DON'T MISS OUT! Try Our FREE Calculator Now

Quick Summary

- Drawdown lifetime mortgages offer flexible access to home equity, allowing withdrawals as needed and accruing interest only on amounts drawn, enhancing financial control.

- Benefits include aligning cash flow with spending needs, reducing total interest costs, and preserving home equity, making it suitable for managing retirement finances with flexibility.

- Managing this mortgage type involves careful planning of withdrawals to minimise unnecessary interest accrual and safeguard home equity, considering long-term financial strategies and potential impacts on means-tested benefits.

Imagine having the freedom to access your home’s value only when you need it, avoiding unnecessary debt while enjoying financial flexibility in retirement. A drawdown lifetime mortgage offers precisely that.

In this article, the FunWeb team will uncover why the flexibility a drawdown lifetime mortgage offers is crucial for retirees, the key features that make it unique, how it can supplement your income, and help achieve your lifestyle goals.

We’ll also explore the potential drawbacks, associated costs, and inheritance implications while comparing it to other options like lump-sum mortgages and downsizing.

With expert insights and guidance, you’ll be equipped to decide if this is the right solution for your retirement plan.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

What Is a Drawdown Lifetime Mortgage?

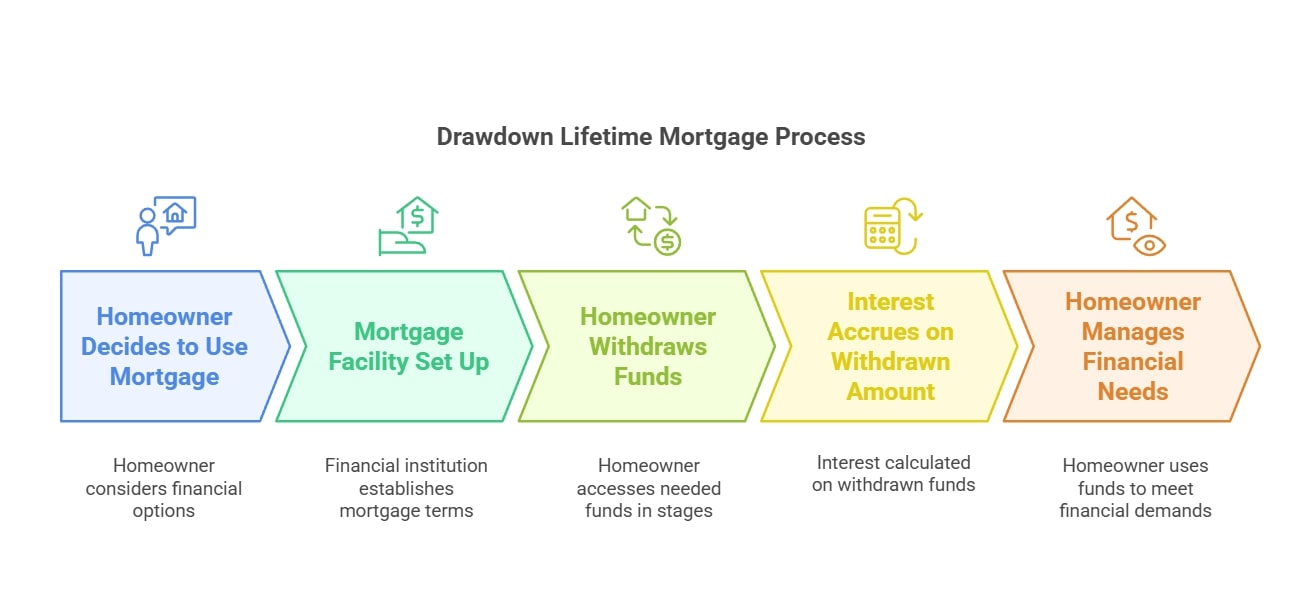

A drawdown lifetime mortgage is a flexible financial product that allows homeowners to access funds in smaller instalments rather than a lump sum, reducing interest costs over time.

Let’s take a closer look:

What Is a Drawdown Lifetime Mortgage and How Does It Work?

A drawdown lifetime mortgage allows you to release equity from your home in stages as needed, rather than receiving a single large sum.

This type of mortgage provides a facility from which you can draw funds over time, which means you only accrue interest on the money you actually withdraw.

This can significantly reduce the amount of interest accumulated over the life of the loan compared to a lump-sum lifetime mortgage.

Why Is Flexibility Important in Retirement?

Flexibility is crucial in retirement planning because it allows you to adapt to changing financial needs and circumstances without committing to a fixed borrowing pattern.

With a drawdown lifetime mortgage, you can manage your cash flow more efficiently, access funds when required for unexpected expenses, or supplement income at times of need, thereby providing a safety net that adjusts to your life’s rhythm and demands.

