DON'T MISS OUT! Try Our FREE Calculator Now

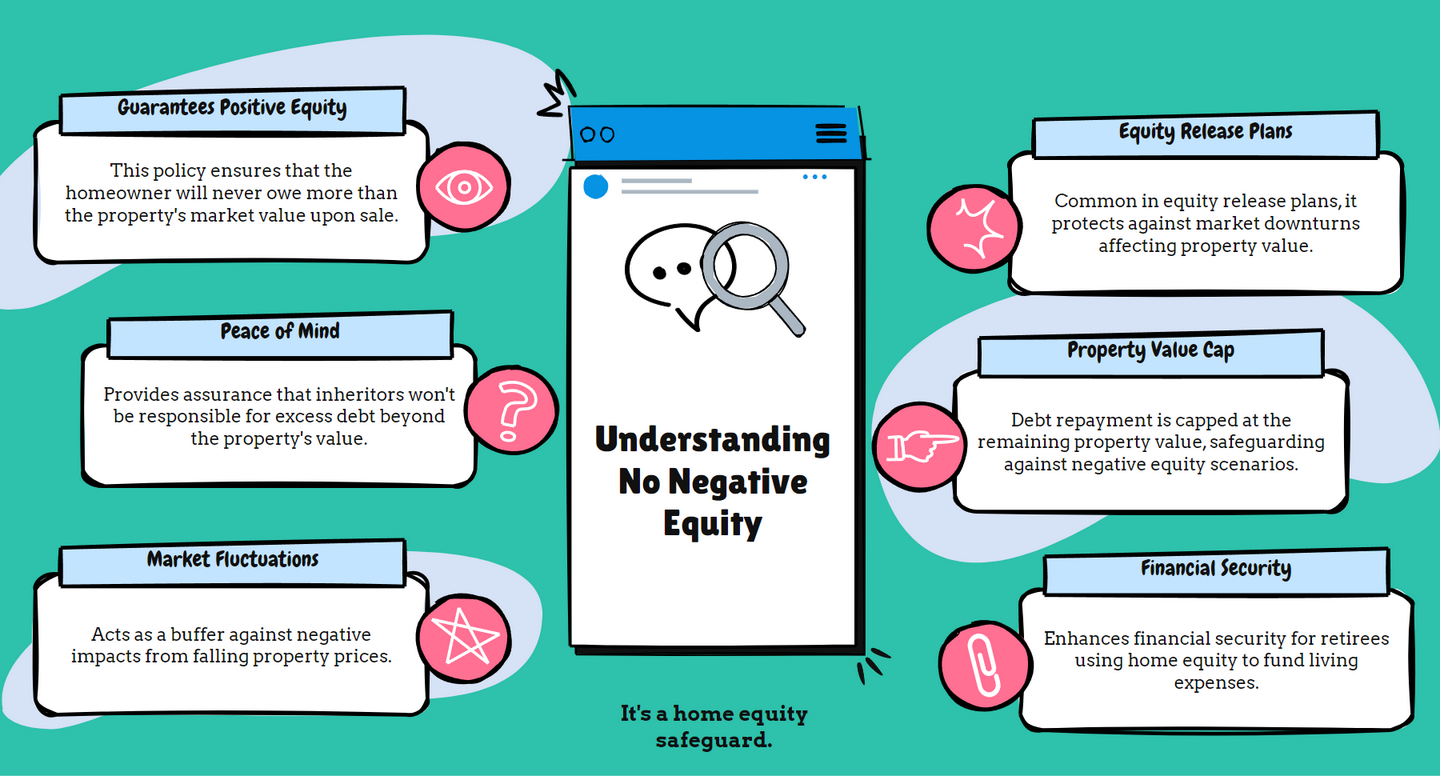

- A no negative equity guarantee in equity release ensures that you will never owe more than the market value of your home, protecting you against housing market fluctuations and ensuring no debt passes to your heirs.

- This guarantee is a standard inclusion in plans offered by members of the Equity Release Council, emphasising the protection it offers to homeowners and their families.

- To ensure the guarantee remains valid, homeowners must maintain the property in good condition and adhere to the terms of the agreement; failure to do so could void this protection.

Homeowners unlocked an average equity of £106,000.1 But what if the property's value dips, making the debt harder to repay? Enter the No Negative Equity Guarantee.

How could this help you?

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This guarantee is offered by all members of the Equity Release Council, and it offers you peace of mind and protection in the event of property values falling.

Read on to learn more…

How Do You Access Equity Release?

It's a financial tool designed for older individuals, enabling them to access the equity in their homes and use it to meet their financial objectives. To access equity release, you will need to speak to a financial institution.

What Is No Negative Equity Guarantee?

The No Negative Equity Guarantee (NNEG) is a protective measure embedded within Equity Release Council-members’ schemes and ensures that no homeowner, upon the maturity of their plan, will ever have to repay more than the current market value of their property.

