DON'T MISS OUT! Try Our FREE Calculator Now

Understanding Home Reversion Plans: A Comprehensive Guide for 2025

- Home reversion allows homeowners (typically 60+) to sell a portion of their property in exchange for a tax-free lump sum or regular payments while retaining the right to live there rent-free for life.

- Home reversion providers consider factors like property value, the percentage sold, the homeowner’s age, and life expectancy when determining a quote. Older homeowners generally receive better offers.

- Unlike equity release loans, home reversion involves selling a share of the property, meaning homeowners will not benefit from future value increases on the sold portion.

- Different home reversion companies offer varying rates and terms, so getting multiple quotes ensures the best deal and higher value for the retained share of the home.

- While home reversion provides financial security, it reduces inheritance value and can affect eligibility for means-tested benefits, making financial advice essential before proceeding.

As homeowners age, financial considerations often take center stage, prompting many to explore various options for securing their financial future.

One such option is a home reversion plan, a type of equity release scheme designed specifically for older homeowners.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This guide aims to elucidate the nuances of home reversion plans, providing insights into how they work, their benefits, and the factors to consider when deciding if this form of equity release is right for you.

What is a Home Reversion Plan?

A home reversion plan is an innovative form of equity release that allows homeowners aged 60 or older to sell all or part of their home in exchange for a cash lump sum or regular income.

This type of equity release is particularly beneficial for those who may have limited income but wish to access funds tied up in their property without the need to downsize.

In this arrangement, homeowners retain the right to live in their property rent-free for the rest of their life or until they move into long-term care, making it an attractive option for many seniors.

Definition of Home Reversion

Home reversion refers to a specific agreement where homeowners sell a share of their home to a home reversion provider.

In exchange, they receive a tax-free cash lump sum or regular payments.

This financial product allows individuals to unlock the value of their property while continuing to reside in it, which can be crucial for those needing additional funds for various purposes.

The arrangement ensures that homeowners can maintain their lifestyle, whether for gifting to family members, funding a holiday, or making essential home improvements.

How Home Reversion Plans Work

In a home reversion plan, the homeowner engages with a reversion company to sell a portion or even all of their property.

The home reversion provider pays a lump sum or regular income, with the homeowner allowed to live in the property rent-free.

The provider takes ownership of the sold share and receives their portion of the proceeds when the property is sold, typically upon the homeowner's death or entry into long-term care.

It is essential to note that the amount paid for the property share is generally lower than the market value, reflecting the risk associated with allowing the homeowner to continue living rent-free.

Benefits of Choosing a Home Reversion Plan

Home reversion plans present numerous advantages, with one of the most significant being the absence of monthly repayments, as these schemes do not function as loans and do not accrue interest.

Homeowners can sell a portion of their home, benefiting from potential market increases on the remaining share of their property.

This can lead to a higher cash release compared to lifetime mortgages.

Additionally, home reversion plans enable homeowners to stay in their homes, providing essential financial support without the need to relocate.

Moreover, if financial situations change, homeowners can also explore the option to sell additional shares in the future.

Types of Equity Release

Home Reversion Schemes

Home reversion schemes represent a unique type of equity release that allows homeowners to sell between 25% and 100% of their home in exchange for a cash lump sum or regular income.

This arrangement is typically available for individuals aged 60 and older, making it a viable option for seniors looking to unlock the value of their property.

The provider pays less than the market value for the property, which reflects the risk they undertake by allowing the homeowner to stay in the property rent-free as a tenant.

Importantly, this scheme is portable, meaning homeowners can move if they choose, provided they inform the reversion company of any changes in circumstances.

Lifetime Mortgages

Lifetime mortgages are more common than home reversion plans and allow homeowners to take out a loan secured against their property while retaining full ownership.

This form of equity release does not require monthly repayments; instead, the loan and accrued interest are repaid when the property is sold, typically upon the homeowner's death or entry into long-term care.

The amount that can be borrowed usually depends on the homeowner's age and health, making lifetime mortgages suitable for those under 60.