How Does a Drawdown Lifetime Mortgage Offer Flexibility?

A drawdown lifetime mortgage offers flexibility by enabling homeowners to withdraw funds as needed, avoiding unnecessary borrowing and minimising interest accrual.

Here’s how it all works:

What Are the Key Features of a Drawdown Lifetime Mortgage?

The key features of a drawdown lifetime mortgage include the ability to access your home equity in smaller amounts as needed, which helps minimise the interest that accumulates since interest is charged only on the amount withdrawn.

Another feature is the flexibility to make withdrawals at various times, which can align better with fluctuating financial needs, such as paying for home repairs, covering healthcare costs, or supplementing retirement income.

Who Can Benefit Most from a Drawdown Lifetime Mortgage?

A drawdown lifetime mortgage is particularly beneficial for retirees who require ongoing access to funds to manage their cash flow effectively over the years.

It suits those who may not need a large cash lump sum at once but anticipate future expenses that will arise periodically.

This flexibility makes it ideal for individuals with progressive needs or those who want to manage their loan interest pragmatically by drawing funds only as required.

What Are the Benefits of a Drawdown Lifetime Mortgage?

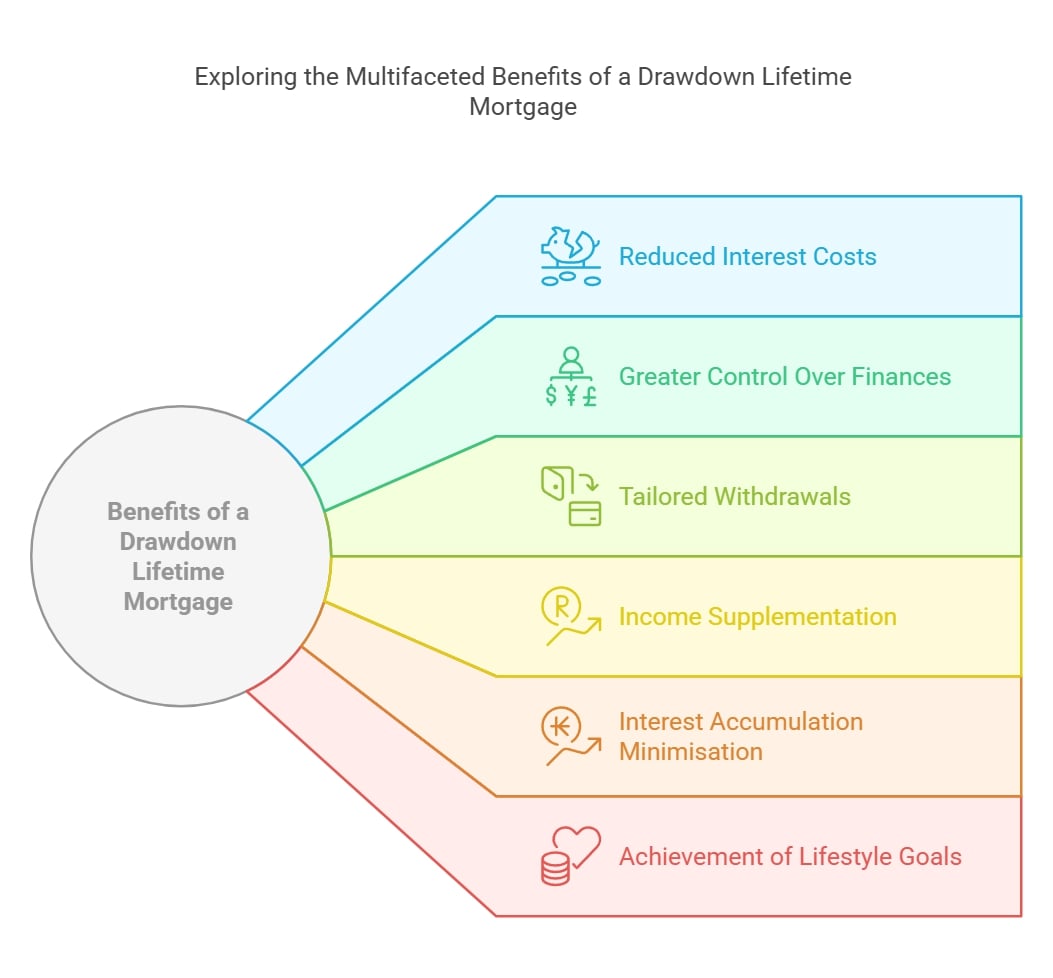

The benefits of a drawdown lifetime mortgage are reduced interest costs, greater control over finances, and the ability to tailor withdrawals to personal needs.

