DON'T MISS OUT! Try Our FREE Calculator Now

- Voluntary repayment lifetime mortgages allowing partial repayments without early charges provide flexibility, letting you manage debt by reducing the principal balance.

- Benefits include greater control over loan balances and less impact on the estate's value by limiting interest accumulation.

- Annual limits on repayments are typically up to 10-15% of the initial loan amount, enabling substantial interest savings over time.

As homeowners age, many seek financial solutions to supplement their retirement income.

One such option is the lifetime mortgage, a type of equity release that allows individuals to access funds tied up in their property.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

This article delves into the nuances of voluntary repayment plans within this financial framework.

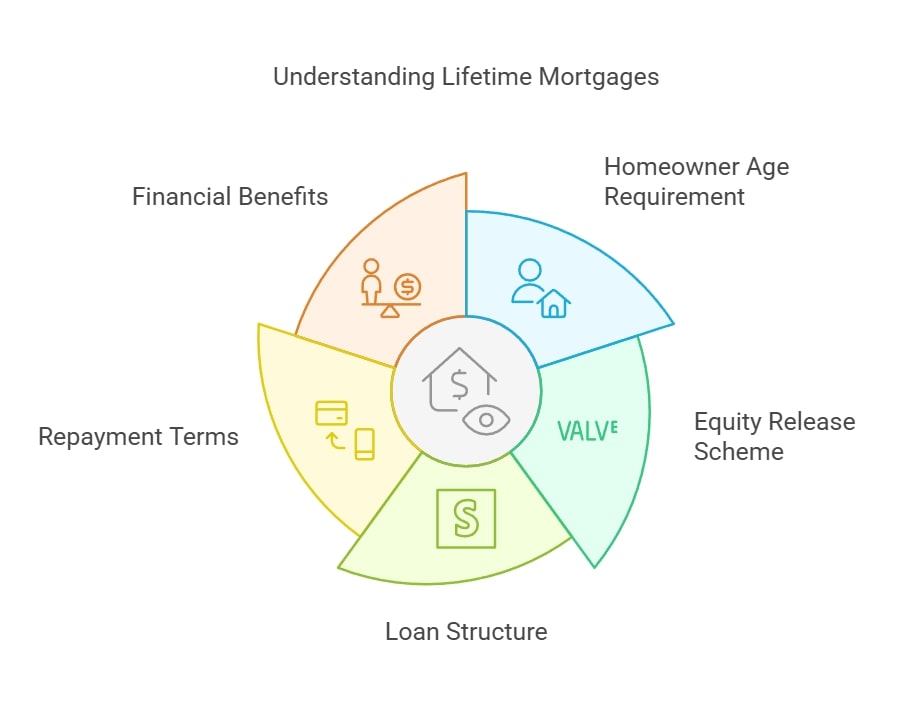

What is a Lifetime Mortgage?

A lifetime mortgage is a type of equity release scheme designed for homeowners aged 55 and over.

It permits them to access the value of their property while retaining ownership.

This financial product enables homeowners to borrow against their home, receiving either a lump sum or regular payments.

The loan amount and accrued interest are repaid when the property is sold, typically upon the homeowner's death or when they move into long-term care.

Unlike traditional mortgages, lifetime mortgages do not necessitate monthly repayments, making them particularly appealing for retirees looking to enhance their income or cover various expenses without the burden of immediate repayment obligations.

How It Works

A lifetime mortgage operates by allowing homeowners to secure a loan against their property's value.

Factors such as the homeowner's age and the property's overall value influence the amount that can be borrowed.

As interest accrues on the outstanding mortgage balance, it is repaid upon the sale of the property.

Homeowners can opt to make voluntary repayments, which helps in reducing the amount of interest that accumulates and the overall debt.

This flexibility fosters more manageable financial planning for retirees, allowing them to adjust their obligations according to their circumstances.

Eligibility Criteria

To qualify for a lifetime mortgage, applicants must be at least 55 years old and own a property valued at a minimum of £70,000.