This flexibility in borrowing can provide immediate cash while ensuring homeowners maintain their right to live in their home for the rest of their life.

Alternative to Home Reversion Plans

Alternatives to home reversion plans include downsizing and other types of equity release, such as enhanced lifetime mortgages.

Downsizing involves selling the current home and purchasing a smaller property, which can provide cash for retirement without the complexities associated with equity release schemes.

Enhanced lifetime mortgages may offer higher cash releases based on health conditions or lifestyle factors, presenting another viable option for homeowners.

It is essential for individuals to explore these alternatives and seek professional financial advice to determine the best course of action aligned with their financial needs and long-term goals.

Finding the Best Home Reversion Provider

Top Home Reversion Providers in 2025

In 2025, several reputable home reversion providers will be available, each offering various products and terms tailored to different financial situations.

It is crucial to compare home reversion providers to find the best deal based on individual circumstances.

Providers should be members of the Equity Release Council and regulated by the Financial Conduct Authority (FCA), ensuring adherence to high standards of service and transparency.

Consulting an independent financial adviser can help homeowners identify the most suitable provider and equity release plan for their specific needs, ensuring a well-informed decision is made.

Criteria to Compare Home Reversion Providers

When comparing home reversion providers, homeowners should consider several factors, including the percentage of market value offered, fees and charges, customer service, and the flexibility of the plan.

It is essential to look for providers that offer transparent terms and conditions and have a solid reputation based on customer reviews and experiences.

Assessing the provider's experience and the range of equity release products they offer can ensure that they meet specific requirements and can provide the best home reversion options suited to individual needs.

Equity Release Products Overview

Equity release products encompass home reversion plans and lifetime mortgages, each featuring distinct characteristics and advantages.

Home reversion plans allow homeowners to sell part or all of their property for immediate cash while retaining the right to live in the home, ensuring continued comfort and stability.

In contrast, lifetime mortgages provide a loan secured against the property, enabling homeowners to access funds while maintaining ownership.

Understanding the differences between these products is vital for making informed decisions about which type of equity release best aligns with your financial situation and goals.

Factors Influencing Your Home Reversion Plan

Several factors can significantly influence the terms of a home reversion plan.

The homeowner's age and health status often determine the percentage of the property value that can be accessed.

Generally, older homeowners may receive a more favorable offer.

The property's condition is also assessed, as reversion providers evaluate their risk when determining the offer amount.

Additionally, market fluctuations impact these offers, with providers basing their estimates on the anticipated future value of the property, making it essential to stay informed about market trends.

