DON'T MISS OUT! Try Our FREE Calculator Now

Quick Summary

- Equity release offers a tax-free enhancement to retirement income, but it can reduce your family's inheritance and impact your eligibility for means-tested benefits.

- For safety and assurance, choose plans approved by the Equity Release Council, which include protections like the No Negative Equity Guarantee.

- Before applying for equity release, it is essential to consult with a qualified adviser to understand its suitability based on your retirement needs and its potential effects on your estate.

Determining whether equity release is a good idea boils down to finding out whether this financial tool could be right for you.

When you consider that over 35,000 borrowers older than 55 took out mortgages in the last quarter of 2025, releasing equity clearly remains a popular choice for older borrowers looking to leverage the value of their homes.1

However, given the complexity and long-term implications of an equity release loan, it is crucial to weigh all the pros and cons, explore alternative strategies, and consult a financial advisor before making up your mind.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Fundweb aims to clarify this complex financial product and provide a balanced overview by highlighting potential risks and revealing the unexpected benefits of equity release.

All our content undergoes extensive quality and compliance checks to ensure you get the most relevant and useful information.

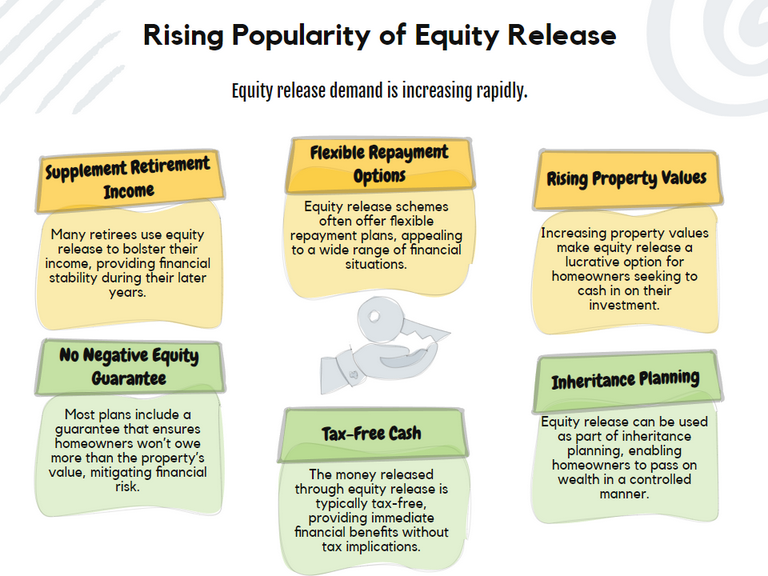

Why Has Equity Release Gained Popularity?

According to the Equity Release Council's 2025 Annual Review, equity release has gained popularity thanks to rising property values, which means homeowners have gained equity to draw on, and the increasing cost of living across the UK.2

What Is Equity Release Used For?

Figures released by Legal & General in 2022 indicated that a quarter of borrowers opting for equity release take out these loans to supplement their income.3

Legal & General Home Finance CEO Craig Brown is quoted in This is Money as saying that equity release borrowing has been used to mitigate the effects of the cost of living crisis.4

This is borne out by a Boon Brokers survey from 2025 that found that covering everyday living costs is the top reason given for taking out equity release loans.5

Why Turn to Equity Release?

The significant increase in property values seen in the UK, where a house bought in 1980 may have increased in price by 1.145% by 20206, has made equity release an attractive option for many7.

Learn More: L&G Equity Release

The Benefits of Borrowing Using Equity Release

The benefits of borrowing using equity release include accessing a lump sum or smaller payments, staying in your home, and having no monthly repayments.

Key advantages include:

- Access to Cash: Provides immediate funds through a lump sum or ad hoc withdrawals.

- No Monthly Repayments: Lifetime mortgage plans do not require monthly repayments; the loan is repaid when you die or move into long-term care.

- Staying in Your Home: Allows you to remain in your home while accessing its value.

- Fixed Interest Rates: Most lifetime mortgage products offer fixed interest rates, meaning your rate won't fluctuate over time.

- Financial Flexibility: Funds can be used for various purposes, such as supplementing retirement income, making home improvements, repaying other debts, or helping family members.

The Potential Drawbacks

The potential drawbacks of equity release include high interest accumulation, reduced inheritance, and potential impacts on means-tested benefits.

Significant disadvantages include:

- Interest Accumulation: Compound interest can significantly increase the amount owed over time.

- Reduced Inheritance: Accessing your home’s equity will decrease the value of your estate, leaving less for your heirs.

