DON'T MISS OUT! Try Our FREE Calculator Now

- Lenders offering enhanced lifetime mortgages may consider an applicant's medical history to assess their life expectancy and determine eligibility. Conditions like cancer, heart disease, or diabetes can result in a higher loan amount due to the potential for a shorter lifespan.

- With medical conditions, individuals may qualify for a larger loan, as their reduced life expectancy can lead to a quicker repayment. This makes enhanced lifetime mortgages a useful financial tool for those with specific health concerns.

- Enhanced lifetime mortgages offer tailored financial solutions based on medical needs. Applicants can use this option to secure additional funds for healthcare costs, home modifications, or lifestyle improvements in retirement.

- Lenders assess both current and historical medical information to offer a fair loan, but applicants should understand how health improvements or deterioration could affect their mortgage terms over time. Regular updates to health conditions may be required.

As homeowners age, they often seek ways to leverage their property to enhance their retirement lifestyle.

Enhanced lifetime mortgages and equity release schemes present viable options for homeowners aged 55 and over.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

In this article, we will delve into the details of these financial products, especially focusing on the features, types, and workings of lifetime mortgages, as well as their relevance in the evolving landscape of 2025.

What is a Lifetime Mortgage?

A lifetime mortgage is a unique financial product that enables homeowners aged 55 and over to borrow against the equity in their property without the need for immediate repayment.

This equity release plan allows individuals to access cash release while maintaining ownership of their home.

The amount available to borrow generally hinges on the homeowner's age and the property value.

Key features of a lifetime mortgage include the option to receive a lump sum or regular payments, a negative equity guarantee, and no requirement for monthly repayments.

The loan, along with accrued interest, is typically repaid only when the homeowner passes away or moves into long-term care, making it an attractive option for those looking to release equity from their home.

Types of Lifetime Mortgages

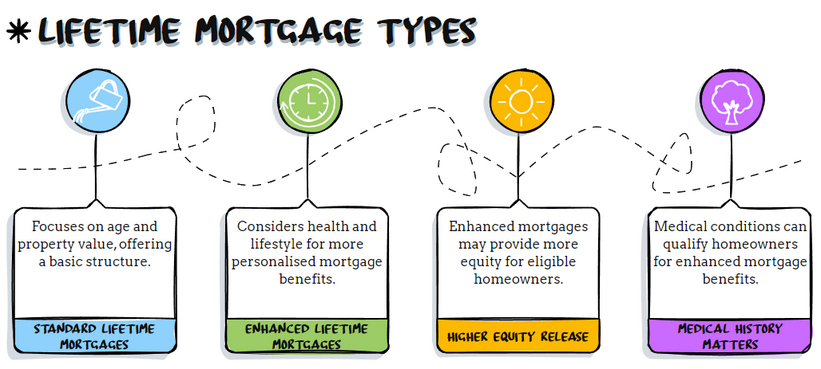

There are primarily two types of lifetime mortgages: standard lifetime mortgages and enhanced lifetime mortgages.

Standard lifetime mortgages mainly consider the homeowner's age and property value, while enhanced lifetime mortgages offer more tailored benefits by taking into account the individual's health and lifestyle factors.

Homeowners who are eligible for an enhanced lifetime mortgage may be able to release a higher amount of equity, which is particularly beneficial for those with a medical history or certain medical conditions.

Additionally, lifetime mortgages can be structured as lump sum plans or drawdown facilities, where funds can be accessed as needed, allowing for greater flexibility in managing finances.

How a Lifetime Mortgage Works

In a lifetime mortgage scenario, the homeowner borrows money secured against their property, with the loan amount determined by various factors such as the homeowner's age and the property's value. Interest on the loan is typically compounded, meaning it accumulates over time and is added to the total amount owed.

The structure of a lifetime mortgage ensures that homeowners retain ownership of their property and can live in it for as long as they wish.

Upon the homeowner's death or transition to long-term care, the property is usually sold to settle the debt.

Understanding how a lifetime mortgage works is essential for those considering equity release in 2025, especially if they wish to qualify for an enhanced equity release scheme based on their unique circumstances.