The property should serve as the applicant's primary residence, ideally with minimal or no outstanding mortgage.

Lenders may impose additional specific criteria, making it essential for potential borrowers to consult with an equity release adviser to fully understand their options and eligibility.

This step ensures that the homeowner is well-informed about the conditions surrounding this type of equity release.

What Are Voluntary Repayments?

Voluntary repayments provide homeowners with a lifetime mortgage the opportunity to make optional payments toward the interest or capital of their loan.

This flexibility allows borrowers to actively manage their debt, potentially reducing the overall amount owed.

Homeowners can typically repay up to 10% to 15% of the initial loan amount each year without incurring early repayment charges, contingent on the lender's specific terms.

This feature differentiates voluntary repayment lifetime mortgages from standard equity release plans, which do not permit repayments until the property is sold.

Benefits of Choosing a Voluntary Repayment Plan

The primary advantages of a voluntary repayment plan encompass enhanced control over debt management, the capability to reduce the overall cost of borrowing, and the potential to leave a larger inheritance for beneficiaries.

By making voluntary repayments, homeowners can mitigate the impact of compound interest, effectively preserving equity in their property.

Additionally, these plans offer the flexibility to adjust repayment amounts according to the homeowner’s financial situation without facing penalties, making them a worthwhile consideration for many.

Comparison with Traditional Repayment Mortgages

In contrast to traditional repayment mortgages, where borrowers must consistently repay both principal and interest, lifetime mortgages with voluntary repayments provide a more adaptable approach.

Homeowners are not obligated to make regular repayments and can choose to pay off interest or principal as their financial circumstances permit.

Traditional mortgages require ongoing payments until the loan is fully repaid, whereas lifetime mortgages generally defer repayment until the homeowner passes away or transitions into long-term care.

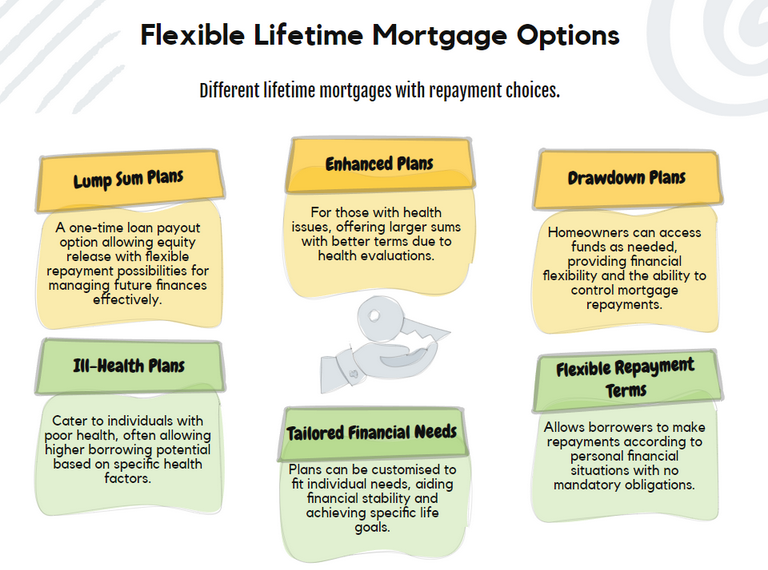

Types of Lifetime Mortgages with Voluntary Repayments

There are various types of lifetime mortgages that offer voluntary repayment options, including lump sum plans, drawdown plans, and enhanced/ill-health plans.

These options allow homeowners to access equity from their property while retaining the flexibility to make repayments.

Each plan has its specific terms and conditions regarding how much can be repaid and when, enabling borrowers to tailor their mortgage to their financial needs and goals.

How to Select the Right Plan

Selecting the right lifetime mortgage plan involves assessing individual financial needs, property value, and future goals.

Homeowners should compare different lenders and their offerings, considering factors such as interest rates, repayment flexibility, and any associated fees.

