DON'T MISS OUT! Try Our FREE Calculator Now

- Lifetime mortgage interest rates are influenced by factors like the borrower's age, property value, and the amount of equity accessed, varying depending on market conditions.

- Rates are typically fixed at the start of the agreement, providing financial predictability, although variable rates are also available and can change based on economic factors.

- To find the best rates, compare multiple providers, use comparison websites, seek advice from financial advisors specialising in equity release, and watch for promotions or special offers by lenders.

As homeowners age, accessing their property’s value can become crucial for financial stability.

In 2025, understanding the various lifetime mortgage interest rates and equity release options is essential for those over 55.

This article delves into the intricacies of lifetime mortgages, helping you navigate the landscape of equity release and make informed decisions regarding your financial future.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Understanding Lifetime Mortgages

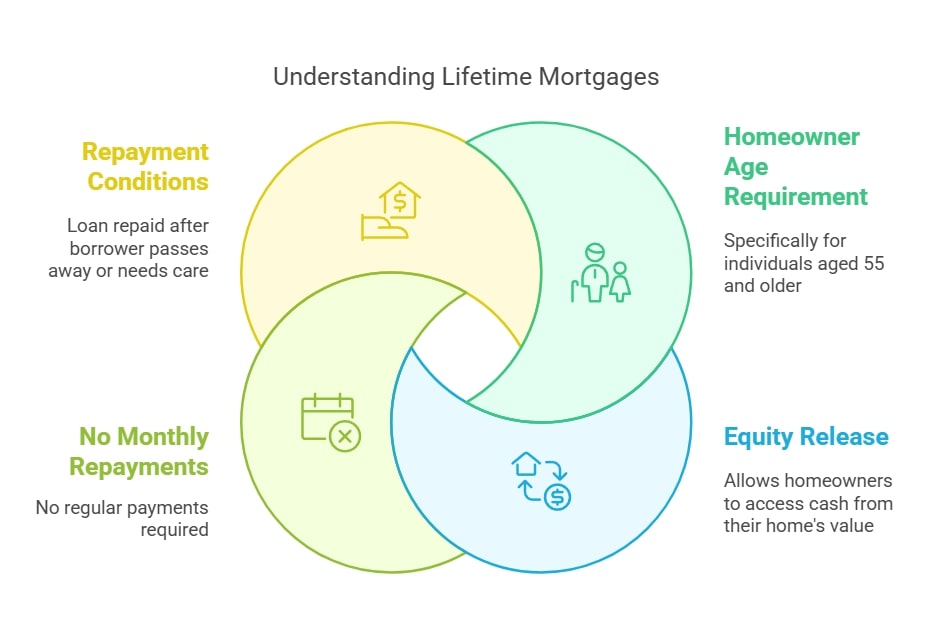

What is a Lifetime Mortgage?

A lifetime mortgage is a financial product specifically designed for individuals aged 55 and older, allowing them to secure a loan against their property.

This type of lifetime mortgage enables homeowners to release a portion of their home’s equity as cash while continuing to live in the property.

Unlike traditional mortgages, there are no monthly repayments; instead, the loan and any accumulated interest are repaid from the estate after the borrower passes away or requires long-term care.

This unique structure makes lifetime mortgages an attractive solution for retirees seeking funds without the burden of regular payments.

Types of Lifetime Mortgages

Homeowners can choose from several types of lifetime mortgages to suit their financial needs.

Lump-sum lifetime mortgages provide a one-time payment, while drawdown mortgages offer funds as needed, which minimises the interest accrued over time.

Additionally, flexible or voluntary payment options allow borrowers to manage their repayments actively, reducing the total interest owed.

Interest-payment lifetime mortgages let borrowers make monthly repayments on interest, preventing the loan balance from escalating due to compound interest.

Each variant caters to different preferences, ensuring borrowers can find the best lifetime mortgage rates that align with their financial goals.

Benefits of Choosing a Lifetime Mortgage

Opting for a lifetime mortgage comes with numerous benefits, particularly for retirees.

One significant advantage is the ability to access cash tied up in the home without needing to sell the property, which can be used for living expenses, home improvements, or other retirement costs.

The absence of monthly repayments alleviates financial pressure for those on a fixed income, allowing for greater flexibility.

