DON'T MISS OUT! Try Our FREE Calculator Now

- A reverse mortgage calculator provides an estimate of how much you can borrow based on factors like home value, age, interest rates, and existing mortgage balance.

- The amount received depends on property value, lender policies, and whether you opt for a lump sum, monthly payments, or a line of credit.

- It helps homeowners aged 62+ assess if a reverse mortgage suits their retirement needs by showing potential loan proceeds and long-term costs.

- The calculator gives an estimate, but actual loan terms depend on lender evaluation, fees, and HUD regulations. Consulting a financial advisor is recommended.

In today's financial landscape, many senior homeowners are exploring the benefits of reverse mortgages as a means to supplement their retirement income.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This article delves into the intricacies of reverse mortgages, providing insights into how they work, their advantages, and how to effectively use a reverse mortgage calculator to estimate loan options.

Understanding these elements is crucial for making informed financial decisions.

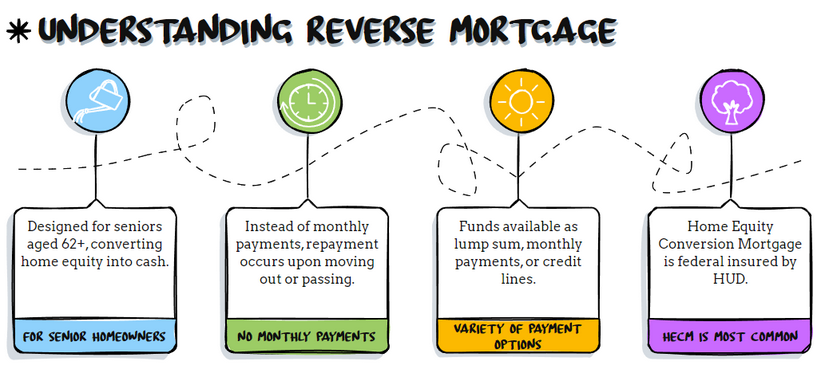

What is a Reverse Mortgage?

A reverse mortgage is a financial product specifically designed for senior homeowners, generally aged 62 and older, allowing them to convert part of their home equity into cash without needing to sell their property.

This unique arrangement provides borrowers with funds in various forms, such as a lump sum, monthly payments, or a line of credit.

Unlike traditional loans, a reverse mortgage does not require monthly payments, with repayment occurring only when the borrower moves out, sells the home, or passes away.

The Home Equity Conversion Mortgage (HECM), which is federally insured and backed by the U.S. Department of Housing and Urban Development (HUD), is the most common type of reverse mortgage.

Homeowners can utilise the funds from a reverse mortgage for a range of expenses, including living costs, healthcare needs, home improvements, and even debt consolidation.

How Does a Reverse Mortgage Work?

A reverse mortgage operates by allowing homeowners to borrow against the equity they have built up in their home.

The available loan amount typically depends on several factors, including the homeowner's age, the current value of the home, and prevailing interest rates.

To qualify for a reverse mortgage, the borrower must reside in the home as their primary residence, possess sufficient equity, and be at least 62 years old.

The loan is structured such that it is repaid only when the borrower sells the home or passes away, with the property itself serving as collateral for the loan.

It is essential for borrowers to continue fulfilling obligations such as property taxes, homeowner's insurance, and property maintenance to avoid defaulting on the loan.

Benefits of Using a Reverse Mortgage

Using a reverse mortgage can present numerous benefits, particularly for retirees seeking to enhance their financial stability.

This financial tool allows seniors to access their home equity without the burden of making monthly mortgage payments, effectively alleviating financial stress.

The loan proceeds can be allocated for various purposes, such as covering medical costs, funding home renovations, or managing everyday living expenses.

Moreover, the payouts from a reverse mortgage are not classified as taxable income, offering a tax-efficient solution for bolstering retirement finances.

Importantly, the equity remaining in the home can still be inherited by heirs, provided the reverse mortgage is repaid upon the homeowner's passing or sale of the property.

