DON'T MISS OUT! Try Our FREE Calculator Now

Quick Summary

- Eligibility for equity release is primarily determined by the value of your home and your age, often making it accessible even for those with bad credit.

- Although lenders may review your financial history, many equity release plans do not heavily prioritise credit scores; however, it's crucial to disclose any financial issues during the application process, as this can influence the terms offered.

- To enhance your chances of approval and potentially improve the terms of equity release, it's advisable to focus on reducing existing debts, maintaining timely payments on all financial obligations, and ensuring your financial report is accurate and up-to-date.

Since nearly one-fifth of the UK population have some level of bad credit, securing equity release with bad credit is not impossible.1

Some financial service providers can still accommodate consumers facing these challenges.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Our expert researchers have made an in-depth study of how releasing equity works when potential consumers are faced with poor credit scores and even bankruptcy.

So if you are struggling with these issues, read here how it can still be an option for you.

How Does Equity Release Work?

Wondering how releasing equity works? Equity release is a way for seniors to unlock the financial potential of their homes, ensuring a more comfortable and financially secure retirement.

Can I Get Equity Release with Bad Credit in the UK?

Obtaining an equity release in the UK with bad credit is indeed possible.

Lenders typically focus on the amount of equity you have in your property, rather than your credit history.

Therefore, having bad credit doesn't necessarily hinder your ability to release equity.

However, the specific terms and conditions may vary depending on the lender's policies.

It's important to note that while bad credit may not prevent you from releasing equity, it could affect the interest rates or the amount you can release.

What Is Bad Credit?

Bad credit refers to a low credit score resulting from a history of late payments, high debt levels, or other financial issues. Individuals with bad credit may face challenges in obtaining loans or credit cards, and they often incur higher interest rates when approved.

Is Your Credit Score Less than Ideal?

If you are stuck with a credit score that is less than ideal, it can severely impact your ability to borrow money.

In the UK, credit scores range from 0-999, with any score under 561 considered 'very poor' by leading credit reference agencies such as Experian.2

However, even with a low credit score, you may still be able to unlock equity from your home.

Can You Unlock Home Equity Despite a Poor Credit Score?

Yes, it is still possible to unlock equity from your home even with a poor credit score.

To qualify for equity release, most providers will place more emphasis on how much your property is worth and your age.

How Is Your Equity Release Scheme Impacted by Bad Credit?

Although bad credit may not exclude you from taking equity release, it could make that you would have to pay higher interest rates and adhere to stricter conditions.

Also

Your loan-to-value (LTV) ratio may be lower, which could reduce the amount you qualify to borrow against your home’s value.

That is why It is crucial to know your credit score and also seek professional advice.

Tackling Debt with Equity Release

You can use the loan to pay off high-interest debts, such as credit card bills and loans.

Apart from giving you immediate financial relief, it could also streamline your debts, by consolidating it into a more manageable, single, usually lower-cost repayment.

Can You Pay Off Credit Card Debt With Equity Release?

Yes, you can release equity to pay off credit card debt, especially if you are paying off multiple high-interest credit cards.

It could be possible to pay off these debts in one fell swoop, not just lowering your monthly payments, but also saving you money in the long run on interest.

However

Keep in mind that while this can ease your immediate financial situation, it essentially means that you are swapping your short-term debts for a long-term loan secured against your home.

Can You Proceed With Equity Release While in Arrears?

Yes, there are some lenders that will provide equity release while you are in arrears.

Usually providers will first expect you to clear you arrears before granting you access to additional money against your property.

However, keep in mind that it all depends on how far you are in arrears and how much equity you have available in your property.

Is Equity Release Possible with a County Court Judgement?

Yes, it is possible to obtain equity release with a County Court Judgement (CCJ),3 but it is all dependent on how strict the judgement is, and the terms and conditions of the equity release provider.

Most equity release providers will consider:

- The age of the CCJ

- The amount outstanding

- Whether repayment plans are in place

Please note, however, a CCJ would probably result in you qualifying for higher interest rates, and stricter conditions, so first seek professional advice.

How does an Individual Voluntary Arrangement (IVA) Impact Equity Release?

If you have an Individual Voluntary Arrangement (IVA)4 in place, the equity in your property may be considered an asset, which could be factored into your repayment plan.

With an IVA you have an agreement with your creditors to pay off part or all of your debts within a certain timeframe, which means you may not be able to borrow any more money, even with equity release.

