DON'T MISS OUT! Try Our FREE Calculator Now

Quick Summary

- Punch in your age and home's value into an equity release calculator to see how much cash you could free up, but expect a ballpark figure on what you might unlock from your home's value.

- Find these calculators online across various provider sites for an easy, speedy peek at potential funds.

- Remember, it's a rough guess—actual cash could shift with your health and lifestyle specificities.

Did you know that the equity release calculator played an essential role in unlocking nearly £700 million1 of housing wealth in the first quarter of this year?

This tool has become indispensable for homeowners aiming to harness their property's equity.

Will it help you, too? Let us find out.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Through this comprehensive guide, we aim to break down the workings of these calculators, its benefits and limitations, and the necessary personal information required.

As a trusted authority in the UK finance landscape, we aim to empower you with the knowledge to make the best decisions about releasing equity from your property.

What Is Releasing Equity?

Equity release is a mechanism that allows older homeowners to benefit from the value of their property without the need to move out or downsize; it's simply a process of releasing equity.

Basics of Equity Release

Equity release is a financial option available to homeowners, typically over the age of 55, allowing them to access the wealth tied up in their home without the need to move.

This can be done either through a lump sum or via smaller, regular payments, and the amount accessed is repaid from the property's value, typically when the homeowner passes away or moves into long-term care.

Equity release is a significant decision that should be considered carefully, often involving consultation with a financial advisor to ensure it fits the homeowner's financial plans and life situation.

Learn More: Equity Release Scheme Reviews

Types of Equity Release Plans

The two primary types of equity release plans are lifetime mortgages and home reversion plans, each affecting how much can be released from your property, distinct features, and impacts on estate value; choosing between them depends on personal circumstances and financial goals.

A lifetime mortgage is the most popular form, where you borrow money against the value of your home, retaining ownership of the property, and the loan along with the accumulated interest is repaid when your home is eventually sold.

Home reversion plans, on the other hand, involve selling a portion or all of your home to a reversion company in return for a lump sum or regular payments and living in the property rent-free until you die or move out.

How Do You Use Our Equity Release Calculator?

Using our free equity release calculator is straightforward and user-friendly; start by navigating to the calculator section at the beginning of our website, where you will input the necessary information.

Begin by entering your age, as this is a crucial factor in determining the amount you can potentially release from your home.

Once all required fields are completed, simply click the 'Calculate' button.

The calculator will process your inputs and provide an estimate of the equity you could release, ultimately designed to give you quick insights without any commitment or the need to consult directly with an advisor initially.

How Much Equity Can You Release?

The amount you can release through equity depends on factors such as your age, property value, and the specific equity release scheme you select.

Calculating Your Potential Release by Age

The amount of equity you can release varies significantly depending on the homeowner's age, as lenders typically offer more substantial sums to older individuals due to the shorter expected loan duration.

For illustrative purposes, consider a standard property value of £250,000.

At age 55, a homeowner might be able to release up to 20% of their home's value, equating to £50,000, and as the homeowner ages, this percentage increases.

By age 70, they could release up to 35%, which would be £87,500.

At 85, the potential release could rise to 50%, or £125,000.

These figures are indicative and can vary based on the lender's policies, the specific product chosen, and other contributing factors, but they provide a general idea of how equity release scales with age.

Factors Influencing Your Release Amount

Several key factors impact the amount of equity you can release from your home; age is the most significant factor, as discussed, with older homeowners typically able to access a larger percentage of their home equity.

The value of your property also plays a crucial role; the higher the value, the more cash can potentially be released; additionally, the type of property matters—certain properties like freehold houses might be more favourable in terms of equity release compared to leasehold flats, which may have certain restrictions.

Lastly, your health status can influence the amount you can release; some lenders offer enhanced terms for homeowners with certain health conditions, allowing them to access more substantial amounts due to a potentially shortened loan term.

How Do Equity Release Amounts Compare?

