DON'T MISS OUT! Try Our FREE Calculator Now

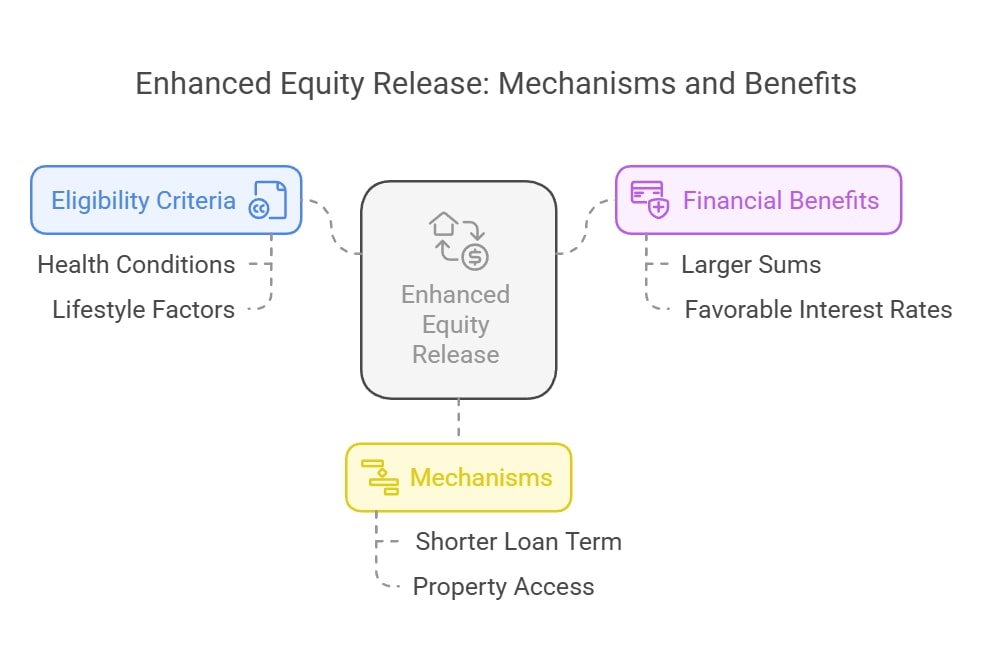

- Enhanced equity release plans offer more favourable terms, like higher loan amounts or lower interest rates, based on health and lifestyle factors.

- This option is suitable for homeowners with conditions or lifestyles that could shorten life expectancy, allowing them to access larger sums of their home's equity.

- Consultation with a specialist adviser is essential to assess eligibility and understand the potential benefits and terms based on your specific health and lifestyle.

Not all equity release plans are created equal—did you know that certain health and lifestyle factors could allow you to unlock more funds from your home? An enhanced equity release plan offers this unique advantage, tailoring options to maximise your financial benefits.

In this article, we’ll explore what makes an enhanced equity release plan different from standard ones, how these plans calculate higher payouts, the application steps, and the documents you’ll need.

Discover the benefits, including increased funds and improved retirement quality, and weigh the potential drawbacks, such as inheritance risks and associated costs.

With expert insights and a comparison to other equity release options, the FundWeb team will help you decide if this plan is the perfect fit for your needs.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

What Is an Enhanced Equity Release Plan & How Does It Work?

An enhanced equity release plan offers tailored financial solutions based on health and lifestyle factors, and it works by allowing eligible homeowners to access more funds compared to standard plans.

Let’s take a closer look:

What Is Enhanced Equity Release and How Does It Work?

Enhanced equity release, often termed an 'enhanced lifetime mortgage', allows homeowners with certain health conditions or lifestyles to access more significant amounts of money from their properties than standard equity release plans.

This type of plan considers your health and life expectancy, offering potentially larger sums or more favourable interest rates based on the assumption of a shorter loan term.

Why Should You Consider an Enhanced Plan Over a Standard Option?

If you have a shorter life expectancy due to health conditions, an enhanced plan could be financially advantageous as it often provides a higher lump sum, which can be crucial for covering medical costs, living expenses, or fulfilling other immediate financial needs.

This option can be more cost-effective compared to standard equity release plans, particularly if you require significant funds urgently.

What Are the Eligibility Criteria for Enhanced Equity Release?

Eligibility for an enhanced equity release typically hinges on health-related factors such as chronic illnesses, lifestyle choices like smoking, or a combination of health conditions that might reduce your life expectancy.

Providers will require a detailed medical questionnaire or access to medical records to assess eligibility.

