DON'T MISS OUT! Try Our FREE Calculator Now

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

How to Get a Mortgage in Your 60s: A Guide to Mortgages for Over 60s

Securing a mortgage in your 60s can feel daunting, but with the right knowledge and preparation, it is entirely achievable.

Many lenders are now offering mortgage products specifically designed for older borrowers, allowing individuals in this age bracket to access the funds they need.

This guide will explore the types of mortgages available, how to improve your chances of approval, and what to consider before taking out a mortgage.

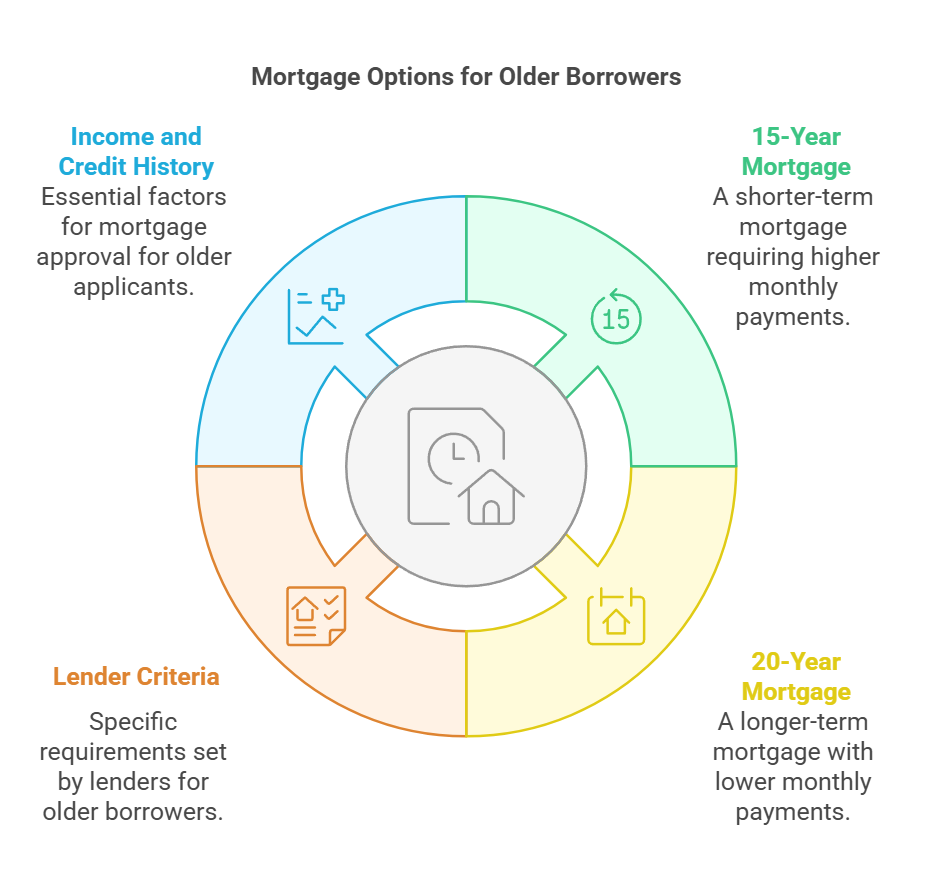

Understanding Mortgages for Older Borrowers

For those over 60, understanding the nuances of the mortgage market is essential. A mortgage for over 60s may present more challenges than for younger applicants, but that doesn’t mean securing one is impossible.

Many lenders recognize the growing need for products tailored to older borrowers. Although there is no formal age limit for applying for a mortgage, most lenders establish their criteria, often requiring repayment of the mortgage by the applicant's 75th or 80th birthday.

Consequently, a 60-year-old might qualify for a 15- or 20-year mortgage if they can demonstrate adequate income and a strong credit history.

What is a Mortgage for Over 60s?

A mortgage for over 60s is specifically designed to cater to older individuals looking to take out a mortgage. While applying for a mortgage in this age range may come with its challenges, it is important to note that many lenders are adapting to meet the needs of this demographic.

The mortgage term may be shorter, and lenders will often consider the maximum age at which the mortgage must be repaid. However, if you maintain a good credit record and demonstrate the ability to keep up repayments, the chances of getting a mortgage can be favorable.

Types of Mortgages Available in Your 60s

Older borrowers have several mortgage options at their disposal, each catering to unique needs and circumstances.

Traditional repayment mortgages can be sustained until the borrower is over 80, while interest-only mortgages may require a plan for capital repayment at the end of the term.