Enhanced Lifetime Mortgages Explained

An enhanced lifetime mortgage is a specialised form of equity release that allows homeowners with certain health conditions or lifestyle factors to access a larger amount of equity from their home.

This type of mortgage considers medical history, including specific medical conditions and lifestyle choices, such as smoking, when determining the loan amount.

As a result, individuals with potentially shorter life expectancies may qualify for a higher loan-to-value ratio compared to standard lifetime mortgages, making this option attractive for those looking to maximise their cash release.

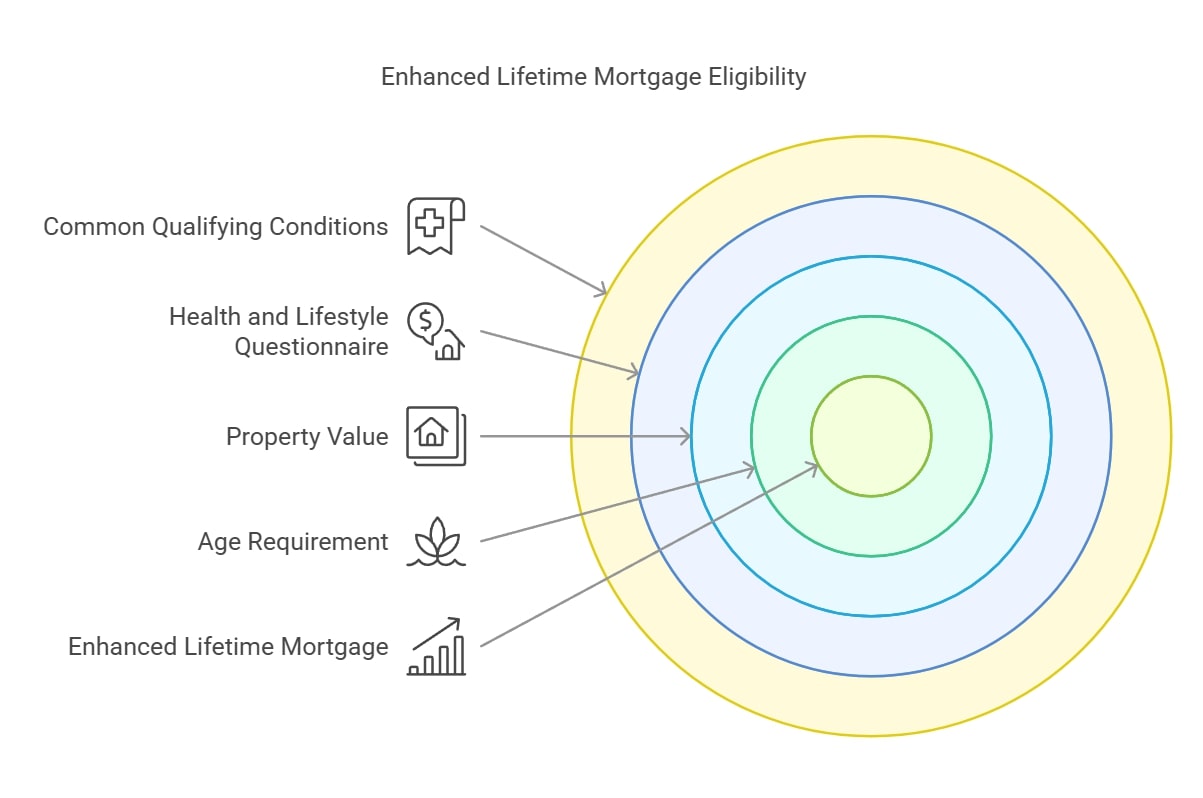

Eligibility Criteria for Enhanced Lifetime Mortgages

To qualify for an enhanced lifetime mortgage, applicants typically need to be at least 55 years old and own a property valued at £70,000 or more.

Additionally, they must complete a health and lifestyle questionnaire that assesses their medical history and lifestyle factors.

Common qualifying conditions include diabetes, high blood pressure, certain types of cancer, and a history of smoking.

Lenders evaluate these factors to determine the potential loan amount, ensuring that those eligible for enhanced terms can effectively release equity from their homes.

Medical History Considerations

Medical history is crucial when applying for an enhanced lifetime mortgage, as lenders closely examine various health conditions that could impact life expectancy.

