DON'T MISS OUT! Try Our FREE Calculator Now

Quick Summary

- Essential rules for equity release include obtaining advice from a certified financial adviser, ensuring all terms are clear, and verifying that the plan complies with Financial Conduct Authority (FCA) regulations.

- Regulations mandate that all equity release plans include a 'no negative equity guarantee' and require that providers and advisers are both qualified and registered with the FCA.

- Before committing to an equity release plan, it's crucial to seek legal advice from a solicitor specialising in this area to ensure the agreement aligns with your interests and to fully understand the financial and legal implications.

Unveiling a surprising fact, as of 2022, UK homeowners aged 55 and above collectively owned nearly £5 trillion in property wealth, putting the spotlight on the significance of understanding Equity Release Rules.1

Our comprehensive guide demystifies this financial tool, from eligibility to property criteria, right through to regulations and ethical guidelines

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

As a trusted source, Fundweb is here to help you navigate this intricate process, ensuring you have the knowledge to make informed decisions.

Read on to find out more about the rules associated with releasing equity.

What Are Equity Release Schemes?

In the realm of personal finance, equity release schemes are a tailored approach for individuals over 65 to access the wealth accumulated in their homes.

What Are the Current Equity Release Rules in the United Kingdom?

The current Equity Release rules in the United Kingdom stipulate that homeowners must be 55 years or older to access these schemes.

The amount you can borrow depends on your age and the value of your property, usually ranging from 20% for those aged 60 to 50% for those 90 and above.

There's no restriction on how the released funds are spent.

Approved by the Equity Release Council, these rules ensure that you can't owe more than the value of your home, protecting you from negative Equity.

The 'no negative equity guarantee' ensures that your debt will never exceed the value of your property.

Also, with 'lifetime mortgages', the most common type of Equity Release, you retain home ownership and the mortgage is repaid when you pass away or move into long-term care.

Who Is Eligible for Equity Release?

Equity release is not for every homeowner. Several conditions define eligibility, ranging from age requirements to specific property criteria.

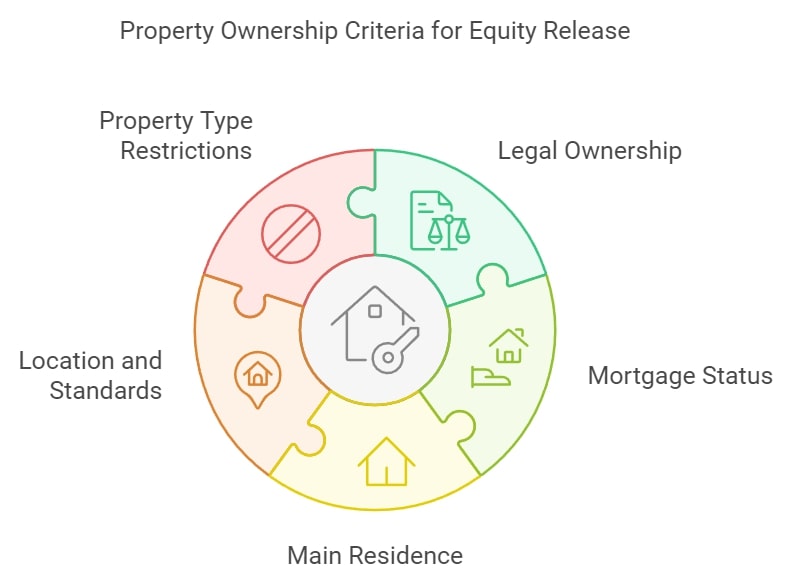

What Are the Property Ownership Criteria?

The property ownership criteria for releasing equity vary depending on the type of plan and the lender you choose.

However, some common criteria are:

- You must be the legal owner of the property and have the right to sell it.

- You must have little or no mortgage left on the property, or be able to repay it with the equity release proceeds.

- The property must be your main residence and you must live there for at least six months of the year.

- The property must be located in the UK or neighbouring islands, and meet the lender’s standards regarding its value, condition, and construction materials.

