DON'T MISS OUT! Try Our FREE Calculator Now

Quick Summary

- Average interest rates for equity release in the UK typically range between 4% and 6%, generally higher than traditional mortgages due to the inclusion of a no negative equity guarantee.

- Interest rates can be fixed or variable, with most providers offering fixed rates to ensure predictable costs throughout the term of the plan.

- Rates are influenced by factors including the Bank of England base rate, property value, and the borrower's age, impacting the overall cost of borrowing.

A good grasp of the fundamentals of equity release interest rates is essential to managing your financial future.

With the recent Bank of England base rate hikes, higher food and fuel costs, the retirement funds needed for a basic standard of living increasing by nearly £2,000 in 2022.1

That is why getting to grips with equity interest rates mechanisms, product functions, average differences between fixed and variable rates, and terms like APR, MER, and the role of AER is crucial.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

FundWeb, your trusted resource in the realm of equity release, provides well-researched and up-to-date articles, offering valuable guidance on various financial topics to empower your decision making.

Let us learn more…

What Is An Equity Release Mortgage?

An equity release mortgage is a financial product designed for seniors, offering a way to convert the equity in their homes into usable cash, which can be received as a lump sum or in installments.

What Are the Average Interest Rates for Equity Release in 2026?

The average interest rates for equity release in 2026 have hovered around 6.14% to 6.46% (AER).*

These rates can vary significantly depending on factors like the provider, property value, and individual circumstances.

*These rates were accurate upon publication. While we endeavour to keep our rates information accurate, these rates may have been changed since our last update.

How Do Equity Release Interest Rates Vary by Age?

Rates vary by age with older applicants generally getting more preferable rates than younger ones.

Given their shorter life expectancy, homeowners in their 70s may get lower rates because the equity release mortgage may be of shorter duration and therefore less risky by lenders.

The earlier you unlock your property value (it is available from 55) the longer the loan terms and the higher the risk.

This age-based variation in rates emphasises the importance of seeking professional financial advice to understand the full implications and obtain an equity release product best suited to an individual's age and circumstances.