How Does the Process Differ for Enhanced Plans?

The application process for an enhanced equity release plan involves additional steps compared to standard plans, particularly in the assessment of your health.

This might include more detailed health questionnaires or interviews.

Providers might also consult with your doctors to verify your medical condition, ensuring the plan offered matches your health profile.

How Is the Released Amount Calculated?

The amount you can release through an enhanced plan is calculated based on your age, the value of your property, and your health condition.

Providers use actuarial data to estimate your life expectancy, adjusting the maximum loan amount accordingly.

Generally, poorer health could mean a higher release amount, reflecting the potentially shorter loan period.

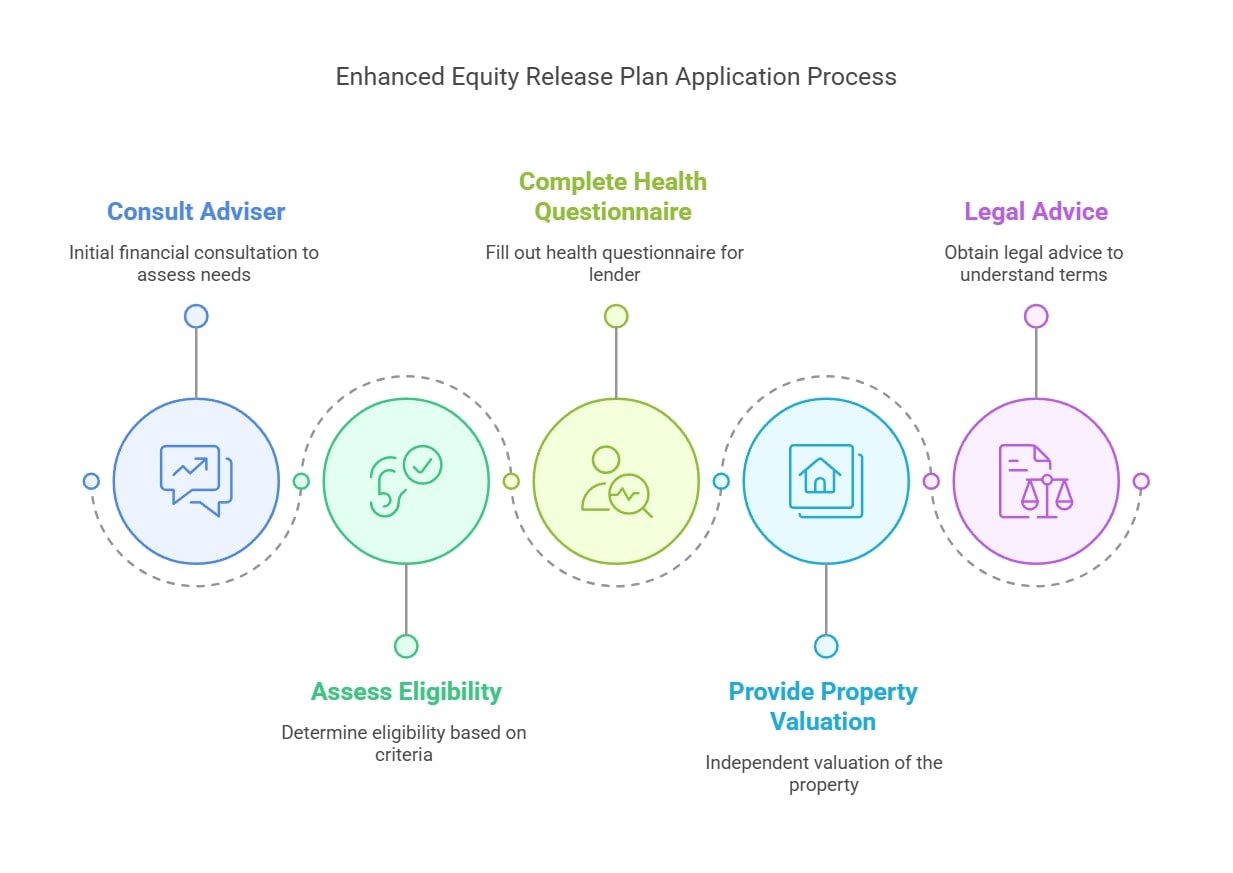

Steps to Apply for an Enhanced Equity Release Plan

The steps to apply for an enhanced equity release plan include consulting an adviser, assessing eligibility, completing documentation, and undergoing approval tailored to personal circumstances.

