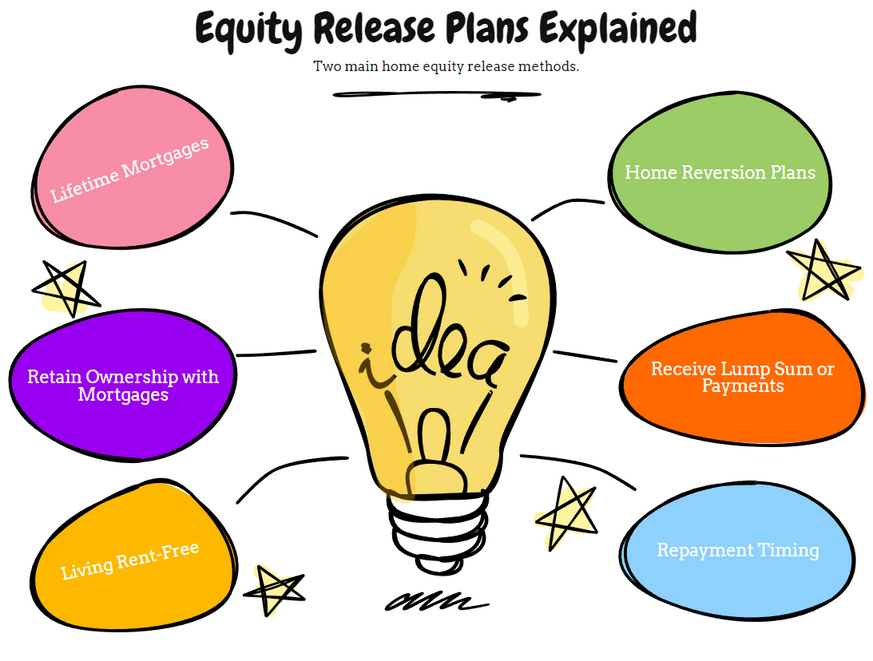

Types of Equity Release Plans

In the UK, the two primary types of equity release plans are lifetime mortgages and home reversion plans.

Lifetime mortgages allow homeowners to borrow against their property's value while retaining ownership, with repayment due when they pass away or enter long-term care.

On the other hand, home reversion plans involve selling a portion of the property in exchange for a lump sum or regular payments, allowing the homeowner to live in the property rent-free until they pass away or move into care.

Understanding these options is essential when considering how to release equity from your home.

How Equity Release Works

Equity release works by enabling homeowners to unlock a portion of their home’s value while continuing to live there.

The amount available for release depends on factors such as the homeowner's age, property value, and the specific terms of the equity release plan.

Homeowners can receive funds tax-free, which can be used for various purposes, including home improvements, travel, or supporting family members.

However, it is crucial to remember that the loan amount plus interest must be repaid when the homeowner dies or moves into long-term care, impacting the inheritance for heirs.

Can I Sell My House with Equity Release?

Yes, homeowners can sell their house with an existing equity release plan, but it's important to understand how it impacts the sale.

When selling your home, you must repay the equity release loan from the proceeds, which includes both the original loan amount and any accrued interest.

The remaining funds can be utilised as the homeowner wishes.

However, be mindful of potential early repayment charges if the sale occurs within a specific timeframe set out in the equity release agreement, as this could affect your net proceeds significantly.

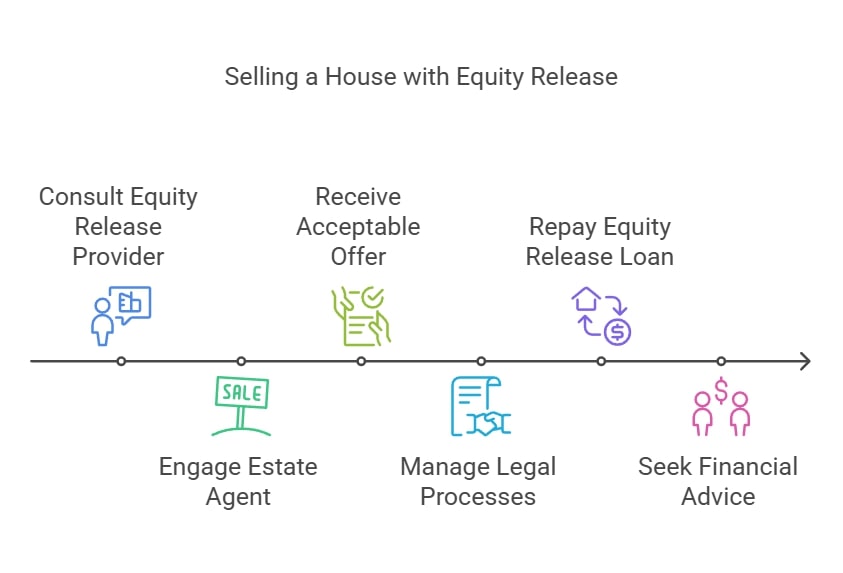

Steps to Sell Your House with Equity Release

To sell a house with equity release, the first step is to consult your equity release provider for a settlement figure that indicates the total amount owed.