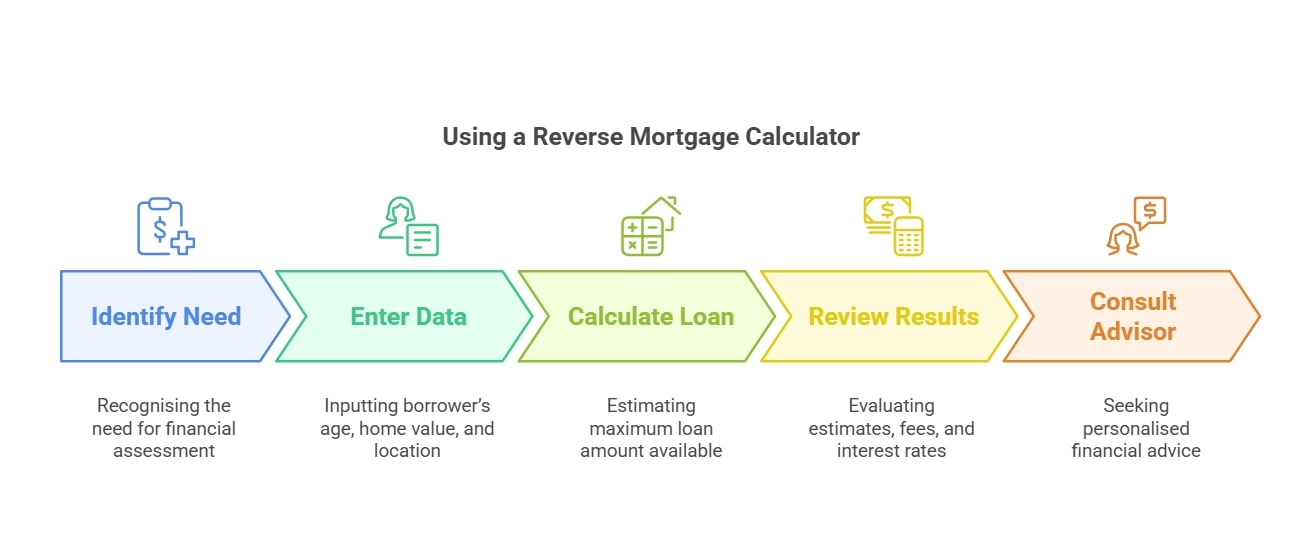

Using a Reverse Mortgage Calculator

Using a reverse mortgage calculator is a straightforward process that can provide valuable insights for potential borrowers.

To use this calculator effectively, you must enter specific information, such as the borrower's age, the home value, and the property location.

By inputting this data, the calculator estimates the maximum loan amount available, which is crucial for those considering taking out a reverse mortgage.

After you have entered the required information, you will receive an estimate that includes potential fees and interest rates associated with the loan.

While the results can serve as a useful starting point, it is essential to remember that these calculations do not replace personalised advice from a financial professional who can offer tailored guidance based on your unique situation.

Factors Influencing the Calculation

Several factors play a significant role in the calculation of a reverse mortgage, directly impacting the amount of equity a borrower can access.

One key element is the borrower's age; generally, older borrowers can access more equity due to their shorter life expectancy, which reduces the lender's risk.

Additionally, the appraised value of the home is critical; homes with higher market values provide more equity to draw from.

Current interest rates also influence the calculation, as they can vary widely, affecting the total amount available under a reverse mortgage loan.

Furthermore, the type of reverse mortgage chosen, such as a Home Equity Conversion Mortgage (HECM) or a proprietary reverse mortgage, can change the available options.

By understanding these factors, potential borrowers can make informed decisions regarding their reverse mortgage options and better estimate how much they can benefit from this financial tool.

Understanding Your Results

When utilising a reverse mortgage calculator, the results provide an estimate of the maximum loan amount accessible based on the inputs you provided.