Here’s what you need:

What Documents and Information Are Needed?

To apply for an enhanced equity release plan, you'll need to provide comprehensive personal information including proof of age, residence, property ownership documents, and detailed medical records.

The medical information is crucial as it affects the amount you can release.

Lenders may also require details about any outstanding mortgage or loans secured against the property.

What Is the Application Process Like?

The application process for an enhanced equity release plan involves several key steps; initially, you'll undergo a financial consultation to assess your needs and circumstances.

Following this, you'll complete a detailed health questionnaire, which your lender will use along with an independent property valuation to determine the amount you can borrow.

Finally, legal advice is mandatory to ensure you understand the terms and to complete the transaction, ensuring all legal protections are in place.

Who Can Benefit from an Enhanced Equity Release Plan?

Those who can benefit from an enhanced equity release plan are homeowners with specific health conditions or lifestyle factors that increase their equity access.

Check out why this plan could be the best choice:

Is Enhanced Equity Release Right for You?

Enhanced equity release may be right for you if you're looking to maximise the money you can draw from your home due to health concerns; it's especially suitable for homeowners with serious or chronic health issues, as it offers larger sums than standard plans and a potentially shorter loan period.

Assessing your health, financial needs, and long-term care plans with a financial advisor can help determine if this option aligns with your retirement goals.

What Health Factors Qualify You for Enhanced Plans?

Health factors that could qualify you for an enhanced equity release plan include chronic illnesses such as heart disease, cancer, or diabetes, and lifestyle factors like smoking.

Providers take into account the severity and impact of your condition on life expectancy, which can significantly increase the amount you are eligible to release from your home.

An assessment by an independent physician might be required to establish your eligibility based on your health status.

What Are the Benefits of an Enhanced Equity Release Plan?

The benefits of an enhanced equity release plan are higher payouts, greater flexibility, and tailored financial solutions for eligible individuals.

Here’s what an enhanced equity release plan offers:

Can You Access More Funds with an Enhanced Plan?

Yes, you can access more funds with an enhanced equity release plan compared to standard options, as these plans are tailored for individuals with shorter life expectancies due to health conditions, allowing them to unlock a greater percentage of their home's value.

This can provide significant financial relief, especially if facing costly medical treatments or needing to modify your home for accessibility.

How Can Enhanced Equity Release Improve Retirement Quality?

Enhanced equity release can significantly improve the quality of your retirement by providing additional funds to manage health care costs, maintain your lifestyle, or fulfil bucket list dreams.

The extra money can also be used to cover in-home care services, thus enabling you to stay in your familiar environment longer and more comfortably.

Is an Enhanced Equity Release Plan Better Alternative to Downsizing?

For many, enhanced equity release might be a better alternative to downsizing, seeing as it allows you to stay in your home and maintain your lifestyle without the disruption of moving.

This can be particularly valuable for those who place a high emotional value on their home or who find the physical process of moving too daunting a task due to health issues.

What Are the Potential Drawbacks and Considerations?

The potential drawbacks and considerations of an enhanced equity release plan include reduced inheritance, interest accumulation, and potential impacts on benefits.

These are some of the things to keep in mind:

What Costs Are Involved in Enhanced Equity Release Plans?

Enhanced equity release plans often involve various costs such as higher interest rates due to the increased amount of capital available, arrangement fees, legal fees, and potentially an advisor's fee.

These costs can accumulate over time, impacting the total amount repayable and reducing the equity left in your home.

What Are the Risks to Inheritance?

One significant risk of enhanced equity release is the reduction in the amount you can pass on as inheritance, and as these plans typically offer larger sums upfront, they can also accumulate interest quickly, significantly reducing the remaining equity in your home over time.

This means less wealth may be left to your heirs, which is a critical consideration for many when planning their estates.

Are There Restrictions on How You Use the Funds?

Generally, there are few restrictions on how you can use the funds from an enhanced equity release plan; however, lenders may have specific stipulations or recommend that the funds be used for purposes that improve your quality of life, such as home adaptations or healthcare needs, aligning the product's benefits with the borrower's health status and requirements.

How Does Enhanced Equity Release Compare to Other Plans?

Enhanced equity release compares favourably to other plans by offering higher payouts for those with qualifying health and lifestyle conditions, unlike standard options.