- Costs and Fees: These include arrangement, valuation, and legal fees, which can be substantial.

- Impact on Benefits: An equity release loan may affect your eligibility for means-tested state benefits.

- Long-Term Financial Impact: As the loan amount increases over time owing to compound interest, the remaining equity in your home decreases, which can restrict your options if you need additional funds later or encounter unexpected financial challenges.

Speak to a qualified equity release advisor to discuss all the potential downsides of these products.

Making an Informed Decision

Making an informed decision about equity release requires understanding the products available and their long-term implications.

Weigh the immediate benefits against future financial impacts and consider alternative options.

Factors to Consider Before Proceeding With Equity Release

Before proceeding, consider your long-term financial needs, the impact on your estate, and how it might affect your eligibility for state benefits.

Assessing your current and future financial situation will help determine if this is the best option for you.

How Your Decision Impacts Future Inheritance & State Benefits

Releasing equity from your home reduces the value of your estate, potentially leaving less for your heirs.

Additionally, the extra funds may affect your eligibility for means-tested state benefits, such as Pension Credit or Council Tax Reduction.

Navigating the Risks & Safeguards

Navigating the risks and safeguards starts with understanding them.

Risks include rising debt owing to compound interest and the impact on inheritance, while safeguards like fixed interest rates and the No Negative Equity guarantee can mitigate some of these risks.

Protection Through the Equity Release Council

The Equity Release Council (ERC)8 sets product standards that its members are obliged to follow.

This results in protections for consumers, including the guarantee that you can stay in your home for life and that interest rates will be fixed or capped.

Membership in the ERC is a sign of a trustworthy provider, as ERC members follow a strict code of conduct to ensure transparency and consumer protection.9

The Role of the FCA

The Financial Conduct Authority (FCA)10 regulates equity release products, ensuring they meet high standards of fairness and transparency.

The FCA’s oversight protects consumers from unscrupulous practices and ensures independent advisors offer sound, unbiased advice.

Expert Advice & Legal Counsel

Seeking expert advice and legal guidance is extremely important—and also mandatory—when considering equity release.11

A financial advisor can provide tailored advice based on your circumstances, while a solicitor can help navigate the legal aspects of the agreements.

Read On: What is an Equity Release Solicitor?

The Importance of Independent Advice

Independent financial advice ensures you receive unbiased recommendations tailored to your situation.

Advisors not tied to specific providers can offer a broader view of the options available, helping you make a well-informed decision.

Checking Your Advisor's Credentials

Ensure your advisor is qualified and experienced in equity release by checking their credentials.

Look for membership of the Equity Release Council12 and verify their standing with the Financial Conduct Authority by checking their register13.

Can Equity Release Affect Your Financial Future?

Equity release can significantly affect your financial future owing to the long-term effects of compound interest.

The interest on lifetime mortgages can grow rapidly and erode the amount of equity left in your home, which makes it crucial to understand how this will affect your finances over time.

For instance, having less equity available may mean you cannot borrow against your home again.

Can Equity Release Affect Your Retirement Plans?

Equity release can provide a crucial boost to retirement income, allowing you to enjoy a more comfortable lifestyle.

However, you should balance this benefit against the potential reduction in your estate's value and the impact on your long-term financial health.

Equity release can be a tool to support your retirement plans, but it should not jeopardise your long-term financial security.

Exploring Alternatives to Equity Release

Alternatives to equity release include downsizing to a smaller property, renting out a part of your home, or considering other financial products like Retirement Interest-Only (RIO) mortgages.

Exploring these options can help determine the best course of action for your needs.

Common Questions

What Are the Pros and Cons of Equity Release?

How Safe Is Equity Release?

What Are the Risks Involved in Equity Release?

How Does Equity Release Impact My Estate?

Can Equity Release Be a Good Retirement Option?

Are There Any Age Restrictions or Limitations When Accessing Equity Release?

Can I Still Move Home After Releasing Equity?

What Happens to the Equity Release Plan If I Pass Away or Move Into Long-Term Care?

What Steps Can Be Taken If I Regret My Equity Release Decision Later On?

How Does Equity Release Impact Any Existing Mortgages or Debts on the Property?

Conclusion

Equity release can be a useful method of unlocking your home's value, but taking out an equity release loan requires careful thought and planning.

By understanding the benefits and drawbacks, seeking independent advice, and exploring all alternatives, you can make an informed decision that aligns with your financial goals and needs.

Determining whether equity release is a good idea for you may be one of the first steps you take as you start planning for your retirement.

Read On: Full Guide to Releasing Equity

WAIT! Before You Go...