Retirement Interest Only Mortgages (RIOs) allow for indefinite interest payments, with capital repaid upon death or moving into care.

Additionally, lifetime mortgages, a form of equity release available from age 55, do not necessitate monthly repayments, while Home Reversion Plans enable homeowners to monetise part of their property while retaining the right to live in it.

Lifetime Mortgages Explained

A lifetime mortgage is a popular form of equity release that allows homeowners to access cash tied up in their property without selling it. This option is particularly appealing for those in their 60s who wish to supplement their pension or finance retirement plans.

Instead of making monthly repayments on your mortgage, interest accumulates and is settled when the homeowner passes away or moves into long-term care.

Typically available to those aged 55 and over, lifetime mortgages come with a no-negative-equity guarantee, ensuring that borrowers will never owe more than their home’s value, though it is vital to consider the implications for inheritance and means-tested benefits before proceeding.

Getting a Mortgage at 60: Your Options

Traditional Mortgages vs. Later Life Mortgages

When considering how to get a mortgage at 60, it's crucial to understand the differences between traditional mortgages and later life mortgages.

Traditional mortgages may still be offered to older borrowers; however, many lenders impose an age limit on the maximum age for repayment, typically ranging from 70 to 85 years. This can result in stricter eligibility criteria and potentially higher interest rates.

Conversely, later life mortgages, such as retirement interest-only (RIO) mortgages and lifetime mortgages, are tailored for older individuals, often featuring more flexible requirements that may not necessitate proof of regular income. This accessibility is vital for retirees who wish to secure financing without the burden of traditional repayment schedules.

Interest-Only Mortgages for Older Borrowers

Interest-only mortgages can be an appealing option for older borrowers seeking flexibility in their mortgage repayments. These types of mortgages allow individuals to pay only the interest on the loan for a specified period, with the principal amount due at the end of the mortgage term.

For older borrowers in their 60s, obtaining an interest-only mortgage is viable, provided they create a clear repayment strategy for the capital. Many lenders accept applications from individuals up to the age of 80, but it is essential for borrowers to articulate a solid plan for repaying the principal, such as selling the home or utilising savings or investments.

How to Remortgage in Your 60s

Remortgaging can prove beneficial for those in their 60s, especially when it results in lower interest rates or improved terms. Common motivations for older borrowers to remortgage include obtaining a more favourable rate when a fixed term concludes, raising capital for investments, or consolidating existing debts.

It is crucial for older applicants to carefully assess their financial situation, ensuring they explore options that best align with their needs.

Whether switching to a better deal with their current lender or seeking a new lender that offers advantageous terms for older borrowers, a strategic approach to remortgaging can enhance the chances of approval and financial stability.

Factors Influencing Your Chances of Getting a Mortgage

Age and Its Impact on Mortgage Application

Age plays a significant role in the mortgage application process, particularly for older borrowers. As individuals approach retirement, lenders may view them as higher risk due to the possibility of reduced income.

This perception can result in stricter lending criteria, including maximum age limits by which the mortgage must be repaid. While some lenders extend repayment terms into retirement, others may require the loan to be settled before the borrower reaches a certain age. Consequently, this can limit the options available for older applicants seeking to secure a mortgage in their 60s.

Affordability Considerations for Older Borrowers

Affordability is a critical aspect that lenders scrutinise when assessing mortgage applications from older borrowers. They will evaluate the applicant's income, which may comprise pensions, investments, or part-time employment, alongside their debt-to-income ratio.

A substantial part of the assessment focuses on the individual's ability to meet mortgage repayments once they retire, which may necessitate providing proof of expected retirement income or savings.

Therefore, maintaining a strong financial profile is essential for enhancing the chances of getting a mortgage, as it demonstrates the ability to manage the financial obligations associated with a mortgage in later life.

The Role of Pension Income in Mortgage Applications

Pension income plays a pivotal role in the mortgage application process for older borrowers. Lenders often require documentation proving pension income to ensure that applicants can sustain their mortgage repayments during retirement.

This may include pension statements or forecasts that outline expected income levels. A robust pension plan can significantly improve an applicant's chances of securing a mortgage, as it provides a reliable source of income that can comfortably cover ongoing mortgage payments.

As older borrowers navigate the mortgage market, demonstrating stable pension income can be a key factor in obtaining favourable mortgage terms.

Equity Release and Other Mortgage Products

What is Equity Release?

Equity release is a financial product that allows homeowners, typically over the age of 55, to access the cash tied up in their property without having to sell it.