Conditions such as heart disease, diabetes, and cancer, combined with lifestyle choices like smoking and alcohol consumption, are critical in this assessment.

Applicants typically provide this information through a health questionnaire, which helps lenders determine the appropriate loan amount.

Notably, while a medical examination is often not required, some applicants may need to submit medical records for verification purposes.

Understanding Equity Release

Equity release is a financial solution that enables homeowners to access the equity built up in their properties, allowing them to obtain cash without the need to move.

The two primary forms of equity release in the UK are lifetime mortgages and home reversion plans.

With equity release, homeowners can receive a lump sum or regular payments, and these funds are generally tax-free.

The loan is repaid when the homeowner passes away or moves into long-term care, with the property typically sold to cover any outstanding debt, ensuring a negative equity guarantee.

Types of Equity Release Available

The main types of equity release available to homeowners are lifetime mortgages and home reversion plans.

Lifetime mortgages enable homeowners to borrow against the value of their property while retaining ownership, with repayment occurring upon death or entry into long-term care.

In contrast, home reversion plans involve selling part or all of the home to a provider in exchange for a lump sum or regular income, allowing homeowners to live in the property rent-free until a specified event occurs.

Each option presents different implications for ownership and repayment, catering to diverse homeowner needs.

How to Qualify for an Enhanced Equity Release Plan

Qualifying for an enhanced equity release plan generally requires homeowners to be at least 55 years old and own a property valued at £70,000 or more.

Applicants must complete a health and lifestyle questionnaire designed to identify any qualifying health conditions that could lead to a higher loan amount.

Factors such as age, property value, and specific medical conditions are thoroughly assessed to determine eligibility and the potential amount that can be released. Consulting with an equity release adviser can greatly facilitate navigating the qualification process and ensuring the best options are considered for those looking to release equity from their homes.

Benefits of Enhanced Equity Release

Potential Increase in Equity Release Amount

One of the primary benefits of enhanced equity release is the potential for a higher loan amount compared to standard lifetime mortgages.

This is particularly advantageous for individuals with specific health conditions or lifestyle factors that may lead to a shorter life expectancy.

By considering these factors, lenders can offer a more favorable loan-to-value ratio, allowing homeowners to access a larger portion of their property's equity. This increased access to funds can provide greater financial flexibility for various needs, such as healthcare costs, home improvements, or even travel expenses, thereby enhancing the quality of life during retirement.

Medically Enhanced Options

Medically enhanced options in equity release allow individuals with health conditions to unlock more equity from their homes.

These options are designed to support those who may have shorter life expectancies due to medical issues, enabling them to access additional funds that can be used for healthcare, home modifications, or other financial needs.

The assessment process focuses on the individual's health and lifestyle, allowing for personalized loan amounts based on their unique circumstances.

By tailoring the equity release scheme to the borrower's medical history, enhanced lifetime mortgages can provide solutions that directly align with their financial and personal needs, ensuring a more secure retirement.