- The property must not be a retirement home, park home, or leasehold property with less than 80 years left on the lease.

These are general guidelines and may not apply to all equity release plans or lenders.

You should always check the specific criteria and eligibility requirements with your chosen provider before applying for equity release.

What Are the Rules for Using Equity Release Funds?

Equity release schemes are gaining popularity as a financial strategy among UK homeowners aged 55 and above.

However, like any significant financial choice, understanding the governing regulations of these schemes is crucial.

We will delve into the rules related to how the funds can be used. This includes a comprehensive look at their allowable applications, as well as highlighting any limitations or prohibitions that may apply.

Permissible Uses

When it comes to these plans, the UK law is quite flexible.

After you have released equity from your home, you can typically use the funds in any way you see fit.

Here are some common ways homeowners use their equity release funds:

- Debt repayment

- Home Renovations

- Holiday or leisure activities

- Providing a living inheritance

- Long-term care costs

Restrictions and Prohibitions

Although these plans offer flexibility, they also come with certain limitations.

These limitations include:

- No funds can be used for illegal activities.

- Some lenders limit use for speculative business investments.

- Gambling with these funds is often discouraged or prohibited.

It is highly recommended to steer clear of expenditures that carry a high risk. For informed decision-making, always seek guidance from a financial adviser or consult directly with your equity release provider.

What Are the Different Equity Release Products and Their Requirements?

In the UK, the 2 primary products are Lifetime Mortgages and Home Reversion plans.

Both products have their specific requirements which we will explore here.

Home Reversion Plans

This involves selling all or part of your property to a reversion company for a lump sum or regular payments.

Upon plan completion, the property is sold, and proceeds are shared based on ownership proportions.

Lifetime Mortgages

This allows homeowners to access home equity either as a tax-free lump sum or an initial sum followed by a cash reserve.

No monthly repayments are needed; the loan and interest are usually repaid upon the homeowner's death or move to long-term care.

Key features include:

- Right to Reside: Both products legally guarantee the homeowner's right to live in the property until they pass away or move into care.

- Transfer of Plan: Most Lifetime Mortgages can be transferred to a new qualifying property.

- Negative Equity Protection: This ensures homeowners will never owe more than their home's value, protecting them from any future drop in property prices.

- Options for Repayment: While regular repayments are not required, some Lifetime Mortgages offer voluntary payments. As of 28 March 2022, the Equity Release Council mandates that new Lifetime Mortgages should allow up to 10% annual voluntary repayments without penalties.2

