DON'T MISS OUT! Try Our FREE Calculator Now

- Equity release plans with no early repayment charge allow borrowers to repay the loan partially or in full without facing hefty penalties, providing greater financial flexibility.

- Without early repayment charges, homeowners can reduce overall interest costs by making voluntary repayments, helping to manage long-term financial commitments.

- Borrowers can adapt their repayment strategy based on changing financial circumstances, such as receiving an inheritance or downsizing, without worrying about extra fees.

- Some equity release providers offer plans with no early repayment charge under specific conditions, ensuring fairer terms for homeowners who may need to exit the plan earlier than expected.

As homeowners approach retirement, many consider options like equity release to unlock the cash tied up in their property.

However, understanding the implications of early repayment charges is crucial for those who may want to repay their equity release loan sooner than expected.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This article explores the nature of equity release, the different types of plans, and the conditions surrounding early repayment.

What is Equity Release Early?

Equity release early refers to the process of repaying an equity release loan before the agreed-upon term.

Equity release is primarily aimed at homeowners aged 55 and over in the UK, allowing them to unlock cash tied up in their property without selling it.

The funds can be utilised for various purposes, such as enhancing retirement income or supporting family members.

However, repaying the loan early may come with specific conditions and potential early repayment charges that borrowers should understand.

Definition of Equity Release

Equity release is a financial product designed for homeowners aged 55 and over in the UK. It allows individuals to access the cash tied up in their property without needing to sell.

This cash can be utilised for various purposes, including supplementing retirement income, funding home improvements, or providing assistance to family members.

Typically, the equity release loan is repaid when the homeowner sells the property, moves into long-term care, or passes away, at which point the lender recoups the loan amount plus interest from the sale proceeds.

Types of Equity Release Plans

There are primarily two types of equity release plans: lifetime mortgages and home reversion plans.

A lifetime mortgage allows homeowners to borrow against their property while retaining ownership, with the loan and interest repaid upon sale of the home.

Conversely, a home reversion plan involves selling a portion of the property to a provider in exchange for a lump sum, allowing homeowners to live in the property rent-free until they pass away or move out.

Each equity release product has unique features, benefits, and implications for inheritance and estate planning, making it essential for borrowers to understand their options.

Overview of Lifetime Mortgages

A lifetime mortgage is the most common form of equity release, enabling homeowners to borrow money secured against their property while retaining ownership.

Interest typically rolls up and is added to the loan balance, meaning no monthly repayments are required during the homeowner's lifetime.

The loan is repaid when the homeowner dies or moves into long-term care.

Lifetime mortgages offer flexibility, with some plans allowing for partial repayment or drawdown options, enabling homeowners to access funds as needed while keeping in mind the potential implications of early repayment charges if they wish to repay their equity release early.

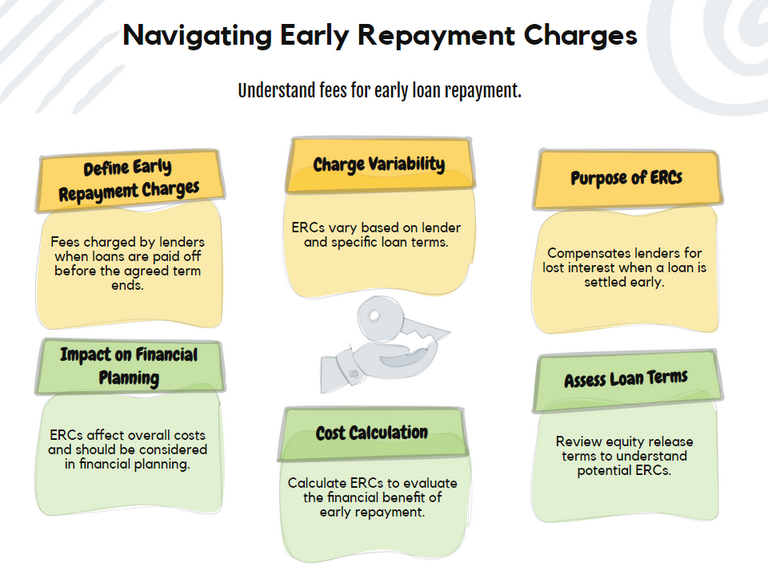

Understanding Early Repayment Charges

Early repayment charges (ERCs) are fees that lenders impose on borrowers when they choose to repay their equity release loan before the agreed-upon term concludes.