The most common types of equity release are lifetime mortgages and home reversion plans. With a lifetime mortgage, borrowers can receive a lump sum or regular payments, with the loan and interest repaid when the homeowner passes away or moves into care.

Home reversion plans involve selling part of the home to a provider in exchange for a cash lump sum while retaining the right to live in the property.

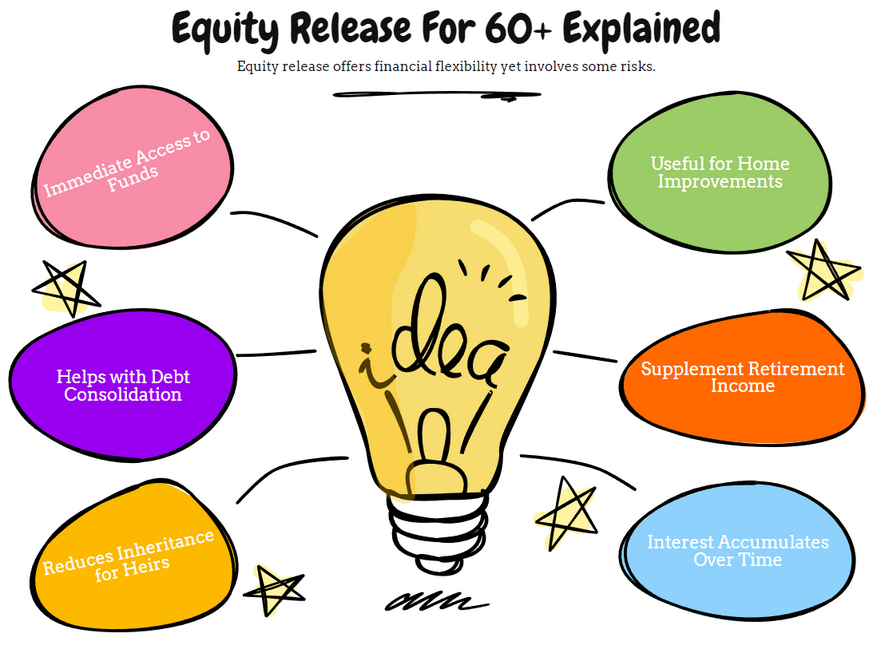

Pros and Cons of Equity Release for Over 60s

Equity release can provide older homeowners with access to funds for various purposes, such as home improvements, debt consolidation, or supplementing retirement income.

However, there are significant downsides to consider, including the potential reduction of inheritance for heirs and the accumulation of interest over time, which can lead to owing more than the property's value.

It is essential for individuals to seek independent financial advice before proceeding with equity release to fully understand the implications.

Comparing Equity Release with Traditional Mortgages

When comparing equity release with traditional mortgages, key differences arise in terms of repayment and eligibility. Traditional mortgages require monthly repayments and are often tied to the borrower's income, while equity release products typically do not require regular payments, allowing the loan to accumulate until the homeowner passes away or sells the property. However, equity release can be more expensive in the long run and may affect eligibility for means-tested benefits, making it crucial for borrowers to weigh their options carefully.

Preparing to Apply for a Mortgage in Your 60s

Documentation Needed for Mortgage Application

When applying for a mortgage in your 60s, lenders will require various documents to assess your financial situation. Essential paperwork includes proof of identity, such as a driver's license or passport, utility bills for address verification, and income statements, including payslips and bank statements from the last three to six months. If you are nearing retirement, it is also advisable to provide documentation regarding your pension income or any other expected sources of income during retirement.

Finding the Right Lender for Your Needs

Finding a lender that understands the unique needs of older borrowers is crucial for securing a mortgage. Many lenders have specific products tailored for those over 60, and working with a mortgage broker can help identify the best options. Brokers can navigate the lending landscape, ensuring that borrowers are matched with lenders that have more flexible age criteria and favorable terms. It's important for borrowers to research potential lenders thoroughly and consider their own financial circumstances before making a decision.

Improving Your Chances of Approval

To enhance the likelihood of mortgage approval, older borrowers should take proactive steps to improve their financial profile. This includes checking and improving their credit score, ensuring they have a stable source of income, and saving for a larger deposit, which can make them more attractive to lenders. Additionally, having all necessary documentation organized and ready for submission can streamline the application process. Seeking advice from a qualified mortgage advisor can also provide valuable insights into the best strategies for securing a mortgage in later life.

WAIT! Before You Go...