Take a peek at the benefits:

How Can a Drawdown Lifetime Mortgage Supplement Your Income?

A drawdown lifetime mortgage can effectively supplement your income by providing regular, flexible withdrawals from your home equity.

This setup allows you to maintain a consistent cash flow to cover daily expenses, unexpected costs, or leisure activities, making it a strategic tool to ensure financial stability throughout retirement without the need for a full upfront lump sum.

Can It Help Avoid Interest Accumulation?

Yes, one of the significant benefits of a drawdown lifetime mortgage is its ability to minimise interest accumulation.

Unlike traditional lump-sum equity releases, where interest compounds on the total amount from the start, the drawdown option allows interest to accrue only on the amount you actually withdraw.

This means if you access your equity gradually, the overall interest charged over time can be significantly reduced.

What Lifestyle Goals Can You Achieve with This Mortgage?

With a drawdown lifetime mortgage, you can achieve various lifestyle goals that require financial input over time, such as funding ongoing home renovations, covering travel expenses, or even supporting hobbies and leisure activities.

This mortgage type offers the flexibility to fund a comfortable and fulfilling retirement lifestyle, allowing retirees to enjoy their later years without financial strain.

What Are the Potential Drawbacks and Considerations of a Drawdown Lifetime Mortgage?

The potential drawbacks of a drawdown lifetime mortgage include reduced inheritance, possible changes to interest rates, and the impact on means-tested benefits.

Consider these factors to look out for:

What Costs Are Associated with a Drawdown Lifetime Mortgage?

The costs associated with a drawdown lifetime mortgage can include arrangement fees, ongoing interest rates, and potential legal and valuation fees.

While these costs are similar to those of standard lifetime mortgages, the flexibility of drawdown options may incur additional management fees for each withdrawal, which could increase the overall cost depending on how frequently you access the funds.

Does It Impact Inheritance?

Yes, a drawdown lifetime mortgage can impact the inheritance you leave behind; because the amount you owe grows over time due to compounded interest on the money drawn, the remaining equity in your home—which forms part of your estate—could be significantly reduced, thus leaving less for your heirs.

Are There Any Risks to Be Aware Of?

Key risks of a drawdown lifetime mortgage include the potential for the loan amount to grow larger than the value of the home, particularly if the property's value decreases or if interest rates rise unexpectedly.

This could result in negative equity, though many plans come with a 'no negative equity guarantee.' It's also important to consider how withdrawing equity from your home affects your eligibility for means-tested benefits.

How Does a Drawdown Lifetime Mortgage Compare to Other Retirement Financing Options?

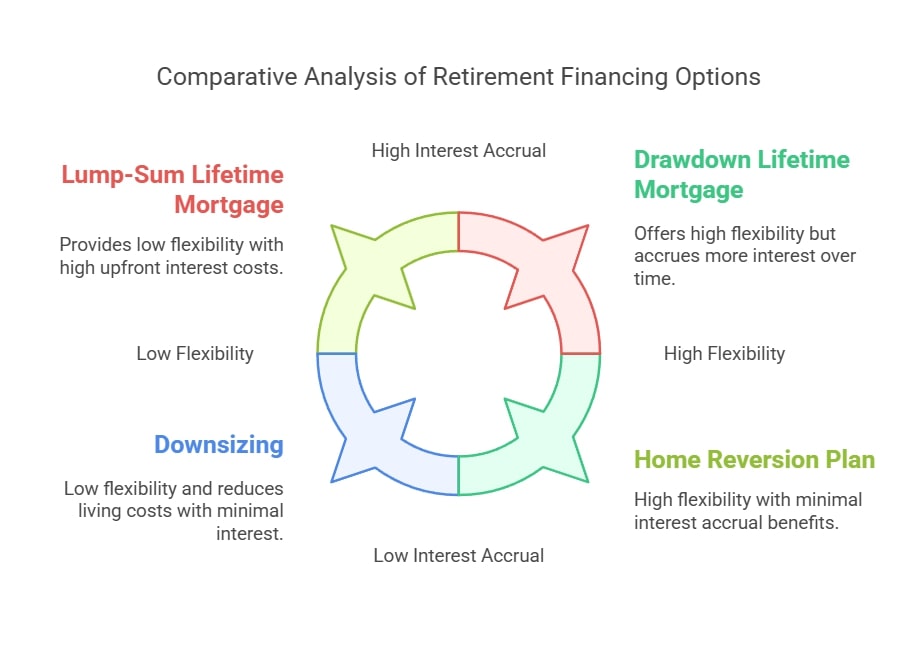

A drawdown lifetime mortgage compares favourably to other options by providing flexibility and reducing interest accrual, unlike lump-sum lifetime mortgages or annuities.