Providers that may consider your application despite an ongoing IVA, will probably enforce a higher interest rate or require you to pay off the IVA with the released funds.

Does a Charging Order Affect Your Chances of Equity Release?

Yes, it does as a charging order5 places a legal claim against your property, requiring you to settle your debt before selling or releasing equity from the property.

How does that affect me?

The size of your debt would dictate the amount of equity you could release; the higher your debt, the less equity you would be able to release.

How Could Bankruptcy Impact Your Equity Release Strategy?

Bankruptcy could make it more difficult to qualify for equity release, since you would be seen as a high risk.

It could result in:

- Harsher conditions

- Lower loan-to-value ratios

- Even outright disqualification

Usually after one year of being released from bankruptcy in the UK, and can start again to rebuild your credit standing.

This means that equity release providers may consider your application, albeit with more cautious terms and conditions.

Can Equity Release be Secured Without a Credit Assessment?

Most providers will conduct a credit assessment as part of their due diligence.

However, some providers may not as equity release products are classed as a secured loan6 against your property.

Navigating the Path to Equity Release With a Poor Credit Rating

Navigating the path to equity release with a poor credit rating can be challenging, but not entirely impossible.

It is all about understanding your credit situation, seeking professional advice, and finding an understanding provider who can help structure a plan best suited to your circumstances.

Evaluating Your Credit Report

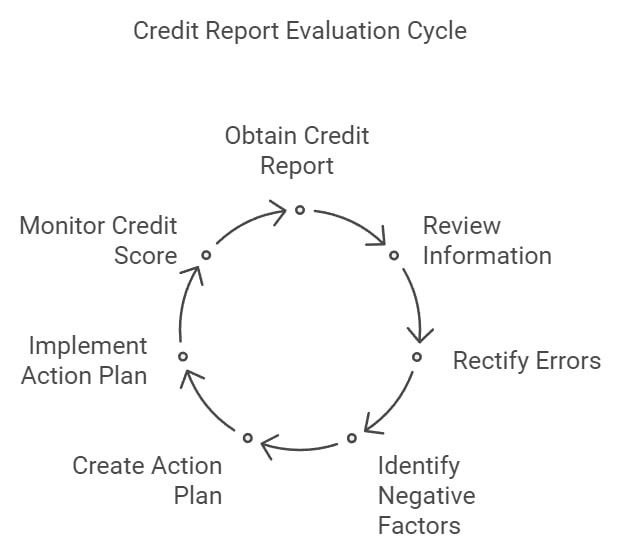

Evaluate your credit report by obtaining a copy from a reputable credit reference agency such as Experian, Equifax, or TransUnion in the UK.

Carefully review all the information, including:

- Personal details

- Financial links

- Credit accounts

- Any instances of late payments or defaults

You can improve your credit score by rectifying any errors.

Identify what it is that negatively affects your credit score and use it to create an action plan for improving your creditworthiness in future.

Consulting an Expert

It is highly recommended to consult with a financial advisor or equity release broker.

They can provide personalised advice based on your circumstances and help navigate the market.

Choosing Your Provider

Finally, it is important to choose a provider that best suits your individual needs.

Take care to not just focus on the terms of the offer, but also consider the provider’s experience in working with individuals with bad credit.

Common Questions

Can I Get Equity Release with Bad Credit in the UK

What Are the Risks of Equity Release for People with Bad Credit

How Does Bad Credit Impact Equity Release Options

Are There Any Special Equity Release Schemes for People with Bad Credit

Is It Possible to Improve My Chances for Equity Release with Bad Credit

What Steps Can I Take To Improve My Credit Score Before Applying for Equity Release

What Are the Potential Risks Involved in Equity Release for Someone With Bad Credit

Can I Repay My Equity Release Plan Early to Improve My Credit Score

If I Have Multiple Credit Issues, How Does That Affect My Ability to Get an Equity Release Plan

Can I Refinance My Equity Release Plan if My Credit Score Improves

Conclusion

Understanding the impact of your credit standing, recognising potential risks, and identifying the appropriate path forward are all important things to consider when contemplating releasing property value.

With due diligence, professional advice, and a proactive approach it is possible to overcome the challenges that come with managing bad credit.

However, if you are considering equity release with bad credit, you will need advice from a qualified financial advisor to support you in making the best decision for you.

WAIT! Before You Go...