DON'T MISS OUT! Try Our FREE Calculator Now

Quick Summary

- If you're over 65, the best thing to do is deep dive into your equity release options, align them with your finances and dreams, and chat with an independent advisor before deciding on a plan.

- Picking the right plan means weighing your current and future financial needs, plan flexibility, interest rates, and again, that golden advice from an independent pro.

- Equity release can eat into the legacy you leave, needing payback from your home's sale value; alternatively, while it might tweak your benefits eligibility, it usually doesn't mess with your pension.

Did you know that over 557,000 equity release plans were taken out between the year 2000 and 2020, and if you want to join the ranks, you will need to obtain the best equity release advice.1

Welcome to our comprehensive guide on seeking support before unlocking your property value.

As industry leaders with years of experience, we are here to offer you in-depth, impartial advice on everything you need to know about equity release – from understanding "what's equity release" and weighing up the pros and cons, to choosing between an equity release broker and a financial advisor.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

We promise to help you navigate this potentially complex financial landscape, providing you with the essential tools to make the best decision for your circumstances.

Let us explore this path together.

What's Equity Release?

It's a financial option that enables homeowners to tap into the wealth accumulated in their property, providing a stream of cash or a lump sum.

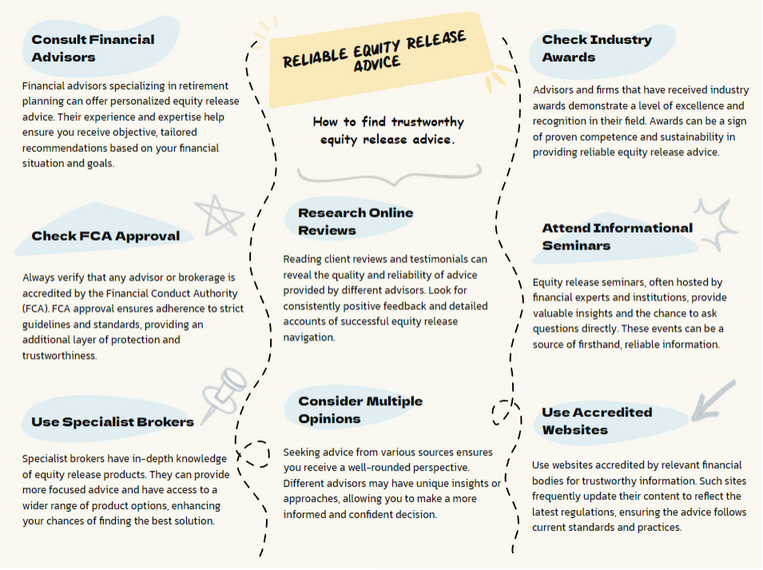

What Is the Best Source for Reliable Equity Release Advice?

The best source for reliable Equity release advice would undoubtedly be a certified financial adviser with extensive experience in retirement planning and equity release schemes.

These professionals have the requisite knowledge and skills to guide homeowners through the complexities of releasing equity from their homes.

They can offer unbiased advice as they're bound by a professional code of conduct that requires them to act in their clients' best interests.

Furthermore, you can also look for dependable advice from established financial institutions and reputable organizations specializing in Equity release.

Make sure these institutions are regulated by the Financial Conduct Authority (FCA) for assurance of their credibility.

Websites like the Equity Release Council also offer valuable information and can point you towards accredited advisers in your area.

Remember, obtaining advice from trustworthy and accredited sources is crucial to make an informed decision about equity release.

The Importance of Equity Release Advice

The world of unlocking property equity is complex, and making an informed decision requires a thorough understanding of the available options.

Professional advice can help you make sense of these options, identify and avoid potential pitfalls, and ensure you secure the best possible deal.

Will You Need Assistance in Deciphering the Options Available?

In the UK, for those over the age of 55 looking to utilise the wealth tied up in their property, equity release schemes present a viable option.

With a multitude of plans available, navigating the complexities of these schemes can be challenging.

To alleviate this issue, the Equity Release Council (ERC), the industry body for the sector, mandates consultation with an independent advisor.

