DON'T MISS OUT! Try Our FREE Calculator Now

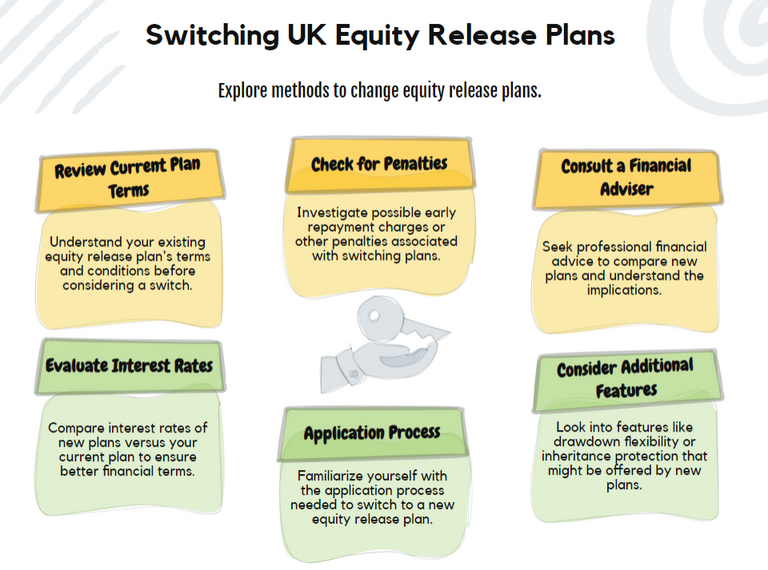

- To consider switching your equity release plan, review your current plan's terms, compare other available options for lower interest rates or better features, and consult with a financial adviser.

- Potential advantages of switching include securing a lower interest rate, obtaining more favourable terms or flexible withdrawal options, and potentially lowering the overall cost of the plan.

- Be aware of possible penalties (such as early repayment charges), evaluate any fees involved with a new arrangement, and assess how these factors align with your long-term financial goals before making a switch.

Switching equity release plans is not just a financial decision, but a step towards optimising your assets.

Given that the number of product options available on the market once tripled, reevaluating your plan could potentially net you thousands in savings.1

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This comprehensive guide delves deep into the why, what, and how of reassessing your current plan and offers the best equity release guidance.

Lean on our years of expertise and insight, and let us navigate you through the intricacies of ensuring your equity works best for you.

What Are the Options for Switching Equity Release Plans in the UK?

In the UK, you have quite a few options to consider when thinking of switching equity release plans.

You can choose to remortgage to a new plan with a lower interest rate, which can significantly reduce your future balance.

Alternatively, you might decide to switch to a drawdown plan, thereby only paying interest on the amount you've taken out.

If you wish to preserve more of your estate for inheritance, you could switch to an interest-only lifetime mortgage, where you pay the interest monthly thus ensuring the balance doesn't grow.

Another option could be to move to an enhanced plan, which may offer you a larger amount of equity if you have certain health conditions.

Lastly, you can switch to a home reversion plan, where you sell part or all of your home in return for a tax-free lump sum, regular payments, or both.

Here's Some Equity Release Guidance

Need equity release guidance? Equity release is a method that empowers homeowners to leverage the value of their property, offering a source of funds for diverse financial goals.

Why Is It Essential to Reassess Your Equity Release Plan?

It is essential to regularly reassess your plan to ensure you are benefiting from the best terms available.

That is why switching plans has become increasingly prevalent in today's dynamic financial landscape.

You no longer need to be tied into your original terms and conditions until the end of the loan, and can instead make use of newer features and regulations in the market.

Moreover

With economic fluctuations, what may have been suitable a few years ago may not serve your current financial needs.

What Are the Benefits of Switching Your Equity Release Plan?

There are numerous advantages to reevaluating your plan, including better interest rates, adding the latest product features and potentially saving money.

The potential for enhanced financial flexibility can not be underestimated, so you may be asking yourself…

Can You Secure a Better Interest Rate?

Yes, you may be able to secure a better interest, unless you chose a plan when the rates were at an all-time low.

Some newer plans may offer competitive rates that were not available when you initially signed up.

You may also be significantly older now, which may allow you to qualify for lower rates with an enhanced lifetime mortgage.

Bear in mind

You may need to account for early repayment fees if you do move your scheme from one provider to another.

How Can You Access More Tax-Free Cash?

A rise in property values can increase your property's available equity, potentially allowing you to release more.

Additionally, certain products may offer higher loan-to-value (LTV) percentages.

What Latest Features Can You Benefit From?