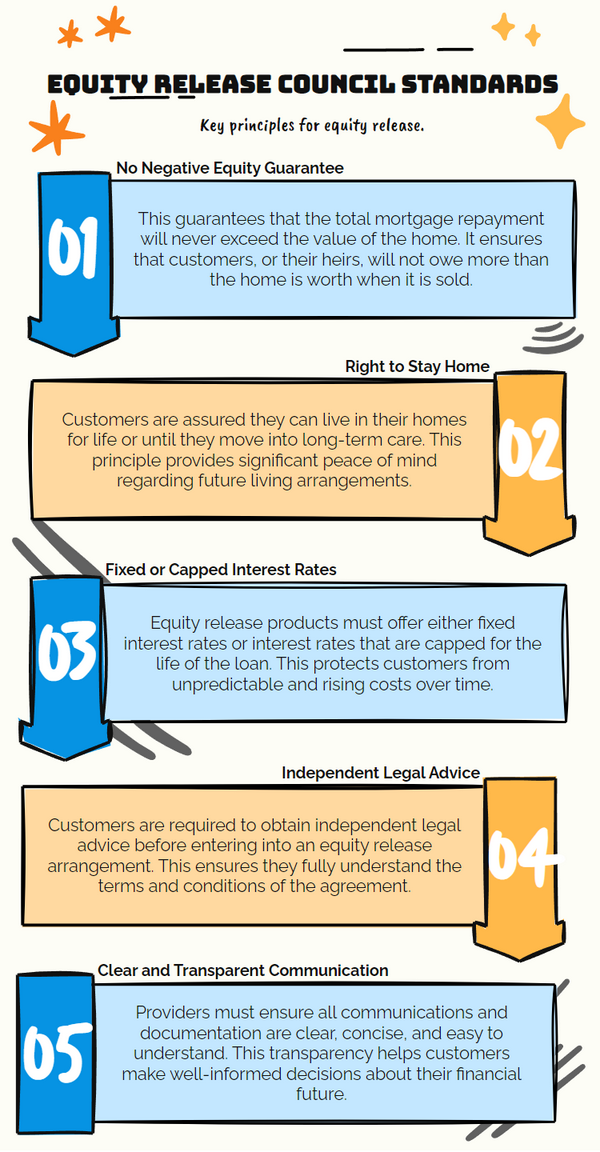

What Standards and Principles Does the Equity Release Council Enforce?

The Equity Release Council sets high standards over and above the basic regulatory requirements to ensure these products are safe and reliable for consumers.

Core Values

At its core are a series of robust standards and principles, aiming to maintain high levels of consumer protection.

These are:

- Transparency: They have to practice clear communication about costs, benefits, risks, and obligations.

- Flexibility: They must offer products catering to individual needs.

- Security: The homeowners' right to remain in their property is protected.

The guarantees offered by the ERC include:

- Positive customer outcomes

- No negative equity guarantee

- Right to property residency

- Advice from a qualified and ERC-approved advisor

- Sympathetic support during financial difficulties

What Regulations and Ethical Guidelines Must Equity Release Stakeholders Follow?

To maintain a fair and trustworthy environment in the market, several stringent regulations and ethical guidelines are in place.

The 2 primary regulatory bodies are the Financial Conduct Authority (FCA) and the Equity Release Council (ERC).

The FCA stipulates the rules for:

- Financial promotions

- Proper disclosure

- Conduct of business

- Complaint management

These areas represent just a few of the key aspects regulated by the FCA to ensure fair and transparent financial practices.

The ERC sets out standards and principles that all its members, including advisors and providers, must adhere to.

Additionally, there are crucial ethical practices that stakeholders must follow.

These include:

- Maintaining clear communication with customers

- Providing comprehensive advice

- Considering alternative solutions

- Offering personalised illustrations for a more transparent understanding of the equity release plan

How Are Equity Release Advisors Regulated?

Regulation is particularly essential when it comes to advisors as they directly interact with consumers and have the power to influence their decisions.

Regulation by FCA

In the UK, equity release advisors are regulated by the FCA, ensuring they maintain professionalism, ethical conduct, and provide clear, suitable advice to customers.

Mandatory Qualifications

For an advisor to offer advice on these products, they must have a specific qualification recognised by the FCA.

The most common is the Certificate in Regulated Equity Release (CeRER),3 but others such as the Certificate in Mortgage Advice and Practice (CeMAP) are also valid.4

Ongoing Training and Professional Growth

To keep up with the constantly evolving financial landscape, advisors are required to commit to ongoing professional development.

This includes staying updated with the latest market trends, regulations, and products through continuous training and learning.

Ethical Practices

Equity release advisors must:

- Clearly communicate complex concepts

- Provide comprehensive advice based on the client's finances, health, and future needs

- Consider alternative solutions

- Offer personalised illustrations to clarify potential impacts.

Independent Advice and Record Maintenance

Advisors should give unbiased advice based on thorough market analysis, recommending the most suitable products.

Legally, they must maintain detailed records of client interactions and decisions to ensure accountability for both parties.

What Standards Must Equity Release Providers Meet?

Providers must follow a strict set of standards that protect consumers and ensure fair treatment.

These standards encompass a range of practices, including adherence to regulatory body guidelines, maintaining transparency in communication, ensuring fair treatment of customers, and upholding responsible lending practices.

Let us delve deeper into each of these critical areas.