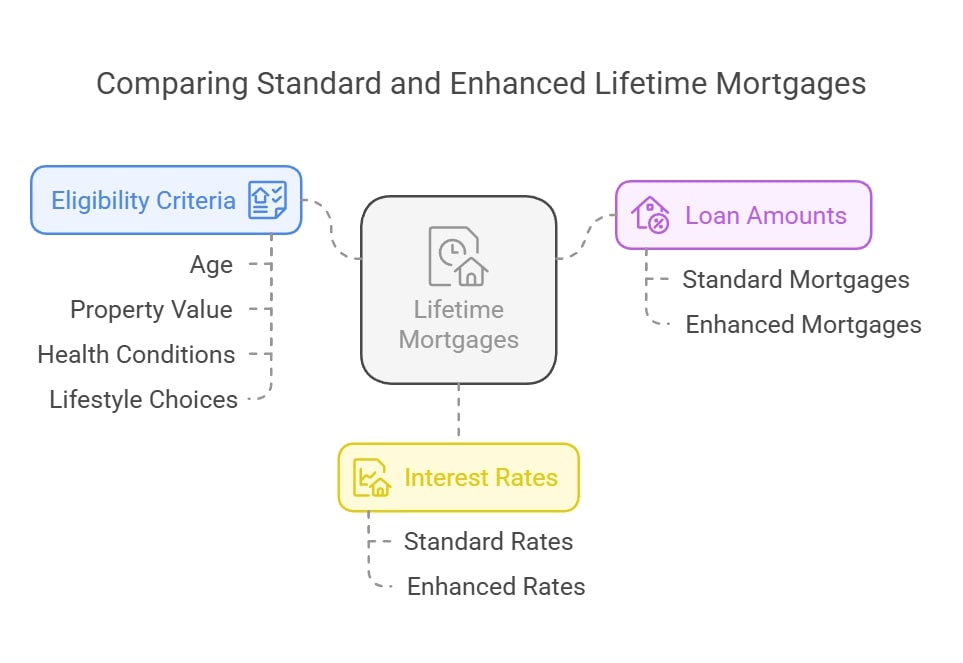

Comparing Standard vs Enhanced Terms

When comparing standard lifetime mortgages to enhanced lifetime mortgages, the key differences lie in the eligibility criteria and potential loan amounts.

Standard lifetime mortgages primarily consider age and property value, while enhanced mortgages factor in health conditions and lifestyle choices, often resulting in higher borrowing limits.

Additionally, enhanced lifetime mortgages may offer lower interest rates due to the perceived risk associated with shorter life expectancies.

Understanding these differences is essential for homeowners when selecting the most suitable equity release option.

By evaluating both types of equity release, individuals can make informed decisions that maximize their financial outcomes and align with their long-term goals.

Disadvantages of Enhanced Lifetime Mortgages

Interest Rates and Costs

Enhanced lifetime mortgages may come with higher interest rates compared to standard plans, which can lead to increased overall costs over time.

Additionally, borrowers should be aware of various fees associated with securing an enhanced mortgage, including valuation fees, arrangement fees, and potential early repayment charges.

It is crucial for homeowners to thoroughly understand these costs and how they will impact the total amount owed upon repayment, which typically occurs when the homeowner passes away or enters long-term care.

By assessing these costs upfront, homeowners can better plan their finances and avoid unexpected financial burdens down the line.

Impact on Inheritance

Taking out an enhanced lifetime mortgage can significantly impact the inheritance left for beneficiaries.

Since the loan amount, along with accrued interest, is repaid from the sale of the property after the homeowner's death, the value of the estate may be reduced.

Homeowners who prioritize leaving a substantial inheritance may need to carefully consider the implications of equity release and explore options such as inheritance protection plans, which allow them to ring-fence a portion of their home's value for their heirs.

By understanding the potential effects on their estate, homeowners can make more informed decisions about their financial future and the legacy they wish to leave behind.

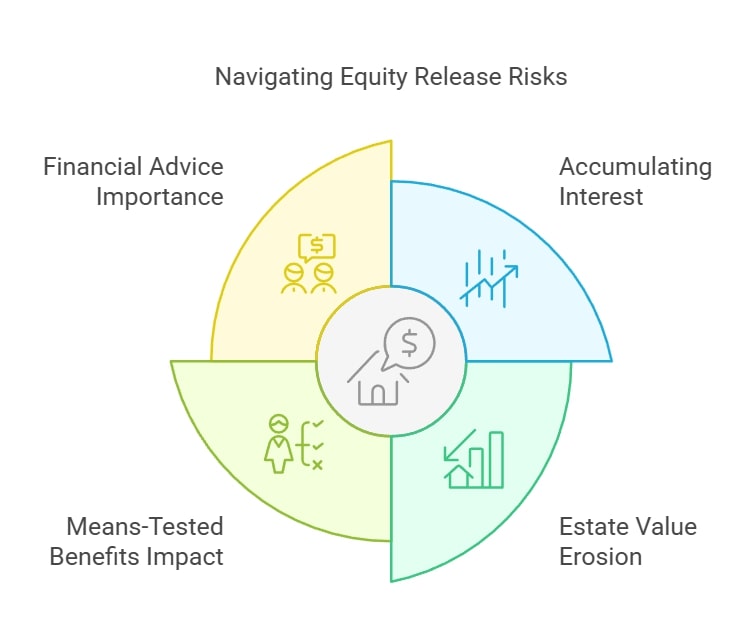

Potential Risks of Equity Release

Equity release, including enhanced lifetime mortgages, carries certain risks that homeowners should be aware of.

