DON'T MISS OUT! Try Our FREE Calculator Now

- Equity release schemes typically include 2 main plans; lifetime mortgages and home reversion plans.

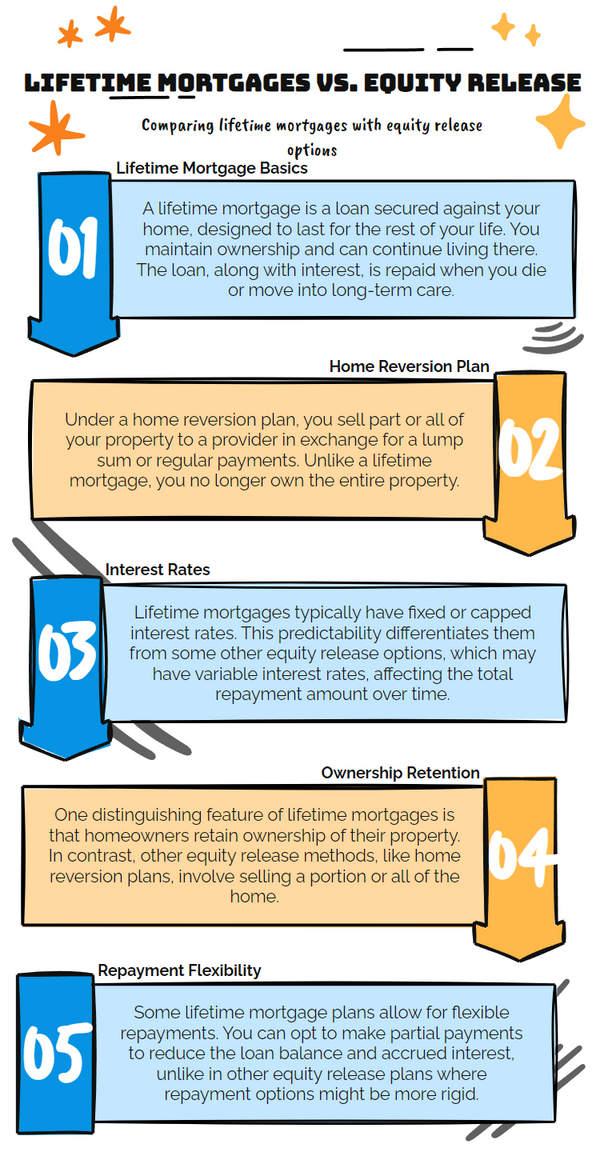

- Lifetime mortgages offer the benefit of staying in your home with flexible withdrawal options but may reduce inheritance through accruing interest, whereas home reversion plans provide funds without interest but require selling part of your property.

- When selecting an equity release scheme, it's important to assess your financial needs, understand the flexibility of each scheme, and consider their impact on your estate and inheritance.

Understanding the types of Equity release plans available has become increasingly relevant in the current economic climate.

The popularity of this financial tool designed for later-life borrowers is evident, considering that the number of products has nearly tripled from 547 to 1,557 in 2022.1

As the number of products increases, it is imperative to understand the diverse options available and how each can cater to distinct financial needs.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Fundweb dedicates time and resources to researching the world of equity release, translating complex concepts into easy-to-understand terms to assist you in navigating its intricacies.

We have covered all the bases, from the fundamentals to the nuances of tailored plans so that you can make a well-informed choice and answer the question of "equity release, how does it work?"

Let us dive in…

Equity Release, How Does It Work?

So, equity release, how does it work?

In the context of homeownership, equity release is a method that allows individuals to turn their property into a liquid asset, providing financial flexibility.

What Are the Different Plans Available?

You have the option of a lifetime mortgage or a home reversion plan in the UK.

There are also customised versions of these, which allow you to choose drawdown or lump sum withdrawals, as well as enhanced plans, and options for voluntary repayments.

How Does a Lifetime Mortgage Differ From Other Equity Release Options?

A lifetime mortgage differs from other options because homeowners can secure a loan against their property while retaining full ownership.2

You would have the option to only repay the loan and interest when you die or enter long-term care.