Compliance with FCA and ERC

Providers in the UK are regulated by the Financial Conduct Authority (FCA) and the Equity Release Council (ERC) to ensure adherence to legal and ethical standards.

Both bodies establish rigorous guidelines focused on consumer protection and market integrity. Adherence to these standards is a key indicator of a provider's credibility, offering enhanced safeguards and peace of mind for consumers.

Product Norms and Transparent Communication

Products such as lifetime mortgages require clear and transparent communication.

Providers are obligated to fully disclose all associated fees, potential risks, and the impacts on taxes, welfare benefits, and inheritance.

Such comprehensive information is crucial to ensure that customers can make well-informed decisions regarding the release of their property's value.

Fair Treatment of Customers

The FCA and ERC both mandate the fair treatment of customers.

This means that providers must not only provide high-quality, suitable products, but also treat customers honestly, fairly, and professionally at all times.

They must consider each customer's individual circumstances and provide advice that is in their best interest.

Responsible Lending Practices

Responsible lending is a cornerstone of the sector.

It is imperative for providers to not only ensure that the product aligns with the customer's specific needs but also to guarantee that the customer fully comprehends the long-term implications and commitments associated with these loans.

Complaints Procedure

Customers who are dissatisfied with their equity release product or service have the right to lodge a complaint.

It is essential for providers to offer clear, straightforward, and easily accessible procedures for filing these complaints.

What Rules Apply to Equity Release Solicitors?

In the United Kingdom, this sector is under strict regulation to safeguard consumer interests.

Solicitors, who play a crucial role in offering equity release advice, are bound by rigorous rules to ensure ethical and professional conduct in their services.

SRA or CLC Governance

Equity release solicitors fall under the regulatory oversight of either the Solicitors Regulation Authority (SRA)5 or the Council for Licensed Conveyancers (CLC).6

The SRA, serving as the regulatory body for solicitors in England and Wales, establishes and upholds the standards that solicitors must meet and maintain in their client dealings.

This authority actively monitors the conduct of both firms and individuals, and it takes decisive enforcement action in instances where these standards are not adhered to.

Similarly, the CLC oversees licensed conveyancers who specialise in providing equity release advice.

This body ensures that these professionals conduct their services with a high degree of professionalism, integrity, and competence, thereby offering robust protection and avenues for recourse to their clients.

Professional Competence and Independent Counsel

Equity release solicitors must demonstrate high standards of professional competence.

They need to understand fully the intricacies of the equity release market, including:

- The types of equity release schemes available (lifetime mortgages and home reversion plans)

- Interest rates

- Early repayment charges

- The 'no negative equity' guarantee

- The impact on the client's estate

- Entitlement to means-tested benefits

They play a crucial role in offering independent counsel, ensuring that clients are thoroughly informed about all potential options and consequences, extending beyond just those pertaining to equity release.

Ethical Considerations: Confidentiality, Due Diligence, Client Care, Transparency

Equity release solicitors are bound by several ethical principles, each critical to maintaining the highest standards of professional conduct.

These principles include:

- Confidentiality: They are entrusted with safeguarding clients' private information, ensuring that all confidential details are securely protected at all times.

- Due Diligence: It is imperative for solicitors to conduct comprehensive due diligence. This includes verifying client identities, confirming legal property ownership, and validating the accuracy of all relevant documentation.

- Client Care: Acting in the best interest of their clients is paramount. Solicitors are responsible for clearly explaining both the legal and financial aspects of equity release in an understandable way, empowering clients to make decisions that are well-informed.

- Transparency: Openness about services and fees is essential. Solicitors should provide clients with a detailed and transparent breakdown of all costs, facilitating informed financial choices.

Managing Conflicts of Interest and Record-Keeping

Solicitors are obligated to steer clear of conflicts of interest and must swiftly disclose any that may arise.

They are also required to meticulously document all client interactions, encompassing advice given, decisions made, and actions taken.

This diligent record-keeping is crucial for maintaining transparency and safeguarding the interests of both parties.