Following this, it is advisable to engage a qualified estate agent to list your property effectively.

Once you receive an acceptable offer, a solicitor will manage the legal processes, ensuring the equity release loan is repaid directly from the sale proceeds.

Homeowners should also consider seeking equity release advice from a financial advisor to understand all implications of the sale.

Considerations Before Selling Your Home

Before making the decision to sell your home with equity release, various factors must be considered.

This includes potential early repayment charges that may apply, the current market value of your property, and how selling may impact your overall financial situation.

Consulting with a financial advisor can provide tailored insights, helping you navigate your options and associated costs.

It's crucial to ensure that the sale proceeds will adequately cover the equity release debt, as any shortfall could lead to financial complications, affecting your future plans.

How to Repay Your Equity Release Loan

Repayment of the equity release loan when selling your property is generally handled through the sale proceeds.

Homeowners must ensure that the sale price covers the outstanding loan amount along with any accrued interest.

The solicitor managing the sale will coordinate this repayment process, ensuring the lender receives the necessary funds before any remaining proceeds are distributed to the homeowner.

To avoid unexpected outcomes, it's prudent to obtain a clear settlement figure from your equity release provider prior to finalising the sale.

Understanding Early Repayment Charges

Early repayment charges (ERCs) can apply if a homeowner sells their property before the end of the equity release plan's term.

These charges may differ significantly based on the lender's terms and could be a percentage of the outstanding balance or a fixed fee.

It's vital for homeowners to thoroughly review their equity release agreement to understand any potential ERCs and incorporate these costs into their financial planning when considering the sale.

Consulting a financial advisor can clarify the implications of ERCs on your sale proceeds.

Using Sale Proceeds to Repay

When selling a house with equity release, the sale proceeds predominantly serve to repay the outstanding equity release loan, encompassing both the principal borrowed and any accumulated interest.

Once the loan is paid off, any remaining funds from the sale are available for the homeowner to utilise as desired, whether to purchase a new property, fund retirement, or cover other expenses.

It is essential to confirm that the sale proceeds exceed the repayment amount to prevent financial strain and ensure a smooth transition after the sale.

Pros and Cons of Selling a House with Equity Release

Advantages of Selling

Selling a house with equity release can offer significant advantages for homeowners.

One of the main benefits is the ability to access cash from the sale, which can be used for various purposes, such as funding retirement or purchasing a new property.

Additionally, many homeowners may find value in downsizing, as it can lead to reduced maintenance costs and a more manageable living situation.

If the homeowner has a lifetime mortgage with a no negative equity guarantee, they can sell their property confidently, knowing they won't owe more than its sale value, thus ensuring financial security during their retirement years.

Disadvantages of Selling

Despite the potential benefits, selling a house with equity release comes with its share of disadvantages.

Homeowners might encounter early repayment charges and other fees that can significantly diminish the net proceeds from the sale.

Furthermore, if property values have declined, there may be insufficient funds available to repay the equity release loan, potentially impacting the homeowner's financial situation.

The complexities of selling a home with equity release can also be daunting and may necessitate professional guidance to navigate the process effectively.