Compare here:

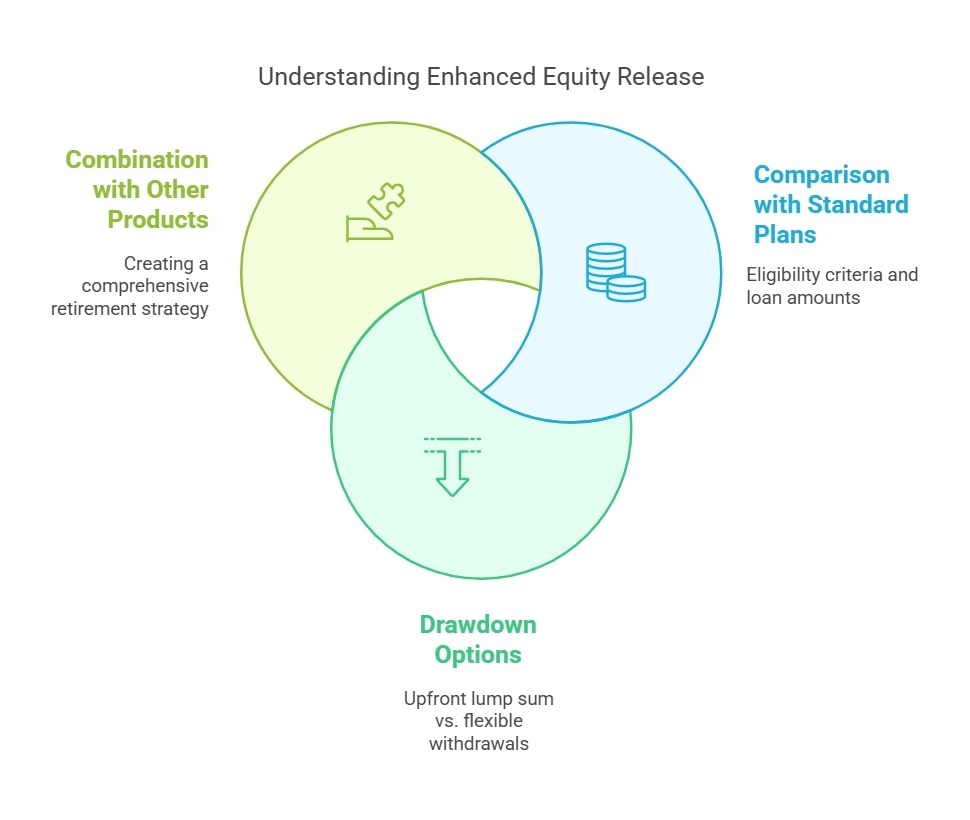

How Does Enhanced Equity Release Differ from Standard Plans?

Enhanced equity release plans differ primarily in their eligibility criteria and potential loan amounts.

These plans are designed for individuals with specific health conditions or lifestyle choices that may reduce their life expectancy.

Because of this, lenders might offer larger amounts or more favourable terms compared to standard plans, acknowledging the potentially shorter loan period.

Is Enhanced Equity Release Better Than Drawdown Options?

Whether enhanced equity release is better than drawdown options depends on your financial needs and personal circumstances.

Enhanced plans can provide a larger lump sum upfront, which might be beneficial for immediate, high-cost needs.

In contrast, drawdown plans allow you to take money as needed, which can reduce the overall interest accrued over time and provide more flexibility in managing funds.

Can Enhanced Equity Release Be Combined with Other Financial Products?

Yes, enhanced equity release can often be combined with other financial products to create a more comprehensive retirement strategy; for example, you might use a portion of the released funds to purchase an annuity for a consistent income stream or invest in long-term care insurance.

Combining products should be done with careful planning and advice to ensure it meets your overall financial goals and needs.

Expert Insights and Guidance on Enhanced Equity Release

Expert insights and guidance on enhanced equity release highlight its suitability for maximising equity access while addressing individual circumstances.

Here’s what professionals have to say:

What Do Financial Advisors Say About Enhanced Equity Release?

Financial advisors often highlight the potential benefits of enhanced equity release for those with shorter life expectancies due to health conditions.

They point out that qualifying for an enhanced plan can significantly increase the amount you can release from your home, potentially improving your quality of life during retirement.

However, advisors also stress the importance of considering how this could impact your overall estate and eligibility for means-tested benefits.

How Can Legal Advice Help Protect Your Interests?

Legal advice is crucial when considering an enhanced equity release to ensure that all agreements align with your personal and financial interests.

A solicitor can help you understand the fine print, and the implications on your estate, and ensure that the contract adheres to equity release regulations.