Types of Equity Release Interest Rates

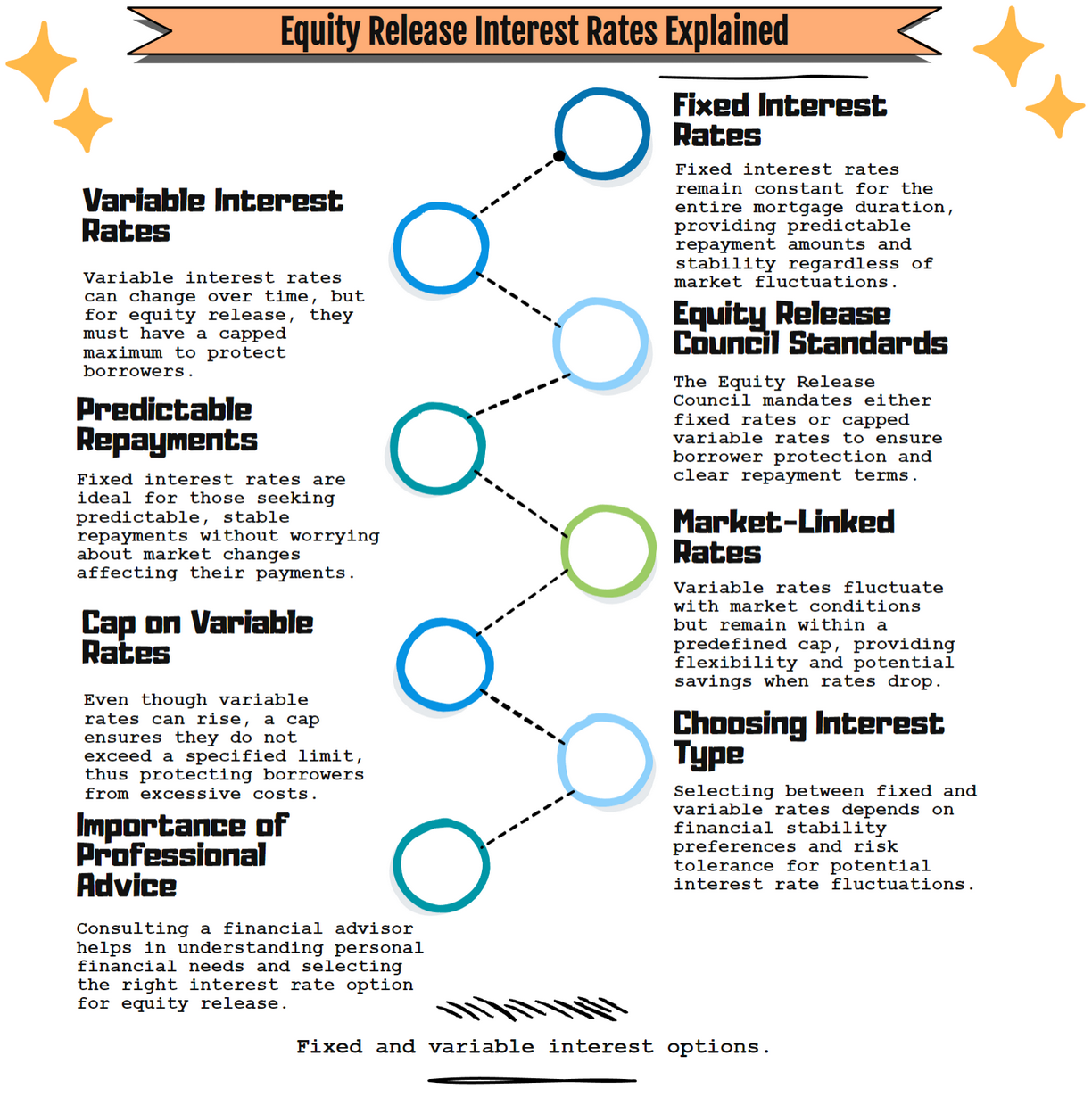

Equity release interest rates come in 2 types: fixed and variable.

The Equity Release Council's product standards state that interest rates for lifetime mortgages must be either set as fixed for each release or, if they are variable, they must have a cap for the entire loan duration.2

What Is the Difference Between Fixed vs Variable Interest Rates?

Fixed and variable equity release interest rates differ in their structure and impact on the borrower:

- Fixed interest rates: Offer a sense of stability, as the rate remains constant throughout the life of the loan, allowing for predictable monthly payments and overall cost.

- Variable interest rates: Tied to market conditions and may rise or fall accordingly. While this can potentially lead to savings if the rates drop, it also introduces an element of risk, as rates may increase, causing higher payments over time.

Choosing between these 2 options requires a careful assessment of your own risk tolerance, financial situation, and long-term goals.

An equity release specialist can help you understand the full implications of each choice.

APR vs MER

APR (annual percentage rate) is a common measure used in the UK to represent the yearly cost of a loan, encompassing both interest and any associated fees.

This consolidated figure allows for straightforward comparisons between different loan products.

MER (monthly equivalent rate), on the other hand, calculates interest on a monthly basis and may offer a more nuanced view of how interest compounds over time.

While APR gives an overall annual cost, the MER can provide more detailed insights into the actual cost behaviour of a loan, particularly in an environment where interest rates fluctuate.

Both have their uses in assessing loans, and understanding the differences can be crucial in selecting the best product for your needs.

What Is the Role of the Annual Equivalent Rate (AER)?

The annual equivalent rate (AER) serves as a critical tool for comparing the annual interest across different savings and investment products, especially when the compounding frequency varies.

By including compounding, the AER provides a more accurate reflection of the overall returns on an investment over a year.

What does that mean?

This considers not just the nominal interest rate but also how often that interest is added to the account.

The AER offers a standardised way to compare products, making it easier to identify the most profitable options.

It is an essential measure simplifying the often complex world of financial interest rates, helping savers and investors make more informed decisions.

Current Equity Release Interest Rates Compared

| Provider | Monthly (Rate) The amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. | (Annual Equivalent Rate)The percentage of interest on a loan or financial product if compound interest accumulates over a year during which with no payments are made. | APR (Annual Percentage Rate) The number that represents the total yearly cost of borrowing money, expressed as a percentage of the principal loan amount. |

|---|---|---|---|

| Pure Retirement | 5.97% | 6.14% | 6.14% |

| Canada Life | 6.13% | 6.31% | 6.31% |

| Canada Life | 6.16% | 6.34% | 6.34% |

| Aviva | N/A | 6.35% | 6.30% |

| Canada Life | 6.20% | 6.38% | 6.30% |

| Canada Life | 6.24% | 6.42% | 6.38% |

| Just Retirement | 6.25% | 6.43% | 6.42% |

| Just Retirement | 6.25% | 6.43% | 7.20% |

| Canada Life | 6.27% | 6.45% | 7.20% |

| Just Retirement | 6.28% | 6.46% | 6.45% |

Updated: 17 February 2025

Scenario: 60-year-old single male with a £300,000 property value, who wants to release £30,000.

Learn More: Just Retirement, Canada Life Equity Release, Pure Retirement Equity Release

How Can You Compare Equity Release Interest Rates?

Comparing interest rates is a multifaceted process, requiring careful examination of several key factors.

Besides looking at the APR, which provides a comprehensive view of the total cost, you must consider whether the rates are fixed or variable, which will influence future payment predictability.