Getting a Home Reversion Plan

Steps to Get a Home Reversion

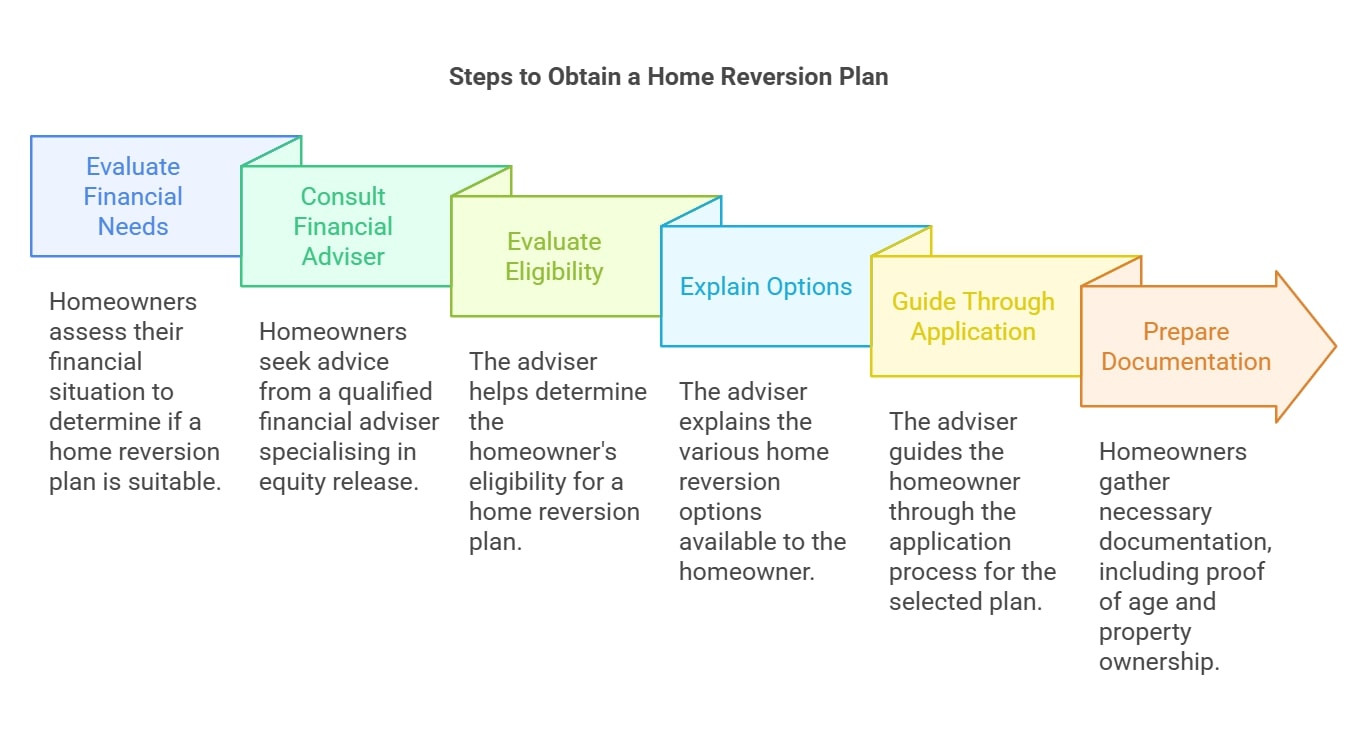

To successfully obtain a home reversion plan, homeowners should begin by evaluating their financial needs.

This assessment helps determine whether a home reversion is the right option for them.

The next crucial step involves consulting a qualified financial adviser who specialises in equity release.

This adviser will evaluate the homeowner's eligibility, explain various available options, and guide them through the application process.

Once a suitable plan is selected, homeowners will complete necessary paperwork, including property valuations and legal documentation, ensuring they are fully informed before proceeding.

Consulting with an Adviser

Engaging with a financial adviser is a vital step in navigating the complexities of home reversion plans.

These professionals provide tailored advice based on individual circumstances, helping homeowners understand the implications of entering into a home reversion agreement.

They assist in comparing different providers and products, ensuring that homeowners can make the best choice.

Selecting an adviser regulated by the Financial Conduct Authority (FCA) and a member of the Equity Release Council guarantees quality service and protection for the homeowner throughout the process.

Preparing for the Application Process

Before starting the application process for a home reversion plan, homeowners should prepare by gathering essential documentation, including proof of age and property ownership.

Understanding the specific terms and conditions of the plan is also crucial to avoid any surprises.

Homeowners must consider their long-term financial goals and how entering into a home reversion plan may impact their inheritance and state benefits.

Working closely with a financial adviser during this stage can provide clarity, ensuring that all important aspects are reviewed before moving forward with the application.

Common Questions

1. What is home reversion, and how does it work?

2. How are home reversion quotes calculated?

3. Will I still own my home if I enter into a home reversion agreement?

4. What happens to my home’s value if I enter into a home reversion agreement?

5. Are there any risks involved with home reversion?

Conclusion

Home reversion can be a valuable option for homeowners seeking financial flexibility in later life without taking on debt.

However, it’s essential to carefully consider how much of your property you’re willing to sell and compare quotes from different providers to get the best value.

Since home reversion affects property ownership, inheritance, and potential benefits, seeking professional financial advice is crucial before making a decision.

By fully understanding the terms and long-term implications, homeowners can make an informed choice that aligns with their financial goals and lifestyle needs.

WAIT! Before You Go...