Moreover, lifetime mortgages often feature a no-negative equity guarantee, ensuring borrowers or their estates will never owe more than the home's value, thereby providing reassurance and financial security for both borrowers and their beneficiaries.

Lifetime Mortgage Interest Rates in 2025

Current Trends in Interest Rates

As of 2025, lifetime mortgage interest rates in the UK typically range from approximately 5% to 7%, influenced by various factors such as the lender, borrower age, and prevailing market conditions.

Current rates are reported to be between 5.65% and 5.85%, with an average of around 6.1%.

Despite a gradual increase in rates after a period of decline, they remain below the peaks seen in previous years, making it a potentially favourable time for those considering a lifetime mortgage.

Consulting with a financial adviser is recommended to navigate these changes effectively.

Factors Affecting Lifetime Mortgage Interest Rates

Several key factors influence lifetime mortgage interest rates.

These include the borrower's age, as older individuals typically qualify for lower rates due to shorter expected loan durations.

The property value and loan-to-value ratio also play significant roles, with higher property values often leading to more favourable rates.

Additionally, market conditions, including the Bank of England's base rate and economic stability, can impact lender offerings.

Borrower health and lifestyle may also be considered, as these factors can affect the perceived risk for lenders.

Comparing Lifetime Mortgage Rates

When comparing lifetime mortgage rates, it is crucial to consider the type of interest rate offered—fixed or variable.

Fixed rates provide stability, ensuring payments remain constant throughout the loan term, while variable rates may offer lower initial costs but come with the risk of future increases.

Additionally, borrowers should evaluate the overall terms and conditions of each mortgage product, including any fees associated with setting up the mortgage and potential early repayment charges.

Consulting with multiple providers and utilising online comparison tools can help borrowers secure the most competitive rates tailored to their financial situation.

Equity Release Options for 2025

Understanding Equity Release

Equity release is a financial product that allows homeowners, typically those aged 55 and over, to access the equity in their property without having to sell it.

The two primary forms of equity release are lifetime mortgages and home reversion plans.

Lifetime mortgages enable borrowers to take out a loan against their home value, while home reversion plans involve selling a portion of the home to a lender in exchange for a lump sum or regular payments.

Equity release can provide significant financial flexibility, allowing retirees to fund their retirement while continuing to live in their homes.

Different Types of Equity Release

The two main types of equity release products are lifetime mortgages and home reversion plans.

Lifetime mortgages allow homeowners to borrow against their property, with the loan and accrued interest repaid upon death or moving into care.

Home reversion plans involve selling a share of the home to a lender in exchange for cash, with the homeowner retaining the right to live in the property.

Each type comes with its own set of advantages and considerations, making it essential for homeowners to assess their individual circumstances and financial goals when choosing an equity release option.

Best Equity Release Options Available

In 2025, the best equity release options typically feature competitive interest rates ranging from 4% to 8%, influenced by factors such as the provider, product type, and market conditions.

Homeowners are encouraged to compare offers from multiple lenders to find the most suitable deal for their financial needs.

Many lenders now offer flexible features, such as the ability to make voluntary repayments or drawdown options that allow for gradual access to funds.

Consulting with a qualified equity release adviser can help homeowners navigate the various products available and find the best solution tailored to their circumstances.

Calculating and Comparing Interest Rates

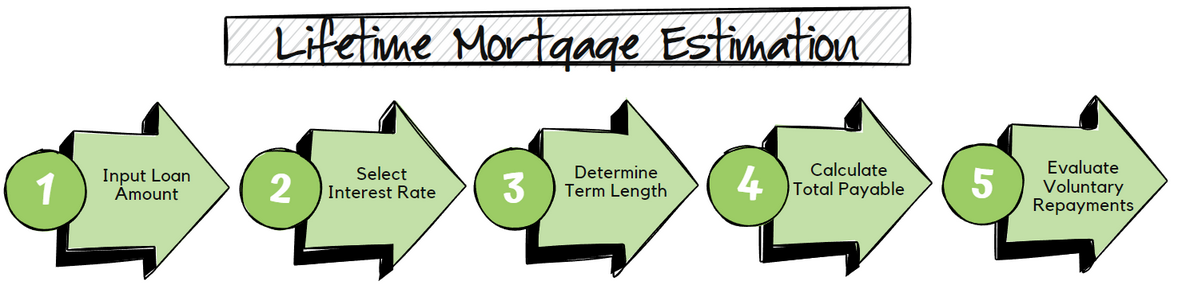

Using a Lifetime Mortgage Calculator

To effectively estimate the total costs associated with a lifetime mortgage, utilising a lifetime mortgage calculator can be highly beneficial.

