DON'T MISS OUT! Try Our FREE Calculator Now

- Lifetime mortgages give you tax-free cash or extra income while you keep living in your home, but watch that growing interest, as it can nibble away at your estate value.

- Fancy a move to a new house? That's alright, so long as your new home fits the lender's bill and you settle any loan difference.

- Thinking of alternatives? Look into downsizing, tapping into savings, drawing from pensions, or eyeing home reversion schemes.

Unravelling 'What's a Lifetime Mortgage?' reveals the complexities of home finance, crucial for those exploring later-life lending options.

At the close of 2023, there was a notable shift in the financial landscape, with equity release interest rates falling below 6% in December. This, alongside lenders raising loan-to-value ratios, enhances borrowing potential, offering a unique opportunity for those considering lifetime mortgages in a rapidly evolving financial landscape.1

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Our commitment at BankingTimes goes beyond just presenting numbers; we aim to offer a clear, comprehensive understanding of this financial landscape. Whether you're considering a lifetime mortgage for the first time or looking to better understand your existing plan, our guide equips you with all the essential information to make informed decisions.

What is a Lifetime Mortgage?

A lifetime mortgage is a type of equity release scheme available to older homeowners. It allows you to unlock the value of your property while retaining ownership.

Unlike traditional mortgages, there's typically no requirement to make monthly repayments. Instead, the loan, along with the accrued interest, is repaid when you pass away or move into long-term care.

This option is increasingly popular among retirees looking to supplement their income, fund home improvements, or manage existing debts.

Read More: What are Equity Release Schemes?

How Do Lifetime Mortgages Actually Work?

Lifetime mortgages involve borrowing a portion of your home's value. The amount you can borrow largely depends on your age and the property's value.

Interest is charged on the loan, which compounds over time, meaning the amount you owe can grow quickly.

However, a 'no negative equity guarantee' ensures you'll never owe more than the value of your home.

Typically, the loan along with its accrued interest is settled through the sale of your property, either upon your passing or when you transition into a permanent care facility.

Why Consider a Lifetime Mortgage?

For many retirees, these mortgages offer a way to access the wealth tied up in their homes without the need to downsize.

It can provide a lump sum or smaller instalments to help cover living expenses, home renovations, or even provide financial assistance to family members.

It's a flexible solution that can be tailored to individual financial needs and circumstances.

Who is Eligible for a Lifetime Mortgage?

