DON'T MISS OUT! Try Our FREE Calculator Now

Home Reversion Calculator: Your Guide to Equity Release Plans in 2025

- Home reversion allows homeowners to sell a portion or all of their property in exchange for a tax-free lump sum or regular payments while retaining the right to live in it rent-free.

- This tool helps estimate the amount a homeowner could receive based on factors like property value, the percentage sold, and the homeowner’s age.

- Key variables include property market value, the proportion sold, homeowner’s age (older individuals receive more), and the provider’s discount rate.

- It provides a quick, easy estimate, helping homeowners compare options and make informed decisions before seeking professional advice.

- The calculator offers an estimate only—actual offers depend on provider-specific criteria, legal fees, and market conditions.

As homeowners approach retirement, many seek ways to enhance their financial security.

One effective method is through equity release, specifically home reversion plans, which allow individuals to access funds tied up in their properties.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This guide provides valuable insights into home reversion calculators and equity release plans, helping you understand how to make informed decisions about your financial future.

Understanding Equity Release

What is Equity Release?

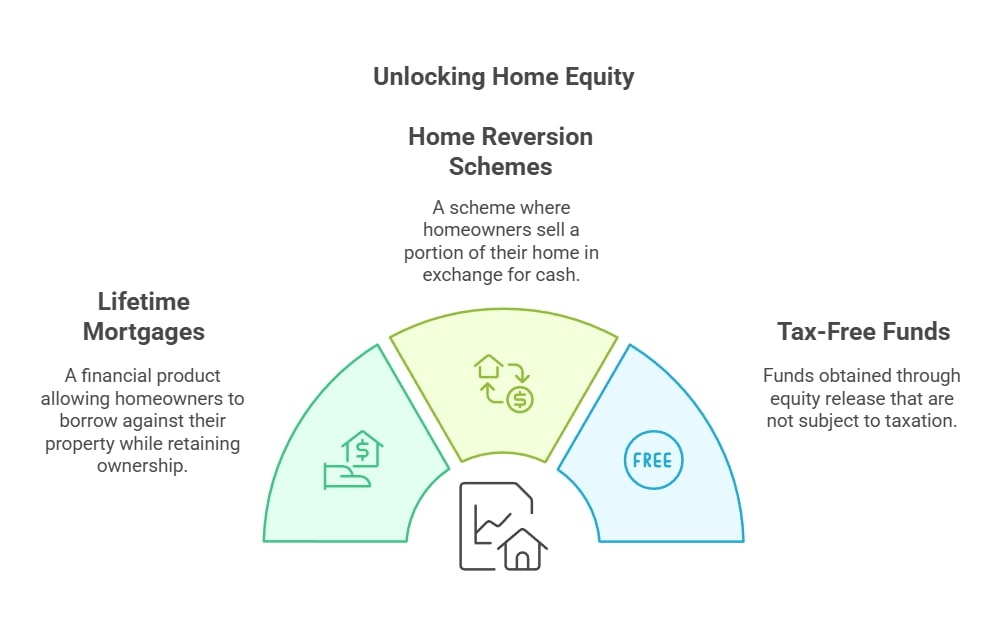

Equity release is a financial term that encompasses a range of products designed to unlock the capital invested in your home.

It allows homeowners, typically over the age of 55, to access cash from their property without needing to sell it.

There are two primary types of equity release products: lifetime mortgages and home reversion schemes.

The funds released through equity release are tax-free, providing a potential financial boost for retirement or other needs.

Types of Equity Release Plans

There are two main types of equity release plans: lifetime mortgages and home reversion plans.

A lifetime mortgage allows you to borrow against the value of your home while retaining ownership, with the loan repaid upon death or moving into long-term care.

Home reversion plans involve selling a percentage of your home to a provider in exchange for cash, while retaining the right to live in the property for life.

The amount of equity you can release varies based on factors such as age and property value, typically ranging from 30.9% to 59.3% of the property's value.

Benefits and Risks of Equity Release

Equity release can provide significant financial benefits, such as a tax-free cash lump sum or regular income to support retirement lifestyles, fund home improvements, or pay off debts.

However, there are risks involved, including the potential to reduce the inheritance left to heirs, impact on means-tested benefits, and the obligation to repay the loan or share of the property upon death.

It is essential to consider these factors carefully and consult with a financial advisor before proceeding.

Home Reversion Plans Explained

What is a Home Reversion Plan?

A home reversion plan is a type of equity release where homeowners sell a portion of their property to a mortgage company in exchange for tax-free cash.

In return, they retain the right to live in the home for life under a Lifetime Lease agreement.

The amount received is typically between 20% and 60% of the property's market value, depending on factors such as age and the percentage of the home sold.

This plan can be a suitable option for those looking to access funds without the burden of monthly repayments.

How Home Reversion Works

In a home reversion plan, the homeowner sells a share of their property to a reversion provider, receiving cash based on the percentage sold.

The homeowner can continue living in the property without paying rent.