This step is vital for protecting your assets and ensuring that your rights are upheld throughout the process.

What Does the Future Hold for Equity Release Products?

The future of equity release products looks promising, with a trend towards more flexible and health-conscious options.

Industry experts predict innovations that could offer lower interest rates, improved terms for repayments, and plans that cater more specifically to a broader range of health conditions, enhancing accessibility and appeal for potential borrowers.

How Is the Financial Industry Adapting to Health-Based Plans?

The financial industry is increasingly recognising the importance of accommodating diverse health scenarios within retirement planning.

Many lenders are adapting by offering enhanced equity release plans that provide more substantial sums to those with significant health issues.

This adaptation helps individuals unlock greater value from their properties, tailored to their unique life circumstances, which is a shift towards more personalised financial solutions.

Myths and Misconceptions About Enhanced Equity Release

The myths and misconceptions about enhanced equity release often involve eligibility, payout potential, and misunderstandings about its benefits.

Learn the truth:

Is Enhanced Equity Release Only for People with Poor Health?

A common misconception is that enhanced equity release is exclusively for individuals with poor health—in reality, while health issues can qualify someone for potentially larger sums, 'enhanced' plans are designed to accommodate a range of medical conditions and are not solely for those with critical health problems.

This flexibility makes them a viable option for many looking to maximise their retirement funding.

Will Enhanced Equity Release Drain Your Estate?

Many worry that enhanced equity release will significantly deplete the value of their estate; while it's true that equity release reduces the amount you can pass on, enhanced plans often provide larger sums upfront, which might lead to higher interest accrual.

However, with careful planning and the right advice, it is possible to mitigate this impact, ensuring you can still leave behind a meaningful legacy for your beneficiaries.

Tools, Tips, and Resources for Enhanced Equity Release Applicants

The tools, tips, and resources for enhanced equity release applicants include online calculators, specialist advice, and informative guides to ensure informed decisions.

Enhanced Equity Release Calculator

Applicants considering enhanced equity release can utilise tools such as the enhanced equity release calculator to estimate the amount they might be eligible to release from their homes.

This calculator specifically adjusts for health and lifestyle factors, offering a tailored figure that could significantly impact financial planning.

Comparison Tables for Equity Release Options

Comparison tables are invaluable for those exploring enhanced equity release options, as they allow applicants to directly contrast various plans based on factors like interest rates, loan amounts, and special terms associated with health conditions.

These tables provide a clear overview, helping to identify which plans might offer the best terms based on individual circumstances.

How Can You Maximise the Value of Your Enhanced Plan?

Maximising the value of an enhanced equity release plan involves understanding the nuances of how your health can impact the terms offered.

It's wise to consult with multiple providers to explore the best rates and terms tailored to your situation; additionally, maintaining up-to-date knowledge on any changes in regulation or product offerings can ensure you are getting the most beneficial deal.

What Questions Should You Ask Your Provider?

When considering an enhanced equity release plan, it's critical to ask your provider about the specifics of how health impacts your eligibility and the amount you can release.

Inquire about the long-term implications, such as how the loan affects your estate and any early repayment charges.

Also, understand the circumstances under which the plan can be altered in the future, and any fees associated with these changes.

Common Questions

What Are the Key Differences in Interest Rates Between Enhanced and Standard Equity Release Plans?

How Can You Prepare Financially and Legally Before Applying for an Enhanced Equity Release Plan?

What Specific Health Conditions Typically Qualify Applicants for Enhanced Equity Release Plans?

How Should Families Be Involved in the Decision to Pursue an Enhanced Equity Release Plan?

What Are the Common Misunderstandings About the Costs Involved in Enhanced Equity Release Plans?

How Can Enhanced Equity Release Funds Be Used to Support Long-Term Care Needs?

What Should You Look for in the Fine Print of Enhanced Equity Release Agreements?

How Can Enhanced Equity Release Impact Financial Planning for Spouses or Partners?

In Conclusion

The drawdown lifetime mortgage stands as a tailored solution for those looking to enhance their retirement strategy, and by offering access to funds with flexibility tailored to personal health and financial situations, it provides a viable alternative to downsizing.

Navigating this option, though, requires careful consideration of its impact on estate values and potential costs, emphasising the importance of informed decision-making and the active presence of financial advisers and legal experts.

Ultimately, adopting an enhanced drawdown lifetime mortgage should be a strategic move, aligned with a comprehensive retirement plan that secures financial comfort and stability for the years ahead

WAIT! Before You Go...