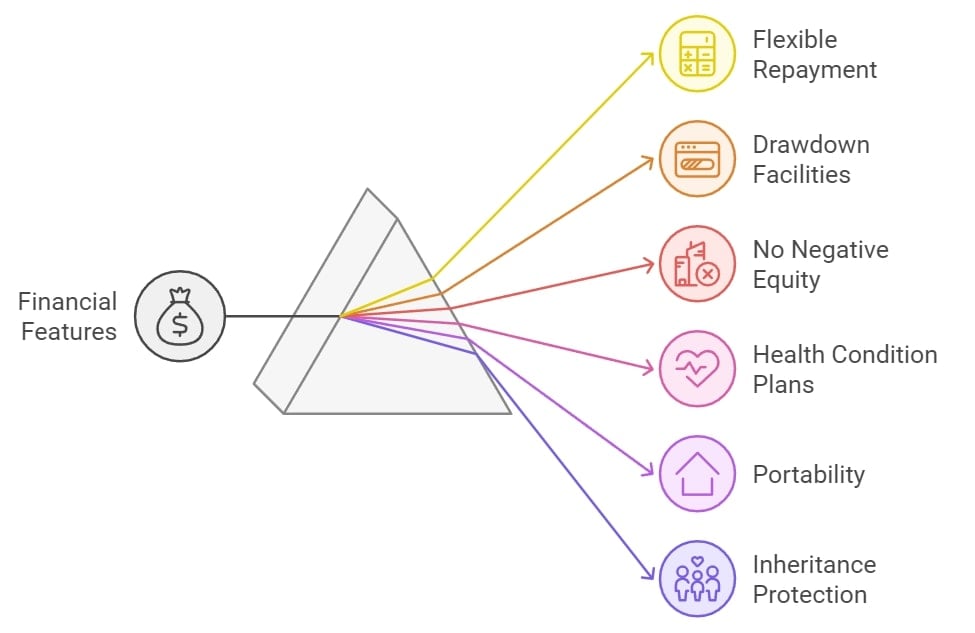

New features, such as drawdown facilities, inheritance protections and No Negative Equity Guarantees.

Here are more features that may not have been available to you:

- Flexible Repayment Options: Some plans now offer the option to make partial or interest-only repayments, allowing you to manage the growth of the loan.

- Drawdown Facilities: This allows you to release equity in stages, taking out funds as and when you need, rather than in a single lump sum. This can reduce the interest accumulation over time.

- No Negative Equity Guarantees: Most modern schemes come with a guarantee that ensures you will never owe more than the value of your home.

- Enhanced Plans for Health Conditions: Some providers offer more favourable terms if you have certain health conditions or lifestyles, as it may affect the expected tenure of the loan.

- Portability: Many products now allow you to move home and transfer your plan to the new property, subject to criteria.

- Inheritance Protection: Some plans offer this feature to protect a portion of your property's value to leave as an inheritance.

- Early Repayment Options: While traditional plans had hefty early repayment charges, some newer products have more lenient terms, allowing you to repay your loan earlier with reduced or no penalties.

- Tiered Interest Rates: Some plans may offer capped variable interest rates based on how much equity you release. This can be beneficial if you only need a small amount initially.

Is There Potential to Save Money?

Yes, by switching plans you may be able to save money. It is not just about new features or bigger sums; it is also about savings.

Some plans may have lower administrative fees or more favourable rates and over the long term, these differences can result in substantial savings.

Are There Opportunities to Access Additional Funds?

If you have only tapped into a portion of your property's equity, you may have the opportunity to access additional funds, especially if life changes or financial needs arise.

Switching to a plan with more drawdown options can be a strategic move to maximise your property's financial potential.

How Can You Effectively Review Your Equity Release Plan?

Effectively reviewing your plan requires a structured approach, we have listed the steps below.

Firstly

It is essential to assess your current financial needs and how they may have evolved since you took out your plan.

Next

By comparing your existing terms with the most recent offerings in the market, you can pinpoint areas for potential improvement.

Finally

Engaging with professional equity release advisors provides an added layer of expertise, ensuring you are informed about the nuances of the current landscape.

It is vital to be well-informed about any penalties or costs linked to switching, and as always, weighing these immediate expenses against prospective long-term gains is crucial in making a well-informed decision.

Is Remortgaging Your Plan a Viable Option?

This is not a yes or no answer, unfortunately, because with newer products often presenting enhanced features and benefits, remortgaging may actually prove more advantageous for some.

Yet, interest rates are not at their lowest and the decision is not without its caveats.

Early repayment charges, which are sometimes substantial depending on your initial agreement, can influence the decision to remortgage.

While remortgaging may offer better terms and interest rates, it is crucial to factor in all potential fees and discuss the move with a financial advisor to determine its viability for your unique situation.

Common Questions

Can I Switch My Equity Release Plan

What Are the Steps to Switching Equity Release Plans

Are There Penalties for Switching Equity Release Plan

When Should I Consider Switching My Equity Release Plan

What Are the Benefits of Switching Equity Release Plans

How Do Changing Market Conditions Affect Existing Equity Release Plans

What Are the Implications of Switching for Inheritance Planning

Are There Age Restrictions When Considering Switching Plans

How Do Different Equity Release Providers View Switching

How Does One’s Health Condition Factor Into Switching Decisions

Conclusion

Navigating the complexities of financial decisions can be challenging, especially when it involves the value locked in your home.

If you are contemplating a change or just curious about its benefits, seeking advice from a trusted financial advisor is imperative.

Remember, your home is more than just a property; it is a vital financial asset, therefore switching equity release plans could be the next step in optimising your financial journey.

WAIT! Before You Go...