Upon the sale of the home, the provider receives their agreed share of the proceeds.

The scheme allows for a fixed percentage of the property to be safeguarded for beneficiaries, ensuring they inherit a portion of the property value.

The plan is regulated by the Financial Conduct Authority, ensuring consumer protection.

Eligibility Criteria for Home Reversion Plans

To qualify for a home reversion plan, applicants typically must be at least 60 years old, although some providers may allow younger applicants if they have a joint application with an older individual.

The property must have a minimum value of £80,000, and the applicant must be a homeowner.

The percentage of the property sold will also depend on the applicant's age, with older individuals able to sell a larger share due to the reduced risk for the provider.

Utilising the Home Reversion Calculator

How to Use a Home Reversion Calculator

A home reversion calculator is a straightforward tool that estimates how much equity you can release from your home.

To use it effectively, you will need to input basic information such as your age, property value, postcode, and the percentage of equity you wish to release.

The calculator analyses these inputs against the lending criteria to provide an estimate of the maximum amount available as a lump sum or regular income.

This can be a useful starting point to understand your financial options and how much equity you could access.

Understanding Your Results

Results from a home reversion calculator provide an approximation of the equity you could release based on your inputs.

The output typically includes the estimated cash amount available and the percentage of the property that can be sold.

It is essential to understand that these results are not guaranteed and serve as a guide.

For a more accurate figure, consulting with a financial advisor is recommended to consider specific circumstances.

This insight can help personalize your equity release plan, ensuring it aligns with your financial goals.

Comparing with Other Equity Release Calculators

Home reversion calculators can be compared with other equity release calculators, such as those for lifetime mortgages, to evaluate different options.

Each calculator may yield different results based on the type of plan, property value, age, and other factors.

By using multiple calculators, homeowners can assess which equity release scheme best fits their financial needs and future plans.

This comparison enables individuals to make informed choices regarding releasing equity from their homes, ensuring they select the most beneficial option.

Calculating Your Equity Release Options

How Much Equity Could You Release?

The amount of equity you can release through a home reversion plan typically ranges from 20% to 60% of your home’s market value.

This percentage varies based on your age, property value, and how much of the property you wish to sell.

The older you are, the larger the share of equity you may be able to release, as providers anticipate receiving their share of the property's value sooner.

Understanding this range can help you plan effectively for your financial future.

Factors Affecting Your Equity Release Calculation

Several factors influence the amount of equity you can release, including your age, the current market value of your property, and the percentage of equity you wish to sell.

Other considerations include any existing mortgages or financial obligations, as these can affect the total amount available for release.

The specific terms and conditions of the reversion provider will also play a role in determining the final equity release amount. Recognizing these factors is crucial for accurately calculating your potential equity release.

Using a Free Equity Release Calculator

Free equity release calculators are widely available online and provide a quick way to estimate potential equity release amounts.

These calculators typically require basic information about your age, property value, and desired equity percentage.

After inputting the data, users receive instant estimates, which can help inform decisions about equity release plans.

However, it's important to remember that these calculators serve as a starting point, and personalized advice from a financial advisor is crucial for making informed choices.

This guidance ensures that your equity release strategy aligns with your overall financial objectives.

Common Mistakes to Avoid

When considering home reversion plans, potential pitfalls can arise, such as underestimating the impact on inheritance, failing to fully understand the terms of the plan, and neglecting to seek independent financial advice.

Often, homeowners overlook the long-term implications of selling a portion of their property, which could lead to a decrease in estate value.

Conducting thorough research and consulting with professionals is essential to navigate these common mistakes and make informed decisions regarding equity release.

Common Questions

What is a Home Reversion Calculator?

How accurate is a Home Reversion Calculator?

What factors influence the amount I can receive?

Do I have to sell my entire home in a home reversion plan?

Is a home reversion plan the same as equity release?

Conclusion and Next Steps

Choosing the right equity release plan necessitates careful consideration of your financial situation, needs, and goals.

Homeowners should assess various options, including home reversion plans and lifetime mortgages, to determine which best aligns with their circumstances.

Although using calculators can provide initial estimates, consulting with a financial advisor is crucial to making informed decisions and understanding the broader implications of equity release tailored to your objectives.

Consulting with an Expert

Engaging with a qualified financial advisor can greatly assist you in navigating the complexities of equity release.

Advisors can provide personalized illustrations based on your unique situation, helping you understand the benefits, risks, and potential impacts on your financial future.

Their expertise is invaluable in ensuring that you make the best choices regarding home reversion plans or other equity release options, ultimately supporting your long-term financial health.

Final Thoughts on Home Reversion Calculators

Home reversion calculators are vital tools that estimate potential equity release amounts, serving as a useful starting point for homeowners considering this financial option.

However, these calculators should not be the sole basis for decision-making.

A comprehensive understanding of the terms, risks, and implications associated with home reversion plans is crucial.

Consulting with a financial advisor can ensure homeowners make informed decisions that align with their long-term financial goals and objectives.

WAIT! Before You Go...