Consulting with an equity release adviser can provide valuable insights and help homeowners make informed decisions tailored to their circumstances.

Understanding Lender Terms and Conditions

Each lender has specific terms and conditions for their lifetime mortgage products, particularly regarding voluntary repayments.

Homeowners should carefully review these terms to understand the limits on repayment amounts, any fees associated with voluntary repayments, and the implications of not making repayments.

Understanding these details is crucial for effective financial planning and ensuring that the mortgage aligns with the borrower's long-term objectives.

What is an Equity Release Calculator?

An equity release calculator is a tool that helps homeowners estimate how much equity they can release from their property and the potential impact of making voluntary repayments.

By inputting details such as property value, age, and desired repayment amounts, users can receive instant calculations showing their mortgage balance over time.

This tool is invaluable for planning and understanding the financial implications of different equity release options.

Calculating Potential Voluntary Repayments

Homeowners can use an equity release calculator to simulate various repayment scenarios, including how much they could save by making voluntary repayments.

The calculator provides insights into the future balance of the mortgage under different repayment strategies, helping borrowers see the long-term benefits of reducing their debt. This information can guide homeowners in deciding how much and how often to make repayments, aligning their financial strategies with their retirement goals.

How to Interpret the Results

Interpreting the results from an equity release calculator involves understanding the projected mortgage balance over time, considering both scenarios with and without voluntary repayments.

Homeowners should analyse how different repayment amounts affect the overall debt and the potential inheritance left for beneficiaries.

By reviewing these projections, borrowers can make informed decisions about their repayment strategies and adjust their financial planning accordingly.

Control the Balance with Voluntary Repayments

By making voluntary repayments on a lifetime mortgage, homeowners can actively manage their mortgage balance and keep it in check.

This proactive approach helps prevent excessive growth due to compound interest, allowing borrowers to repay part of the interest or capital.

Such management is crucial for those aiming to leave a meaningful inheritance.

Not only does this provide peace of mind, but it also contributes to financial stability during retirement, ensuring that the mortgage remains a helpful financial tool rather than a burden.

Long-Term Financial Implications

The long-term financial implications of a voluntary repayment lifetime mortgage can be significant.

By choosing to make regular repayments, homeowners may save on interest costs and preserve their home equity.

This strategy reduces the total amount owed by the time the mortgage is settled, providing advantages for estate planning.

However, it’s essential to evaluate how these repayments might influence disposable income and overall financial health, necessitating a careful balance in budgeting to ensure ongoing financial security.

Tips for Successful Management

Successfully managing a voluntary repayment lifetime mortgage requires a clear budget and regular reviews of financial circumstances.

Homeowners should consult with an equity release adviser to create a repayment plan that aligns with their income and expenses.

Establishing a flexible repayment strategy allows borrowers to make voluntary payments without stress.

Staying informed about mortgage terms and personal financial changes will help ensure the mortgage remains beneficial throughout retirement, reducing any potential strain on finances.

Common Questions

What Is a Voluntary Repayment Lifetime Mortgage in the UK

How Does a Voluntary Repayment Lifetime Mortgage Work

What Are the Benefits of a Voluntary Repayment Lifetime Mortgage

Who Qualifies for a Voluntary Repayment Lifetime Mortgage

What Are the Risks Involved With Voluntary Repayment Lifetime Mortgages

Conclusion

Voluntary Repayment Lifetime Mortgage offers homeowners greater control over their financial future, enabling them to make repayments when possible and reduce the amount of interest accruing on their loan.

This flexible option can help borrowers manage their debt more effectively, provide peace of mind, and potentially leave a smaller inheritance for loved ones.

It’s important to carefully consider your personal circumstances and seek professional advice to fully understand how voluntary repayments can benefit you.

By taking charge of your mortgage repayments, you can make informed decisions that align with your financial goals and ensure long-term stability.

WAIT! Before You Go...