This estimate typically includes potential fees and interest rates associated with the reverse mortgage.

It is crucial for users to carefully review these results to understand how much equity they can access and what implications this might have for their financial situation.

Keep in mind that these estimates may differ from actual amounts due to lender-specific criteria and changing market conditions.

Thus, it is advisable to consult with a financial advisor who can help clarify the results and offer insights into how these findings align with your broader financial goals.

Finding the Right Lender

When seeking a reverse mortgage, it is essential to understand that various types of lenders can provide these financial products.

You can obtain a reverse mortgage from banks, credit unions, and specialised reverse mortgage companies.

Each lender may offer different products, terms, and fees, which means it is vital to compare lenders to find the best fit for your financial needs.

Some lenders might provide proprietary reverse mortgage products that are not federally insured, offering different benefits but potentially higher risks. By comprehensively understanding the options available, borrowers can make informed choices that align with their financial situations and long-term goals.

Questions to Ask Your Lender

When considering a reverse mortgage, asking potential lenders specific questions is crucial to ensure you fully understand the terms and conditions of the loan.

Key inquiries should include:

What types of reverse mortgage products do you offer?

What are the fees associated with the loan?

How is the interest rate determined?

What repayment options are available?

Additionally, it is vital to understand what happens if you need to move or pass away.

By addressing these aspects, borrowers can gauge the lender's reliability and determine the suitability of the mortgage for their individual financial situation, ultimately leading to a more informed decision.

How a Broker Can Help You Find the Best Deal

A mortgage broker can be an invaluable resource in your search for the most favourable reverse mortgage deal.

Brokers have access to a wide range of lenders and can assist borrowers in comparing different products and terms tailored to their needs.

They can provide insights into the best options based on individual financial situations and help navigate the complexities of reverse mortgages.

Moreover, brokers can facilitate the application process, ensuring that all necessary documentation is submitted correctly and promptly.

Their expertise can save borrowers time and potentially money by helping them secure the most advantageous terms available, making them a vital ally in the reverse mortgage journey.

Calculating Your Home Equity

Home equity is a vital component in understanding the potential financial benefits of a reverse mortgage.

It is calculated as the difference between the current market value of a home and any outstanding mortgage balances.

To determine how much equity can be accessed through a reverse mortgage, homeowners should first obtain an appraisal to establish the home's value.

The amount of equity available for a reverse mortgage will also depend on the borrower's age and the type of reverse mortgage chosen.

Generally, the more equity a homeowner has, the larger the potential loan amount, making it essential to assess home equity accurately.

Understanding home equity helps in using a reverse mortgage calculator effectively to estimate the loan options available.

Who Can Be a Borrower?

Eligibility criteria for reverse mortgages ensure that only qualified individuals can access this financial tool.

Generally, the primary borrower must be at least 62 years old and must occupy the home as their primary residence.

Additionally, the borrower should have sufficient equity in the home, which can be determined through an appraisal.

If there are multiple borrowers, they must both meet the age requirement.

It is also essential that borrowers are not delinquent on any federal debt and can demonstrate the ability to cover property taxes, insurance, and maintenance costs.

Understanding these borrower considerations is crucial for making informed decisions about taking out a reverse mortgage and maximising the benefits of home equity.

Impact of Age on Your Reverse Mortgage Options

Age plays a significant role in determining the amount of equity available through a reverse mortgage.

Generally, older borrowers can access more equity due to a shorter life expectancy, which the lender considers when calculating the loan amount.

For instance, a 70-year-old homeowner may qualify for a larger loan than a 62-year-old, all else being equal.

This factor is crucial for retirees looking to maximise their financial resources during retirement.

Understanding how age impacts loan options can help borrowers plan effectively and make informed decisions regarding their reverse mortgage strategies, ensuring that they utilise their home equity to its fullest potential.