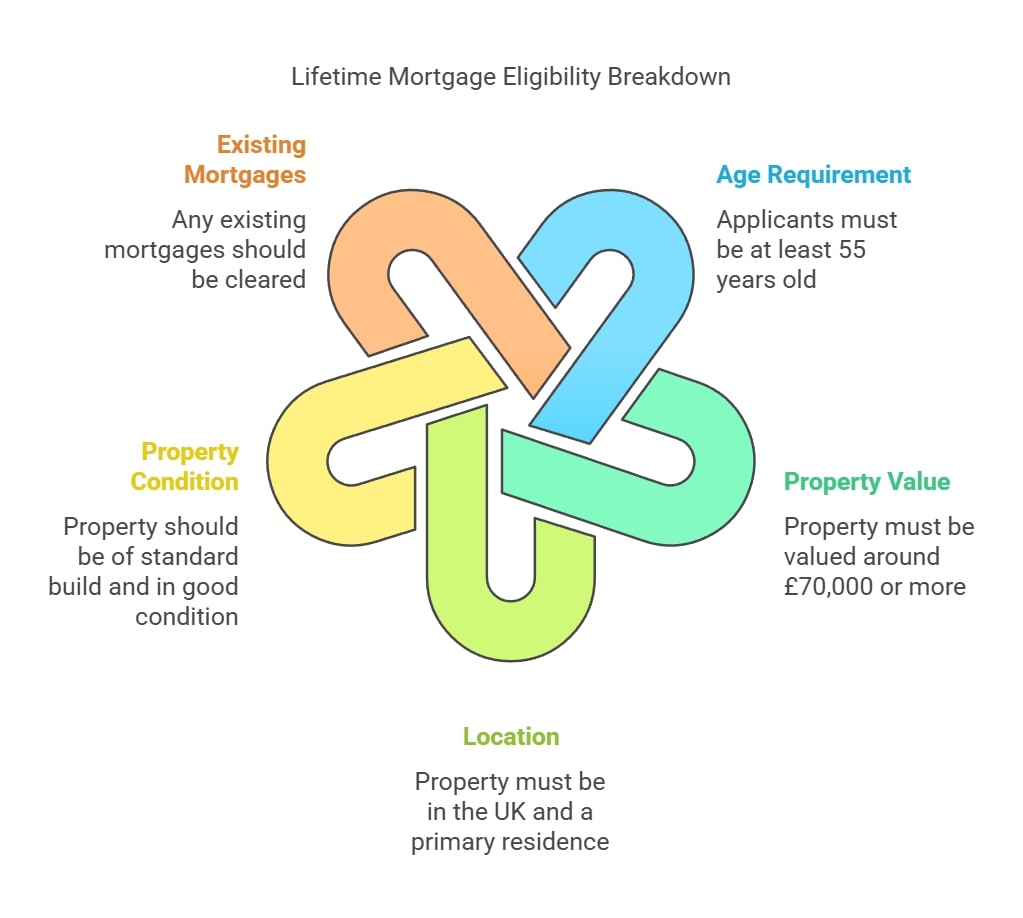

To be eligible for these loans you must meet specific age and property criteria.

The key eligibility requirements dictate that:

- Applicants must be at least 55 years old. This age requirement applies to both partners in joint plans.

- Your property should generally have a minimum value, often around £70,000 or more. This amount may vary between lenders and plans.

- The property must be in the UK and serve as your primary residence. Additionally, you should be a permanent UK resident.

- The property should be of a standard build and should also be in good condition. Some lenders may request repairs before proceeding with equity release.

- If there's an existing mortgage or loan secured against the property, it typically needs to be cleared, either prior to or as part of the equity release process.

These criteria ensure that the equity release product is suitable for your circumstances and that the property offers sufficient security for the loan.

Exploring the Different Types of Lifetime Mortgages

There are several types of lifetime mortgages, each catering to different needs:

- Lump-Sum Lifetime Mortgages: Provide a single, substantial cash amount, typically accompanied by a fixed interest rate.

- Drawdown Lifetime Mortgages: Offer a flexible facility allowing you to withdraw funds as needed, which helps in reducing the accumulation of interest.

- Interest-Payment Lifetime Mortgages: Allow the option to pay some or all of the interest every month, thereby reducing the total debt over time.

- Enhanced Lifetime Mortgages: Specifically designed for homeowners with certain health conditions or lifestyle factors. This plan enables borrowing a larger amount than standard lifetime mortgages, often at a more favourable interest rate.

- Buy-to-Let Lifetime Mortgages: Tailored for landlords aged 55 and over, this option allows the release of equity from rental properties, while still enabling the landlord to earn rental income.

What Are the Pros and Cons of These Mortgages?