Equity release amounts vary based on the plan, the lender's terms, the property's value, and the borrower's age, affecting how much capital can be freed from the home.

Differences Between Equity Release Products

The amount of equity you can release from your home can vary significantly depending on the type of equity release product you choose.

Let's look at the two main types:

- Lifetime mortgage: With this most common product type, you can choose to receive a lump sum or smaller, regular payments, and interest accumulates over time on the amount borrowed. This product often allows for larger initial releases but results in increasing debt due to accrued interest.

- Home reversion plan: In contrast, this plan involves selling a part or all of your property to a provider in exchange for a lump sum or regular payments, with no interest accumulating because it's not a loan, but this typically offers less cash upfront compared to the home's market value.

For example, if you are 70 years old and have a home valued at £250,000, a lifetime mortgage might allow you to release up to 35% of your home's value, depending on the lender's criteria, providing around £87,500.

In a home reversion plan, you might need to sell up to 60% of your home to receive a similar amount because the company assumes the risk of future property value changes.

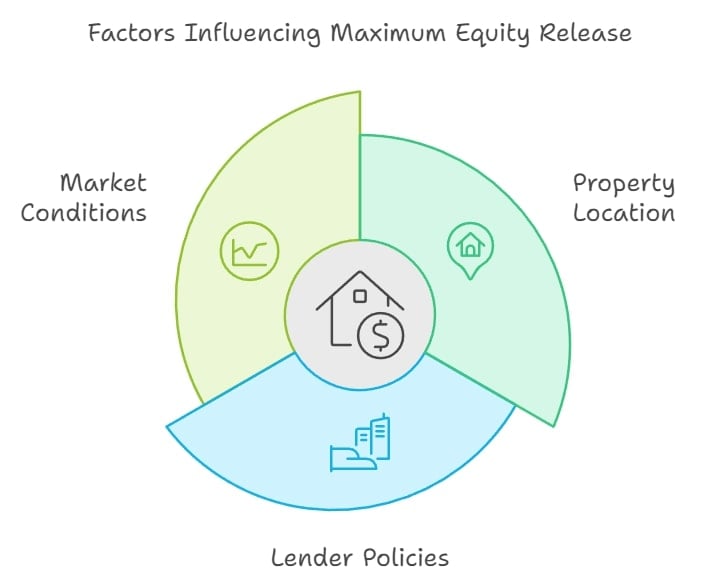

What Affects the Maximum Release?

Several external factors can affect the maximum amount of equity you can release.

Consider the following factors:

- Property location: This is crucial; homes in high-demand areas like London may have higher potential release amounts due to their higher market values.

- Lender policies: These vary widely, with some lenders having more conservative lending criteria based on their risk assessment models which can affect the loan-to-value ratio offered.

- Market conditions: This plays a significant role; during times of economic stability and rising property prices, lenders might be willing to offer more favourable terms; conversely, in uncertain economic times, lenders might tighten their criteria, reducing the amounts homeowners can borrow.

What Are the Financial Implications of Equity Release?

The financial implications of equity release include accruing interest, potential impact on inheritance, and effects on eligibility for means-tested benefits.

Understanding Interest Rates and Repayment

Understanding interest rates and repayment options is crucial for managing the long-term costs and financial impact of loans and credit agreements.

For lifetime mortgages, the interest rate is typically fixed at the inception of the agreement and accumulates on a compound basis, meaning that interest is charged on both the initial amount borrowed and the accumulated interest from previous years.

This compounding effect can significantly increase the total amount owed if the loan is not repaid until the homeowner passes away or moves into long-term care.

Repayment is typically made from the sale of the property, and careful consideration is needed because the longer the term of the loan, the more the debt grows, potentially consuming a substantial portion of the property's value.

Impact on Inheritance and Benefits

Releasing equity from your home can also have significant implications for your inheritance and eligibility for means-tested benefits, and since the amount released plus any accrued interest is usually repaid by selling the home when the homeowner dies or moves into care, the value of the estate left to heirs can be considerably reduced.