The NNEG offers assurance that irrespective of market dynamics, individuals who opt to access equity release will not find themselves in a position where their debt outgrows their home's worth.

This not only provides peace of mind but also reinforces the responsible lending practices of financial institutions offering these products.

How Does NNEG Work in Different Market Scenarios?

As the housing market transitions from stability to downturns and onto recovery, the NNEGs functionality evolves.

Here is a closer look at how the NNEG works in different market scenarios.

Stable Market Conditions

In a stable housing market where property values remain consistent or are on a gradual upward trend, the implications of NNEG may not be immediately apparent.

The loan's outstanding balance, even when compounded with interest, is likely to be less than the property’s appreciating value.

However

It is in such times that homeowners often feel comfortable opting to unlock property value, knowing that the NNEG serves as insurance against future market uncertainties.

Market Downturns

It is during downturns that the NNEG showcases its importance.

If property values fall significantly, there is a risk of the loan, with its accumulating interest, surpassing the house's depreciated value.

Ultimately

You are protected from this scenario; you will never owe more than the current market value of your house, regardless of how low that value may fall.

Recovery Phase

Post a market downturn, as property values start to recover, the NNEG continues to play a pivotal role.

While the value of a property may appreciate again, the interest on the loan may have accumulated over the downturn period.

This means

Your heirs will not be burdened with an inflated debt amount resulting from the downturn phase.

Who Enforces Guarantee?

When it comes to the enforcement and oversight of the No Negative Equity Guarantee, the Equity Release Council and the Financial Conduct Authority play pivotal roles.

Here is a breakdown of each.

Role of Equity Release Council (ERC)

The Council stands as the leading industry body dedicated to the promotion and supervision of the sector.2

One of its foundational principles is the No Negative Equity Guarantee.

As such, any institution or provider wanting to be a member of the ERC must strictly adhere to the guarantee, ensuring that their schemes align with this essential safeguard.

This not only serves to protect consumers but also helps to enhance the credibility and trustworthiness of the industry as a whole.

Read On: Which Equity Release Companies Should You Avoid

Oversight by the Financial Conduct Authority (FCA)

The FCA holds a broader mandate to regulate financial firms in the UK, ensuring consumer protection across various financial products and services, including oversight of equity release providers.3

The FCA's role in relation to the NNEG is to guarantee that financial institutions abide by the regulatory standards and best practices.

Providers risk serious repercussions from the FCA, including potential fines or licence revocation, if they do not honour the NNEG or are caught misleading consumers.

What Is the Impact of the NNEG on Property Value and Debt?

The NNEG has profound implications on both the property value and the amount of debt homeowners may accrue in an agreement.

Let us delve into the various aspects of its influence.

How Does It Safeguard Home Value?

It is main purpose is to shield you from the unpredictable shifts in the housing market. It promises that, no matter how property values change, you (or your heirs) will not find yourselves owing more than the house's current market value.

Even if property values dip, the combined loan and interest will never be more than your home's market value.

What is the Implication for Rising Debts?

The property market is not the only area of uncertainty. Interest rates can vary, and for homeowners who have opted to let interest compound, the amount they owe can significantly grow over the years.

However, with the NNEG, there is a safeguard in place.

No matter how much interest accumulates, the debt will not grow to an amount exceeding the property's value meaning homeowners can have peace of mind knowing their debt remains under control, irrespective of how long the plan lasts.

Will My Heirs Inherit My Debt?

Many people worry about the financial legacy they may leave for their heirs and the idea of passing on significant debt can be overwhelming.

Yet, the guarantee offers peace of mind. It ensures that your heirs or beneficiaries will never owe more than the current market value of the property.

In simple terms

Even if there is debt, it will not exceed the house's worth meaning your heirs can inherit the property free from crippling debt, giving them the choice to keep or sell the house without financial strain.

Common Questions

What Is the No Negative Equity Guarantee in an Equity Release Plan

How Does the No Negative Equity Guarantee Protect Homeowners

Is the No Negative Equity Guarantee Included in All Equity Release Schemes

What are the Advantages of a No Negative Equity Guarantee

How Can I Ensure My Equity Release Plan Includes a No Negative Equity Guarantee

Why Was the No Negative Equity Guarantee Introduced in the UK

Are There Situations Where NNEG Might Be Invalidated

Is NNEG Automatically Included in All Equity Release Plans

If the Housing Market Faces a Severe Downturn, How Effective Is the No Negative Equity Guarantee

Does NNEG Affect the Interest Rates on Equity Release Plans

Conclusion

If you are considering unlocking your property value, ensure this guarantee is part of your plan and always consult with a financial advisor to make well-informed decisions.

The No Negative Equity Guarantee represents a pivotal advancement in the UK's equity release sector, ensuring that homeowners can confidently leverage their property's value without the looming risk of debt surpassing their home's worth.

WAIT! Before You Go...