Using a Reverse Mortgage as Part of Your Retirement Strategy

Incorporating a reverse mortgage into a retirement strategy can provide retirees with additional cash flow to cover living expenses, healthcare costs, and other financial needs.

By accessing home equity, seniors can supplement their retirement income without selling their home.

This strategy allows them to maintain their lifestyle while preserving other retirement savings.

However, it is essential to consider the long-term implications, such as the impact on inheritance and the potential for increased debt over time due to accrued interest.

By using a reverse mortgage calculator, retirees can estimate how much equity they can access and how this financial tool can fit into their broader retirement planning.

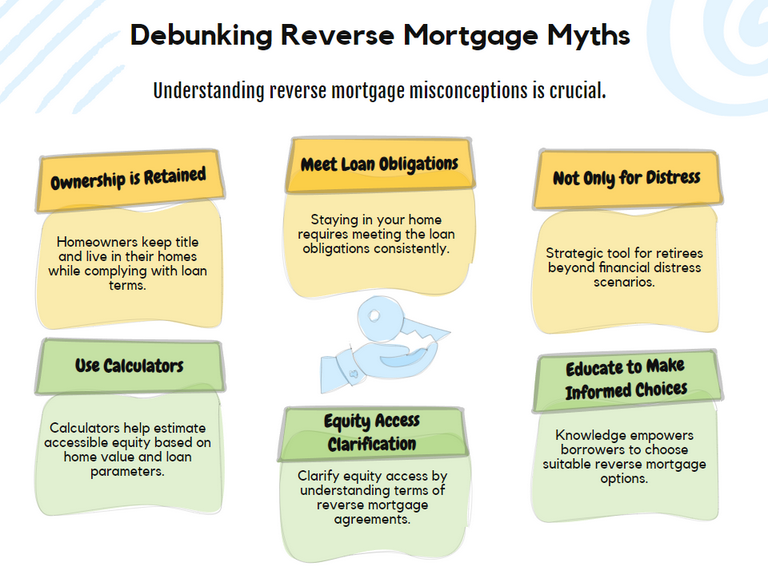

Common Misconceptions About Reverse Mortgages

Many misconceptions surround reverse mortgages, often leading to confusion among potential borrowers.

One common myth is that borrowers lose ownership of their homes; however, homeowners retain title and can live in their homes for as long as they meet loan obligations.

Another misconception is that reverse mortgages are only for those in financial distress; in reality, they can be a strategic financial tool for many retirees.

Understanding these misconceptions is critical for making informed decisions about reverse mortgages.

By educating themselves, borrowers can navigate the options available and utilise a reverse mortgage calculator to clarify how much equity can realistically be accessed.

Long-term Considerations for Retirees

Retirees should carefully consider the long-term implications of taking out a reverse mortgage.

While it can provide immediate financial relief, it can also reduce the equity available for heirs and potentially impact eligibility for government assistance programs.

Additionally, homeowners must continue to meet obligations such as property taxes, insurance, and maintenance to avoid foreclosure.

Planning for the future, including understanding how a reverse mortgage affects estate planning and inheritance, is essential for making sound financial decisions.

Utilizing a reverse mortgage calculator can help retirees gain insight into the equity they can access and inform their long-term financial strategies.

Common Questions

1. What is a reverse mortgage calculator and how does it work?

2. Do I need a perfect credit score to use a reverse mortgage calculator?

3. Is the amount I receive from a reverse mortgage the same as the estimate from the calculator?

4. Can a reverse mortgage calculator help me decide if a reverse mortgage is right for me?

Conclusion

A Reverse Mortgage Calculator is a valuable tool for seniors considering a reverse mortgage, offering a quick estimate of potential loan amounts based on key factors like home value and age.

While it helps with financial planning, it’s important to remember that the figures provided are only estimates—actual loan terms depend on lender assessments, fees, and market conditions. T

o make an informed decision, homeowners should consult a financial expert to understand the long-term impact and ensure a reverse mortgage aligns with their retirement goals.

WAIT! Before You Go...