One significant risk is the potential for accumulating interest to erode the value of the estate over time, leading to less equity available for beneficiaries.

Additionally, receiving a lump sum from equity release can affect eligibility for means-tested benefits, which may have long-term financial implications.

Homeowners are encouraged to seek independent financial advice to fully understand these risks before proceeding with an equity release plan.

By being informed of these potential pitfalls, individuals can better navigate the complexities of equity release and make choices that suit their financial circumstances.

Getting an Equity Release Quote

To obtain an equity release quote, homeowners should consult with a qualified financial advisor or an equity release specialist who can assess their individual circumstances.

The process typically involves providing information about the property, financial needs, and health conditions.

Advisors will then search for suitable equity release options from various providers to present personalized quotes that reflect the homeowner's eligibility and desired loan amount.

It's essential to compare quotes and understand the terms before making a decision.

Factors Affecting Your Quote

Several factors influence the equity release quote a homeowner may receive, including the age of the applicants, the value of the property, and any outstanding debts secured against it.

Additionally, health conditions and lifestyle factors can significantly impact the potential loan amount, especially for enhanced lifetime mortgages.

Lenders will assess these variables to determine the maximum amount available for release and the associated interest rates, making it crucial for homeowners to disclose accurate information during the application process.

Understanding Offers for Enhanced Lifetime Mortgages

When evaluating offers for enhanced lifetime mortgages, homeowners should carefully review the terms and conditions, including interest rates, repayment options, and any associated fees.

It's important to understand how the loan amount is calculated based on health and lifestyle factors, as well as the implications for future repayments.

Homeowners should also inquire about any potential early repayment charges and the process for accessing funds, whether as a lump sum or through a drawdown facility.

Repaying an Enhanced Lifetime Mortgage

Repayment terms for enhanced lifetime mortgages typically stipulate that the loan, along with any accrued interest, is repaid when the homeowner passes away or moves into long-term care.

Homeowners have the option to make voluntary interest payments during the term to prevent the loan from growing significantly.

However, these payments are not mandatory, and many choose to roll up interest, which compounds over time.

Understanding these terms is crucial for homeowners to plan their finances effectively.

Options for Repaying an Enhanced Lifetime Mortgage

While enhanced lifetime mortgages are primarily repaid through the sale of the property, homeowners may have options for early repayment.

Some plans allow for partial repayments without incurring penalties, while others may impose early repayment charges (ERCs) if the loan is paid off in full before the agreed-upon time.

Homeowners should carefully review their mortgage terms and discuss repayment options with their lender or advisor to ensure they understand the implications of early repayment.

What Happens After Repayment?

After repaying an enhanced lifetime mortgage, homeowners typically retain any remaining equity in their property, which can be passed on to beneficiaries or used for other financial needs.

The property is sold to cover the loan amount, including any accumulated interest, and any surplus funds are distributed according to the homeowner's wishes.

It's essential for homeowners to communicate their plans with their beneficiaries to ensure a clear understanding of the estate's financial situation following the sale of the property.

Common Questions

1. What is an enhanced lifetime mortgage?

2. How does my medical history affect my eligibility for an enhanced lifetime mortgage?

3. Can I get an enhanced lifetime mortgage if I am in good health?

4. Do I need to provide evidence of my medical condition?

5. What happens if my health improves or worsens after I take out an enhanced lifetime mortgage?

Conclusion

Enhanced lifetime mortgages offer a valuable financial option for individuals with specific medical histories, providing access to higher loan amounts based on life expectancy.

By factoring in medical conditions, these mortgages allow for personalized financial solutions that can support healthcare needs and improve quality of life in retirement.

However, it's important for applicants to understand how their health can influence both eligibility and loan terms, as changes in medical conditions could impact the loan's value.

Overall, for those with qualifying medical histories, enhanced lifetime mortgages can provide significant financial support tailored to individual needs.

WAIT! Before You Go...