These professionals assist homeowners in understanding the various options, offering comprehensive overviews and personalised recommendations based on individual financial circumstances and future goals.

What this means is

The role of an advisor is essential in simplifying the landscape.

From lifetime mortgages to home reversion plans, each option carries its unique implications, benefits, and drawbacks.

With their expertise, advisors help decipher these terms, providing clarity and direction to homeowners.

While it may seem like another step in the process, this requirement ensures that homeowners have access to impartial advice, reducing the potential for misunderstanding and miscommunication.

How to Identify and Avoid Potential Pitfalls

These schemes, while beneficial for many, come with potential pitfalls that need careful consideration.

One of the primary concerns of releasing equity is the accumulation of interest, which can significantly increase the loan amount over time, particularly in the case of lifetime mortgages.

In some cases, this can lead to negative equity, where the loan amount exceeds the property's value.

Advisors can help identify these issues, informing homeowners about the No Negative Equity Guarantee that reputable providers, as members of the ERC, must offer.

Another potential pitfall is the impact on means-tested benefits.

Some state benefits in the UK are dependent on income and savings, and a lump sum from a plan could affect eligibility for these benefits.

An advisor will be able to guide homeowners on how to best manage their plans to minimise the impact on these benefits.

Understanding these potential pitfalls is crucial to ensure schemes do not lead to unexpected financial burdens in the future.

Learn About: Equity Release Providers that are Less Reputable

Assurance of Securing the Best Possible Deal

Securing the best possible deal is about more than just getting the highest amount of cash.

It is about finding a plan that meets individual financial needs, provides flexibility for the future, and comes with favourable interest rates and conditions.

So what is the solution?

Independent advisors are essential in this process as they provide an objective perspective and have a comprehensive understanding of the market.

It is worth noting that advisors who adhere to the standards of the ERC are obligated to compare different products and only recommend a plan if it is the most suitable for the client's circumstances.

They are also required to provide a clear illustration of the financial implications of the scheme.

These safeguards ensure that homeowners are not only assured of getting a deal that suits their needs but also one that is financially prudent, contributing to peace of mind in their retirement years.

Brokers vs Financial Advisors

Both equity release brokers and financial advisors can offer guidance, but there are differences between the 2.

Brokers specialise in these products and work with a range of lenders, whereas financial advisors offer broader financial advice that includes, but is not limited to, equity release.

They typically address a client's overall financial situation and future planning, which may involve pensions, investments, insurance, tax planning, and more.

What Are The Role and Functions of an Equity Release Broker?

Brokers act as intermediaries between the client (a homeowner looking to release equity) and the lender (the institution providing the scheme).

They primarily focus on understanding the client's individual circumstances, needs, and future goals.

What happens then?

From this information, they can assess suitability, provide a comprehensive overview of the various schemes available, and help the client choose the most suitable scheme.

Brokers also have an in-depth understanding of the market and keep up-to-date with the latest products and changes in regulations.

They work with a panel of lenders, which allows them to compare various schemes to find the best deal for their client.

In line with the ERC's standards, they must ensure the client receives independent legal advice before finalising a scheme.

What Are The Role and Functions of an Equity Release Financial Advisor?

Financial Advisors have a broader remit than Brokers.

While they can also provide advice on schemes, their role encompasses a wider range of financial advice and planning services.

This can include:

- Retirement planning

- Investment advice

- Tax planning

- Insurance services, among others

A Financial Advisor will assess the suitability of releasing property value in the context of the client's overall financial situation and future goals.

They will consider how it fits into the client's wider financial landscape, including its potential impact on their tax situation, benefits entitlement, and estate planning. If these products are deemed suitable, they can help the client choose the most appropriate scheme, just like a Broker.

What else?

They will also explore and suggest alternative solutions that may be more suitable, such as downsizing or using other assets, thus providing a more holistic approach to the client's financial planning.

It is important to note that these specialist Financial Advisors must hold a specialist qualification in equity release and adhere to the ERC's standards.

Equity Release Advisors vs. Direct Providers

While some homeowners prefer the personalised service of an advisor, others may choose to go directly to a provider.