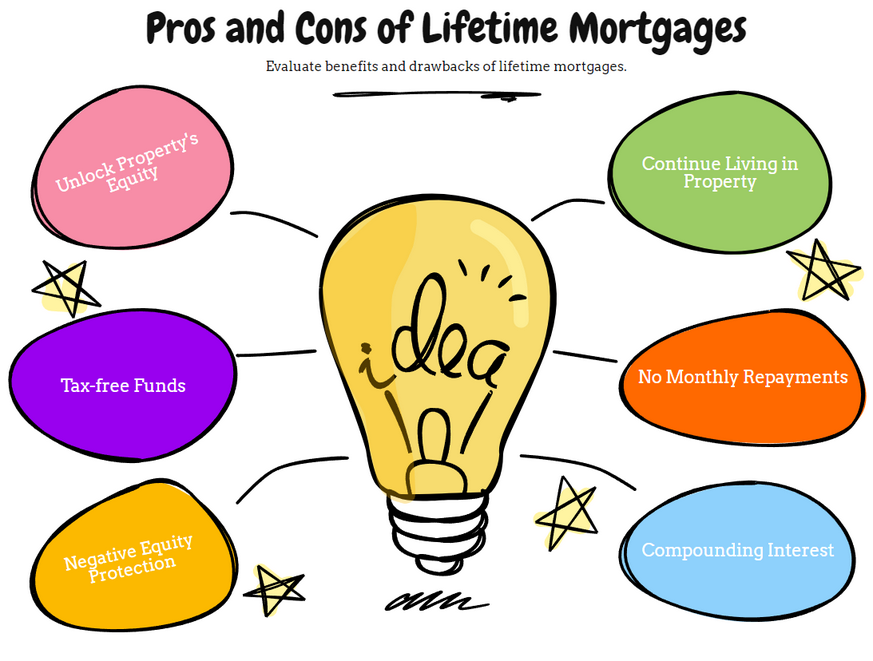

When considering a lifetime mortgage, it's essential to weigh its benefits and drawbacks. This financial strategy allows you to leverage your property's equity, but it also means not fully utilising the entire value of your property.

Let’s take a closer look at the various aspects.

Advantages:

- You can unlock your property's equity, receiving it as either a lump sum or regular withdrawals.

- You have the option to continue living in your property.

- The funds released are tax-free and can be used for various purposes.

- No monthly repayments are required; the loan is repaid after your death or when you move into care.

- A variety of lifetime mortgage plans are available to suit your needs.

- These plans include protection against negative equity.

Disadvantages:

- The interest on your loan compounds over time, increasing the total debt.

- Repaying the loan and interest from your property's sale can reduce the inheritance you leave behind.

- Receiving additional income may affect your eligibility for certain means-tested benefits.

- Early repayment of your loan may incur charges.

- The amount you can borrow is typically limited by your property's value and your age.

- You are responsible for maintaining your property in good condition.

Can These Plans Affect Your Inheritance?

Yes, these equity release plans can reduce the amount you're able to leave as an inheritance. The loan and accrued interest are repaid from your estate, potentially leaving less for your beneficiaries.

However, some plans offer an inheritance protection option to safeguard a portion of your property's value for your heirs.

How Should You Plan Financially When Considering a Lifetime Mortgage?

It's crucial to consider your long-term financial needs and how a lifetime mortgage fits into your overall retirement plan.

Think about potential changes in property values, the impact on your estate, and how it affects your eligibility for means-tested benefits.

Seeking advice from a financial advisor is essential to ensure this decision aligns with your financial goals.

Understanding the Financial Implications of Lifetime Mortgages

The key financial implication of a lifetime mortgage is the compound interest, which can significantly increase the amount you owe over time. It's important to understand the interest rate and how it will accumulate.

Additionally, consider the potential impact on your tax situation and eligibility for state benefits.

What Are the Alternatives to Lifetime Mortgages?

If a lifetime mortgage doesn't seem right for you, there are several alternatives available, each with its own set of benefits and considerations.

These alternatives include:

- Downsizing: Selling your current home and moving to a smaller, less expensive property. This can free up equity without the need for a loan.

- Home Reversion Plans: These involve selling a part or all of your home to a home reversion provider in exchange for a lump sum or regular payments while retaining the right to live in the property rent-free.

- Unsecured Personal Loans or Credit Lines: If you have a good credit rating and a stable income, you might consider unsecured loans or credit lines. However, these typically require monthly repayments and are generally for smaller amounts.