These tools allow borrowers to input their desired loan amount, interest rate, and term length to generate an estimate of the total amount payable over the life of the mortgage.

Many lenders provide these calculators on their websites, making it easy for potential borrowers to assess their options.

Additionally, calculators can help determine the impact of making voluntary repayments on the overall loan balance, providing clearer insights into long-term financial implications.

How to Compare Equity Release Interest Rates

When comparing equity release interest rates, borrowers should consider both the nominal interest rate and the effective annual rate (AER), which accounts for compounding interest.

It is also essential to evaluate the terms and conditions associated with each product, including any fees, early repayment charges, and the flexibility of repayment options.

By reviewing offers from multiple lenders and utilising online comparison tools, homeowners can make informed decisions that align with their financial goals.

Consulting with an independent financial adviser can further enhance the comparison process, ensuring borrowers understand the nuances of each product.

Average Interest Rates and What They Mean

The average interest rates for lifetime mortgages currently hover around 6.1%, with variations depending on the lender and specific terms.

Understanding the implications of these rates is crucial, as they directly affect the total amount payable over the life of the mortgage.

Higher interest rates can lead to faster debt growth, diminishing the equity available in the home over time.

Borrowers should carefully evaluate their financial situation and consider the long-term effects of the chosen interest rate, as it can significantly impact their estate and beneficiaries.

Future Predictions for Lifetime Mortgages

Interest Rates Forecast for December 2025

Forecasts for lifetime mortgage interest rates in December 2025 suggest a potential increase due to anticipated economic conditions and central bank policies.

As the Bank of England continues to adjust its base rate in response to inflation and economic stability, lifetime mortgage rates may follow suit.

Borrowers are advised to stay informed about market trends and consult with financial advisers to navigate these changes effectively.

Understanding potential rate fluctuations can help homeowners make timely decisions regarding equity release and lifetime mortgages.

Impact of Economic Factors on Mortgage Rates

Economic factors such as inflation, employment rates, and overall market stability significantly impact lifetime mortgage interest rates.

During periods of economic growth, rates may be more favourable, reflecting lower risk for lenders.

Conversely, in times of economic uncertainty, rates may rise as lenders seek to mitigate risk exposure.

The Bank of England's monetary policy, particularly changes to the base rate, also plays a crucial role in shaping mortgage rates.

Homeowners considering a lifetime mortgage should remain vigilant about these economic indicators to make informed financial decisions.

Advice for Prospective Borrowers

Prospective borrowers considering a lifetime mortgage should conduct thorough research and seek professional advice before making a decision.

Consulting with an independent financial adviser can provide valuable insights into the various products available and help assess individual financial circumstances.

It is essential to understand the long-term implications of taking out a lifetime mortgage, including how interest rates may affect home equity and estate planning.

Additionally, comparing offers from multiple lenders and evaluating the terms and conditions can help secure the best deal tailored to specific needs.

Common Questions

1. What factors influence lifetime mortgage interest rates?

2. Are lifetime mortgage interest rates fixed or variable?

3. How do rising interest rates impact lifetime mortgages?

4. Can I switch to a better lifetime mortgage rate later?

5. How can I find the best lifetime mortgage interest rate?

Conclusion

Lifetime mortgage interest rates are influenced by various factors, including inflation, the Bank of England’s base rate, and lender policies.

While rates have fluctuated in recent years, current trends suggest a gradual stabilisation, offering retirees more predictable options.

Understanding these trends is crucial for homeowners considering equity release, as even small rate changes can impact long-term costs.

Before committing, it’s essential to compare lenders, assess fixed vs. variable rates, and seek independent financial advice.

By staying informed, retirees can make confident decisions about unlocking their home’s value while managing future financial security.

WAIT! Before You Go...