Unlike many other alternative loans, there are no obligatory monthly repayments, but interest does compound over time.

Learn More: Can You Release Equity if You Have a Mortgage?

What Exactly Is a Home Reversion Plan?

A home reversion is where you sell a share or full ownership of your property to a reversion provider in exchange for a once-off payment or a regular income.3

You can continue living in your home, either rent free or for a nominal rent.

However

When the property is sold, you or your heirs will be entitled to your portion of the proceeds.

How Do Custom Equity Release Products Work?

Custom plans in the UK offer a more individualised approach to accessing property wealth than standard plans.

These tailored options allow homeowners to define terms, such as:

- Setting up voluntary repayments

- Periodically drawing down funds

- Adjusting loan amounts based on specific health criteria

This flexibility caters to homeowners’ unique circumstances.

Are Drawdown Plans Suitable for Regular Income Needs?

UK homeowners increasingly favour drawdown plans, especially those seeking a regular income stream from their property's equity.

How does it work?

Simply put, drawdown allows you to withdraw amounts as needed, and interest is only applied as and when you make withdrawals.

Why Might Someone Choose a Lump Sum Plan?

Someone may choose a lump sum plan if they need a large amount quickly for a specific purpose.

This could be paying off debt, making major home improvements, or covering other large, unexpected costs.

However, interest begins to accumulate immediately on the entire sum, which can lead to a faster increase in debt over time.

What Benefits Do Enhanced Plans Offer?

Enhanced plans offer benefits for homeowners with particular health diagnoses or lifestyle choices, such as smoking, that may shorten their life expectancy.

These plans, frequently referred to as 'ill-health plans’, typically offer higher lump sum amounts or more favourable terms than standard schemes.

As with any financial product, seeking expert advice is crucial to understanding if an enhanced plan aligns with your circumstances.

Can I Make Voluntary Repayments?

Lifetime mortgages allow for voluntary repayments, enabling homeowners to pay back some or all of the interest, or even part of the capital, without incurring penalties.

This can help to manage the loan from compounding and the final amount owed.

In fact, in 2022, over 90,000 equity release customers decreased their loans by £102m by making voluntary partial repayments.4

Additionally

The Equity Release Council made it mandatory for its members to allow lifetime mortgage borrowers to voluntarily pay back up to 10% of the capital amount per year without incurring any penalty fees from March 2022.5

This only affects lifetime mortgages taken out after the date of the announcement.

Which Is the Prevailing Plan in the UK?

The prevailing product in the UK is the lifetime mortgage.

This rise in popularity can be attributed to its unique flexibility in accessing funds and the assurance of retaining full ownership of your property.

The plan allows homeowners to tap into their property's value without the need to move or downsize.

For many UK homeowners, particularly those seeking financial comfort in their later years, a lifetime mortgage offers both security and adaptability.

But remember

Before making a decision, however, it is essential to consult with a specialised advisor to ensure this option aligns with individual financial goals and circumstances.

How Can I Determine the Right Product for My Needs?

To determine the best option for you, consider your financial needs, future plans, and personal circumstances.

Engage with a qualified equity release advisor who can provide expert guidance, assess the available options, and ensure that any choice made is in your best interest.

Common Questions

What Are the Different Types of Equity Release Schemes Available

How Does Each Type of Equity Release Work

Which Type of Equity Release is Most Suitable for Me

What are the Pros and Cons of Different Types of Equity Release

Are There Any Risks Involved in Different Types of Equity Release

Is Equity Release Safe for Homeowners

How Are Interest Rates Calculated

Are There Age Restrictions for Equity Release Plans

What Happens to My Plan If I Move or Downsize

Can I Take Out Equity Release If I Still Have a Mortgage

Conclusion

The variety of options and considerations for homeowners can be confusing and each has pros and cons. Hence, it is important to stay well-informed.

If you are considering going down this road, you must speak with a knowledgeable advisor to ensure you have got a thorough understanding of each type and can make decisions that align with your financial and personal circumstances.

Now that you know about the different types of equity releases, it is time to take action, get help from a professional, and start planning your financial future immediately.

WAIT! Before You Go...