These charges serve to compensate lenders for the potential loss of interest income they would have earned had the loan remained active for its full duration.

The specific amount of an early repayment charge can vary significantly based on the lender and the terms of the equity release plan.

For homeowners considering the option to pay back their equity release early, it is crucial to fully understand the implications of these charges, as they can impact the overall cost and financial planning surrounding equity release.

Types of Early Repayment Charges

When it comes to early repayment charges, there are generally two types: fixed and variable.

A fixed early repayment charge remains constant throughout the life of the equity release loan, providing borrowers with predictability in their repayment costs.

In contrast, variable early repayment charges can fluctuate based on prevailing market conditions or interest rates.

This variability could lead to higher costs if rates increase.

Understanding which type of ERC applies to your specific equity release product is essential, as it can profoundly influence your financial decision-making and ability to repay your equity release loan early without incurring excessive costs.

Typical Equity Release Early Repayment Scenarios

Several common scenarios may lead homeowners to consider repaying their equity release loan early, potentially incurring early repayment charges.

For instance, selling a property or refinancing an existing equity release plan can trigger these costs.

Additionally, if a borrower has access to inheritance or substantial savings, they might decide to pay off their equity release loan early.

Typically, if more than a certain percentage of the initial amount borrowed is repaid within the first few years, an early repayment charge may apply.

By understanding these scenarios, homeowners can make informed decisions regarding their equity release options and weigh the financial implications of repaying their equity release early.

Can You Pay Back Equity Release Early?

Yes, homeowners can pay back their equity release loans early; however, it’s crucial to understand the potential implications of early repayment charges associated with various equity release plans.

Many lenders allow early repayments, but borrowers may face substantial fees, particularly if they choose to repay during the initial years of the loan.

Therefore, it's essential for borrowers to carefully review their equity release contract and comprehend the conditions surrounding early repayment before making any decisions regarding how and when to repay their equity release loan.

Steps to Pay Off Equity Release Early

To pay off equity release early, homeowners should first examine the specific terms of their equity release plan to identify any early repayment charges that may apply.

Seeking equity release advice from a specialist mortgage broker can clarify the costs and implications of early repayment.

Once borrowers are adequately informed, they can proceed by contacting their lender to initiate the repayment process.

This can typically be accomplished through multiple payment methods, including direct debit, bank transfer, or cheque, ensuring adherence to the necessary steps to avoid unexpected fees.

Benefits of Paying Off Equity Release Early

Paying off equity release early can provide numerous advantages, such as significantly reducing the overall interest paid throughout the loan's duration and minimising the debt passed on to heirs.

Moreover, it can grant homeowners peace of mind by eliminating a financial obligation, allowing for better control over estate planning.

Additionally, by repaying their equity release loan early, homeowners can enhance the equity available in their property for future necessities or for inheritance purposes, creating a more secure financial environment for their family.

Low Early Repayment Charges Options

Equity Release with Low Early Repayment Charges

Some equity release plans come with low or no early repayment charges, giving homeowners greater flexibility in managing their financial commitments.

These options often feature provisions that allow for a certain percentage of the loan to be repaid annually without incurring an early repayment charge.

Homeowners should diligently compare different equity release products and lenders to discover plans that align with their financial needs while minimizing potential costs associated with early repayment of their equity release loan.

How to Find Low Early Repayment Charges

To find equity release products that offer low early repayment charges, borrowers should engage in comprehensive research and comparison of various lenders’ offerings.

Consulting with a mortgage broker who specializes in equity release can provide valuable insights into which products feature favorable terms.

Furthermore, reviewing the Equity Release Council's standards can assist in identifying reputable lenders that offer competitive options, ensuring that homeowners can make informed decisions regarding their equity release plans without incurring excessive costs.

Pros and Cons of Low Early Repayment Charges

Low early repayment charges present significant benefits, including enhanced flexibility and reduced costs when repaying equity release loans.