This could impact plans for family inheritance; additionally, the income or lump sum received from equity release might affect eligibility for means-tested benefits such as pension credit, income support, or council tax support.

Homeowners should consult with a financial advisor to understand how equity release might affect their specific financial situation and explore strategies to mitigate these impacts if they proceed with releasing equity.

Comparative Analysis of Equity Release Plans: How Do They Compare?

A comparative analysis of equity release plans reveals differences in expert financial advice, real-life examples of different types of plans, and advanced calculator features to aid in selecting the best option.

Seeking Expert Financial Guidance

Navigating the complexities of equity release requires sound financial advice; consulting with an expert can provide you with tailored recommendations based on your unique financial situation and long-term goals.

These professionals can assess your current financial health, help you understand the various types of equity release products, and guide you through the potential impacts on your estate and retirement planning.

Expert financial advice is particularly crucial in equity release to ensure that you comply with all legal requirements, make the most of the available options, avoid costly mistakes, and ensure that the chosen plan aligns with your future needs and family considerations.

More on Equity Release Guidance

Practical Examples and Case Studies

Practical examples and case studies of equity release can illustrate the practical application and outcomes of different plans—for instance, consider John, a 70-year-old retiree who used a lifetime mortgage to supplement his pension and finance his granddaughter's education.

By releasing £40,000 from his home, valued at £250,000, he could comfortably cover these expenses without affecting his daily living costs.

Alternatively, Susan, aged 75, opted for a home reversion plan, selling 50% of her home to secure a lump sum and eliminate her worries about future living expenses.

These examples highlight how equity release can be adapted to meet diverse personal and financial circumstances, providing tangible benefits while also outlining the responsibilities and impacts associated with each decision.

Enhanced Features of Equity Release Calculators

Some equity release calculators can be equipped with enhanced features designed to give users a comprehensive understanding of their potential equity release options.

Calculators include customisable inputs for age, property value, and type, allowing users to tailor the calculations to their specific situations; additionally, they offer a range of scenario analyses, such as the impact of changing interest rates or property values over time.

Users can also benefit from features that estimate the loan's future balance, considering different compound interest rates.

These advanced tools help users not only get an immediate estimate but also understand how different variables could affect the long-term outcomes of their equity release.

Understanding Legal and Regulatory Frameworks in Equity Release

Understanding the legal and regulatory frameworks in equity release will show that it is regulated by the Financial Conduct Authority (FCA) and governed by strict legal standards to ensure consumer protection.

All equity release schemes, such as lifetime mortgages and home reversion plans, must comply with these regulations, which mandate clear communication and responsible financial advice.

Additionally, members of the Equity Release Council adhere to a code of conduct that includes a no-negative-equity guarantee, ensuring that borrowers will never owe more than their home’s value.

Legal advice is mandatory before finalising any equity release plan, ensuring all parties understand the agreement's terms and implications, consumers are protected, and confidence in using equity release as a safe way to access property equity is built.

Common Questions

Can I Use an Equity Release Calculator Online?

What Should I Expect from an Equity Release Calculator's Results?

Are Equity Release Calculators Accurate?

Are All Equity Release Calculators Created Equally?

How Often Should I Use an Equity Release Calculator?

Why Do Different Calculators Give Different Results?

Is It Safe to Enter My Personal Details Into an Online Equity Release Calculator?

Are Results from Equity Release Calculators Guaranteed?

Do Equity Release Calculators Consider Market Fluctuations?

Do Equity Release Calculators Include All Types of Equity Release Products?

In Conclusion

In conclusion, an Equity Release Calculator is an invaluable tool if you are considering tapping into the value of your property.

It offers a quick and straightforward estimate, becoming integral to your financial planning process.

However, always remember that it provides an estimate, and a host of other factors will come into play when you proceed with an equity release application.

If the results of your equity release calculator align with your goals, do not hesitate to contact a financial advisor today to potentially turn those estimates into reality.

WAIT! Before You Go...