DON'T MISS OUT! Try Our FREE Calculator Now

- Typical costs involved in equity release include arrangement fees, legal fees, valuation fees, and the interest that accumulates throughout the loan.

- Be aware of hidden fees such as early repayment charges and possible increased interest rates for drawing additional funds—always thoroughly review contract details.

- The total cost of releasing equity can be calculated by adding up all initial fees and using an online calculator to estimate the total interest that will accrue.

Equity release costs may seem daunting, especially when you consider that over 55s in the UK hold over £2.6 trillion of property wealth.1

Unraveling this often complex process is crucial to better financial health and decision-making.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

In this comprehensive guide, we will help you understand everything from the initial fees to strategies for minimising these expenses to equip you with the knowledge you need to make informed decisions.

Trust us to guide you through this journey with your best interests at heart.

What Are Equity Release Plans?

At their core, equity release plans are a method for homeowners to monetize the value of their property while retaining the right to live in it.

What Are the Typical Costs Associated with Equity Release in the UK?

Equity release in the UK typically involves several costs including arrangement or application fees, valuation fees, solicitor's fees, and advisory fees.

Arrangement fees can be up to £2,000, valuation fees depend on the property's value (around £200-£600), while solicitor and advisory fees may vary.

Additionally, there might be an early repayment charge if the equity release plan is settled before its term.

There are also potential costs involved with equity release plans themselves.

The most significant is the accumulating interest, which can significantly increase the amount you owe over time.

Some equity release schemes may have additional charges such as set-up, completion, or administration fees.

The total cost can be substantial, hence it's crucial to understand all associated costs before proceeding with equity release in the UK.

What Are the Initial Costs of Equity Release?

Equity release plans can be a lifeline for many, offering a financial boost in retirement but not without initial fees.

Having the costs of equity release explained is critical in order to make a fully informed decision.

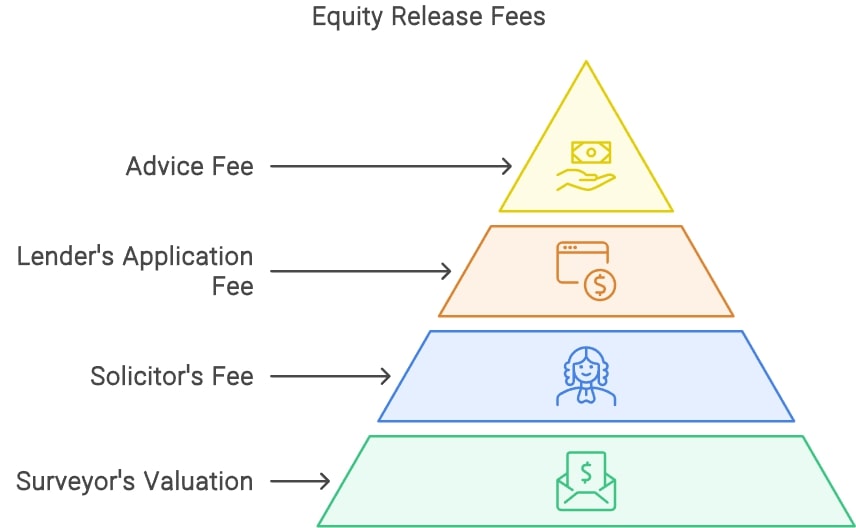

The equity release set-up costs include:

- Professional equity release advice fees

- Application cost

- Surveyor valuation fees

- Solicitors' fees

They can quickly add up, so factoring them into your financial planning is essential.

Professional Advice Fees

Seeking advice from a qualified financial advisor is crucial in navigating the complexity of equity release, and you will pay for this advice.

Application Cost

Application costs, also known as arrangement or product fees, are charged by the lender for setting up the equity release plan.

Depending on your chosen provider and product, they can range from zero to upwards of £2000.

Surveyor Valuation

A property survey is required to determine the market value of your home, which in turn influences the amount you can release.

Fees for this service vary depending on your property's value but typically range from £400 to £1,425.2

Some lenders offer a free valuation as a part of your package.

Solicitors' Fees

Legal work is involved in setting up an equity release plan so that you can expect equity release solicitor’s fees.

Solicitors handle this, and their fees are around £6503 but differ significantly depending on the complexity of the transaction and the service provider you choose.

What About Additional and Unforeseen Expenses?

Equity release schemes can also come with additional and unforeseen expenses.

These include early repayment charges and potential interest accumulation, which may not be immediately apparent but can significantly impact the overall amount you will pay.

Here is what you need to know.

Early Repayment Charges

Early repayment charges are penalties imposed by lenders to compensate for the interest they will lose if you repay your plan earlier than expected.