Additionally, equity release solicitors are expected to rigorously adhere to the rules and regulations established by their respective governing bodies.

What Responsibilities Come with Equity Release Council Membership?

Membership in the Equity Release Council, formerly known as SHIP (Safe Home Income Plans), comes with a set of responsibilities aimed at safeguarding homeowners' interests.

These responsibilities include:

Adherence to Principles

Members must commit to the council's Statement of Principles, which emphasises fairness, transparency, and responsibility in dealings with customers. This includes providing clear, jargon-free documentation.

Council's Standards

Members are required to comply with the ERC’s standards, which are designed to protect and inform customers.

Key aspects include offering detailed information about equity release options, ensuring a 'no negative equity guarantee', and guaranteeing customers the right to remain in their homes for life.

Regulatory Compliance with FCA

Following the Financial Conduct Authority (FCA) regulations is crucial.

This regulatory body oversees all financial services in the UK, and its guidelines include conducting thorough affordability checks and providing transparent information about the risks and benefits of equity release.

Provision of Legal Guidance

It is essential for members to ensure that customers receive independent and personalised legal advice before committing to any equity release plan.

Continual Membership

Members must consistently maintain these standards, which is verified through regular audits and ongoing training.

Non-compliance or failure to uphold these standards can lead to removal from the council.

How Are Property Valuations Conducted in the Equity Release Industry?

When considering equity release, the first step is understanding the value of your property, as it forms the foundation upon which your equity release plan will be constructed.

It is the job of a professional valuer to conduct an accurate and fair valuation.

Valuation Factors

Professional valuers assess factors like the property's age, location, size, and condition to estimate its value.

A higher valuation can mean a more significant equity release potential.

RICS Standards

Valuations must align with the standards set by RICS, a professional body emphasising high-quality valuation standards.

Only RICS-registered valuers should conduct evaluations.

Independence and Market Value

Valuations must be impartial. A surveyor's role is to provide an unbiased market value, considering factors such as property size, layout, location, recent sales, and the current housing market.

Using Comparables

'Comparables' are recently sold properties resembling the one being valued in size, location, and features. They help in deriving a realistic market value.

Physical Inspections

Surveyors conduct inspections to assess the property's actual state, considering its condition, layout, and unique features.

Valuation Reporting

After the valuation, a report detailing the findings and estimated market value is shared with the homeowner and equity release provider.

Note that valuations can be revisited under specific conditions, like increased borrowing or notable market shifts.

Common Questions

What Are the Current Equity Release Rules in the UK

How Have Equity Release Rules Changed Over the Years

Who Regulates Equity Release Rules in the UK

Can Equity Release Rules Affect My Retirement Finances

What Do I Need to Know About Equity Release Rules Before Applying

Can an Equity Release Scheme Be Transferred to a Different Property if I Decide to Move

Are There Any Specific Types of Properties That Are Not Eligible for Equity Release

What Happens to My Equity Release Plan if I Need to Move Into Long-Term Care

Is There an Option to Make Regular Payments to Reduce the Amount of Interest Rolled Up in a Lifetime Mortgage

How Often Can Property Valuations Be Updated or Reviewed Within an Equity Release Scheme

Conclusion

Understanding and adhering to equity release rules is paramount to ensure a smooth and fair process when unlocking the equity tied up in your home.

From the initial property valuation to the final release of funds, each step is governed by rules established by the Equity Release Council.

As a homeowner, being aware of these rules empowers you to navigate this complex journey with confidence and assurance.

Despite the regulatory structures in place, it is always recommended to seek the advice of an independent financial advisor who can provide guidance tailored to your individual circumstances.

After all, equity release is a significant decision that can influence your financial situation for years to come.

So, before deciding to embark on the equity release journey, make sure you have a solid grasp of the equity release rules.

Armed with this knowledge, you many need to be well-prepared to make informed decisions that are truly in your best interest. If you want to learn more about equity release rules, do not hesitate to reach out to a financial expert today.

WAIT! Before You Go...