Each has its merits, and the best choice will depend on your comfort level with the process and your need for personalised guidance.

Comparison Between Equity Release Advisors and Direct Providers

Advisors are professionals who specialise in offering advice on equity release products.

They are typically independent, meaning they are not tied to any particular provider and can recommend a broad range of products available in the market.

They generally charge a fee for their service, which can either be a fixed fee, a percentage of the amount released, or a combination of both.

Direct Providers, on the other hand, are the financial institutions, like banks or building societies, that actually lend the money for equity release.

When you deal with a direct provider, you are typically discussing the specific products that they offer.

While they are obligated to treat customers fairly under FCA regulations, their primary goal is to provide information about and sell their specific products.

Therefore, the range of products you discuss with them is limited compared to what you may find with an independent advisor.

Finding Local Equity Release Advisors

Finding a local advisor can be accomplished through several means, including search engines and recommendations from family or friends.

Here is more.

Online Search Engines

The internet is an excellent starting point for finding local advisors.

Search engines like Google can yield a list of advisors in your local area.

It is advisable to look for advisors who are members of the Equity Release Council as they adhere to a strict code of conduct, providing additional peace of mind.

Professional Directories

Professional directories are another resource.

Websites such as the Financial Conduct Authority (FCA) offer a register of regulated advisors.

The Council also maintains a directory of members.

These directories provide a list of professionals who have met specific standards of professionalism and ethics.

Recommendations

Personal recommendations from trusted friends, family members, or colleagues can also be a valuable source.

If someone you know had a positive experience with an advisor, that advisor may be a good fit for you as well.

Professional Associations

Professional associations can also assist in finding local advisors.

The Society of Later Life Advisers (SOLLA), for example, is dedicated to assisting older people and their families in financial matters, including equity release.2

How Equity Release Advisors Charge

Advisors charge for their services in two primary ways: fixed fees and commission-based fees.

Fixed Fees

Fixed fees are a set amount that an advisor charges for their advice and guidance, irrespective of the size of the loan or the time it takes to complete the process.

These fees typically range from £500 to £1500 depending on the complexity of the homeowner's situation and the level of service provided by the advisor.

The benefit of fixed fees is that they are agreed upon upfront and do not change, providing certainty for the homeowner.

Commission-based Fees

On the other hand, commission-based fees are calculated as a percentage of the loan amount that the homeowner decides to release.

These fees are typically around 1-2% of the equity released, meaning the cost will vary depending on the size of the scheme chosen.

For larger loan amounts, commission-based fees can potentially be more costly than a fixed fee.

Equity release advisors should always be transparent about their fees and explain the charging structure at the outset.

This allows homeowners to factor in the cost of advice when considering the overall financial implications.

It is also worth noting that these fees are often added to the loan, meaning the homeowner does not necessarily need to have the funds available upfront.

Given the long-term implications and the potential for high-interest accrual, seeking advice from a knowledgeable and fair-charging equity release advisor is a key step in the process.