They are often calculated as a percentage of the initial loan, and the amount varies based on how long ago you released your equity.

This usually ranges between 3% and 8%, with no early repayment fees after 15 years.*

These charges can significantly increase the total cost, which may affect your financial planning.

It is vital to fully understand the terms and conditions of your scheme, including potential early repayment charges before you agree to it.

*These figures are for indicative purposes only, with exact amounts being lender-dependent.

Interest Accumulation

When discussing interest accumulation in the context of equity release plans, it is essential to understand that it works on the principle of compound interest.

This means that the interest is not calculated solely on the original amount you have borrowed but also on the accrued interest from previous periods.

Over time, this interest-on-interest effect can cause your debt to grow exponentially, which may result in you owing considerably more than what you initially borrowed.

How does this affect me?

This factor is particularly important if you are considering a plan to fund your retirement, as the accumulated interest over an extended period can reduce the inheritance left for your beneficiaries.

If you can afford it, you can choose to pay the interest each month to stop the compounding.

Compound interest example:

If you borrowed £100,000 at an interest rate of 5%, the first year would see £5,000 added to your debt.

However, the following year, interest would be calculated on £105,000 rather than the original £100,000, leading to a higher amount owed.

*These figures are for indicative purposes only.

Understanding Potential Unexpected Costs

These are like early repayment charges; if your circumstances change, you can emerge from a myriad of unpredictable situations, and it is vital to be financially ready to tackle them.

More examples

For homeowners, providers often mandate regular upkeep of the property, with neglect potentially leading to significant repairs.

With these and other unexpected life costs, creating an emergency fund and having a robust financial strategy are critical to plan ahead effectively.

Calculating the Total Cost of Equity Release

The total involves all the initial amounts, accumulated interest, set-up fees, and any potential unforeseen expenses.

The average fees for equity release when setting up will be between £1,500 and £3,000,4 depending on your suppliers.

This will cover:

- The initial lump sum borrowed

- Professional advice fees

- Application fees

- Surveyor's fees

- Legal fees

The true cost of equity release will be evident when you get an actual quote.

What Factors Can Influence Your Equity Release Scheme Costs?

Factors influencing these are the plan choice, prevailing interest rates, and property value.

Personal factors such as your age and health and the specific terms set by your provider also play significant roles.

What Strategies Can You Use to Minimise Costs?

Ways to minimise expenses are by comparing providers and interest rates, understanding and negotiating fees, seeking professional advice, and considering a drawdown lifetime mortgage can help.

We have broken these down.

Comparing Providers and Interest Rates

Shopping around and comparing different providers' interest rates can help you find the best deal.

The rate you settle on will significantly affect the total paid, so finding a lower rate can lead to significant savings over time.

Understanding and Negotiating Fees

Understanding the fees involved in equity release allows you to budget effectively and possibly negotiate a better deal.

Some providers may waive or reduce certain fees, lowering your overall spend.

The Benefit of Professional Advice

Professional advice can be invaluable in minimising costs.

A qualified advisor can help you navigate the market, understand the fees involved, and advise on the best plan to suit your needs and circumstances.

The Drawdown Lifetime Mortgage

Drawdown lifetime mortgages are a popular form of equity release product in the UK, enabling homeowners 55 years or older to access the wealth tied up in their property in increments, according to their financial needs.

Unlike lump-sum schemes, where the entire loan amount is released simultaneously, drawdowns allow for more control and flexibility and help minimise interest charges.

As the interest only accrues on the amount withdrawn, the total owed can be significantly less over time compared to the lump-sum method.

However

It is crucial to understand that the property is typically sold upon the homeowner's death or move to long-term care, and the loan plus accrued interest is then repaid.

Common Questions

What Are the Typical Costs of Equity Release in the UK

Are There Any Hidden Equity Release Costs to Be Aware Of

How Do Equity Release Costs Compare to Other Financial Solutions

What Impact Do Equity Release Costs Have on My Retirement Financial Plans

Can Equity Release Costs Be Reduced or Negotiated

Are There Equity Calculator Costs

How does a rise in property values affect equity release fees

Are there any governmental charges or taxes involved in equity release

Are the costs of equity release tax-deductible

How do equity release fees compare to other forms of borrowing, such as remortgaging or taking a personal loan

Conclusion

Navigating equity release costs can be complex, but with comprehensive information and expert advice, you can make informed decisions for your financial future.

Remember, each fee plays a role in the total expense.

Considerations such as property value, age, health, and the provider's terms can also influence these.

In essence, understanding the spectrum of equity release costs is essential to making beneficial decisions, and do not forget to seek professional advice.

WAIT! Before You Go...