The plan's flexibility, including options for making voluntary repayments or the potential for drawdowns, is also crucial.

Additional features like:

- Cashback offers

- Incentives

- Specific legal protections can also vary between providers, making them essential considerations.

Leveraging online comparison tools designed for these products can help simplify this process by aligning offerings with your unique needs.

However, consulting with a financial advisor who specialises in equity release is advisable, as their expert insights can help navigate the complexities, ensuring the selection of a product that is well-suited to your individual financial situation and long-term objectives.

What Strategies Can Help Reduce Your Interest Rate?

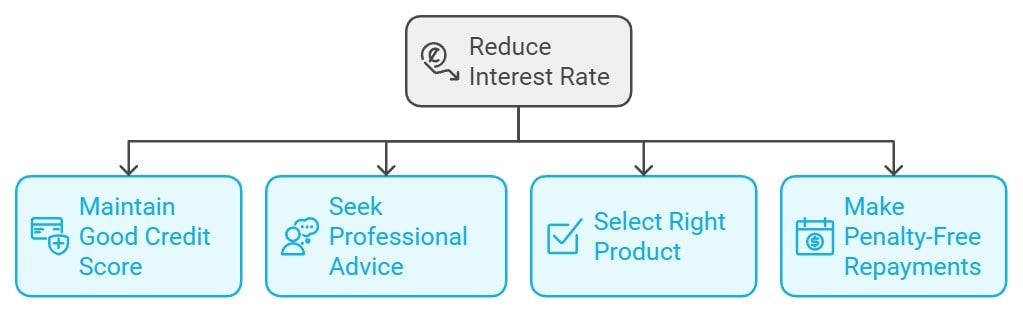

There are a few strategies you can use to reduce your interest rate.

They include:

- Maintaining a good credit score demonstrates financial reliability, potentially securing lower rates.

- Seeking professional advice from a financial adviser specialising in equity release ensures that you are exploring all available options tailored to your situation.

- Selecting the right product that aligns with your needs and preferences can also make a substantial difference in the interest rate you receive.

- Plans taken since March 2022 now allow for penalty-free repayments of up to 10% of the total value of your loan per year, to keep a lid on compounding.3

It is essential to understand that these strategies may vary in effectiveness depending on individual circumstances, market conditions, and the specific features of the plan chosen.

Therefore

Personalised consultation with an equity release expert is often recommended.

How Can Interest on Equity Release Plans Be Paid Back?

Interest on plans can be managed in several ways, each with its own implications.

If rolled up into the total loan amount, interest compounds over time, possibly leading to a significant debt that is deducted from the property's sale proceeds.

Voluntary payments provide an option to pay off interest regularly, thereby reducing the overall debt, but this may strain your cash flow.

Paying back interest through the eventual sale of the property ensures that no immediate out-of-pocket expenses are incurred, but it can significantly diminish the inheritance left to beneficiaries.

Getting the right professional advice will help you explore your options.

What Are the Recent Trends and Developments in Equity Release Interest Rates?

A greater range of products has shaped recent trends in equity release interest rates in the UK, producing more competitive interest rates, and an increased focus on flexibility and customer protection.

Regulatory bodies and industry associations have emphasised transparency, ethical practices, and consumer education.

These proactive measures aim to safeguard the interests of the UK's ageing population, who are increasingly turning to equity release to enhance financial stability in retirement.

The combination of these factors illustrates how the equity release market has matured and become more consumer-friendly.

Learn More: How Safe is Equity Release?

Common Questions

What Are the Average Equity Release Interest Rates in the UK

How Do Equity Release Interest Rates Compare to Traditional Mortgage Rates

Can Equity Release Interest Rates Change Over Time

What Factors Affect Equity Release Interest Rates

Are There Fixed Interest Rate Options for Equity Release

How Do Economic Conditions Influence Equity Release Interest Rates

Can I Switch My Provider to Get a Better Interest Rate

What Impact Do Changes in the Bank of England Base Rate Have on Equity Release Interest Rates

Is the Interest Rate on My Equity Release Plan Likely to Change Over Time

What Are Drawdown Plans and How Do Interest Rates Work With Them

Conclusion

In the ever-changing landscape of personal finance, releasing equity presents a compelling opportunity for the ageing population of the UK - considering equity release interest rates of course.

With an array of options available, including drawdown plans, enhanced equity release, and varied interest rates, the path to unlocking property wealth’s expanding.

However, this complexity need not be a barrier.

A professional financial advisor can help you find the best-fit options for your needs.

Understanding the nuanced mechanisms behind equity release interest rates, from the influencing economic factors to the specific product types and their regulatory oversight, is vital for those considering this financial route.

Read More: Fundamentals of Equity Release in 2026

WAIT! Before You Go...