Let’s compare your options:

How Does It Differ from Lump-Sum Lifetime Mortgages?

A drawdown lifetime mortgage differs from a lump-sum option primarily in its flexibility; with a drawdown, you can access the equity in your home gradually, withdrawing amounts as needed, which can result in lower overall interest costs compared to receiving and being charged interest on a lump sum upfront.

This setup allows better cash flow management, particularly useful if you do not need a large cash amount immediately.

Is a Drawdown Lifetime Mortgage Better Than Downsizing?

Whether a drawdown lifetime mortgage is better than downsizing depends on personal circumstances.

For those keen to stay in their family home, drawdown options provide financial support without moving; however, downsizing can often result in freeing up more equity and potentially reducing living costs, with no debt or interest accumulation to consider.

What Are the Alternatives to Consider?

Alternatives to a drawdown lifetime mortgage include home reversion plans, where part of your home is sold for a tax-free lump sum or regular payments, and retirement interest-only mortgages, which require regular interest payments without touching the principal.

Each option comes with distinct advantages and considerations, depending on your financial goals and personal preferences.

Expert Insights and Guidance on a Drawdown Lifetime Mortgage

Expert insights on a drawdown lifetime mortgage highlight its suitability for managing retirement finances efficiently, tailored to individual needs.

See what professionals have to say:

What Do Financial Advisers Say About Drawdown Lifetime Mortgages?

Financial advisers often highlight the versatility of drawdown lifetime mortgages in retirement planning, pointing out that these mortgages allow borrowers to tailor their cash flow to their needs, reducing interest costs over time compared to lump-sum alternatives.

Advisers might recommend them, especially for retirees who expect varying expenses over the years and appreciate the ability to manage the loan balance actively.

How Can Legal Guidance Help?

Legal guidance is crucial when considering a drawdown lifetime mortgage, as it can help clarify the terms and conditions of the mortgage agreement, ensuring you fully understand your obligations and rights.

They can also assist in spotting any clauses that might affect your estate planning or financial stability, thus protecting your interests and ensuring the mortgage aligns with your overall retirement strategy.

Steps to Apply for a Drawdown Lifetime Mortgage

The steps to apply for a drawdown lifetime mortgage involve consulting an adviser, assessing eligibility, submitting documentation, and finalising a plan with tailored withdrawal options.

Keep these tidbits in mind during the application process:

What Do You Need to Know Before Applying?

Before applying for a drawdown lifetime mortgage, it's essential to understand your financial needs and the potential long-term impacts on your estate.

You should evaluate your current and future financial needs, consider how much you might need to draw down over time, and assess how this will affect your total interest costs.

It's also important to consider your health, age, and property value, as these factors can significantly influence the terms and viability of the mortgage.

What Is the Application Process Like?

The application process for a drawdown lifetime mortgage typically involves several key steps. Initially, you'll need to consult with a financial adviser to ensure this product suits your financial goals.

Following this, you'll undergo a property valuation to determine how much you can borrow.

Afterwards, you will review and choose the most suitable offer, complete the necessary paperwork, and finally, receive legal advice to understand all the implications fully.

The funds are then released to you, which you can draw upon as needed within the agreed limit.

Common Questions

How Often Can Adjustments Be Made to the Withdrawal Amounts in a Drawdown Lifetime Mortgage Plan?

What Strategies Can Be Employed to Minimise the Impact of a Drawdown Lifetime Mortgage on Inheritance?

How Does the Interest Rate on a Drawdown Lifetime Mortgage Compare to Other Types of Credit or Loans Available to Seniors?

What Are the Implications of Repaying a Drawdown Lifetime Mortgage Early, and Are There Penalties Involved?

Can Changes in Housing Market Values Affect the Terms or Viability of a Drawdown Lifetime Mortgage?Yes, significant shifts in property values can influence the equity available for further withdrawals and potentially alter the terms of the agreement, particularly if the property value decreases below the debt level.

How Can Retirees Ensure They Are Choosing the Most Suitable Drawdown Lifetime Mortgage Product Among Various Options Available?

What Resources Are Available to Help Understand the Long-Term Financial Projections Associated with Taking Out a Drawdown Lifetime Mortgage?

In Conclusion

The drawdown lifetime mortgage emerges as a strategic choice for those seeking a flexible approach to retirement finance, and by allowing tailored access to home equity, it addresses the need for manageable cash flow while preserving estate value for future generations.

This option not only offers immediate financial relief but also aligns seamlessly with long-term retirement plans, making it a prudent choice for those looking to maintain their lifestyle without sacrificing their home.

Always remember that engaging with financial and legal advisers is essential to fully integrate this tool into your broader financial landscape, ensuring it enhances your retirement effectively.

WAIT! Before You Go...