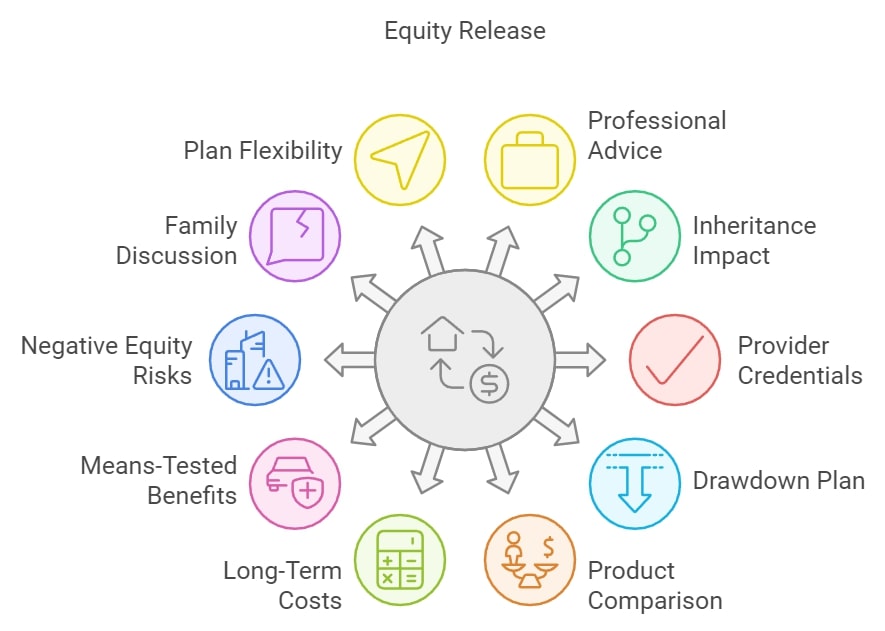

12 Key Pieces of Advice for Equity Release

It is important to consider all aspects before making a decision.

Below are 12 key pieces of advice for anyone considering equity release.

Consider All Options

Before settling on equity release, consider all potential options.

This may include downsizing, taking out a conventional loan, or using savings.

Only move forward if it is the best fit for your circumstances.

Seek Professional Advice

It is a requirement from the ERC to consult with an independent advisor when considering equity release.

These professionals can provide objective advice, explain the process in detail, and help choose the most suitable plan.

Understand the Impact on Inheritance

Equity release reduces the value of your estate, potentially impacting the inheritance you can pass on.

Discuss this with your beneficiaries to ensure they understand the implications.

Check Provider’s Credentials

Always ensure your provider is registered with the Financial Conduct Authority (FCA) and is a member of the Equity Release Council.

This provides assurance that they adhere to a strict code of conduct.

Consider a Drawdown Plan

A drawdown plan allows you to withdraw funds as and when needed, rather than receiving a lump sum.

This can be more cost-effective as interest is only charged on the amount withdrawn.

Compare Different Equity Release Products

There are various types of products including lifetime mortgages and home reversion plans.

Understand the pros and cons of each and compare them to find the one that best meets your needs.

Understand Long-Term Costs

There are various types of products including lifetime mortgages and home reversion plans.

Understand the pros and cons of each and compare them to find the one that best meets your needs.

Know the Impact on Means-Tested Benefits

Equity release may affect your entitlement to means-tested benefits.

Professional advisors can provide guidance on how to release equity without jeopardising these benefits.

Understand the Risks of Negative Equity

Some schemes could lead to a 'negative equity' scenario, where you owe more than your home is worth.

Opt for plans with a 'no negative equity guarantee' to avoid this risk.

Discuss With Your Family

Discussing your plans with your family is essential. It helps them understand your decision and its implications on future inheritance.

Evaluate the Flexibility of the Plan

Assess how flexible the plan is, for instance, can you move home while the plan is in place, or make repayments to control the balance?

The more flexibility, the better the plan may adapt to your changing needs.

Plan for the Future

Consider how equity release fits into your broader financial plan for retirement.

It should complement your other income sources and meet your future financial needs.

Common Questions

What Is the Best Equity Release Advice for Homeowners Over 65

What Are the Risks Involved in Equity Release Schemes

How to Choose the Right Equity Release Plan

What Is the Impact of Equity Release on Inheritance

Can Equity Release Impact My Pension or Benefits

What Are the Tax Implications of Equity Release

What Happens to an Equity Release Plan if I Need to Move Into Long-Term Care

Can I Repay the Equity Release Earlier Than Planned

What Are the Consequences if I Outlive the Value of My Home

How Does the Interest on an Equity Release Work

Conclusion

In conclusion, getting equity release advice and making the decision to release equity from your home is a significant one with long-term implications.

This is why obtaining independent, comprehensive advice is critical.

By fully understanding your options and the potential impacts on your finances and estate, you can make a confident, well-informed decision.

Always remember to take your time, consider all variables, and consult with an expert to secure the best possible deal for your circumstances.

Are you ready to take the next step? Do not hesitate to reach out to a professional equity release advisor today to explore your options and start your journey.

WAIT! Before You Go...