- Retirement Interest-Only Mortgages: A type of mortgage where you only pay the interest each month and the principal is repaid when your home is sold, you move into long-term care, or pass away.

- Savings and Investments: Using your savings or liquidating investments can be an alternative, though this might impact your long-term financial security.

- Government Grants and Benefits: Exploring available government assistance programs for home repairs or modifications can be a viable option, especially for those with limited income.

- Renting Out a Room: If you have spare space, renting out a room in your home can generate additional income.

- Equity Release from a Second Property: If you own more than one property, you might consider releasing equity from a second home or a buy-to-let property.

Each of these alternatives has its own implications for your financial situation, tax obligations, and estate planning, and should be considered carefully, ideally with the advice of a financial advisor.

Read More: Is Releasing Equity a Good Idea?

How to Secure a Lifetime Mortgage: A Step-by-Step Guide

Securing a plan involves several steps, each important in ensuring you find the right solution for your financial needs.

Here's a step-by-step guide to help you through the process:

- Consultation: Begin by consulting with a financial advisor. They can provide valuable insights into whether a lifetime mortgage is suitable for you, considering your financial situation and future plans.

- Choose a Plan: Based on your advisor's recommendations, select the type of lifetime mortgage that aligns with your needs. There are various plans available, each with its own features and benefits.

- Application: Once you've chosen a suitable plan, proceed with the application process. This involves providing your chosen lender with the necessary details about your financial status and property.

- Valuation: The lender will arrange for a professional valuation of your property. This step is crucial as it determines the maximum amount you can borrow and ensures your property meets the lender's criteria.

- Offer: After the valuation, if your application is approved, the lender will present you with a mortgage offer. Review this offer carefully, ideally with your financial advisor, to ensure it meets your expectations and requirements.

- Legal Advice: Seek independent legal advice. A solicitor can help you understand the legal aspects of the mortgage and ensure that all necessary legal checks are conducted.

- Completion: If you decide to proceed, accept the offer and complete the necessary paperwork. The process will be finalised by your solicitor, and the funds will be released to you.

Each step in this process is designed to ensure that you are fully informed and comfortable with your decision to take out a lifetime mortgage. Remember, this is a long-term financial commitment and should be considered as part of your overall retirement planning.

What Regulations Govern Lifetime Mortgages?

Lifetime mortgages in the UK are regulated by the Financial Conduct Authority (FCA).2 This ensures that lenders adhere to strict standards, offering products that are fair and suitable for consumers.

The FCA regulation also means that you must receive advice from a qualified financial advisor before taking out a lifetime mortgage.

Furthermore

The Equity Release Council (ERC)3 upholds standards for its members, including guaranteeing customers the right to stay in their property for life and mandating thorough explanations of products along with qualified financial advice.

Such regulations play a crucial role in safeguarding the integrity and practicality of lifetime mortgages for homeowners.

Common Questions

What Are the Advantages and Disadvantages of Lifetime Mortgages?

How Do Lifetime Mortgages Work in the UK?

Can You Move House With a Lifetime Mortgage?

What Are the Alternatives to Lifetime Mortgages?

Are Lifetime Mortgages a Safe Option for Retirement Funding?

Can a Lifetime Mortgage Be Transferred to Another Property?

What Happens if the Loan Amount Exceeds the Property Value?

Are There Any Early Repayment Charges?

Can I Still Leave an Inheritance With a Lifetime Mortgage?

How Does a Lifetime Mortgage Affect State Benefits?

Conclusion

Deciding on a lifetime mortgage is a significant financial decision that requires careful consideration. It offers a way to access the equity in your home, providing financial flexibility in retirement.

However, it's important to understand the long-term implications, including the impact on your estate and inheritance.

Consulting with a financial advisor and carefully evaluating all your options is crucial to not only understanding what a lifetime mortgage is but also ensuring it aligns seamlessly with your financial goals and personal needs.

WAIT! Before You Go...