However, these attractive features may come with trade-offs such as higher initial fees or interest rates.

Homeowners must carefully evaluate the advantages of lower repayment charges against the overall costs of their equity release plan to determine the most suitable financial decision for their unique situation, ensuring they can effectively manage their financial obligations while planning for the future.

Downsizing Protection in Equity Release

What Is Downsizing Protection?

Downsizing protection is an essential feature in certain equity release plans, specifically designed to provide homeowners with the flexibility to repay their equity release loan without incurring early repayment charges.

This feature is particularly beneficial for those considering a lifestyle change, such as moving to a smaller home after selling their property.

Typically, this protection becomes available after a specified period, often around five years, allowing borrowers to navigate their housing needs without the financial burden of penalties for repaying the loan early.

Homeowners should carefully review their equity release product to understand the precise terms of downsizing protection and how it can aid in financial planning.

How Downsizing Affects Early Repayment

When homeowners opt to downsize, downsizing protection plays a critical role in determining how they can manage their equity release loan.

With this feature, borrowers are often able to repay their equity release loan early without facing early repayment charges, easing the transition to a new property.

It is vital for homeowners to familiarize themselves with their lender's specific criteria regarding downsizing, as not all equity release plans include this advantageous feature.

Understanding these details helps homeowners make informed decisions about their property and financial future, ensuring they can move without the burden of unexpected fees.

Choosing the Right Equity Release Plan with Downsizing Protection

Choosing an equity release plan that includes downsizing protection requires careful consideration of long-term financial goals and future needs.

Homeowners should compare various equity release products and lenders, focusing on those that offer this critical feature.

Consulting a specialist mortgage broker can provide tailored equity release advice, helping borrowers navigate the complexities of their options.

This guidance ensures that homeowners fully understand how downsizing protection can integrate into their overall financial strategy, offering them peace of mind as they plan for potential lifestyle changes in the years ahead.

Working with a Mortgage Broker

Engaging a mortgage broker presents numerous advantages for homeowners contemplating equity release.

Brokers have access to a diverse range of equity release products and lenders, enabling them to identify options best suited to individual circumstances.

Their expertise is invaluable, particularly in understanding early repayment charges and the intricacies of the application process.

Moreover, established relationships with lenders can streamline transactions, making the overall experience smoother for borrowers.

By leveraging a mortgage broker's knowledge, homeowners can make informed choices about their equity release plans, ensuring they navigate the complexities with confidence.

How a Broker Can Help with Early Repayment Charges

A mortgage broker is instrumental in helping homeowners comprehend the specifics of early repayment charges associated with their equity release plans.

They can evaluate potential costs related to repaying the loan early and guide borrowers through the process, ensuring they are fully aware of any implications.

By providing personalized advice, brokers empower homeowners to align their decisions with their financial goals, helping them avoid unnecessary fees.

This support is particularly crucial for those considering making changes to their equity release loan early, allowing them to navigate the complexities more efficiently.

Finding the Right Broker for Equity Release

To find the right mortgage broker for equity release, homeowners should prioritize professionals who specialize in this field and possess a proven track record of success.

Conducting thorough research, reading reviews, checking qualifications, and soliciting recommendations can significantly aid in finding a broker that meets specific needs.

Ensuring that the broker is a member of relevant professional bodies, such as the Equity Release Council, provides additional assurance regarding their expertise and adherence to industry standards.

This diligence can lead to a more informed and beneficial equity release experience.

Common Questions

1. What is equity release with no early repayment charge?

2. Who is eligible for equity release with no early repayment charge?

3. Are there any costs involved with early repayment?

4. Can I pay off the loan early without any penalties?

5. Will repaying the loan early save me money?

Conclusion

Choosing an equity release plan with no early repayment charge offers homeowners greater financial flexibility, cost savings, and control over their repayments.

By avoiding hefty penalties, borrowers can adapt their plans to suit changing circumstances, whether they wish to pay off the loan early or manage interest costs more effectively.

However, it's essential to carefully review the terms and conditions of different providers to ensure the plan aligns with your long-term financial goals.

Seeking professional advice can help you make an informed decision and maximise the benefits of equity release while maintaining financial security.

WAIT! Before You Go...