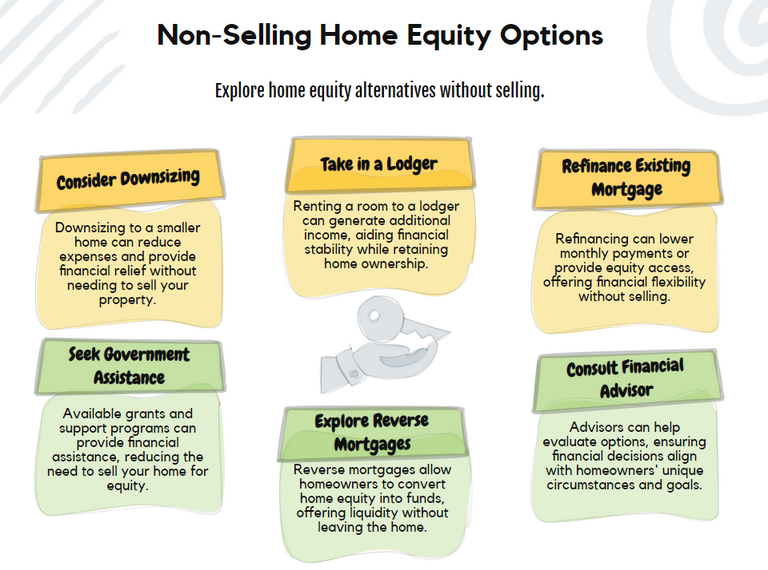

Alternatives to Selling Your Home

For homeowners considering selling their property with equity release, exploring alternatives can be beneficial.

Options such as downsizing to a more manageable property can provide financial relief without the need to sell.

Homeowners might also consider refinancing their existing mortgage or taking in a lodger to generate additional income.

Additionally, government grants and support programs can offer financial assistance.

Consulting with a financial advisor can help homeowners assess these alternatives and determine the most suitable course of action based on their unique circumstances and financial goals.

Moving House After Equity Release

Downsizing vs. Upsizing

When moving house after equity release, homeowners often grapple with the decision of whether to downsize or upsize.

Downsizing can alleviate financial pressure by lowering mortgage payments and reducing maintenance costs, ultimately promoting a more manageable living situation.

Conversely, upsizing may be appealing for those looking to accommodate a growing family or enhance their living conditions.

Each option carries distinct financial implications, and homeowners should carefully evaluate their needs and current financial situation to make the best-informed decision possible.

Considerations for Moving House

Before deciding to move house after equity release, homeowners must take several factors into account.

Key considerations include the current property market, potential early repayment charges, and whether the new property is suitable for equity release.

It's imperative to consult with the equity release provider to ensure the new home meets their lending criteria.

Homeowners should also evaluate the costs associated with moving, such as solicitors' fees, valuation fees, and stamp duty, to facilitate a smooth transition while avoiding financial strain.

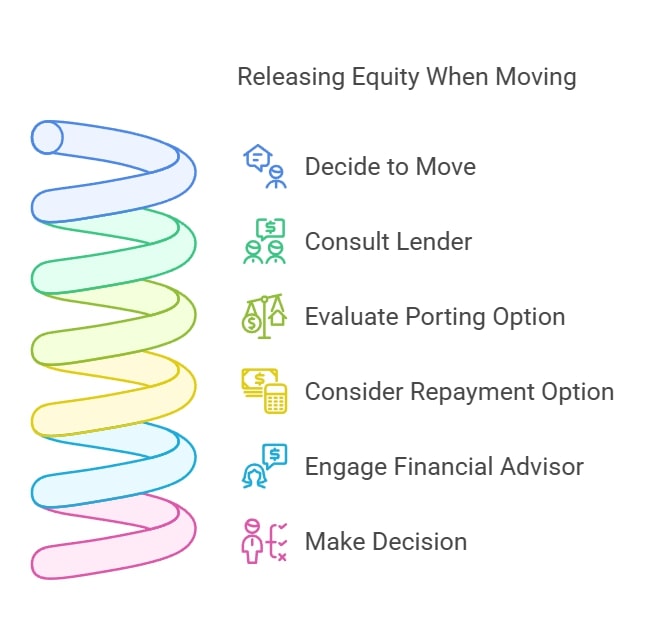

How to Release Equity When Moving

To successfully release equity when moving, homeowners have the option to either port their existing equity release plan to the new property or repay the current loan and take out a new one.

Porting enables homeowners to retain the same loan terms, while repaying the loan may incur early repayment charges.

The new property must align with the lender's criteria for equity release, making it essential for homeowners to consult with their provider to understand the implications of each option.

Engaging a financial advisor can offer valuable insights and help navigate this complex process efficiently.

Common Questions

1. What is equity release?

2. Can I sell my home after taking out equity release?

3. Will I still own my home if I release equity?

4. How much equity can I release from my home?

5. What are the risks of selling my home with equity release?

Conclusion

Selling a house with equity release can provide homeowners with a viable solution to access much-needed funds, especially for retirement or other significant expenses.

While it offers flexibility, it’s essential to understand the long-term effects, including the potential reduction in inheritance for heirs.

Consulting with financial and legal professionals is crucial to ensure the decision aligns with your financial goals and needs.

By taking a thoughtful approach, homeowners can make informed choices that benefit both their current situation and future plans.

WAIT! Before You Go...